The bailout costs ten years after the crash

25/08/2017

It’s ten years since the the financial crisis started in 2007 when some key interbank credit markets froze setting in motion a cascade of failures in the credit system and eventually the insolvency of many large financial institutions. The resulting financial crises not only precipitated the Great Recession, which caused the economies of the developed nations to sharply contract, but also saddled various governments with huge debts as they rushed to prevent a generalised collapse of the financial system. Governments were also forced to take on even more debt as the economic contraction reduced tax revenues just as social and welfare costs soared.

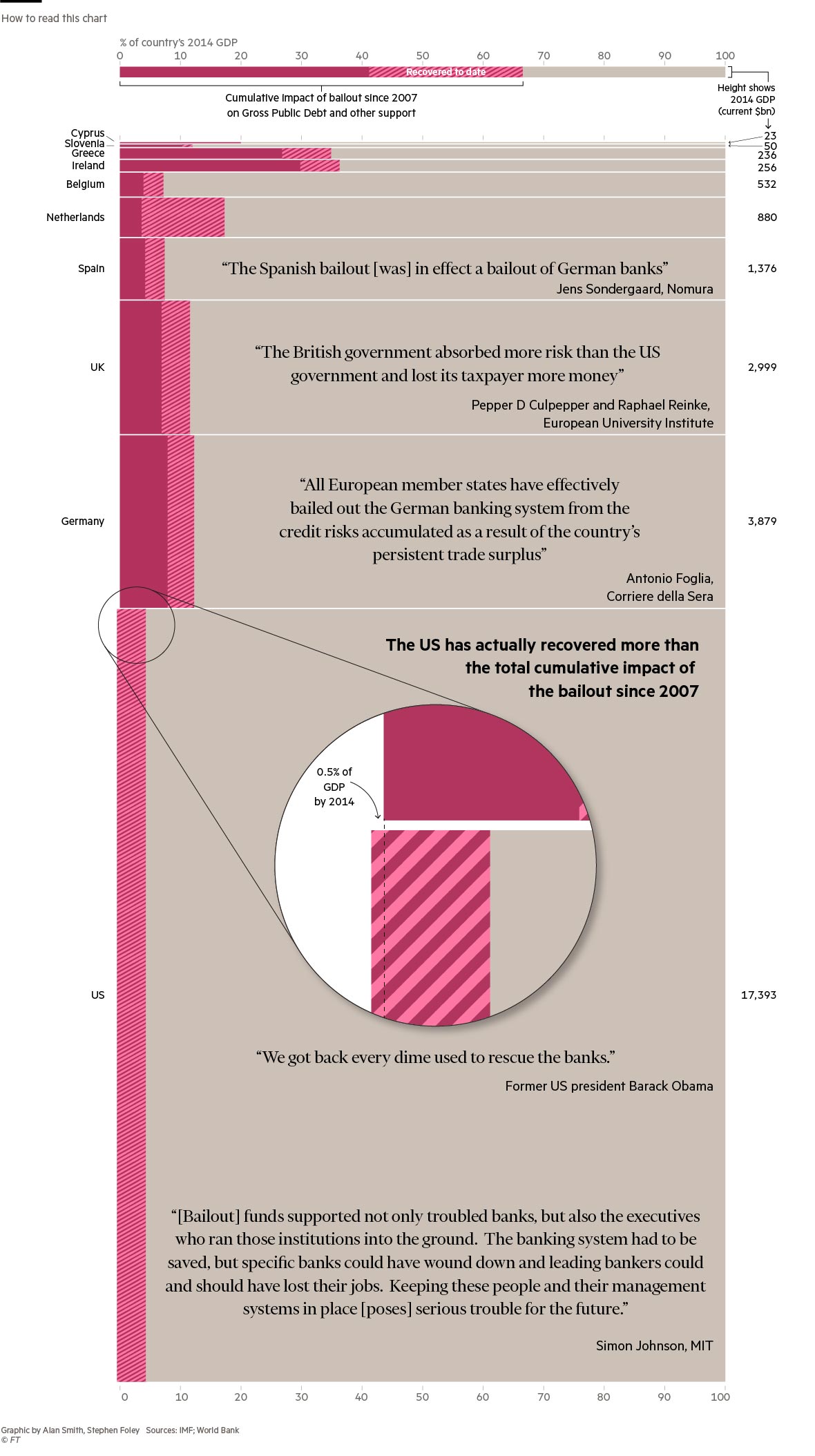

The diagram below shows what the financial repercussions of the bank bailout have been for the governments of various countries. The hight of each horizontal country bar shows the relative size of that country’s GDP. The pink sections shows the total size of the bailout in that country as a proportion of GDP. The dark pink section is costs that have not yet been recovered and the hatched pink section shows the costs that have been recovered to date.

Some points of interest revealed by the graphic:

The US government has not only recovered all the money spent on the bailout but has actually made a small profit. US banks have paid back their loans with interest and the mortgage giants Fannie Mae and Freddie Mac (which were nationalised at the hight of the crisis) hand more of their profits to the US Treasury each quarter. A very significant advantage that the USA had was that its banks and financial sector were a much smaller proportion of GDP than, for example, the UK financial sector and so proportionately the bailout costs in the US were smaller.

The UK bailout was big and less than half has been recovered. The UK has sold the last of its stake in Lloyds, but it still controls Royal Bank of Scotland. As the UK’s National Audit Office puts it: “It is likely that a substantial proportion of these schemes and investments will be with us for some time.”

The debt burdens of Greece and Ireland, as proportion of their GDP, are huge, and only a small proportion has been recovered, although Ireland recouped €3 billon more by selling part of the nationalised Allied Irish Banks this year.

The German bailout is surprisingly large, bigger absolutely and proportionately than the UK bailout. This was because in Europe a key driver inflating credit bubbles in the eurozone periphery, as well as fuelling the Greek government’s spending spree, was exported German capital accumulated via Germany’s vast trade surplus. When the bubbles in the periphery popped and Greece went bust the German banks faced massive losses. The costs of the bailout of German banks should have been much higher for the German government, at least twice as big, because so many German banks would have been driven into insolvency if Greece had defaulted on its debts. Instead the EU, under German leadership, insisted that Greece should not declare itself bankrupt and that the EU and the IMF would give Greece the biggest loan in history in order for it to pay back the German banks. This had two effects. One was to spread the costs of bailing out the German banks all around the EU, thus making the bailout much, much cheaper for Germany. The second effect was to burden Greece with an impossibly vast debt burden, thus blocking the option of defaulting on its debts and thus utterly impoverishing the Greek people and driving Greece into a deep depression in which it is still trapped. There was perhaps one final effect of crushing the Greeks with debt and in the process dissipating the German bailout costs around the EU, the CDU of Chancellor Angela Merkel won their best result in the 2013 election since 1990.