How economic imbalances lead to imbalances in trade

We saw in part one of this series how an economy is balanced if its consumption and investment are the same size as its production. In other words if its savings are the same size as its investments. We also saw how an economy could become unbalanced if its savings were not completely spent on investment, in which case not all the products made by that country could be sold because there would be insufficient demand.

There are a number of ways that an economy can adjust under such circumstances to re-establish balance and if, like most economies on earth, a country has external trading relationships, one way is to export the goods that domestic demand cannot buy. By exporting the economy can continue to operate at full capacity and the economic contraction that would otherwise occur as result of excessive savings can be avoided because now the payment for some of the goods are coming from abroad. Rebalancing an economy through exports to overcome the lack of demand caused by too much saving requires that a country run a trade surplus, that it exports more than it imports.

Before looking at how an imbalance caused by too much savings can be corrected by trade it is worth briefly looking at how balanced trade works. When a country’s trade is in balance its exports are the same as its imports so the export/import trade has no impact on the overall balance of the economy. This balanced trade scenario is the one which features in analysis based on the Ricardian idea of ‘Comparative Advantage (where trade benefits all through the international division of labour and national specialisation) and in the serene world of neo-classical economics, where everything balances around the optimum best through the operation of self correcting market forces, it is balanced trade that is portrayed as being the norm. In fact the global trading system is fraught with persistent and deep imbalances and is very rarely balanced and it is this real world of imbalances that is the focus of these article.

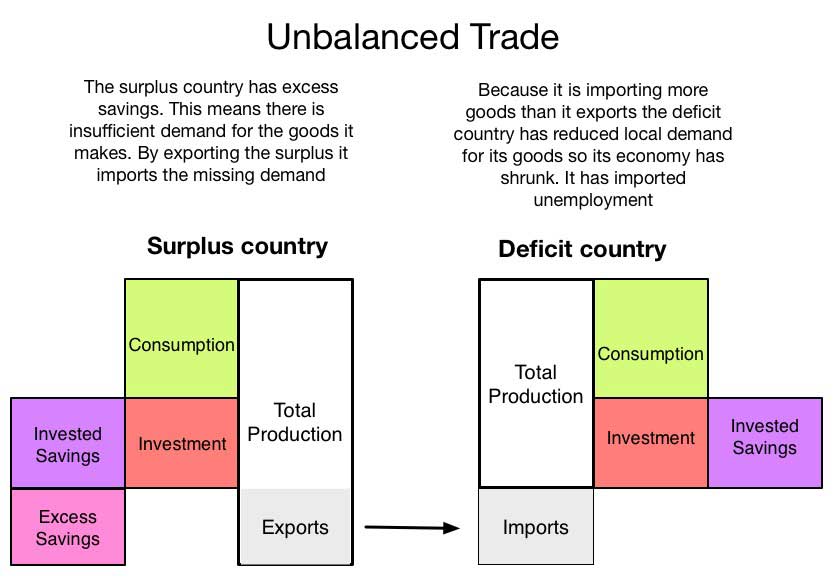

To see how an unbalanced trade system works lets imagine just two countries, one is running a trade surplus and the other a matching trade deficit. The country with the trade surplus is exporting goods it could not sell domestically because of lack of demand. The country importing the goods now finds some of its investment or consumption goods are being supplied by imports so the demand for goods from its domestic economy will shrink and so the domestic economy will shrink. Unemployment will go up. The two economies combined are balanced in the sense that combined their consumption plus investment balances with total production, but the balance is different for each individual country. The surplus country has solved it underconsumption problem by importing some demand from the deficit country, while the deficit country has seen its economy shrink and so it has also imported unemployment.

