The financial crisis of 2008, and Great Recession that followed it, was the most serious economic crisis since the Great Depression in the 1930s. The economies of the developed nations have never really recovered since the 2008 crash and weaknesses in the financial system, low investment, high unemployment and low growth have persisted. The economies of the emerging nations, most notably China, weathered the 2008 crisis fairly well and until recently their economies continued to grow. However it now looks like the global economy is once again slowing and this time around the slowdown really is global as the economies of the emerging nations slow and even contract.

Claudio Borio, chief of the Bank for International Settlements (the central bank for the world’s central banks) said in its latest quarterly report that the “uneasy calm” of previous months had given way to turbulence and a “gathering storm”, He went on to say that “the tension between the markets’ tranquillity and the underlying economic vulnerabilities had to be resolved at some point. In the recent quarter, we may have been witnessing the beginning of its resolution,” he added. “We may not be seeing isolated bolts from the blue, but the signs of a gathering storm that has been building for a long time,” he warned.

William White, the Swiss-based chairman of the OECD’s review committee and former chief economist of the Bank for International Settlements (BIS) said recently that the “the situation is worse than it was in 2007. Our macroeconomic ammunition to fight downturns is essentially all used up” and that ”emerging markets were part of the solution after the Lehman crisis. Now they are part of the problem, too. Debts have continued to build up over the last eight years and they have reached such levels in every part of the world that they have become a potent cause for mischief. It will become obvious in the next recession that many of these debts will never be serviced or repaid, and this will be uncomfortable for a lot of people who think they own assets that are worth something,”. I explored the problem of continuing global debt growth and its relationship to continuing imbalances in the global economy in a previous article entitled ‘Global debt and the great rebalancing’.

What is causing the new global slowdown and how does it relate to the crisis of 2008 and its aftermath?

An overview of the causes of the 2008 crisis

During the decade before the 2008 financial crisis very big imbalances in global trade developed. Some countries went heavily into deficit on their current account and some countries developed matching very large surpluses.

This development grew out of the patterns and organisation of international trade that had preceded it but the imbalances in trade in the decade prior to the crises were much larger than anything seen before. The most significant imbalance was the huge trade deficit that the USA developed prior to 2007 but large trade deficits also developed in the weaker Eurozone countries. These defects were matched by the development of huge surpluses by China, Japan and Germany, and significant surpluses in the oil exporting countries.

None of these imbalances were corrected by currency shifts. The dollar did not fall in value because countries like China and Japan were deliberately keeping their currencies cheap and the dollar strong to ensure they continued to generate current account surpluses. The status of the dollar as the world’s reserve currency also helped keep it strong. Germany’s surplus was not corrected by a strengthening currency because it was now inside the Eurozone and the Euro was undervalued in terms of Germany’s trade performance (although over valued for the weaker Eurozone countries).

As a result of these growing and uncorrected trade imbalances large amounts of capital accumulated in the surplus countries where it was recycled via the major financial global centres and flowed back from the surplus countries to the deficit countries. These capital inflows to the deficit countries were not given but lent so the inflows built up a very large debt levels in the deficit countries such as the US and the eurozone periphery. The capital inflows from the surplus countries were partially used to buy USA government debt (Treasury Bills) thus fuelling a ballooning US government deficit and incidentally paying for the costly post 9/11 wars. Other governments, such as the Greek government, also found it easy to finance large government deficits.

The recycled capital from the surplus countries also poured into the global financial system looking for investment opportunities and in the process driving down interest rates (because there was now a surplus of capital available for lending). The trade imbalances that had generated the capital flows were the result of the inability of businesses in the surplus countries to compete with foreign business so by definition it was hard to find productive profitable investment opportunities in deficit countries such as the USA or eurozone periphery for the inflowing capital generated in the surplus countries. As a consequence big flows of capital began to flow into property markets in a number of countries, particularly the USA, Ireland and Spain, and a series of property bubbles began to develop as prices were pushed up. Capital also flowed into cheap credit offerings in the personal finance market and so personal debt also rose significantly, particularly in the form of of mortgages. The asset and private debt bubbles generated attractive rates of return and were therefore attractive investment opportunities which in turn sucked in even more capital and so the various credit bubbles became very inflated.

