After the 2008 financial crisis and the longest and deepest global recession since World War II, it was widely expected that the world’s economies would deleverage and that global levels debt would be slowly reduced as usually happens in the aftermath of a financial crisis. It has not happened. Instead, debt continue to grow in nearly all countries, in both absolute terms and relative to GDP. This creates fresh risks in some countries and limits growth prospects in many. Meanwhile the global economy remains severely unbalanced. The imbalances in trade, and the associated capital flows and debt increases resulting from those imbalances, were not corrected by the financial crises. The inevitable rebalancing that will occur at some point, possibly quite soon, and the debt adjustments that will accompany that rebalancing, will probably be very disruptive and if the adjustment occurs in a disorderly way then the possibility for a new round of global economic crisis is quite high.

Financial crises are part and parcel of the capitalist system. There have always been financial crisis, especially since the birth of industrial capitalism, and there always will be financial crises in the future (assuming that the capitalist system continues into the future and I certainly see no reason why it won’t). All financial crises have more or less the same sort of structure and causation. The great analyst of financial crises was the economist Hyman Minsky, who died in 1996, and whose work was almost forgotten during the hubris of the Great Moderation but who has since the financial crisis of 2007 been rediscovered. Most macroeconomists work with what they call “equilibrium models”, the idea that a modern market economy is fundamentally stable. The theory does not say nothing ever changes but that the economy’s default state is to grow in a steady way, and that to generate an economic crisis or a sudden boom some sort of external shock has to occur, whether that be a rise in oil prices, a war or the invention of the internet. Minsky disagreed. He thought that the system itself could generate shocks through its own internal dynamics. He believed that during periods of economic stability, banks, firms and other economic agents become complacent. They assume that the good times will keep on going and begin to take ever greater risks in pursuit of profit. So the seeds of the next crisis are sown in the good time.

All financial crises are at their heart crisis of debt. Minsky had a theory, the “financial instability hypothesis”, arguing that lending goes through three distinct stages. He dubbed these the Hedge, the Speculative and the Ponzi stages (named after financial fraudster Charles Ponzi). In the first stage, soon after the preceding crisis, banks and borrowers are cautious. Loans are made in modest amounts and the borrower can afford to repay both the initial principal and the interest. As confidence rises banks begin to make loans in which the borrower can only afford to pay the interest. Usually this loan is against an asset which is rising in value. Finally, when the previous crisis is a distant memory, we reach the final stage – Ponzi finance. At this point banks make loans to firms and households that can afford to pay neither the interest nor the principal. Again this is underpinned by a belief that asset prices will rise.

The easiest way to understand this is to think of a typical mortgage. Normal hedge type finance means a normal capital repayment loan, speculative finance is more akin to an interest-only loan and then Ponzi finance is something beyond even this. It is like getting a mortgage, making no payments at all for a few years and then hoping the value of the house has gone up enough that its sale can cover the initial loan and all the missed payments. You can see that the model is a pretty good description of the kind of lending that led to the 2007 financial crisis. The “Minsky moment”, a term coined by later economists, is the moment when the whole house of cards falls down. Ponzi finance is underpinned by rising asset prices and when asset prices eventually start to fall then borrowers and banks realise there is debt in the system that can never be paid off. People rush to sell assets causing an even larger fall in asset prices and a crisis is unleased as asset values collapse and bad debt explodes.

During the acute phase of a financial crisis all sorts of assets (including financial instruments like bonds and mortgages, and real assets like property, inventories and capital equipment) fall in value as everybody tries to of sell off their assets at the same time, as they desperately try to turn them in to cash, causing the price of assets to fall drastically. This means that what were good assets with value suddenly fall in value or even lose all value. As the value of assets collapses so what were good debts become bad debts. The value of a mortgage secured against a property whose price has collapsed is suddenly worth less than was paid for it, and of course during the exuberant and insane period just before the crisis lots of assets were bought with borrowed money. Now the devalued assets cannot be sold to cover the costs of all those debts that were incurred before the crisis to buy the assets. So immediately after a financial crisis there will be a lot of bad debt inside the financial system and all that bad debt will have to be paid off, or written off, during the post crisis phase, a process usually referred to as deleveraging.