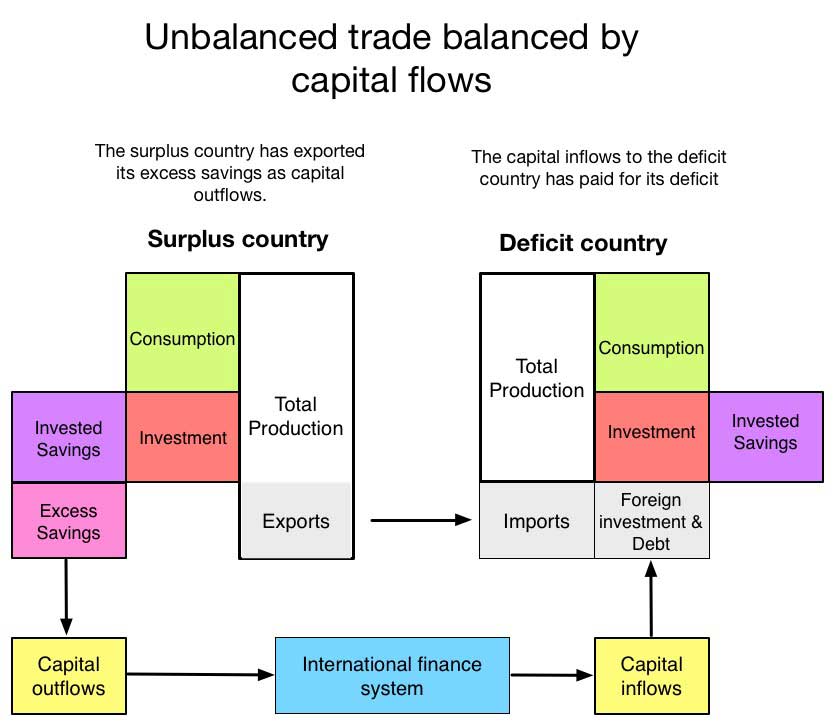

This unequal balance of trade does not seem very stable. The exporting country is still saving too much, its savings are piling up in its financial institutions and because all its investment costs have already been met there are no domestic ways left to invest those accumulating savings. At the same time the importing deficit country has seen its economy shrink, because imports have replaced demand for domestic goods, and so its economy no longer generates enough income to pay for those imports.

So in theory the imbalance of trade, one country running a surplus and the other running a deficit, should self correct very quickly. However in the real world this does not happen and surpluses and deficits can last for a very long time and grow to be very large. This is because the obvious solution to the problem of the instability of uneven trade, of surpluses and too much savings in one country, and deficits and too little demand in the other economy, is for the surplus country to send some of its excess saving to the deficit country to increase its domestic demand. This movement of funds across borders is called capital flows. And capital flows are at the root of the current global and eurozone economic crises.

There are many ways the excess savings of the surplus country finds its way to the deficit country and they all involve using the immensely complex system of global financial institutions. These financial institutions have increased dramatically in size, overall weight in the economy, complexity and global reach in the last two to three decades. How the global finance system mutated and evolved in recent decades is an unimportant part of the story of what went wrong in 2007 and is a topic I will be looking at in a later section. For now all we need to know is that this giant complex system exists and that through it vast amounts of excess savings can flow in very complex and labyrinthine ways from the surplus countries of the world to the deficit countries of the world.

Surplus countries can transfer excess savings by its businesses making direct investments in deficit countries, either through the purchase of local companies or through actual capital investment in things such as new factories, transport facilities or communication systems. This sort of capital flow is positive as it improves the recipient country’s economy and is not very volatile because the capital cannot be withdrawn easily or quickly. There are limitations to how much such direct investment can take place in the circumstances of an imbalance of trade. The reason the imbalances that generated the capital flow exists in the first place are because the products of the surplus countries were penetrating the economies of the deficit countries and so by definition it is very likely that there will be limited investment opportunities in the deficit countries.

A big part of the capital flows from surplus to deficit countries consists of the purchase by financial institutions in the surplus countries of an enormous variety of bonds and other financial instruments and derivatives. As we shall see the global financial system has in recent decades been astonishingly creative about ways to chop up, package, repackage debt in order to create ever more elaborate new types of investment products (and this creativity was a key factor in making the system as whole unstable). A holder of surplus savings in a surplus country, such as pension funds, corporate investment managers, insurance companies, etc, seek out investment products in financial institutions that seem to offer security, a high return and, if possible, the ability to liquidate their holdings promptly if required. Once an investment has been made the invested capital enters a vast and byzantine global financial machine that redistributes the invested savings, often through multiple intermediaries, all across the globe and into the deficit countries.

