“The lesson of the 1930s was that orthodoxies are never abandoned by central banks and fiscal authorities voluntarily: when orthodoxies were in conflict with democracy, orthodoxies were overruled by elections and political decisions.”

Does Central Bank Independence Frustrate the Optimal Fiscal-Monetary Policy Mix in a Liquidity Trap? , Paul McCulley, and Zoltan Pozsar

The negotiations between the Troika and the Greek government pivots around the issue of austerity. The reform program is largely a red herring at this stage, reform in this context largely means the Troika’s insistence on a reduction of Greek state expenditure and increases in taxation. The aim is to force, through brute fiscal adjustment, the Greek state to generate a surplus on its budget for year after a year and for decades to come so that it can repay its debts. The aim is to ensure that over time the ratio of debt to GDP can be forced down to the 60% level which is the maximum permitted under the treaties that established the monetary union. So the core issue is what schedule of surplus target figures the Greek government will accept.

The problem is that this strategy, of forcing primary budget surpluses in order to reduce the GDP to debt level by paying off debts, has resulted in a huge decline in Greek GDP, a decline in excess of 25%, and this decline has actually worsened the debt to GDP ratio. The Syriza government is saying enough is enough and that ratcheting down the economy through yet another round of cuts and taxation increases will get the nation no closer to the 60% ratio and will merely further shrink the Greek economy and further impoverish the Greek population. What Syriza is proposing is strategy for growth, because if GDP grows then debt ratios are automatically reduced.

The strategy of reducing the debt ratio through austerity has been imposed across the indebted peripheral countries of the eurozone. The IMF, in its Fiscal Monitor (2013), sketched a scenario in which the obligations of heavily indebted European sovereigns first stabilise, and then fall to the 60% level targeted by the EU’s Fiscal Compact by 2030. It makes assumptions regarding interest rates, growth rates and related variables, and computes the cyclically adjusted primary budget surplus (the surplus exclusive of interest payments) consistent with this scenario. The heavier the debt, the higher the interest rate and the slower the growth rate, the larger the requisite surplus. The average primary surplus in the decade 2020-2030 is calculated as 5.6% for Ireland, 6.6% for Italy, 5.9% for Portugal, 4.0% for Spain, and 7.2% for Greece.

These are large primary surpluses. There are both political and economic reasons for questioning whether they are plausible. When tax revenues rise, legislators and their constituents apply pressure to spend them. In 2014, Greece enjoyed its first primary surpluses after years of deficits and fiscal austerity; the government immediately came under pressure to disburse a ‘social dividend’ of €525 million to 500,000 low-income households. It is inherently implausible to assume that democratically elected governments can sustain very high budget surpluses for year after year whilst at the same time the population suffers high unemployment and poverty. Eventually the democratic process will produce a government that says no to austerity and no to generating any further large primary surpluses. In Greece this produced the anti-austerity Syriza government and elsewhere, with the surge in anti-austerity parties in the recent local and regional elections in Spain for example, other anti-austerity governments will probably be elected at some point. The response of the EU institutions is to deny the validity of such election results and simply demand that the austerity program must continue.

The strategy of sustaining large budget surpluses in the indebted countries can, and almost certainly will, be easily blown off course by a slowdown in global growth, worsening terms of trade, or another global recession, all of which can disrupt the efforts of even the most dedicated governments seeking to run large primary surpluses for a decade. Recession depresses tax revenues, and the spending cuts needed to maintain the surplus above the promised threshold may depress activity and revenues still further. The government may prefer to let its automatic fiscal stabilisers operate. Whatever the other merits of that choice, it too will prevent the string of primary surpluses from being maintained.

