While all eyes are on Brexit and the various critical elections looming in the EU the the tragic and cruel farce continues in Greece.

The publication of the International Monetary Fund’s World Economic Outlook (WEO) on Tuesday revealed worse estimates for the Greek economy compared to the upbeat set of forecasts included in its previous forecasts, which were released early last October.

The Fund now expects the domestic economy to grow at a slower pace of 2.2 percent in 2017 compared to its initial forecast of 2.8 percent, which stood at high-end of the estimates made last year.

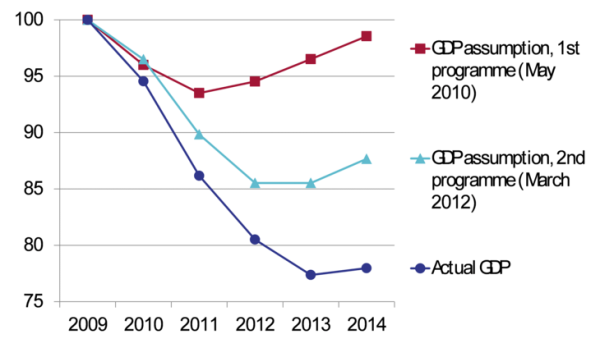

The fact that the October forecast was wrong and that the IMF has – once again – over estimated Greek recovery should come as no surprise. Since the beginning of the crisis in 2010 the IMF has consistently been wrong, often wildly, about Greek economic prospects, always claiming that recovery is about to start and then it doesn’t. Here is a graph showing what the IMF forecast to happen to the Greek economy prior to the 1st bail out programme (May 2010) and the second programme (March 2012) compared to the actual performance.

The downward revision reflects the weaker-than-expected GDP outcome in the fourth quarter (Q4) of 2016, as well as the negative impact from the delay in the conclusion of the second programme review. GDP contracted 1.1 percent year on year compared to IMF’s estimate for a growth of 0.7 percent.

The European Commission (EC) and the Finance Ministry anticipate GDP growth of 2.5 percent this year. In addition, the Bank of Greece (BoG) has a slightly lower estimate of 2.5 percent, while the OECD foresees a much slower growth of 1.3 percent for 2017.

For 2018, the IMF expects GDP growth to accelerate to 2.7 percent, while its medium-term estimate stands at 1 percent for 2022, lower than its previous forecast of 1.8 percent for 2021.

The report also outlines that the GDP evolution in the last quarter of the year, which is seen growing 4.2 percent in Q4 2017 and 2 percent in Q4 2018.

Even if the IMF is correct and Greek GDP growth accelerates and its economy does start to grow again it is still projecting cripplingly high unemployment. The Fund upped its estimate for the jobless rate to 21.9 percent in 2017 from 21.5 percent previously, which now stands close to the EC estimate of 22 percent. The Finance Ministry and OECD have higher unemployment forecasts of 22.6 and 23.1 percent for 2017.

For 2018, the IMF expects the jobless rate to drop to 21 percent. However, the decline by 0.9 percentage points (pp) within 2018 is much lower than that (-1.9 pp) estimated for this year.

Whatever happens a rate of unemployment of around one in five of the workforce is comparable to Great Depression levels. The IMF, along with fellow Troika members the ECB and the EU, still thinks that its possible to somehow squeeze over a hundred billion in debt repayments out of Greece and foster economic growth. What planet are these people from?

The simple truth about Greece is that it went bankrupt in 2010 but its bankruptcy was blocked by the EU and it was forced to accept massive loans. In the real world everyone knows that lending yet more money to an already debt ridden bankrupt would be pointless and would actually make matters worse. The reason the Greeks were sacrificed was to save the Euro, if it had defaulted on its debts to the bank who held its bonds it would have pushed the yields on a variety of euro bonds through the roof and trigged massive debt crisis in other indebted eurozone countries so its default had to be blocked. So Greece was cast into a sort of endless financial and economic purgatory, trapped at the bottom of a very deep hole it could not climb out of. The bail out also meant that private bad debt being carried by the banks (mostly German) was transformed into public debt between various countries and institutions. This both poisoned European solidarity and cast millions of Greeks into terrible poverty.

A note on Greek unpaid taxes

The Independent Authority of Public Revenue (IAPR) published on Monday its annual report for 2016, which revealed useful data on the composition of Greece’s tax debt.

The report showed that 4.31 million taxpayers (individuals and companies) owed 92.88 billion (52.8 percent of GDP) in unpaid tax in the beginning of December 2016. Over the last 12 months, the outstanding tax debt has increased by 8.6 percent.

This plays to a common narrative of feckless Greeks who don’t pay their debts. However if that tax debt is broken down it shows that the tax debt is largely a problem of the Greek oligarchs.

The breakdown showed that only 2 percent of the total tax debt (1.82 billion) is owed by 83.8 percent of taxpayers (3.61 million). Those taxpayers owe less than 3,000 euros each. It is also worth noting that 2.39 million taxpayers (55.4 percent of total) owe less than 500 euros each.

In contrast, just 16,290 taxpayers (0.4 percent of total) owe more than 300,000 euros each for a total amount of 78.79 billion corresponding to 84.8 percent of total unpaid tax obligations. It is pointed out that 7,296 taxpayers owe more than 1 million euros each for a total amount of 74 billion (80 percent of total).