The problem that this flow of non-direct investment encounters is the lack of enough destinations that can generate investment returns. Once productive investment is saturated, and a country running as trade deficit is by definition likely to have only low and limited productive investment opportunities, then what remains as investment opportunities will tend to be more speculative in nature. As was explained in the previous article an excess of savings can be resolved in only a limited number of ways and that although running a trade surplus, and a capital outflow, can resolve the excess savings of an individual country, taken as a whole the global economy cannot run a trade surplus so only one of the four options (or a combination of them) outlined in the previous section can occur at a global levelled. Once productive investment is saturated then the only other option as a destination for outflowing capital (outflowing excessive savings) is investment in a debt fuelled consumption boom in the deficit countries. In fact almost invariably all large flows of capital generated by large trade imbalances have led to some sort of asset inflation and speculative boom/bubble. As the spare savings from the surplus countries sloshes around the financial system seeking a return on investment the apparently better than average, and then much better than average, rates of return generated by investment bubbles will act as a powerful attractor for further investment and as capital is attracted so the speculative boom and the resulting bubbles are inflated further in a deadly feedback loop.

The details of how specific capital flows prior to the crash of 2007 led to such speculative bubbles will be examined later.

Another way that the excess savings from the surplus countries can be invested abroad is through the purchase of government bonds (which are often referred to as ‘sovereigns’ in economic discourse). Government bonds are very attractive to investors because they are considered very safe (governments almost never default) and, because they are highly tradable, they are considered highly liquid (i.e can be turned back into cash very easily). This duel characteristic, that they are safe and liquid, means that sovereigns play a special role for banks who are allowed to lend a higher ratio against the sovereigns they hold than other forms of investment, and the more banks can lend the more money they make. Certain government bonds, such US Treasury Bills, UK Gilts, German Bunds, are very sought after investment vehicles and so those governments can borrow almost unlimited amounts very cheaply.

When the government of a deficit country sells its debt abroad, when foreign investors buys its bonds, what is happening is that foreign capital is replacing local domestic taxation as a source of funding for government spending. The inflowing capital by buying government debt is fuelling an increase in consumption in the recipient country as the citizens and business pay less taxes but the government continues to spend, so total consumption can go up. This increase in consumption is an increase in national income (even though a portion of that is now borrowed) and the increase in income pays for the imports flowing from the surplus countries. The excess savings of the surplus country has flowed, via purchases of the deficit country’s sovereigns into the deficit country’s economy and has paid for the imports that cause the deficit that matches the surplus.

Finally it is worth mentioning the diaspora remittances of the estimated 250 million migrant workers in the world who save money to send home to support their families and these remittances are part of the transfer of excess savings from surplus to deficit countries. The total amount of global remittances, estimated at $534 billion in 2012, is fairly trivial in terms of the scale of global capital flows but of course has a huge positive humanitarian impact.

Although the pattern of imbalances in global trade have shifted over the years, for example one big change was when the USA shifted after the early 1970s from being a surplus country exporting capital to being a deficit country importing capital, the existence of trade imbalances has been a persistent feature of global trade. And this persistence and recurrence of imbalances has meant that large capital flows have been a persistently destabilising factor in the global economy. How these capital flows could be handled in a less destabilising way was addressed by Keynes at the Bretton Woods conference in 1946 which set up the post war international monetary system. Keynes took quite a radical position at the conference and proposed a global surplus recycling mechanism ( to use Varoufakis’s term). Keynes’s proposal for curbing the problem was to create global rules that would place equal pressure on both creditor and debtor nations to adjust their respective trade imbalances, helping to ease the burden shouldered by debtor nations. He recognised that the key problem was that way the international system of exchange and currencies worked there would be pressure on the deficit nation to reduce its deficits but no pressure on surplus countries to reduce their surpluses. The onus, and cost, of adjustment was always placed on the shoulders of the defecit countries. He suggested that any nation that failed to ensure its trade surplus did not exceed a particular percentage of its trade volume would be charged interest, compelling its currency to appreciate. These interest payments would help to finance the second arm of Keynes’s proposal: the creation of an International Clearing Union. The ICU would act as a sort of automatic “global surplus recycling mechanism. When Keynes first introduced his proposal, the US delegation at Bretton Woods showed little interest in a plan that would restrict their ability to run whatever surpluses they wanted to. After intense negotiations, Bretton Woods delegates reached an agreement that largely reflected the interests of the US contingent