The financial system was poorly prepared to handle these huge flows of capital because, for a complex raft of reasons, it had become systemically incapable of managing risk and had become ever more relaxed about taking risks. At the same time ludicrously complex new financial instruments and mechanism were being invented and widely adopted. These were seen as spreading the risk around the finance system, and thus reducing risk. In fact these new new financial instruments were actually spreading high risk poison around the system whilst also camouflaging it and confusing the financial sector corporate managers.

The prevailing neoclassical theoretical and neoliberal policy consensus which underlay the management of the global economy, and of the finance system, was heavily focussed on ensuring inflation did not rise, and did not have the theoretical framework which allowed those responsible to understand that the financial system was growing increasingly unstable. The long boom of the Great Moderation lulled the managers of the global economy into a false complacency and, assisted by the neoclassical belief in self correcting equilibria, in to a belief that systemic crises were a thing of the past.

Eventually the major centres of the global financial system became deeply unstable and in 2007 imploded. The pyramid of debt collapsed and almost overnight the world became saturated with bad debt.

The Great Recession

The result of the crash of 2008 was the Great Recession. This differed from previous recessions in that the trough of the downturn was much deeper and the recovery, at least in the developed economies, was much slower. Many of the worlds most developed economies took a long term to recover from the crash and in a number of countries growth rates after the crash appear to have been permanently reset to a lower level.

Although the crash hit the large developed economies hard the emerging economies, particularly the so called BRICS group, seemed to avoid the worst effects of the recession and these economies saw strong growth returning quite quickly after 2008. It was the growth in the emerging countries that helped restore and then sustain global growth in the years after the crash.

The three really worrying features of the slow recovery phase after the crash were the continuation of large global trade imbalances, the continuing build up of global debt levels and the exhaustion of policy options in the developed economies.

The large trade surplus countries continued after 2008 running large trade surpluses, and some countries, such as the USA and UK, continued to run large trade deficits. Most importantly the USA continues to be consumer of last resort for the global economy, assisted by the demand generated by the Chinese investment programme. The only place where trade imbalances were partially corrected was inside the eurozone where a ruthless program of adjustment was implemented, but the design of the eurozone precluded policy measures (i.e. what used to be called social democracy) that could ease the pain of adjustment and the result was the suppression of internal demand, deflation, massive unemployment and economic stagnation.