The process of deleveraging after a financial crisis, and losses incurred during the financial crisis, means that financial institutions and firms are wary, or even incapable, of delivering or securing the credit necessary to fund normal economic growth and investment. So a financial crisis can cause the real economy to slow down or even contract. Eventually the bad debt level subsides, the deleveraging has run its course, credit conditions become healthy once again and the real economy recovers. Sometimes a financial crises, because it is localised by sector or country, doesn’t even cause any slow down in the real economy. This is what happened with the so called ‘dot com’ crisis in 2000 when some wildly overprices internet related stock prices collapsed, but nothing much happened in the real economy as a result.

In the Great Depression what began as a financial crises rapidly became a generalised and deep crisis of the real economy. This happened because although there were specific problems in the financial system caused by a “Minsky moment” there were also deep structural problems in the real global economy, fault lines that the financial crisis opened up. In the 1930s these deep imbalances were associated with the decline of the British economy as the dominant force in the global economy and its replacement by the USA, the global economic leadership vacuum that had opened up, the overhang of a complex raft of large international war debts between the the USA, the UK, France and Germany, and the attempts to re-establish the gold standard. The latter meant that instead of currency arrangements being a shock absorber they were, because of the rigidity imposed by the gold standard, a transmission belt for spreading and amplifying shocks. It was only as countries such as the UK and the US abandoned the gold standard that their economies could begin to stabilise.

The 2007 crisis was the largest financial crisis since the Great Depression and it had a severe impact on the real global economy with growth falling, many national economies contracting, global trade falling, unemployment rising and many financial institutions becoming insolvent. There was a massive and fairly well coordinated effort by governments and central banks around the world to prevent the collapse of the financial system (which was successful) and to reduce the impact on the real economy (which was somewhat less successfully and quite a bit more hit and miss).

At the time of the 2007 crisis the two great global shock absorbers were the US and China. The US acted as a sort of consumer of last resort buying up via its vast trade and budget deficits the world’s goods and thus kept the wheels of global commerce turning. The US did this by literally printing money via it’s Quantitive Easing (QE) program and by continuing to borrow money on a vast scale. China also acted as a global shock absorber by accelerating internal investment to balance falling global trade and thus keep its growth rate high, this in turn meant the the price of many commodities remained high protecting economies dependent on commodity export from the impact of the recession in the developed countries caused by the financial crisis. However the acceleration of internal investment also deepened the internal imbalances in the Chinese economy (see my article on China) and was largely debt fuelled.

The Eurozone countries had abandoned the most important national shock absorbers, such as control over monetary policy, the ability to devalue and the ability to run large deficits, and instead had adopted a rigid system of rules that meant that many governments were forced to implement pro-cyclical policies (i.e policies that deepened rather than reduced recessionary forces). The result has been that the recession in the eurozone has been long lasting and recovery has been very weak. In many ways the eurozone system is very much like a modern gold standard, except that countries cannot abandon it with relative ease as they could the gold standard, and its based on paper and treaties rather than precious metal. As with the gold standard in the eurozone all adjustments, and most of the costs, are forced upon the deficit countries and there is no mechanism in place to force the surplus countries to adjust even though they have both greater responsibility for the structural problems and greater resources to cope with difficult adjustments.

Based on the pattern of previous financial crisis one would therefore expect that in the eight years since the crisis first erupted there should have been a significant degree of global deleveraging undertaken as old bad debts were either finally paid off or written off. Indeed in some sectors and some countries some deleveraging has occurred, such as in the UK household sector where debt has fallen from its pre-2007 high.

However globally debt levels have not fallen, in fact global debt levels have risen significantly and now, worryingly, stand much higher than they did in 2007. The reason that debt has risen rather than fallen is because the underlying structural imbalances in the global economy which were a prime driver of the 2007 crisis have not yet been fixed, those imbalances have remained in place.

Fixing these large-scale imbalances in the global economy will not be easy and there will be strong pressures on national governments to try to off load the costs of adjustments on to other countries and therefore finding a way to create an effective mechanism to globally manage the adjustment will be very hard, so the risks of a disorderly adjustment are quite high.

