The steep drop in the price of oil is obviously having a severe impact on the Russian economy. Russia is correctly seen as being heavily dependent on oil and gas revenues but merely categorising Russia as a petro-rentier nation misses some of the important nuances of its political economy. The way in which the inflated oil revenues have been deployed within Russian economy and society dictate the sorts of economic and political affects that a prolonged slump in oil revenues will have.

The consensus external view of Russia is that the sharp increases in oil prices over the last 15 years pumped up Russia’s oil and gas revenues which in turn subsidised the Russian economy and funded the expanded global ambitions Putin and his regime. Following the chaotic collapse of the old Soviet system and empire between 1989-992, and the resulting period of deep national weakness, Moscow was left profoundly disatisfied with the post-1991 balance of power in the world and, specifically, with American unilateralism. Since the accession of Putin the Kremlin has been working to build a new more assertive global role for Russian and a new global strategy based on a different version of the world order, centred on multilateralism as understood from a Russian perspective. Economic growth during 2000-13, averaging 6.3 percent per year, helped sustain the efforts and appearance of a resurgent Russia on the global stage, as evidenced by the country’s presence in global forums such as G8, G20, BRICs etc, as well as its daring military adventures in Georgia and the Ukraine, and the annexation of the Crimea peninsular.

The major aim of Russia’s strategy is to establish a new global bloc to counteract US hegemony and unilateralism by reasserting its influence over world affairs and geopolitics, in particular, by building a Eurasian Union (“from Lisbon to Vladivostok”), the idea was first mentioned by Putin in Munich in 2007. The Eurasian Economic Union (EEU), officially launched in January 2015 by Russia, Belarus, Kazakhstan, Armenia and Kyrgyzstan has so far proved to be economically insignificant (together, the four members account for 3.7 percent of the world’s GDP, with Russia being the largest economic partner) and politically destabilising (Ukraine’s hesitancy to join the Union triggered a war in the region in the summer of 2014, which in turn, is causing further political tension between Eurasian member states).

Russia’s military incursions in the Ukraine in 2014 have been penalised by external economic pressures from the West. These pressures include financial and diplomatic sanctions which have been doubly effective because they coincided with a steep drop in the price of oil in the world markets. The hope in the West is that the internal economic crisis caused by by a combination of low oil revenues and financial sanctions, will generate two effects. First, it will prove too costly for the Kremlin to continue the military involvement in Ukraine; second, falling incomes and rising inflation will also weaken the popular support for Putin and his rule and may bring about a change of policy (or leadership) in Moscow.

How likely is such a scenario?

The data strongly supports the view that the Russian economy is indeed entering a contractionary crisis. Since April 2014, the rouble has lost nearly half its value, net capital flight out of the country has doubled reaching 151-160 billion dollars in 2014, economic growth slowed down to 0.6 percent in late 2014, the lowest since 2009 (immediately after the global financial crisis 2008) and the latest data shows that Russia has officially entered a recession, between April and June 2015, Russia’s GDP contracted by some 5 percent (and by 2.2 percent in January-March 2015).

However in order to understand the political impact of these adverse economic shifts a more nuanced analysis of the modern Russian political economy is required because the link between the unfavourable external economic environment and domestic political changes is not linear. The real sources of structural weakness and resulting policy dilemmas facing the Russian leadership today lie not only in the hydrocarbon markets, but in Russia’s complex financialised economy, which has become internationalised over the past 25 years. Note that much of the analysis in this article is based on the work of Professor Anastasia Nesvetailova, Director, City Political Economy Research Centre.