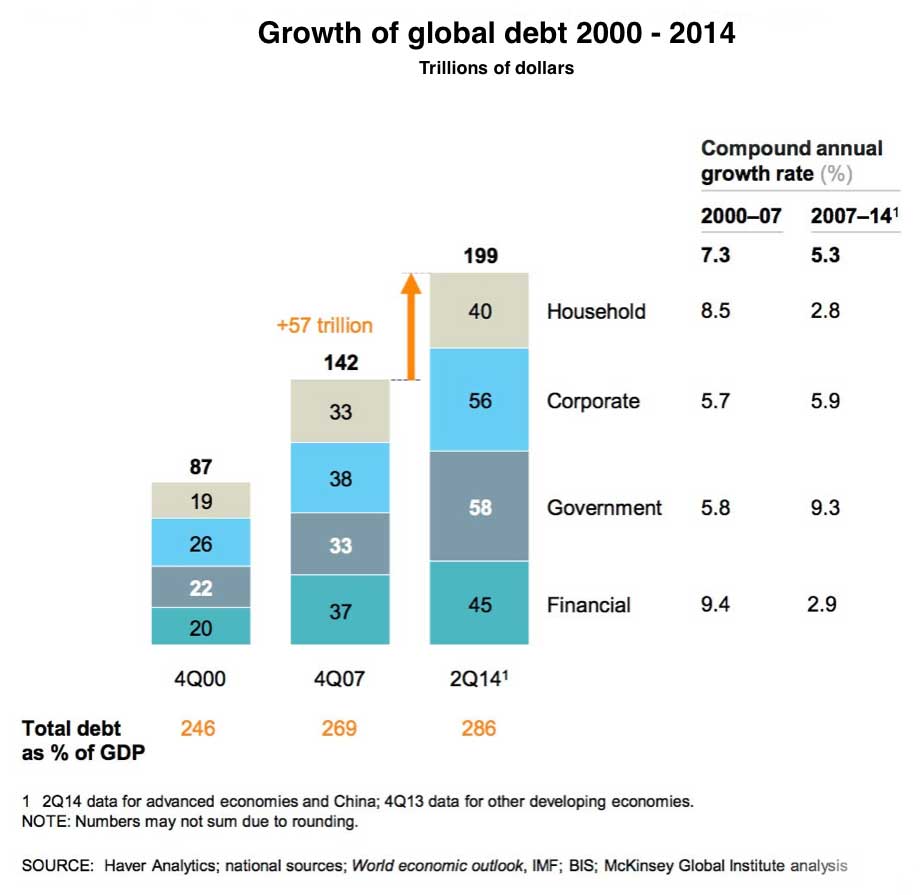

Financial crises are always crises of debt, and are usually followed by a painful process of deleveraging as debts are paid off, bad debt is written off and asset prices fall. And although some deleveraging did occur after 2008 globally debts levels have continued to increase and are now much higher than before the crash of 2008.

Part of the continuing post-crisis growth in global debt was the result of continuing global trade imbalances as the countries that were still running a trade deficit financed their imports, but another major source of debt creation was in China. The Chinese ruling elite responded to the post 2008 slow down in global trade by compensating for reduced exports by massively increasing domestic investment programs (this is explained in some detail in ‘Thinking about China’ and in ‘What is happening in China?’). Chinese investment levels were already the highest in the world and as the level of investment was pumped up even further the Chinese investment program became easily the biggest in history. It was almost completely financed by debt. As a result China has become littered with dozens and dozens of new (and often barely populated) cities, high speed rail links, giant airports and other massive infrastructure projects. Almost none can generate a return on capital and thus almost none can repay the debts incurred to build them.

While it was running at full throttle the Chinese investment program pumped up global commodity prices, including the price of oil, and this allowed a large number of emerging economies to grow strongly, and this helped to pump a lot of demand into the post financial crisis global economy. The very high price of oil after 2008, which allowed the oil producing countries to sustain large spending programs, and the booming commodity economies riding on the Chinese investment program were crucial to sustaining global demand during the post crash period when the developed countries were mired in recession.

The governments and central bankers responded promptly once the scale of the 2008 financial crisis became apparent and moved quickly to prevent the collapse of the banking system. Since then the central banks have been the prime movers in trying to sustain growth via unusual and innovative monetary mechanisms such as super low, or even negative, interest rates, and large scale purchasing of financial assets (known as Quantitative Easing). In the developed economies the use of fiscal techniques for stimulating growth (increasing consumer demand or funding large scale investment through deficit financing) has been far more limited. The USA did not implement a fiscal austerity program after 2008 but there were no no special fiscal stimulus measures either, the UK did implement austerity but has eased it episodically depending on political contingencies, and the eurozone, which now has an institutional resistance to deficit spending, stuck rigidly to austerity. The result has been some recovery in growth in the USA, uneven and unimpressive recovery in the UK and continuing stagnation in the eurozone. Recovery and growth has been in inverse relation to the amount of fiscal retrenchment, the more austerity the less growth.

The current global economic slowdown

The years since the 2008 crash have been marked by reduced rates of growth in the developed economies, and now those rates of growth appear to be slowing, and this time (unlike 2008) the entire global economy, including China and the other developing economies, also seems to be slowing down.

Over and above the ongoing and unresolved structural weakness of imbalanced global trade and escalating global debt levels there are now at least seven separate (but connected) mechanisms causing problems in the global economy.