The deep structural problems of unbalanced global trade

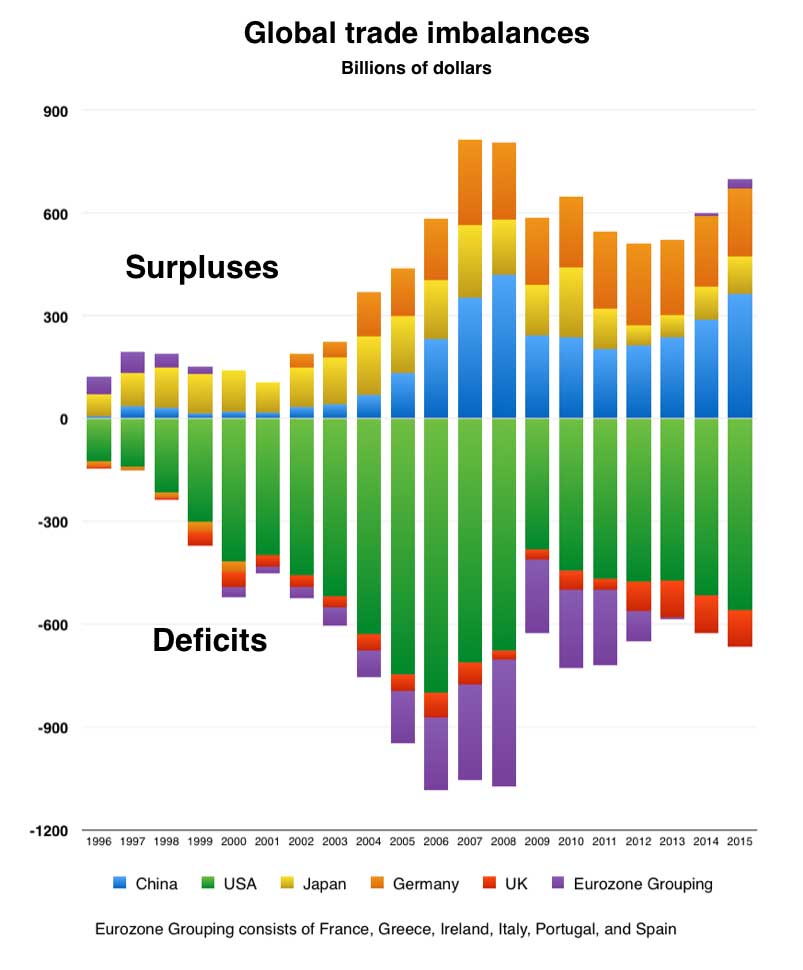

In the decade before the financial crisis of 2007 a deeply unbalanced pattern of global trade had developed. These imbalances involved some countries developing very large and persistent trade surpluses while other countries developed very large and persistent trade deficits. The main trade surplus countries were China, Germany, Japan and the oil producing countries. The main trade deficit countries were the USA, the eurozone periphery and the UK. The financial crisis of 2007 did not fix these large structural imbalances. Immediately after the crisis the scale of the imblances declined a little but they were still large and over recent years the imbalance have once again started to grow. There was a rebalancing of sorts in the eurozone whereby the economies of several indebted and deficit countries were depressed by such a large amount, causing massive increases in unemployment and poverty, that imports to those countries fell thus reducing their trade deficits. Below is a graph that shows the magnitude and length of the various current account imbalances.

In order for current account imbalances of these magnitudes to be sustained for such long periods a numbers of things need to happen. One is that the imbalances are not corrected by changes in currency exchange rates and another is that the deficit countries be able to borrow (or print) the money needed to pay for all those imported goods. Normally the currency of a country that runs a persistent current account deficit will eventually depreciate in value and this will make imports to that country more expensive and make its exports less expensive and both factors will help reduce the deficit. Similarly a persistent surplus country should, under normal circumstances, expect to see its currency appreciate in value making its exports more expensive, its imports cheaper, and that should reduce its surplus over time.

However there are some special circumstances that have prevented the imbalances from being corrected by currency changes. One is the special position of the dollar, another is the commitment of some governments (such as the Chinese and the Japanese) to intervene in currency markets in order to keep their currencies low against the dollar (in order to maintain the competitiveness of their export business), another is the existence of the single currency zone in Europe within which Germany is protected from currency appreciation, and yet another reason that currency changes did not occur was the return flow of capital out of the surplus countries and into the deficit countries.

Even though the USA has been running a truly gigantic deficit on it’s current account for many years the dollar has not collapsed and it still functions as the de facto world reserve currency. The reason the dollar has not collapsed (so far) is because global demand for dollars is only partially related to the US trade, and that demand has remained high. The non-trade related demand for the dollar was caused by a combination of huge capital inflows into the USA from surplus countries, and in particular from China, and the effects of the dollar’s special status as the global reserve currency.