The main pillars that were previously holding up the economic and political success of Putin’s Russia now, during an economic downturn, work as crisis transmission mechanisms. Putin’s Russia can be described as consisting of a globalised economy dependent on oil revenues and vulnerable to external shocks embedded domestically in a socio-political contract of authoritarian rule. The components of the Putin system are:

In the unfolding crisis all three pillars serve as crisis transmission mechanisms, and thus constitute three sets of (interrelated) political problems for the Russian elite. Resolving them in the long-run will probably require a break with the previous system which was successful only as long as oil revenues were high but which, now oil revenues have shrunk drastically, have become dysfunctional. Dealing with the effects of persistent cheap oil will require a significant re-organisation of the Russian political economy in order to guarantee long term stability. The measures currently deployed by the Russian state in dealing with the crisis since the oil price collapse started have been well organised and prompt but are all short term palliative measures and are not yet addressing the sort of deep structural adjustments required for the long term stabilisation of the system.

The secondary economy of the Russian petro-state

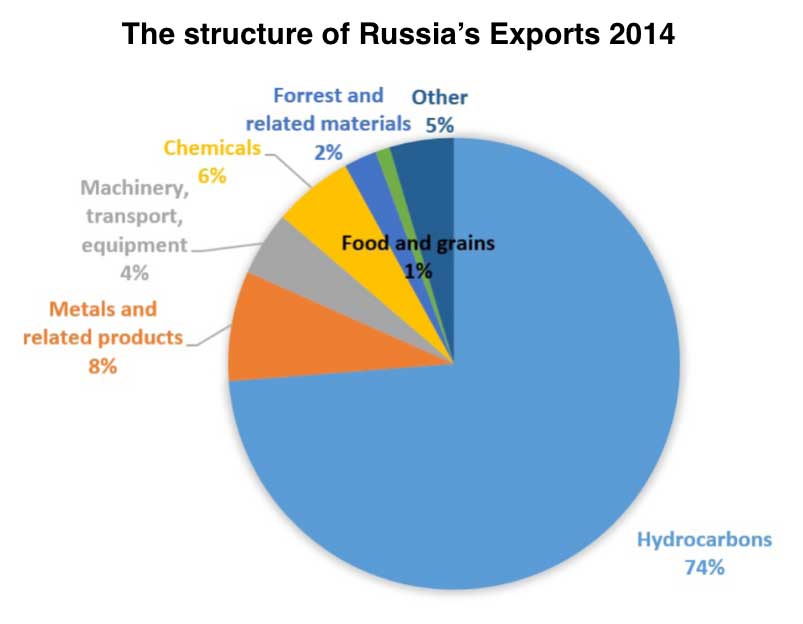

It is commonly accepted that the Russian economy, and its version of capitalism, is heavily dependent on oil exports. Oil, gas and other natural resources make up 70-75 percent of Russian exports. The economic recovery and growth associated with Putin’s terms in power (2000-08; 2012- ) have been financed by oil and gas revenues, in 1999, when Putin first come to power, world oil prices fluctuated at about 13 dollars per barrel; in 2012, when he was elected president for the third time, the Russian ‘Urals’ blend traded at an average of 100-105 dollars per barrel. In this context a common view is that there is a simply correlation between high oil prices, economic growth and the global political aspirations of the Putin regime and that Russia today is simply a petro-state, addicted to hydrocarbon profits. The biggest structural weakness of such an economy, it is argued, is its non-diversified economy; while the corollary of the hydrocarbon addiction is rent-seeking and endemic corruption. Over-reliance on oil and gas exports has actually slowed down Russia’s modernisation and, as a result, the country has been left behind as an industrialised economy. The lack of tangible diversification away from extractive industries, in turn, makes the Russian economy particularly fragile and vulnerable to externally-driven crises.

While it is easy to see the dominance of natural resources in Russia’s exports, and the abundance of petrol and commodity revenues, merely using labels such as “petro-state” obscures the role of the specifically Russian set of complex economic relationships, institutional linkages and political arrangements that make up a large, state-centred secondary economy in Russia today.

