Understanding the basics : How an economy becomes unbalanced

Obviously something pretty big went wrong in the global economy in 2007, something which caused a crisis that is still having profound consequences. The crisis in 2007 happened because of developments that occurred long before the financial crisis broke out, developments which created the conditions for the crisis to happen. What were those developments?

The crisis in 2007 appeared as a fairly sudden and very big general crisis in the global financial system and only later appeared as a slow down in the productive economy. Why was this?

After the global crisis started in 2007 a specific sort of crisis developed in the Eurozone which meant that amongst the developed economies the crisis in the eurozone seems to have been worse and lasted longer than elsewhere. Why was this?

In order to answer all those questions – what went wrong in 2007, the reason the crisis appeared as a giant financial crisis, and why the crisis in the eurozone has rumbled on so much longer – means looking at essentially the same thing: imbalances in the global economy. As we shall see the imbalances that were at the root of the financial crisis in 2007, the continuing eurozone crisis and the continuing global economic problems were all part of a general and related pattern of imbalances in the global economy.

Understanding how economies become balanced and unbalanced, and how through trade and international finance the imbalances of different countries effect each other, is not something that can be easily grasped by reference to everyday experience. So before I discuss the specifics of what went wrong in the global economy I am going to talk through the basic ideas of how economies become balanced and unbalanced, and how international trade fits into that process. I am trying to write this for people who are not familiar with economics so I will be starting at a fairly basic level and after explaining the basic mechanisms of economic balance and trade, move onto to looking at the specifics of what caused the crisis in 2007.

One of the reasons that it is been so hard for a lot of people, especially politicians, to understand the imbalances that were at the root of the current crisis is that we too easily confuse the way household budgets work with the way national and international economies work. We often and mistakenly think of nations as if they were simply very large households. Because we know that the more a household saves out of current income the better prepared it is for the future, and that the more a household saves the more wealth it accumulates, we assume the same must be true for a whole country. But how savings work at an individual household level and how they work at the level of an entire economy, or the global economy, are very different. What makes a lot of sense at an individual level, such as being prudent and building up a good level of personal savings, is not necessarily good or prudent at the scale of whole economies. At the level of an entire economy savings can be the cause of problems rather than a solution.

Countries are not households. Countries are huge complex economies in which each day millions of decisions are made to spend, earn, invest and save, in which countless goods are manufactured, sold and bought, and in which income, profits, money, and capital are all flowing around. All that ceaseless throb of economic activity can only work well if the whole pattern of what is happening, the spending, the saving, the investing, are all basically balanced. If those things get out of balance the economy can weaken and even fall into crisis.

To understand how something like savings can be so different at the level of an entire economy compared to a single household consider this imaginary scenario. You want to save up some money and so you decide to reduce your spending for several months and stuff the money under your mattress. As your stash of saved money gets bigger you get wealthier. That may make a lot of sense at an individual level but consider what happens if everybody were to do this at once. Everybody simultaneously decides to stop spending a big chunk of their income and instead saves it by stuffing it under their mattress. Suddenly because people everywhere are spending less and saving more the sales of goods across the entire economy drops. As a result businesses start to contract or go bust. This means workers are sacked, causing their spending to drop, causing more businesses to go bust. The economy starts to get smaller. As you can see at the level of the entire economy increasing savings can actually cause a lot of problems. Too much savings can reduce economic activity and reduce wealth.

What a country needs to get wealthier is not more savings but rather more productive investment. To be wealthier, to have more stuff, the real economy has to grow, and growing the economy means growing businesses, and that requires investment. Domestic savings matter, of course, but only because they are one of the ways, and probably the safest, to fund domestic investment. Saving in itself, however, does not create wealth. It is productive investment that creates wealth. Domestic savings simply represent a postponement of consumption.

