All too often in the debate about the crises in the Eurozone, and the roles of countries like Germany and Greece, the discussion collapses into speculative discussion of something called ’national character’ based on the idea that the pattern of economic activity in Europe, or elsewhere, is the result of the aggregate behaviour of millions of people all acting out their own set of national stereotypical behaviours. The Germans are hard working and prudent, the Greeks are lazy and spendthrift, etc, etc. Such thinking explains nothing. Greeks actually work longer hours on average than most other European countries and although it’s true that Greece has been rife with corruption, as it always has been, so is Italy and many other European countries. Blaming the recent crises of the Eurozone on the fecklessness of the Greeks or anybody else explains nothing about the real dynamics that are driving the ongoing crises in the Eurozone.

Another fallacy is to think that large economies as whole can be understood in the same way we understand our own personal finances. It is crucially important when considering the dynamic and patterns of economic behaviour to under no circumstances think that aggregate economies behave like individuals, or that what makes sense for individuals is what makes sense at the level of the total economy. A good example of this is the way savings are thought about. At an individual level prudent savings make a lot of sense but at the level of the whole economy those same savings can be a disaster, something that is sometimes known as the ‘paradox of thrift’.

The paradox of thrift (or paradox of saving) is a paradox of economics which was popularised by John Maynard Keynes. The paradox states that if everyone tries to save more money during times of economic recession, then aggregate demand will fall and will in turn lower total savings in the population because of the decrease in consumption and economic growth.

In the context of a national economy savings don’t just mean the amount of money that individuals leave unspent in some saving account, it means what’s left from the total income of the country after adding up all the income spent on household expenditure and all the money spent on investment by businesses or governments. If total household income added together with the total money spent on investment is smaller than total national income the difference, the savings, will appear as a national surplus. This surplus manifests itself as a surplus on the national current account, crudely the difference between what a country buys and what it sells with other countries.

When a country runs a surplus what it is actually doing is importing demand from other countries. Instead of the people and the businesses of the surplus country paying for everything produced by that country some people and businesses in other countries buy part of the national output of the surplus country. This means that some other countries have to consume, and therefore buy, more than they themselves produce, in other words some countries have to run deficits to pay for other countries surpluses.

This is a very, very important feature of the global economy, and one that is central to understanding what is happening in the current global economic crises and in the crises of the Eurozone. All surpluses have to exactly match deficits somewhere else. You cannot have surpluses without matching deficits.

How do surpluses or deficits arise? Do they arise spontaneously from the aggregate behaviour of millions of people acting out their personal national stereotype? No. Surpluses and deficits arise as a result of specific national economic policies. Interest rates can be raised or lowered, making holding income as unspent savings more or less attractive and also making investment more or less costly. Wages can be held down by government policy, or by changes in the balance of power between labour and capital, reducing costs for businesses. All these things effect how much or how little of the national income is spent on household expenditure or investment and thus how much is, or is not, left over to create either a deficit or surplus.

Another important feature of the global economy, and of the Eurozone, is that in the right circumstances countries can deliberately, through national economic policy choices, engineer the creation of a national surplus and in doing so force, through the mechanism of the international trading system, other countries to run a deficit. The countries that have run a deficit look like they are to blame, that they have not been prudent and that they have spent more than they can afford, but in reality the surplus countries can be (and often are) in the driving seat and are the ones forcing the imbalance in trade that lead to another country developing a deficit.

What should happen if an imbalance develops, where a country is selling or consuming more or less than it produces, is that the resulting imbalance in trade leads to an imbalance in demand for the currencies of the countries concerned which in turn causes the value of the currencies to either rise or fall and this in turn ‘corrects’ the imbalance in trade. If a country runs a surplus year after year, in theory, it’s currency should go up in value thus making it’s exports more expensive and imports cheaper and thus eventually the imbalance in trade self corrects. That’s the theory anyway.

One way currency exchange rates can be prevented from correcting trade imbalances is through capital flows. If capital flows from the surplus country back to the deficit country it can prevent currencies rising or falling. This is what happens with China and the USA, China has exported a gigantic amount of capital to the US, mostly in the form of the purchase of US government bonds, and thus prevented it’s currency rising in value against the dollar. This was and is a deliberate policy of the Chinese government and central bank. Sustained trade imbalances almost always create large flows of capital between countries.

There is another way the self correcting movement of currencies can be prevented, thus preventing the correction of the imbalance of trade and thus allowing surpluses or deficits to continue over time. This is when currency arrangements are structurally unusual in such a way that it interferes with the processes that should correct the trade imbalance. For example the relationship between the Chinese Renminbi and the US dollar is unusual (in fact the the entire position of the dollar is unusual but that’s a topic for another post perhaps) in a way that prevents the self correction of the vast trade imbalance between China and the US.

Another way a currency system can be unusual is when several national economies all decide to use the same currency. And this brings us at last back to the issue of the Eurozone, it’s imbalances and who is to blame. Is it all the fault of the feckless Greeks, Italians and Spanish?

