There is another European single currency, other than the Euro, but it is not widely known about in Europe because it is used in Africa.

France has long been committed to maintaining a zone of interest in Africa based on its old colonial possessions. One of the mechanisms it uses to maintain ‘dependency’ amongst its former colonies is the CFA franc, the collective name of two currencies used in West Africa that are still managed from Paris, guaranteed by the French treasury and pegged to the euro. CFA is the acronym for Communauté Financière Africaine (African Financial Community). The reason that the issue of CFA Franc has come to wider attention is because the French National Front is committed to abolishing the entire system of “Françafrique”.

Marine LePen visited the former French colony of Chad during the final stages of the presidential first round election campaign and while she was there she pledged to break with her country’s decades-old relationship with Africa known as “Françafrique” and abolish the CFA franc currency policy that binds Paris and its former colonies.

Speaking at the end of her two day visit to Chad Le Pen sought to outline her policies regarding the continent, which has long held an important place in Frenchforeign policy. “It was only in coming here and explaining that I am able to get around the lies of my political adversaries who don’t want Africa to hear me,” the National Front (FN) party candidate said at a news conference in the capital N’Djamena. “I’ve come to condemn the policy of Francafrique that they’ve carried out. I have come to say I will break with this policy,” she said. She also called for an end to the CFA franc. “I understand the complaints of African states which consider as a matter of principle that they must have their own currency and that the CFA franc is a hindrance to their economic development. I completely agree with this vision,” she said.

Background

The CFA franc was created on 26th December 1945 in the wake of the Bretton Woods conference, in order to cushion the colonies from a strong devaluation of the franc. René Pleven, the French Finance Minister, explained the circumstances of its creation in these terms, “In a show of her generosity and selflessness, metropolitan France, wishing not to impose on her faraway daughters the consequences of her own poverty, is setting different exchange rates for their currency.”

In 1958, the CFA franc then became the ‘Franc of the French Community of Africa’ (FCFA), after Général de Gaulle introduced the notion of ‘community’ to the colonies of West and Central Africa. At the time, Guinea-Conakry, under Sékou Touré, was the only one to reject the offer and the country obtained independence in October 1958, some two years before the other colonies. In 1960, Guinea-Conakry left the franc zone, and set up its own currency and central bank.

The new French franc of December 1958 had a fixed parity of one French franc (FF) for 50 FCFA. This parity would not change for the next 36 years, until the devaluation of the CFA franc was imposed by France, on 12th January 1994.

In the second half of the 1980s, a sharp fall in cocoa, coffee, cotton and oil prices on international markets battered the CFA-zone economies. Simultaneously, the appreciation of the French franc against other major currencies made the zone’s exports less competitive. This double whammy, combined with rising wages and payment arrears, resulted in falling investment and capital flight.

The devaluation of 1994 proved to be a real shock for the economies of the zone. The currency lost half its value in one night as one French franc, previously worth 50 FCFA, became worth 100 FCFA.