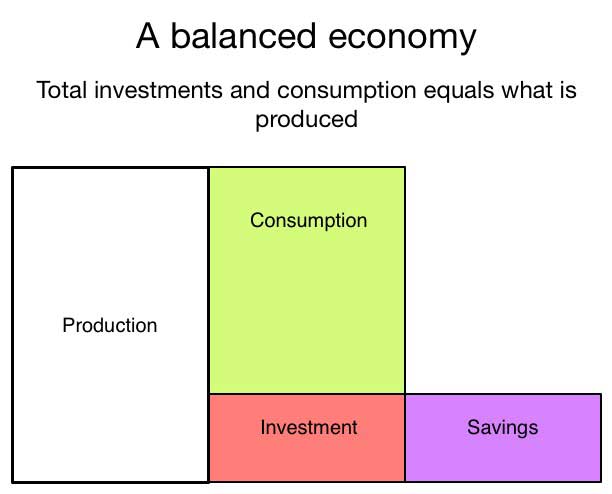

Imagine an economy in a country that has zero trade with the rest of the world. It is a closed economy. In this closed economy a certain amount of the total income is spent immediately (by households and businesses) and a certain amount is saved (by households and businesses). The savings are usually held inside financial institutions who lend out the savings to those who need to borrow to invest (in new factories, new houses, whatever), the borrowers pay a fee for the loan (interest) and some of that is passed onto the savers. In a balanced closed economy the total income not being spent, the national savings, are all loaned for investment. There are no idle wasted savings. The economy is running at full capacity and growing as fast as it is capable of doing because all the savings are being spent on investments.

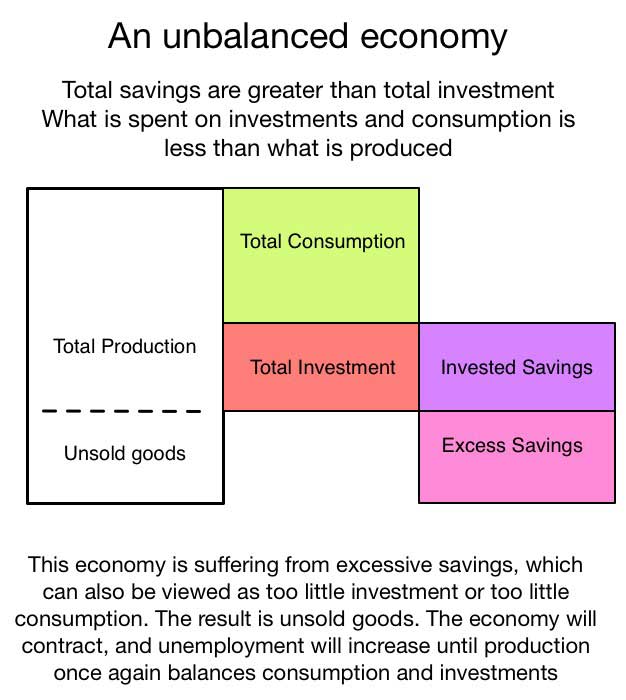

Now consider a closed economy that is not balanced. In this case not all the saving are invested, there is a surplus of savings. That situation is just like the situation described earlier where everyone stuffs money under their mattress. Because of the imbalance, which is too much national savings and too little national investment, there is a short fall in the demand for goods. Businesses suffer, factories close, workers are made unemployed, the economy shrinks. That’s one way that an imbalance caused by too much savings can be fixed, by shrinking the economy and making lots of workers unemployed.

It is very important to understand that national savings are not the result of differences in national character or reflections of an impudent or prudent culture. This means understanding the difference between between national and household savings. Note that I am using mainstream terms such as ‘savings’ but in a Marxist tradition national savings would be called the national surplus.

Household savings represent the amount out of household income that a household chooses not to consume, and so it can be affected by cultural factors such as cultures that value prudence, but the rate of household savings is also affected by non-cultural factors such as demographics (whether a population is ageing and therefore more likely to save for retirement), the existence and credibility of a social safety net, the sophistication of consumer finance, and so on.

The national savings rate, on the other hand, includes not just household savings but also the savings of governments and businesses. It is defined simply as a country’s GDP less its total consumption. While the household savings rate may be determined in part by the cultural preferences of ordinary households, the national savings rate is not. The national savings rate is determined primarily by economic policies and economic institutions, and it is those factors and not national culture that determines the share of household income in the whole economy. National savings, in other words, mostly have very little to do with household preferences and much more to do with the impact of specific economic policies. Sometimes, as we shall see, the polices that determine a national savings rate can be made in another country.