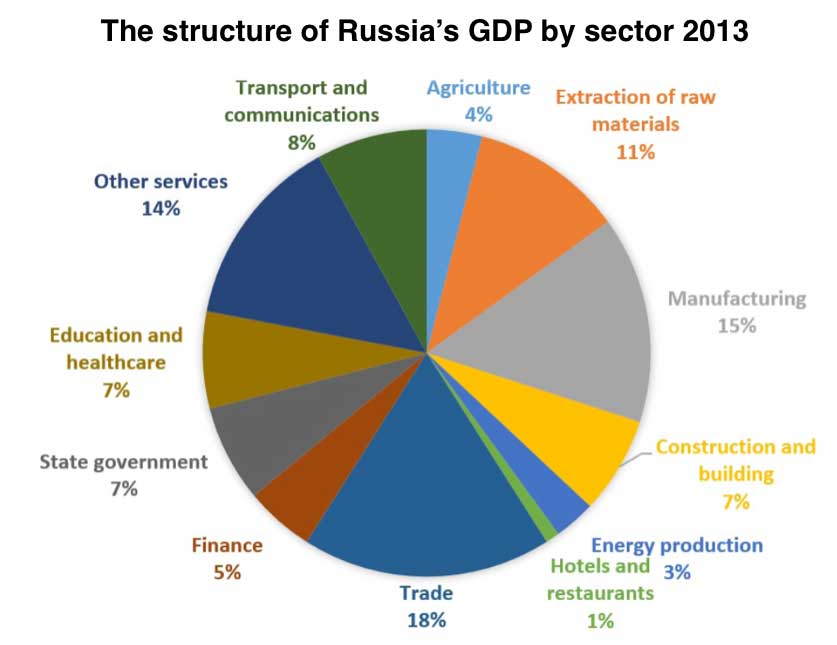

In many ways Russia is not a classic petro-state. Production of oil and gas account for only 9 percent of Russia’s GDP, Russia has inherited a relatively developed industrial infrastructure, it has a highly skilled labour force compared to other petro-states and there is a high proportion of economically active women. The service sector, including finance, trade, transport and communications, accounted for 45 percent of the country’s GDP in 2013. Nevertheless the central role of oil revenues in cementing and underpinning the non-oil economy means that the impact of lower oil prices is severe. This is because during the years of high oil revenues the domestic economy became dependent on demand created by a greatly inflated state system which was in turn funded by oil revenues.

The years of high oil and gas revenues between 2000-14 enabled the Russian state to develop a system of redistribution of oil and gas revenues through the centralisation of export taxation. This redistribution system used profits from hydrocarbon exports to sensibly build up counter-cyclical buffers such as a Federal Reserve (stabilisation) Fund and a National Welfare (future generations) Fund , but also importantly to finance those regions and sectors that are not directly involved in oil and gas exploration. Under this redistribution system, 15 percent of current oil and gas revenues go into the Stabilisation Fund, 55 percent into the federal budget, and 30 percent into regional budgets. Taxes on Oil exports make up 16.2 percent of the federal budget revenue and similar taxes on gas exports make up 5.3 percent of the federal budget revenues and in addition the state owns of large parts of the oil and gas industry thus securing profit flows during the high price phase.

Therefore, hydrocarbons are an indirect but very important source of Russia’s growth. As a proportion of Russia’s GDP, their share is relatively low, yet by contributing about 50 percent to the state budget, they serve as a critical source of funding for the secondary economy and the non-resource sectors, recycled through the system of public finances with all the corruption, patronage and clientelism opportunities that such a system allows. Since 2000, an important trend across this secondary economy has been the growing scope of state ownership, and the growth of the public sector and state bureaucracy. Recent estimates suggest that the share of state ownership in the economy has grown from 38 percent in 2006 to 50 percent of Russia’s GDP in 2012, compared to the world average of 30 percent. The crisis of 2008-09 is believed to have escalated the trend. The share of state-controlled companies in Russia has grown, too. For instance, in 1998-99 the state controlled only 10 percent of the oil sector, today, it controls 40-45 percent. In banking, the share is 49 percent, in transportation, 73 percent.