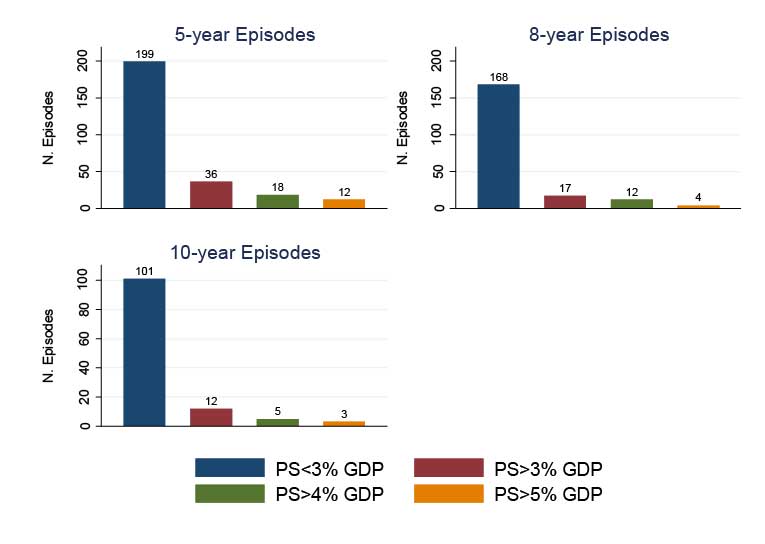

A recent paper by Eichengreen and Panizza explored whether the expectations that European countries will be able to run such large surplus are realistic, they concluded they were not. They used a sample of 54 emerging and advanced economies over the period 1974-2013 to study what type of economic and political variables are associated with large and persistent primary surpluses. In this sample there are 36 such episodes (about 15% of the 235 5-year periods included in their sample) of primary surpluses of at least 3% of GDP that last for at least five years. Larger and longer primary surplus episodes are rarer. Primary surpluses as large as 4% of GDP that last for at least a decade are extremely rare. The five countries identified in the study as having managed to generate a greater than 3% surplus and that last longer than eight years are economically and politically idiosyncratic. The five countries that were able to maintain a primary surplus of at least 4% of GDP for at least ten years were Belgium starting in 1995, Ireland starting in 1991, Norway starting in 1999, Singapore starting in 1990, and New Zealand starting in 1994. Their circumstances are special. Most of these economies are unusually small and open. Belgium’s case was associated with the special circumstances of meeting the Maastricht convergence criteria. Norway’s was associated with North Sea oil and the decision to create a sovereign wealth fund.

For the debts of Europe’s problem countries to be sustainable within the current framework and for those countries to reach the legally binding 60% ratio of debt to GDP without debt restructuring, foreign aid or an unanticipated burst of inflation, means their governments will have to run large primary budget surpluses, in many cases in excess of 5% of GDP, for periods as long as ten years. History suggests that such behaviour, while not entirely unknown, is exceptional. Countries that have run such large surpluses for such extended periods have faced exceptional circumstances.

An alternative debt management strategy would stop focusing on austerity and reduction of GDP to debt ratios through the rapid pay down of existing debts, and instead focus on growth in the Eurozone. This would mean shifting the focus from the indebted countries, which will find it hard to generate growth based only on internal adjustments, and instead focus on the management of the economy of the eurozone as a whole. And that means confronting the continuing insistence of Germany, by far the largest eurozone economy, that it be allowed to run a low wage, high trade surplus and fiscally neutral economy. Its Germany that needs to be in an EU managed program not the indebted nations, and that program should be insisting on vigorous reflation in Germany so that it can generate the demand that an austerity free periphery can use to grow their economies and thus shrink their debts. This of course would require a comprehensive political defeat for Germany and so is unlikely. More likely, whether Syriza is defeated or expelled, is continuing instability and economic depression until such time as new anti-austerity governments are elected and the deadlock is broken.

The last paragraph is especially interesting as turns received wisdom on its head but conclusion somewhat depressing. Think one of your previous blogs showed some hope in this area with signs that German Trade Unions were beginning to fight back and demand pay rises that reflect the strength of the German economy and surpluses.

Somehow we never hear this perspective in the media..

I fear the logs in european politics are jammed very hard. I can’t see how things can go on as they are (although they might I suppose) but its impossible to know what will be the catalyst for change. It could be if an anti-austerity government from the left is elected, in say Spain, but it could also be if an anti-EU party of the right, such as the National Front in France, make an electoral breakthrough. Its all such a mess, they really fucked up a great project when they decided to go for a single currency and with so many countries. Of course at the time I thought it was a good idea 🙁

Comments on this entry are closed.