An example of how a national rate of savings is shaped by economic policy and not mere culture is that of China. In China, which has by far the highest savings rate in the world, part of the reason for the high national savings rate of course is that Chinese households save a relatively high proportion of their income. But while China’s national savings rate is extraordinarily high, the Chinese household savings rate is merely in line with those of similar countries in the region, and in fact lower than some. Chinese households are not nearly as thrifty as their national savings rate implies. Why, then, is China’s national savings rate so extraordinarily high?

The main reason is the very low household income share of GDP. At less than 50% of GDP, Chinese households retain a lower share of all the goods and services the country produces than households in any other country in the world. The policies that led to household income in China being such a low proportion of GDP were set by the Chinese government and had nothing to do with how prudent or imprudent the Chinese people are, it was the result of deliberate policy and not culture.

As we have seen an economy can have an excessive rate of savings, that is savings larger than is required for the level of investments. In a closed economy there are four ways of resolving the imbalances caused by having too much savings.

First, and most obviously, investment can rise and soak up all the savings. In most countries the decision on setting the level of national investments is not taken centrally but is made by thousands of uncoordinated investment decisions by thousands of businesses. In countries such as China with a high degree of state management of the national economy an important part of the setting of national investment rates occurs within the state apparatus but there is still a big component that is distributed in a wide range of decisions taken at a local or enterprise level. However the investment decisions are made it can result in an aggregate decision not to increase investments, even if lots of savings are made available in the form of offers of credits or loans by financial institutions. If the private sector is not investing enough to spend the national savings the government can step in and borrow money, which is unspent savings, and spend it to directly increase investment, for example in infrastructure, and that might be enough to balance national savings and investment. But balancing excessive savings through increased investment is sustainable only as long as there are productive investments that can be made, and by definition if the rate of savings has increased this means consumption has declined. Declining consumption usually means declining sales which means the reasons for investing might well decline too. The purpose of investment today after all is to create consumption tomorrow. Fixing excess savings through increased investment can work for a while but in the end if national household consumption remains a low proportion of GDP, and thus national savings remains high, then eventually there will not be enough productive investment opportunities to soak up the excess savings and the imbalance will reemerge.

If there is not enough productive investment opportunities available then a second way to resolve this in a closed economy – albeit only temporarily – is to fund a debt fuelled consumption boom particularly among lower income households. How would this work? If enough easy and cheap credit is being offered with few strings attached then people will start to borrow more, through things like credit cards, and start buying stuff. Cheap abundant credit will also tend to cause asset prices, such as property prices, to rise, and this means property owners feel richer and will probably start borrowing against their assets to spend money on consumption. As this debt fuelled consumption and property boom develops so investing in new property becomes attractive and as new buildings are built this also increases consumption (through the construction wages paid and the materials bought). As consumption increases, fuelled by credit purchasing and as a result of investment caused by rising property prices, the rate of saving declines and once again savings and investment can balance domestically. We saw this happen in the US and in the peripheral countries of Europe in the run-up to the 2007-09 crisis. The problem with this way of dealing with excess savings is that it builds up a very big mountain of debt and if, as is inevitable at some point, the asset bubbles and hence the boom ends, there is a crisis. For a while this debt fuelled boom can cause the economy to operate at maximum capacity and thus balance consumption, savings and investment. But the cost is an ever growing mountain of debt and at some point the whole process reaches a limit and the asset bubbles created by the unproductive investments collapses and the economy rapidly shrinks and unemployment increases. As a result the old imbalance reemerges and can be even worse because everyone starts to frantically save to pay off their debts, a process known as debt deflation.

The third way to resolve the imbalance is if the government, and social partners like trade unions, take steps to redistribute income downwards towards those on lower incomes. Richer people tend to save more and poorer people tend to save less, so giving more money to the poor instead of the rich should mean more is spent on consumption. This reduces the rate of savings and as the savings rate declines it can reach the point at which savings and investment are once again balanced domestically and then everything a country makes it consumes or invests. In the long run ensuring that income is not concentrated excessively in the hands of rich people is a very healthy way to ensure that there is not a problem of excessive savings.