During the 15 years of Putin’s prosperity, the Russian state has expanded its economic presence significantly. The secondary economy of services, manufacturing and the public sector has evolved on the back of the hydrocarbon boom. The data on the growth of the state and its relationship to petrol income is clear: in 2005, the Russian budget was balanced at 20 dollars per barrel, in 2013, the budget was balanced at 102 per barrel dollars. Today, the welfare of many people directly depends on the federal budget and regional transfers and subsidies. In 2004 16.4 million of people were employed in the state sector, today 20 million workers (or 28 percent of the total workforce) are employed in the state sector. This number is higher than the number of people who were employed in the government sector of the Soviet Union. Sustaining and funding this secondary economy is the biggest and most immediate economic challenge facing the Russian authorities amidst the unfolding crisis caused by the collapse of oil revenues.

This large, state-dominated secondary economy needs to be financed, staffed and governed and this not only brings opportunities for clientelist political systems but has directly and significantly contributed to the growth of Russia’s consuming classes, and this has been a major engine for the growth of domestic demand. Additionally the extra revenues from high oil prices allowed the government to raise pensions and other social provisions which in turn sustained domestic demand. Effectively Russia’s model of growth is based on translating oil and gas extra revenues (2 trillion dollars in total between 2000 and 2013) into domestic demand. In the context of favourable macroeconomic conditions, this has ensured a rapid growth in manufacturing, continuing real wage increases and rising social benefits across all sectors of the economy with beneficial political consequences for the Putin government. But the abundant inflowing oil revenues, which in turn was translated in to subsidised high domestic demand, meant that the domestic economy has been cosseted by the benign economic environment which in turn meant that domestic businesses were oriented towards quantitative aims, the expansion of markets and production, rather than improving efficiency through innovation.

The Russian economy did have some tangible non-oil sources of growth until 2012, but since then they have been crowded out by oil and gas revenues as Russia’s oil revenue dependent growth model has solidified its status as an import-dependent economy. The high demand in the Russian economy during the last fifteen years meant that although seemingly successful Russian firms have actually become often extremely dependent on imported components and an external supply chain. Although the largest country in the world, Russia is a net food importer, with almost 40 percent of its food items coming from abroad. Even in products and brands produced in Russia, components or ingredients tend to be imported from the West. For instance, the share of imported components in canned food produced in Russia (metal packing and labels are imported) is 70 percent, the same as for Russia’s clothing and shoe industry; there is practically no textile production to speak of domestically, in some Russian industries, the share of imported components reaches 90 percent.

This model of using oil revenues to subsidise domestic demand is a fundamental mechanism in the political economy of the Putin system. The resulting social contract is the basis for popular support for the ruling bloc and for Vladimir Putin personally. This social contract is based on the implicit understanding that the elites (be they the “original” oligarchs, the new generation of state oligarchs, or “spookocrats” of the siloviki clan) maintain power by enriching themselves and diverting resources in the name of Russia’s national interests, while ordinary Russians get wealthier (partly by relying on corrupt mechanisms or informal networks), support the cause of popular expansionary nationalism and do not engage in active politics. This social contract is institutionalised around the vast public sector and administrative apparatus which is symbiotically dependent on strong oil and gas export revenues. Over the last 15 years, the growing state presence has appeared to ensure political stability, while remaining a reliable source of rent extraction and economic prosperity.

The crisis of 2014-2015 however, has altered this balance, with some regions already suffering from diminished flow of resources from the federal centre, and some social programmes and financial provisions affected by spending cuts. Because the inflowing oil revenues were its source of funding much of its demand Russia’s domestic economy has been hit the hard by the current crisis. In the absence of a sustainable source of non-oil revenue related growth in the medium term, the stability of domestic demand and the resilience of the social contract with the regime will critically depend on how well Moscow can sustain the mechanisms of redistribution of revenues.