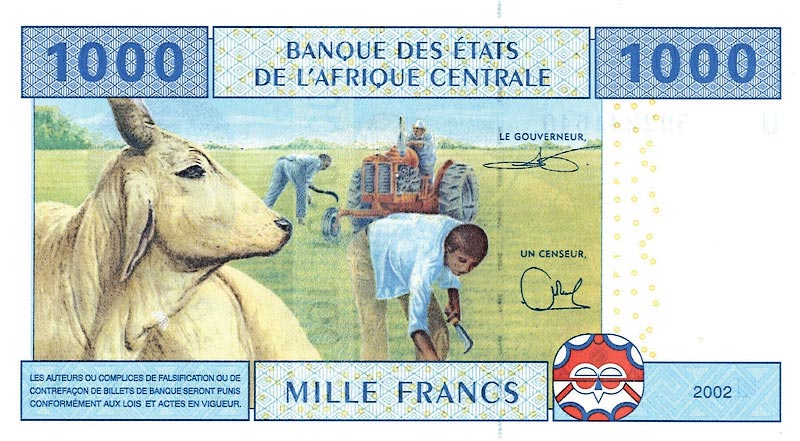

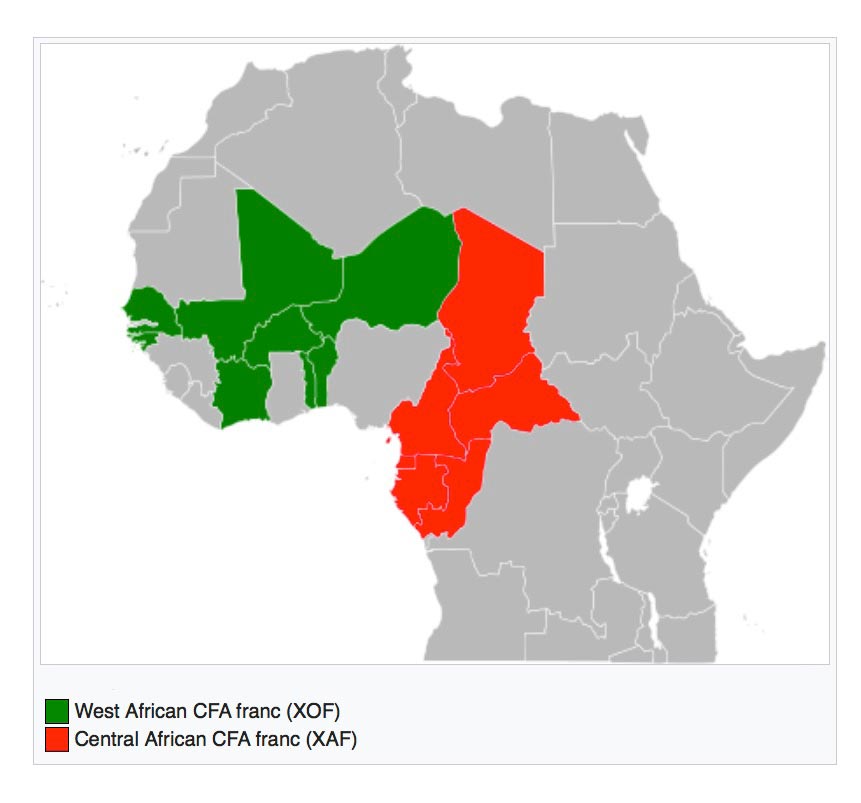

With France’s membership of the euro on 1st January 1999, the parity remained the same, adjusted automatically, making one euro worth 6.55957 FF francs – equivalent to 655.957 FCFA. The currency is currently used by 140m people in 14 countries. In the last 10 years, growth in the WAEMU has been lower than that in non-franc regions in Africa, despite the latter not having the benefits of a single currency zone.

The CFA is composed of two zones, the West African zone and Central African zone, but in practice it functions as one large single currency area containing the following countries: Benin, Burkina Faso, Guinea-Bissau, Ivory Coast, Mali, Niger, Senegal, Togo, Cameroon, Central African Republic, Chad, Republic of the Congo, Equatorial Guinea and Gabon.

An African currency zone run from Paris

The entire CFA single currency system was built in order to ensure that power and control resides in Paris, and of course since the creation of the Euro the power increasingly resides in the European Central Bank (ECB) in Frankfurt as the French Central Bank is now just a branch office of the ECB and thus transmits euro monetary policy to the African currency zone. The operation of the CFA system is actually the responsibility of the French Treasury who guarantee the convertibility of the CFA to the Euro. In a mirror image of the the way the ECB operates in the eurozone the monetary policy governing the economies of the 14 countries in the CFA zone are operated by the French Treasury without reference to the central fiscal authorities of any of the African states.

Each African state must deposit 50% (until recently recently 65%) of its foreign reserves with the French Treasury plus an additional 20% for administration. This means that since the early 1960s around 85% of the fourteen African countries foreign reserves have been transferred to France. These are deposited in the “operations accounts” controlled by the French Treasury. The two CFA banks are African in name, but have no monetary policies of their own. The countries themselves do not know, nor are they told, how much of the pool of foreign reserves held by the French Treasury belongs to them as a group or individually. The earnings of the investment of these funds in the French Treasury pool (at a rate of 0.75%) are supposed to be added to the pool but no accounting has ever been given to either the banks or the countries of the details of any such changes. The limited group of high officials in the French Treasury who have knowledge of the amounts in the “operations accounts”, where these funds are invested; whether there is a profit on these investments; are prohibited from disclosing any of this information to the CFA banks or the central banks of the African states. This makes it impossible for African members to regulate their own monetary policies.

A recent Bloomberg survey estimates that the French Treasury is holding at least US$20 to $40 billion in African foreign reserves which are held in the name of the French Treasury. African governments do not have access to these funds held by the Treasury but are allowed to borrow their own money from the French at commercial rates. In addition to the difficulties posed by the French Treasury holding unaccounted African money, France is in financial trouble. France has run out of money. It has massive public and bank debt. One of the reasons it has been able to sustain itself so far is because it has had the cushion of the cash deposited with the French Treasury by the African states since 1960. Much of this is held in both stocks in the name of the French Treasury and in bonds whose values have been offset and used to collateralise a substantial amount of French gilts, including pledges to the ECB.

West Africa is moving tentatively to break with the CFA system

Mamadou Koulibaly, the former President of the Ivory Coast National Assembly, has been touring the region and holding various meetings trying to raise awareness of the need to move beyond the CFA system and wrest control of the currency system away from Paris. Concern about the future of the CFA system is rising because even if LePen and the FN do not win, her opponents are also not committed to continuing to assist the African states and indicated that they too might seek a revision of the terms of Françafrique.

A disruption of the CFA single currency system would pose a grave danger because the future economic development of the entire continent depends on fostering greater internal trade and that requires a stable currency system. The non-francophone states of the Economic Community of West African States’ (ECOWAS) have already created a mechanism for the introduction of an African Single Currency the ECO. The ECO is the name of the common currency that the West African Monetary Zone (WAMZ) has agreed to introduce within the framework of ECOWAS in 2020. After its introduction, the goal is to merge the new currency with the West African CFA franc, creating a common currency for much of West Africa. The WAMZ member countries include Gambia, Ghana, Guinea, Nigeria and Sierra Leone. The purpose of creating the ECO is to produce a common currency for all of West Africa which will reflect the needs and opportunities for trade which link African economies together and to provide a common platform for interaction with non-African currencies. There are further plans to link the ECO with the rest of the CFA zone later as well as with the emerging East African Community (EAC) and the Common Monetary Area (CMA) of Southern Africa.

In order for these plans to become reality it will be the urgent task of the francophone CFA states to get a transparent statement of their tranche of funds being held by the French Treasury. Several West African Heads of State have already requested this. When these balances are disclosed and agreed they can then be transferred, en bloc, to the new ECO and the CFA franc and its infrastructure then dissolved.