One. The Chinese economy, a major source of demand and growth in the global economy, is only just starting to go through what will almost certainly be a wrenching adjustment as it shifts from an economy based on super high levels of investment to one based on domestic consumption. For reasons explored in the previous articles linked above, this economic adjustment is going to be very difficult for the Chinese, not least because the massive investment program (which is still continuing) has generated a very large amount of debt in the Chinese financial system. A lot of that debt will never be repaid. As a rule of thumb, an emerging economy’s total private and public sector debt should not exceed 100% of GDP. China’s total debt is now more than 250% of GDP and could easily be as high as $40 trillion, or 350% of GDP.

Two. Emerging markets are in serious trouble as they face a series of economic pressures including China’s slowdown, the decline in income resulting from end of the commodity super cycle, the US Fed’s decision to increase interest rates which has driven up the dollar and thus made their dollar denominated debts harder to repay. Many emerging countries are running macro imbalances, such as twin current account and fiscal deficits, and confront rising inflation and slowing growth. Most have not implemented structural reforms to boost sagging potential growth. And currency weakness increases the real value of trillions of dollars of debt built up in the last decade.

Today, most of the major emerging economies have experienced a severe reversal of fortune. Russia and Brazil have plunged into severe crises, with double-digit inflation accompanying a 4% contraction in GDP last year. South Africa is barely growing. Indeed, the future of the BRICS (including South Africa), and that of other emerging markets, looks gloomy. Outside of Asia, most developing economies are principally commodity exporters, and thus are highly exposed to price shocks. Plunging oil prices have cut the value of the Russian ruble by more than half against the US dollar, and further declines appear likely, especially if the US Federal Reserve continues to hike interest rates. Commodity prices could stay low for one or two decades, as they did in the 1980s and 1990s. When it comes to oil, for example, shale gas, tight oil, and liquefied natural gas are boosting energy supply, even as a decade of high prices has spurred conservation and reduced demand.