In the years prior to the 2007 crisis many countries were running large current account surplus, notably Japan (running at around 4%) and a lot of the oil producing countries but two stand out because of the absolute size of their economies and thus the size of their surplus: China and Germany. In the last decade and half the trade surpluses of these two countries have been both very large and very persistent, China regularly exports 25% of its GDP and Germany exports almost 50% of its GDP. The German trade surplus was around 7% prior to the crisis of 2007, it then fell back before growing once again to 7%.The Chinese trade surplus was around 10% prior to the crisis of 2007, it then fell back before settling around the 2-3% mark. This level of persistent trade surplus, in two countries which combined amount to close to a fifth of global GDP, is very high. As was explained earlier, if a country is exporting a surplus then it means that its national savings (the proportion of national income not being consumed domestically) is higher than its domestic investment level. For these two countries to run such large and persistent surpluses means that they are both running very high rates of national savings. The necessary flip side of that is that the proportion of national production in both countries going to domestic consumption is low.

In the next section I will explore the German and Chinese trade surpluses, the effects they had on global capital flows and the roles that these flows played in the crisis of 2007.

It is worth noting that before the 2007 crisis broke concern was growing about imbalances in the global trading system. The group of large surplus countries, and most significantly Germany and China, were running such massive surpluses in the years leading up to 2007 that it became accepted that there was a global ‘savings glut’ a term popularised Ben Bernanke, then a member of the Board of Governors of the Federal Reserve System, in a famous speech in April 2005 entitled “The Global Saving Glut and the U.S. Current Account Deficit”. His speech touches on a lot of the themes that will be explored in the next few sections

Here are some excerpts from Bernake’s speech and as you can see they echo the sort of analysis I have outlined so far about the relationship between national savings, investment, consumption, trading balances and capital flows. His speech is worth reading in full.

Countries typically pursue export-led growth because domestic demand is thought to be insufficient to employ fully domestic resources. Following the 1997-98 financial crisis, many of the East Asian countries seeking to stimulate their exports had high domestic rates of saving and, relative to historical norms, depressed levels of domestic capital investment–also consistent, of course, with strengthened current accounts.

In practice, these countries increased reserves through the expedient of issuing debt to their citizens, thereby mobilizing domestic saving, and then using the proceeds to buy U.S. Treasury securities and other assets. Effectively, governments have acted as financial intermediaries, channeling domestic saving away from local uses and into international capital markets.

From the saving-investment perspective, the U.S. current account deficit rose as capital investment increased (spurred by perceived profit opportunities) at the same time that the rapid increase in household wealth and expectations of future income gains reduced U.S. residents’ perceived need to save. Thus the rapid increase in the U.S. current account deficit between 1996 and 2000 was fuelled to a significant extent both by increased global saving and the greater interest on the part of foreigners in investing in the United States.

Of course, developing countries as a group can increase their current account surpluses only if the industrial countries reduce their current accounts accordingly. How did this occur? Little evidence supports the view that the motivation to save has declined substantially in the industrial countries in recent years;

Most interesting, however, is that the experience of the United States in recent years is not so nearly unique among industrial countries as one might think initially. As shown in table 1, a number of key industrial countries other than the United States have seen their current accounts move substantially toward deficit since 1996, including France, Italy, Spain, Australia, and the United Kingdom. The principal exceptions to this trend among the major industrial countries are Germany and Japan, both of which saw substantial increases in their current account balances between 1996 and 2003 (and significant further increases in 2004). A key difference between the two groups of countries is that the countries whose current accounts have moved toward deficit have generally experienced substantial housing appreciation and increases in household wealth, while Germany and Japan–whose economies have been growing slowly despite very low interest rates–have not. For example, wealth-to-income ratios have risen since 1996 by 14 percent in France, 12 percent in Italy, and 27 percent in the United Kingdom; each of these countries has seen their current account move toward deficit, as already noted. By contrast, wealth-to-income ratios in Germany and Japan have remained flat. The evident link between rising household wealth and a tendency for the current account to shift toward deficit is consistent with the mechanism that I have described today.

Love the article…please send more