As already noted the large surpluses are not accidental but are a direct result of the Chinese policy of maintaining a high dollar and the use by Germany of what is, given its large and persistent surplus, an undervalued Euro (see below). China, Germany and other surplus countries have all deliberately planned to earn more than they spend and to build and sustain very large export economies. These very large planned surpluses, and the resulting capital flows they generated, were a key factor in the destabilisation of the financial system in places like New York and London prior to 2007. These capital inflows take many forms such as direct investment, the placing of funds in money markets, the purchase of government bonds, interbank lending, etc.

A very important part of these flows was the purchasing by various central banks in developing countries, of which the most important by far being the People’s Bank of China (PBC) and the Bank of Japan, of large quantities of US government debt in the form of Treasury Bills. These US Treasury Bills are considered to be some of the safest investment vehicles on the planet because they are denominated in dollars, the world’s reserve currency, and they are backed by the US government. The People’s Bank of China has an astonishing three trillion dollars worth of US Treasury Bills in its reserves. That’s three trillion dollars that China has not spent but rather saved by lending it to the US government. It wasn’t just China or just other developing economies that were running big surpluses, so was Japan and Germany. The German surplus after 2000 (when it had more or less completed the costly reunification process) became, and remains, very large.

Another important reason the value of dollar did not fall as a result of the huge USA deficits related directly to the use of the US dollar as a global reserve currency. Primary commodities are denominated in dollars. This puts the United States in a uniquely privileged position of being the only country whose currency’s demand does not just reflect an increase in the demand of goods and services it produces. To make this plainer, consider the Singapore dollar. The only reason why the demand for it may rise is if persons holding other currencies want to buy goods or services originating in Singapore, if they wish to visit the island state or if they want to buy Singaporean real estate or shares. If Singapore’s products, services and assets become less attractive to foreign buyers, or the state builds up debts which make investors fear that more Singapore dollars will be printed for the same level of output (and for the same level of demand for that currency), capital will migrate away from the Singapore dollar, its demand will fall and so will its value in terms of other currencies. That none of these constraints apply to the US dollar is the cause behind its privileged position.

When Singaporean, German or Chinese drivers put petrol in their car, this act translates into an immediate increase in the demand for US dollars. Moreover, this is so even if the petrol is refined in a French refinery that bought the crude oil from a Libyan company and had it transported to the other side of the world in a Greek tanker, without the involvement of a single US company or national. How come? Simply because oil sales are denominated in dollars. So, the Singaporean petrol station’s business translates into demand for a commodity, crude oil, whose sale from the Libyan oil well to the French refinery must involve the changing of French Euros into US Dollars. In short, the only currency in the world that is demanded for reasons that have nothing to do with economic activities occurring within its country of origin, is the US Dollar. This privileged status empowers the US authorities to run deficits that would cause other countries to buckle under in no time.

Just as this huge imbalance between deficit and surplus countries was developing one of the major surplus nations, Germany, entered into a currency union with a number of weaker nations. The effect of this currency union was profound. The existence of a huge German surplus was both partially obscured by the single currency and could continue unchecked by any currency adjustment. The value of the Euro is determined by the performance of the Eurozone as a whole and as a consequence it’s value is a compromise which leads to a currency under valued for the Germans and over valued for many weaker economies such as Ireland, Greece, Spain, Portugal and Italy. German exports are cheaper than they would be if Germany was still using the Deutschmarks and it’s imports more expensive. Hence the scale of the persistent German surplus. Similarly Greek, Spanish and Portuguese exports are expensive and their imports cheaper than if they were using their old currencies, thus they struggle to grow (some of weaker countries have recently moved from deficit to a small surplus but this is mostly a result of the collapse of demand for imports due to falling living standards).

The upshot of all these large and persistent unbalanced trade flows, matched by capital flows moving in the opposite direction, is that large debts have built up in the global economy. The vast mount of money the surplus countries are loaning to the deficit countries cannot find enough productive investment opportunities so a lot of it is used to fund debt based consumption (either by lending directly to consumers or by lending to their governments who then don’t have to levy taxes high enough to cover their expenditure) and speculative investment such as property. At the moment there are no global mechanisms to correct the giant trade imbalances and nothing to stop global debt growing.