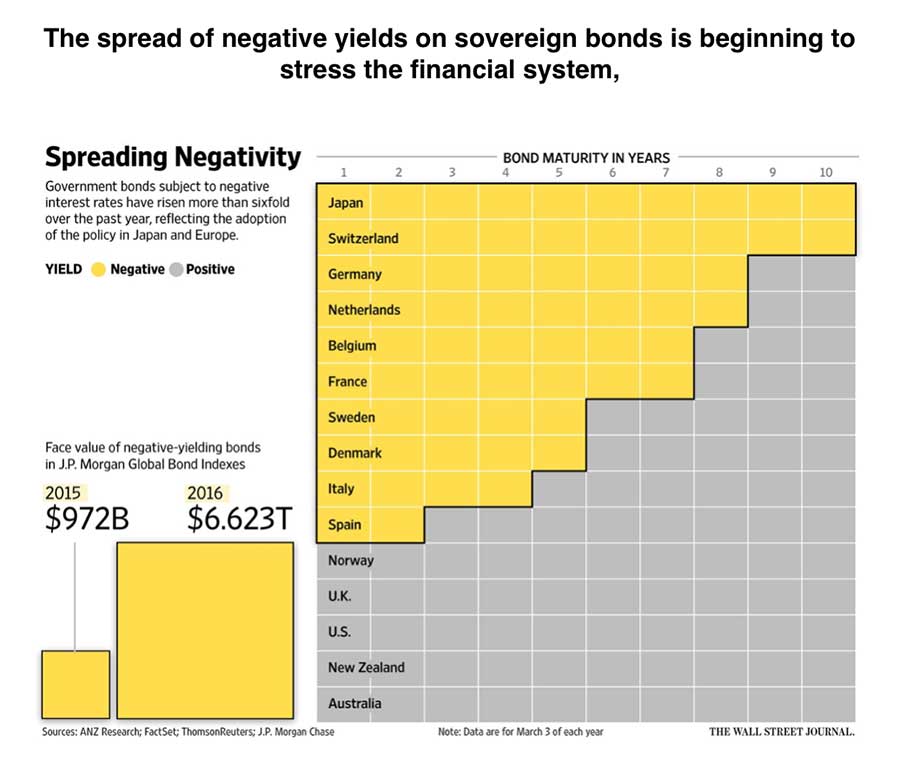

Three. The main policy response to the financial crisis of 2008 was monetary. Central banks have reduced interest rates to very low levels and held them low for a very long time. These sorts of sustained ultra low interest rates are unprecedented in economic history. At the same time Central banks led by the US Fed, followed promptly by the Bank of England, and eventually and after much delay followed by the ECB, have conducted massive programs of asset purchases, known as Quantitative easing. This involves central banks creating new money on their computer systems and then using it to purchase various types of financial assets, mostly government bonds but also other private sector bonds. This is intended to drive up (or at least reduce the decline) of bond prices and theoretically injects greater liquidity into the financial system. The Japanese pioneered this technique of QE after its crash in the 1990s and the Japanese program is now very long standing and very large and yet the Japanese economy has more or less stagnated since the 1990s.

It is worth noting that as a result of the various QE programs central banks now hold a very large proportion of public debt. In the UK the Bank of England owns over 35% of the governments deficit. The BoE could simply delete those debts and overnight night reduce the government deficit by a third. I have yet to see a substantive argument as to why this cannot happen.

The problem central banks, and their governments, now face is that with interest rates at zero (and increasingly even negative) and with central banks running out of bonds to buy, its not clear what further policy instruments central banks can deploy if another economic crisis unfolds. As the recent US Fed decisions to increase interest rates by a fraction of a percent demonstrated, central bankers appear to be tempted to raise interest rates (thus helping to precipitate an economic downturn) in order to have once again the option of reducing them (in order to respond to an economic downturn). And yes that’s as bonkers as it sounds.

Four. Many simmering geopolitical risks are coming to a boil. Perhaps the most immediate source of uncertainty is the prospect of a long-term cold war – punctuated by proxy conflicts – between the Middle East’s regional powers, particularly Sunni Saudi Arabia and Shia Iran.

Five. Weak oil prices are damaging US energy producers, which comprise a large share of the US stock market, which will impose credit losses and potential defaults on net energy exporting economies, public finances (as oil related tax revenues drop), state-owned enterprises, and energy firms. A significant number of large energy companies are now essentially insolvent, and many energy related bonds and debts may now become non-performing. Many of those bonds and debts are denominated in appreciating dollars which will have to be repaid using depreciating national currencies. Energy debt could play a similar role in destabilising and weakening the banking system in the next crisis as sub-prime property bad debt did in 2008.

Six. The financial system in the developed economies is still weak following the crisis of 2008, and appears to be becoming even weaker as bad debts escalate and profits fall. The reduced and stagnant growth rates in the developed economies since 2008, the Chinese super investment program hitting the buffers and the sustained period of low and negative interest rates, have all combined to suppress profitability in the financial sector. Meanwhile the mountain of bad debt are still sitting on the books of many banks after the financial crash, the non-performing loans have not gone away, they were mostly just parked, and now as bad debt is once again escalating the balance sheets of banks are deteriorating. Uncertainty in the banking system has been exacerbated by the flawed provisions of the EU banking Union (see this article) which has caused capital flight from the weaker peripheral banking systems since it came into effect on the 1st January 2016.

Seven. The world’s largest integrated economy, the European Union, is now a source of deflation and instability in the global economy. The flawed architecture of the eurozone means that it has never escaped the post crisis stagnation and now it appears to be weakening again. Many parts of the European banking system are in a dire state. Germany not only continues to run a massive trade surplus (a policy that reduces global demand and exports unemployment) but is busy trying to turn the entire eurozone into a similar export dependent economy.

Unemployment, the resulting political instability, and the migrants crisis are all weakening the European Union meaning the likelihood of substantial reform (much less the partial dismantling) of the flawed eurozone system is less likely. Protracted high unemployment in the eurozone is causing the slow but relentless disintegration of many political parties, particularly on the social democratic left. Populist parties of the right and the left are gaining strength throughout Europe. The migration crisis could lead to the end of the Schengen Agreement, and (together with other domestic troubles) to the end of German Chancellor Angela Merkel’s government. Brexit could trigger another round of instability in the EU, and the Greek crisis will not go away as it is quite impossible that the Greeks will be able to pay their debts off.