This brings us to the fourth and final way an excess of savings over investment can be balanced which is through unemployment. Usually if the proportion of national income going to the poorer people does not increase, and opportunities for productive investment is exhausted, and credit booms and asset bubbles reach there limits of viability, then eventually an excess of savings will lead to an economic contraction (caused by lack of demand) and unemployment will rise. As unemployment grows the incomes of the unemployed will drop, and so consumption grows more slowly than production, companies are forced to cut production and fire even more workers. Fired workers of course produce nothing, and although they still consume something, either out of savings, welfare payments, or handouts from friends and families, their consumption is lower than when they were employed. The drop in incomes caused by the economic contraction and unemployment eventually causes total savings to drop so that once again it balances investment. Unfortunately when an economy begins to contract because of structural imbalances the resulting rising unemployment means declining demand which means lower profits, and with lower profits comes reduced investment, so more workers need to be fired and the process can become self-reinforcing. Unemployment and contraction can cause the whole economy to stabilise and balance at a much lower level of activity and with much higher rates of persistent unemployment. This was Keynes great insight.

So far we have looked at what happens in a closed economy and at the limited number of ways to rebalance an imbalance between consumption, savings and investment, and now we have to look at what happens when there are lots of different national economies, all trading with each other. Open economies, those participating in international trade, have another option when it comes with dealing with the imbalance caused by excess savings, savings which would have resulted in a not enough demand for the good being produced, and that option is to sell goods to other countries.

Before we look at that option it is very important to note that the global economy is exactly like the closed economy discussed above. The global economy is a closed economy. The global economy cannot trade outside of itself so everything said above about the limited options for rebalancing the economy holds true for the global economy as a whole. Much of what goes on in economic relations between countries is about the attempts by countries to get the benefits and avoid the costs of the various rebalancing options outlined above.

Most countries on earth have open trading relationships with many other countries, most import and export goods, so there is actually a fifth way to resolve domestic savings imbalances. Remember that if national savings are higher than investment and consumption combined then there is a shortfall of demand in the economy, which is how excess savings causes problems. So the way an economy connected to the open trading world can adjust to excess savings is to sell goods abroad, to export products and services. Its important to note that this solution only works if a country sells more abroad than it imports. If its imports are the same as it exports then that doesn’t actually soak up the excess savings so in order to rebalance the effect of excess savings through trade it is necessary to run a trade surplus.

By exporting more goods than it imports what a country is doing is importing the missing demand caused by its excess savings. The result of exporting more stuff abroad than it imports is that a country will run a current account surplus. The other side of the coin is that for every surplus generated some other countries have to run a matching deficit. All countries cannot by definition run simultaneous surpluses. All surpluses have matching deficits.

When a country exports or imports all those transactions involve some form of currency exchange, unless of course a country is inside a currency union such as the eurozone. Foreign exchange markets are just like any market, there are buyers and sellers and if there are more buyers than sellers then prices go up and if there are more sellers than buyers then prices go down. In foreign exchange markets the effect of a country having a large trade surplus, because it is exporting more than it is importing, is that more people will be trying to buy its currency in order to pay for the exports and so an export surplus country should see its currency rise in value. This will over time make its exports less attractive because their price, expressed in other currencies, will increase, and it will make its imports more competitive because foreign imported goods will fall in value. Similarly if a country is running a current account deficit then more people will be trying to sell its currency than are trying to buy it so over time its currency will go down in value, this makes its imports more expensive (and therefore less competitive) and its exports less expensive (so more competitive), and as a result its imports should go down and exports should go up.

So theoretically there should not be long lasting imbalances in global trade because changes in exchange rates should over time whittle down surpluses and deficits and balance everything out. But in the real world it never works like that. In the real world, as we shall see, very large surpluses and deficits can persist for a long time and it is those persistent imbalances, with some countries running large and long lasting surpluses and others running very large and long lasting deficits, that have been the primary cause of instability in the world economy. It is persistent imbalances in trade that was the root cause of the global financial and economic crisis, and of the crisis in the eurozone.

How and why these large persistent imbalances have occurred is the topic of the next section.