Global debts are growing

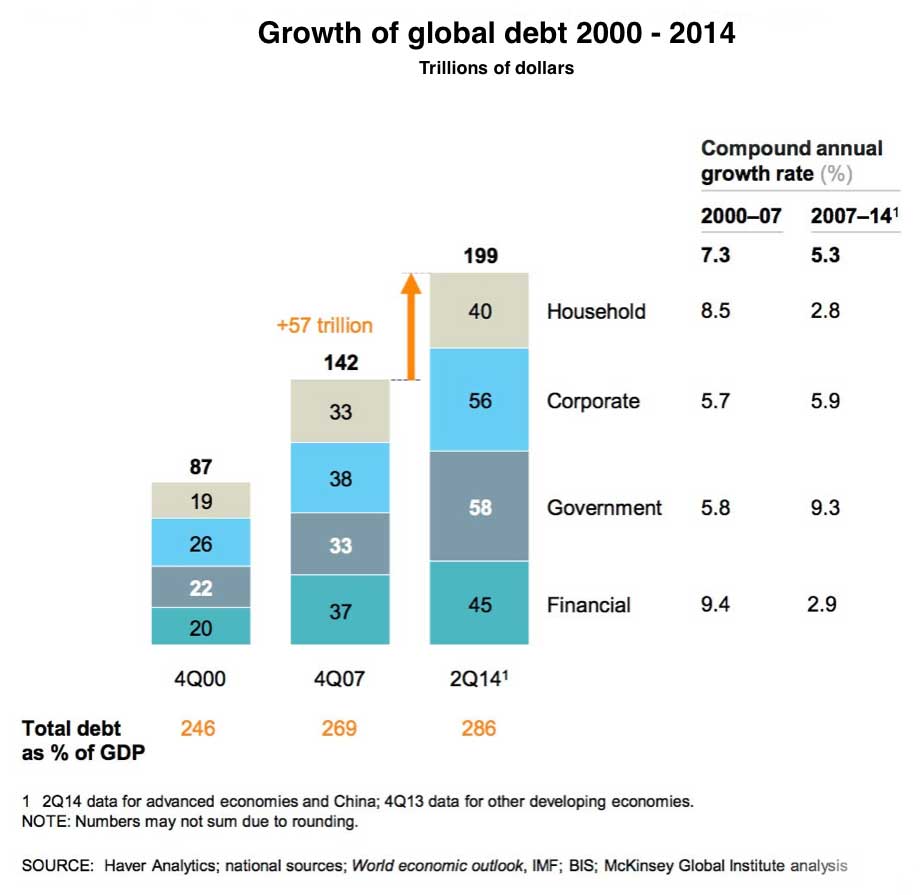

Seven years after the global financial crisis, global debt and leverage have continued to grow. From 2007 through the second quarter of 2014, global debt grew by $57 trillion, raising the ratio of global debt to GDP by 17 percentage points (see graph). This is not as much as the 23‐point increase in the seven years before the crisis, but given in a post financial crisis world a process of deleveraging should be underway it is very problematic that the opposite is happening. Governments in advanced economies have borrowed heavily to fund bailouts in the crisis and offset falling demand in the recession, while corporate and household debt in a range of countries continues to grow rapidly.

There are few indicators that the current trajectory of rising leverage will change, especially in light of diminishing expectations for economic growth. This calls into question basic assumptions of global policy leaders about debt and deleveraging and the adequacy of the tools available to manage global debt and avoid future crises. It is unlikely that economies with total non‐financial debt that is equivalent to three to four times GDP will grow their way out of excessive debt. And the adjustments to government budgets required to start deleveraging of the most indebted governments are on a scale that makes success politically very challenging.