Thus, Europe increasingly risks at worst disintegration and at best a paralysed stagnation. To top it all off, its neighbourhood is unsafe, with wars raging across the Middle East, an uneasy military truce in the Ukraine and severe tensions with while Russia from the Baltic to the Balkans. At the same time the US is trying to pivot away from Europe and the Atlantic alliance and focus more on Asia, China and the pacific arena.

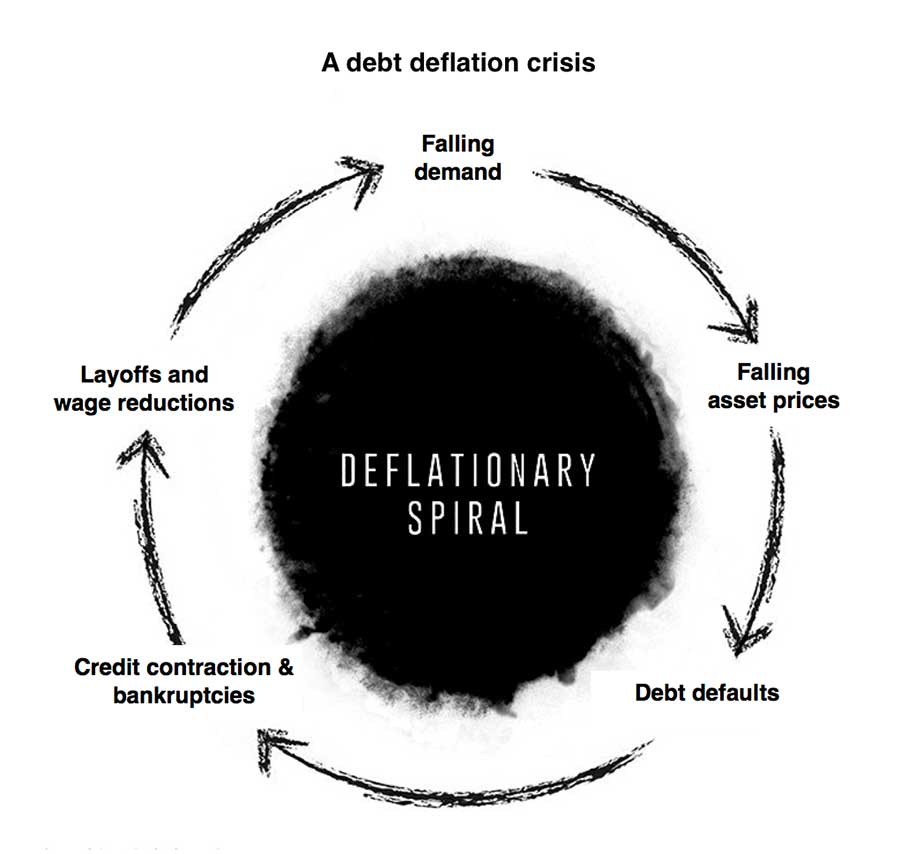

Since the 1970s, and through the Great Moderation, recessions were just brief periods of slower growth and mostly the policy responses were strong and effective. At no time was generalised deflation a problem, and there were no episodes of serious debt deflation. Since 2008 that has all changed. Today, there are seven sources of potential global risk pushing down the world’s economy as it moves from an anaemic expansion to a slowdown, which will lead to further reduction in the price of risky assets worldwide. The danger is a global debt deflation spiral.

At the same time, the policies that stopped and reversed the doom loop between the real economy and assets values in 2008 are running out of steam. The current policy mix is suboptimal, owing to excessive reliance on monetary rather than fiscal policy. Indeed, monetary policies are becoming increasingly unconventional, reflected in the move by several central banks to negative real policy rates; and such unconventional policies risk doing more harm than good as they hurt the profitability of banks and other financial firms.

The big issue, of unbalanced global trade, income inequality which is draining demand from the economy, and a global finance system that has become a mechanism for building ever larger mountains of debt, all require global leadership but are occurring seemingly at a time of US imperial retreat.

Time to buckle up for a bumpy ride.