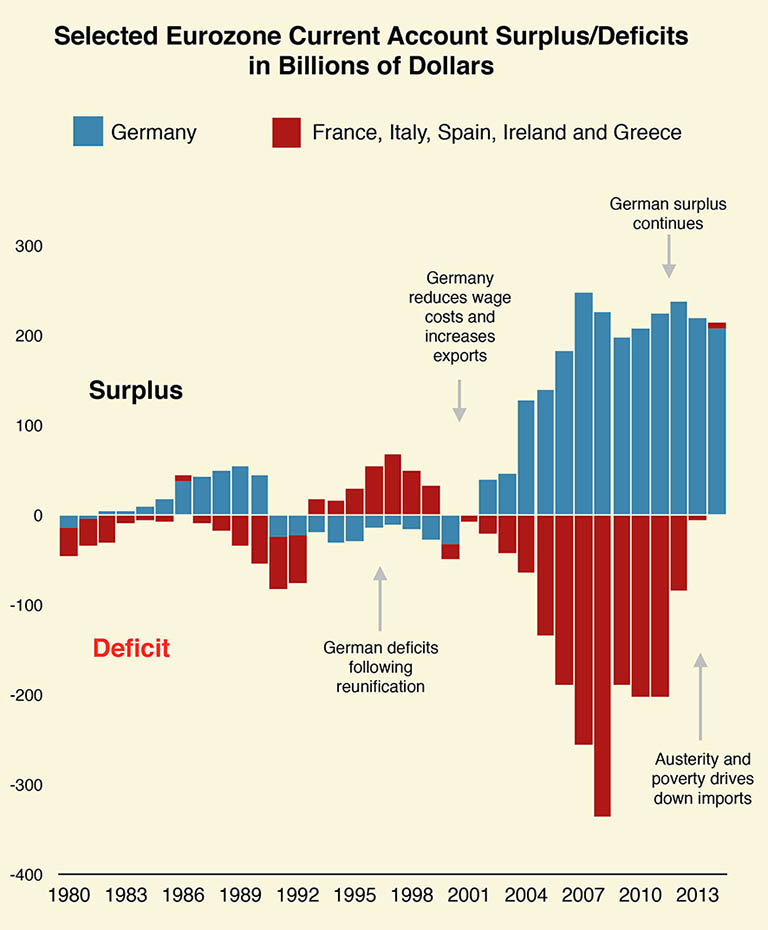

The chart above shows the respective current account surplus of Germany (the largest economy in Europe) compared to a group of other Eurozone countries consisting of France, Italy, Spain Ireland and Greece. Some patterns in the distribution of surpluses and deficits emerge very clearly.

In the decade after reunification in 1990 Germany constantly ran deficits on it’s current account as it carried and absorbed the costs associated with reunification. In 1999 the single currency Eurozone came into existence and then the pattern changes dramatically as Germany begins to consistently run very large surpluses. German surpluses since 2000 have often been so large that they have often been as big as the Chinese surpluses, in fact during some periods since the introduction of the Euro the German surplus have been the largest in the world.

Did the German national characteristic suddenly change after 1999? Were Germans spendthrifts by nature before the Euro and then their character changed so they became super prudent? Obviously that’s absurd. What happened is that the German governments applied a series of policy measures that orientated the economy to exporting, as opposed to consuming, and which as a result forced up the German surplus. Around 75% of Germany’s external trade is with other European Union member states so where do you think the deficits were created to balance the German surplus? If you look at the chart above you can see that the Germans surplus, created by deliberate economic policy, was matched by growing deficits across the the Eurozone.

Germany created it’s export boom, and surplus, by lowering costs, and the costs they lowered most aggressively were labour costs. The influx of cheap, educated and unemployed workers from the old GDR helped weaken labour and the trade unions and this undoubtably helped create the conditions in which real wages could be held down. But the real downward pressure on wages came after the creation of the Euro as real wages were systematically held down for year after year. Gerhard Schroeder, who was chancellor from 1998 to 2005, played an important role in creating this low wage economy by pushing through parliament a massive reform program called Agenda 2010. This reform program successfully rolled back the German welfare state by, among other things, paring unemployment benefits to encourage work, relaxing stultifying regulatory practices, and forging a grand bargain with labor unions whereby the unions agreed to hold down wages and the government assured job security for workers.

Between 2000 and 2007 German wages increased by less than 10% compared to over 20% in the Eurozone as a whole (which of course includes Germany). This difference was not primarily caused by excessive growth in the periphery countries: wages in France, Belgium, the Netherlands, Italy and Spain all increased by between 20% and 30%. The outlier was Germany. Low nominal wage growth in Germany led to lower production costs and prices, which allowed German goods to displace goods produced in other Eurozone countries both in the Eurozone and in third markets. The single currency hugely benefited the German attempt to drive up exports because the Euro is priced by foreign exchanges in relation to the competitiveness of the Eurozone as a whole so the Euro has been under valued in relation to German economic performance making German exports cheaper and German imports more expensive. Conversely the Euro is over valued for many weaker Eurozone countries making their exports too expensive and imports too cheap and thus making it hard to grow their economy.