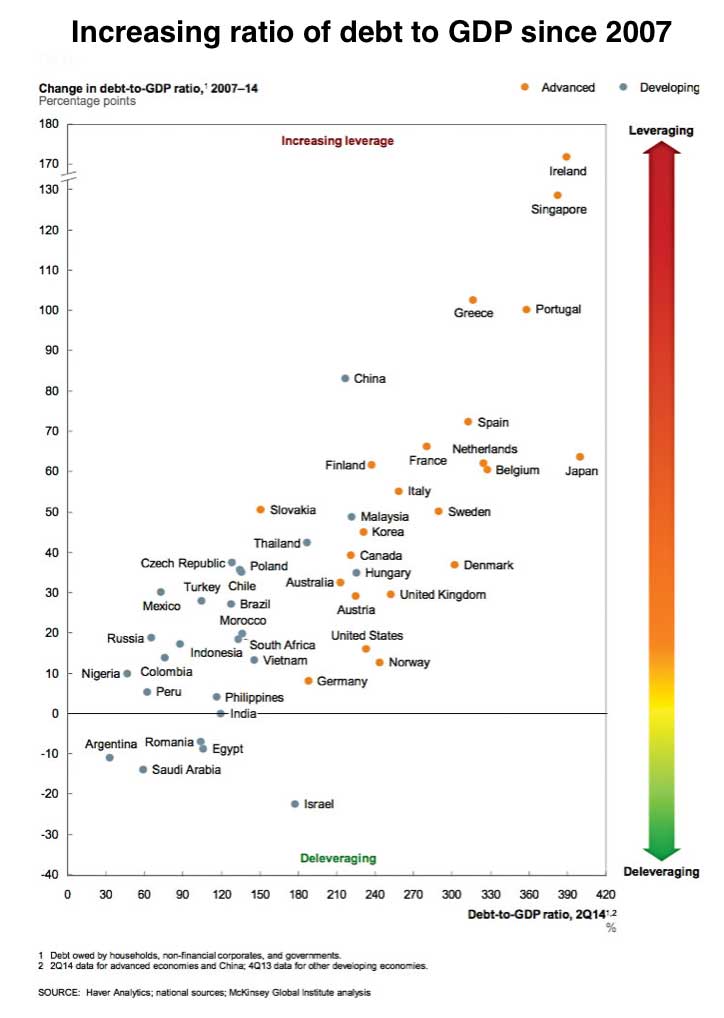

Given the magnitude of the 2008 financial crisis, it is very problematic, that no major economies and only five developing economies have reduced the ratio of debt to GDP in the “real economy” (households, non‐financial corporations, and governments, and excluding financial‐sector debt). In contrast, 14 countries have increased their total debt‐to‐GDP ratios by more than 50 percentage points (see graph). Since the data in the graph below was compiled it is almost certain that Saudi Arabia and Egypt have started increasing their debt levels, the impact of low oil prices on Saudi Arabia has driven its budget deep into deficit and in order to try to preserve reserves it has started to borrow on the open markets

Government debt in advanced economies increased by $19 trillion between 2007 and the second quarter of 2014 and by $6 trillion in developing countries. In the depths of the post 2007 recession, the rise in government spending was actually a welcome counterbalance to the sharp decline in private‐sector demand but government debt has now reached very high levels in a range of countries and is projected to continue to grow. Given current primary fiscal balances, interest rates, inflation, and consensus real GDP growth projections, it looks like that government debt‐to‐GDP ratios will continue to rise over the next five years in Japan (where government debt is already 234 percent of GDP), the United States, and most European countries, with the exceptions of Germany, Ireland, and possibly (if you believe the EU) Greece. It is unclear how the most highly indebted of these advanced economies can reduce government debt. The fiscal adjustment (or improvement in government budget balances) required to start government deleveraging is close to 2 percent of GDP or more in six countries: Spain, Japan, Portugal, France, Italy, and the United Kingdom. Attaining and then sustaining such dramatic changes in fiscal balances is very challenging politically (George Osborne could not do it during the last coalition government) and furthermore, efforts to reduce fiscal deficits could be self‐defeating, inhibiting the growth that is needed to reduce leverage.

Nor in a low growth world are these economies likely to grow their way out of high government debt, which was essential to some previous successful deleveraging episodes, such as Sweden’s and Finland’s in the 1990s. In these countries, too, government debt rose in the recessions that followed their crises. But their private sectors deleveraged rapidly, and both nations benefited from an export boom, fuelled in large part by a 30 percent currency depreciation and strong global demand. Today, many of the world’s largest economies are trying to deleverage at the same time and in an environment of limited global growth and persistently low inflation. Real GDP growth would need to be twice the current projected rates or more to start reducing government debt‐to‐GDP ratios in six countries: Spain, Japan, Portugal, France, Italy, and Finland.

Unsustainable levels of household debt in the United States and a handful of other advanced economies were at the core of the 2008 financial crisis. Between 2000 and 2007, the ratio of household debt relative to income rose by one‐third or more in the United States, the United Kingdom, Spain, Ireland, and Portugal. This was accompanied by, and contributed to, rising housing prices. When housing prices started to decline and the financial crisis occurred, the struggle to keep up with this debt led to a sharp contraction in consumption and a deep recession. Since then, households in those countries have begun deleveraging, with the most progress in Ireland and the United States. In many other countries, however, household debt has continued to rise rapidly. In the Netherlands, Denmark, and Norway, household debt now exceeds 200 percent of income, far above US or UK household debt at the peak. In other advanced economies, such as Canada, South Korea, and Australia, household debt also continues to grow. Household debt has risen rapidly in some developing countries, too, quadrupling in China, for instance.

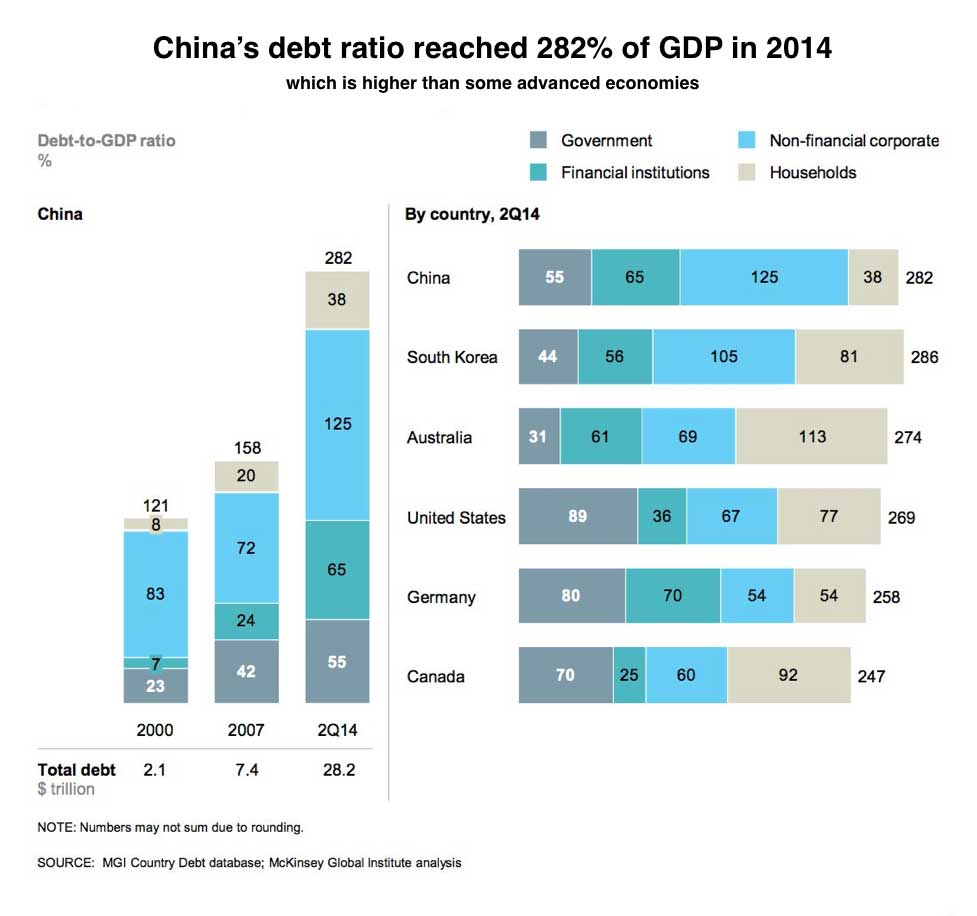

Since 2007, China’s total debt (including debt of the financial sector) has nearly quadrupled, rising from $7.4 trillion to $28.2 trillion by the second quarter of 2014, or from 158% of GDP to 282% (see graph). China’s overall debt ratio is now higher in proportion to GDP than that of the United States, Germany, or Canada. Continuing the current pace of growth would put China at Spain’s current level of debt, 400 percent of GDP, by 2018. There are three particular areas of potential concern: the concentration of Chinese debt in property, the rapid growth and complexity of shadow banking in China, and the off‐balance sheet borrowing by local governments. It is estimated that nearly half of the debt of Chinese households, corporations, and governments is directly or indirectly related to property, collectively worth as much as $9 trillion. This includes mortgages to homeowners; debt of property developers; lending to related industries, such as steel and cement; and debt raised by local governments for property development. This concentration in the property sector poses a significant risk. Property prices have risen by 60 percent since 2008 in 40 Chinese cities, and even more in Shanghai and Shenzhen. Residential property prices in prime locations in Shanghai are now only about 10 percent below those in Paris and New York. Over the past year, a correction has begun. Transaction volumes are down by around 10 percent across China, and unsold inventories are building up: smaller inland cities now have 48 to 77 months of property inventory. A slowdown in the property market would be felt mostly in construction and related industries, which is an enormous sector, accounting for 15 percent of Chinese GDP. Thousands of small players in the industry, many of which rely on high‐cost shadow banking loans, would have trouble keeping up with debt service payments in a prolonged property market slowdown.

The rapid growth of shadow banking in China is an area of concern: loans by shadow banking entities total $6.5 trillion and account for 30 percent of China’s outstanding debt (excluding the financial sector) and half of new lending. Most of the loans are for the property sector. The main vehicles in shadow banking include trust accounts, which promise wealthy investors high returns; wealth management products marketed to retail customers; entrusted loans made by companies to one another; and an array of financing companies, microcredit institutions, and informal lenders. Both trust accounts and wealth management products are often marketed by banks, creating a false impression that they are guaranteed. The underwriting standards and risk management employed by managers of these funds are also unclear. Entrusted loans involve lending between companies, creating the potential for a ripple of defaults in the event that one company fails. The level of risk of shadow banking in China could soon be tested by the slowdown in the property sector.