Another effect of the trade imbalances within the Eurozone, created as we have seen primarily by the giant German surplus resulting from its deliberate policy of encouraging an export based German economy, was that in the years between the creation of the Euro (1999) and the world financial crises (2007-8) there were large capital flows into some of the weaker Eurozone countries. As we have seen above large capital flows almost always accompany large and sustained trade imbalances. In the Eurozone these large capital flows sought investment opportunities but with German investment saturated and the weaker economies not producing opportunities for productive investment the capital began to flow into asset investment, fuelling property bubbles in Ireland and Spain, and into Greek government bonds, fuelling Greek public spending booms. This was not sustainable and when the world financial crises erupted almost all capital and credit flows came to a sudden stop popping the property bubbles (in the process bankrupting many banks) and removing the ability of the Greeks to roll over their government debts (in the process bankrupting many banks and causing the cost of government borrowing across the weaker Eurozone periphery to skyrocket). The trade imbalances in the Eurozone, driven by German economic policy, now erupted as a generalised Eurozone crises and banks and governments needed bailing out on a vast scale.

The giant bailouts were perceived by the Germans, and the other smaller European surplus countries, as being a call on their hard earned savings (resulting from their responsible prudence) by countries who had been imprudent and reckless. Once the collapse of the banking system and of the Eurozone had been averted the surplus countries, led by Germany, demanded that the ‘feckless’ countries put their house in order and through a dose of hard but necessary austerity reform themselves so they too could become responsible savers just like the Germans. As we have seen at the level of the global economy all surpluses require matching deficits so the idea that everyone can run a simultaneous surpluses is impossible. It is not clear who the Germans think should run the matching deficit for a surplus generating Eurozone. The one thing that the Germans have not done is reduce their own surplus.

Since the financial crises of 2008 and the resulting Eurozone crises the policy consensus in the EU institutional structures has been one of austerity. This has been a political victory for Germany (allied with some small surplus nations) and has prevented any challenge to or change in the German export oriented economic model. What has happened is that Germany has continued to generate large surpluses while many previous deficit countries, through economic contraction and impoverishment and at great social cost, have collapsed their imports and thus reduced their deficits. Germanys surplus is now balanced by deficits outside the Eurozone (and includes places like the UK) but the social cost of spreadings it’s low wage export model across the Eurozone has been very, very high. Are the people suffering from malnutrition as they sit in their cold homes with no electricity in Athens heartened by the fact that Greece generated a small trade surplus last year? Is this the best that can be expected from European economic policy?

Here is Yannis Varoufakis. the new Greek Finance Minister in the Syriza government writing in April 2013:

“In 2012, mostly on account of energy imports, Germany had a net trade deficit of €27 billion with Russia, Libya, and Norway. In addition, it sported a €4.7 billion trade deficit vis-à-vis Japan and a sizeable €11.7 billion trade deficit with China. In total, Germany’s trade deficit with these net exporters summed to €43.4 billion. Meanwhile, Germany’s trade surplus with the Eurozone’s deficit nations (France, Italy, Spain, Greece, Portugal, Cyprus and Ireland) came to a still staggering €54.6 billion – despite the sharp diminution of this number following the sharp decline in imports in these crisis-hit nations.

Put differently, Germany’s net exports to the countries that the German press likes to lambast as ‘laggards’ that constitute a drain on German ‘progress’, sufficed to pay for Germany’s net trade deficit vis-à-vis China, Japan, Norway, Russia and Libya, with €11.2 billion to spare: enough to cover for the €3.4 billion transferred to German factories in the Czech Republic and in Slovakia and a large chunk of German companies’ transfer payments to their Dutch partners or subsidiaries (which are in a surplus of more than €15 billion with their German partners).

In short, despite all rumours to the contrary, German global trade surpluses are still being financed by the deficits of the imploding Eurozone ‘stragglers’. It is in this sense that Germany’s denial of the systemic nature of the Eurozone crisis, and its leaders’ commitment to the principle of ‘the greatest austerity for the weakest Eurozone member-states’, is perhaps our epoch’s most spectacular own-goal.”

In order to create growth in the Eurozone, rebuild living standards and repair the damage to political solidarity in Europe the Germans need to abandon their economic model, reflate their economy, let wages rise sharply, and allow the German current account surplus to disappear. German is the most important and largest economy in Europe, is it to be an engine that drives Europe into years of stagnation or one that drives everyone back towards growth?

If you want to read more about trade imbalances and how to understand the relationship between surpluses and deficits I would urge you to read the wonderfully clear “The Great Rebalancing: Trade, Conflict, and the Perilous Road Ahead for the World Economy” by Michael Pettis the professor of finance at Guanghua School of Management at Peking University in Beijing.

Michael Pettis also has an interesting blog on trade, finance and the Chinese economy.