A third potential risk in China is the growing debt accumulated in off‐balance sheet local government financing vehicles, which are used to fund infrastructure (airports, bridges, subways, industrial parks), social housing, and other projects. Local governments rely on these off‐balance sheet entities because they have limited taxing authority, must share revenue with the central government, and until recently have not been permitted to issue municipal bonds. Since China’s 2009 stimulus program, lending to local governments has surged, reaching $2.9 trillion. The central government has recognised the growing risk and in 2014 conducted an audit of local government finances, finding that 40 percent rely on land sales to make loan payments and that 20 percent of new borrowing is to repay older loans. The slowing of property markets puts these entities at risk of default.

Conclusion

Looking at the massive imbalances in global trade and the accompanying growing amounts of global debt it is hard to believe that this sort of arrangement can continue indefinitely. The 2007 financial crisis was a major correction for the financial system, where some astonishingly insane and risky practices had developed, but it did not fix the underlying global trade imbalances. As a result of government action in 2008 to prevent a collapse of the financial system a great deal of government debt was created, debt that is still on the books. The financial crisis also left large tracts of the western banking system in a much weakened state stuffed with bad debt, and at the same time it opened up all the weaknesses and fissures in the poorly designed architecture of the European single currency. In response to the slowdown in global trade triggered by the 2007 crisis, China strongly promoted a frenzy of internal investment, much of it focussed on property development and grandiose infrastructure projects, and most of that was debt funded.

Now one of the great global shock absorbers, China, is moving into an uncertain period as it must deeply rebalance its economy (see this article) and as a result it is highly likely that the Chinese rate of growth will fall significantly. This is already happening and it is the reason that commodity prices, including oil, have fallen sharply. Falling growth, falling trade and falling commodity prices will make serving debt much harder making another global debt crisis possible.

How long the USA can continue to maintain its vast current account and budget surpluses is uncertain but it’s also hard to believe that such deficits can be sustained indefinitely.

The eurozone remains extremely shaky. Its economy as a whole is anaemic with slow growth, very high levels of unemployment, high levels of debt (both government and private) and a still weak financial sector. At the same time it is committed to a rigid system of rule based economic management that creates the same sort of brittleness that existed under the gold standard in the 1930s and which can not even pose the question how countries like Germany need to adjust their irresponsible economic policies. Another round of global recession could very rapidly unpick the entire single currency system.

Against this background of large-scale imbalances and dangerous debt levels there is something of a vacuum of global leadership. A network of central bankers and prompt actions by the US and UK government prevented a collapse of the financial system in 2007 but there is now an urgent need for strong global leadership to coordinate the careful rectification of the trade imbalances, start fixing the debt problems, and start weaning the surplus and deficit countries off of their mutually reinforcing patterns of unhealthy dependency.

Good luck with that.