The financialisation of the Russian economy

During the last 15 years, once it had left the ‘Ponzi’ phase of the 1990s behind, the Russian banking system and credit channels matured and grew to become a significant factor in Russia’s economic growth. Russia’s financial system is bank-based, with four large state banks dominating the credit system, although the vast majority of commercial banks are private. Russian banks are the main providers of credit to enterprises and households, and in addition to the state transfers and redistributions of oil revenues, became a second important mechanism for financing domestic demand between 2000 and 2014. In addition to rising incomes generated by the oil revenues, the boom in domestic demand was financed through international finance. The years of macroeconomic and currency stability (mid- 2000s) facilitated the expansion of Russian banks internationally as they became global borrowers, actively taking loans from Western banks, and enjoying access to international capital markets.

The currency stability during the oil revenue boom years and the expansion of the banking sector have enabled the financialisation of Russian domestic consumption and most crucially, of the households sector. In the years prior to the 2007 financial crisis Russian financialisation accelerated fuelled by low interest rates in the west and increased capital flows into Russia, the previously endemic capital flight out of the country was replaced by net capital inflow, which peaked in 2007. That year, total investable resources in Russia (including financial resources and export revenues) stood at 100 billion dollars. The inflow of capital, in turn, facilitated a credit boom. Between 2000 and 2008, the real value of loans extended to enterprises and households increased more than tenfold, from 10 to 41 percent of GDP. The financialisation meant that loans to households, previously insignificant in the Russian financial system, increased a staggering 46 times between 2000 and 2008, on average by 53 percent per year! The process of Russain financialisation was not significantly slowed by the 2007 financial crisis as capital continued to flowed out of the low interest environments that followed the crash, and Russian finacialisation continued right up to the collapse of oil prices in 2014.

Another important development during financialisation phase prior to the collapse of oil revenues, driven by the stability of the rouble, was the increase between 2000 and 2014 in domestic Russain loans denominated in non-rouble currencies. Until 2008-09, foreign currency loans accounted for about 25 percent of the total Russian loan market. Many households opted for dollar-denominated mortgages which appeared cheaper, in 2006, the share of dollar mortgages was 31.9 percent of the total mortgage market in Russia. In the run up to the 2014 crisis, it was unsecured loans that drove financialisation further. The share of total lending of unsecured loans in 2012-13 stood at 38 percent.

With the collapse of oil revenues a generalised Russian credit and banking crisis began to unfold. The structural underpinnings of the current financial crisis in Russia are a result of the excesses and reckless lending during oil revenue fuelled financialisation of the previous fifteen years. By late 2013 (prior to the collapse in oil prices), the Russian economy and its financial system had already become quite fragile as the consumer boom financed by unsecured loans created dangerous fragility across the entire Russian banking system, and in 2013 after the central bank began toughening its regulatory stance, the first wave of the banking crisis was felt. As the inevitable credit adjustment was starting to unfold the Russian economy and financial system was hit by the collapse of oil revenues in late summer of 2014 and by economic sanctions resulting from the annexation of Crimea in March 2014.

By early 2014, Russia was already experiencing a pronounced banking crisis which was only aggravated by the external pressures in the spring 2014. The financial sanctions that followed the annexation of Crimea and the eventual cut-off of Russian banks from international capital markets aggravated the situation further. The collapse of the rouble, the decrease in oil revenues and hence in available budget resources, translated into a full-scale banking crisis in late 2014, which continues to the present. The ongoing second wave of the financial crisis is claiming not only small and regional banks, but increasingly, larger banks and corporations. Between March 2014 and July 2015, more than ninety Russian banks were either liquidated or had their licenses revoked by the Central Bank of Russia. Additionally, around ten large banks had to be “additionally capitalised” to avoid bankruptcy. Current estimates by the Central Bank of Russia suggest that in the event of ongoing large scale fianancial stress, about 39 banks are likely to face a liquidity crisis, which in the current environment is likely to lead to bankruptcies.

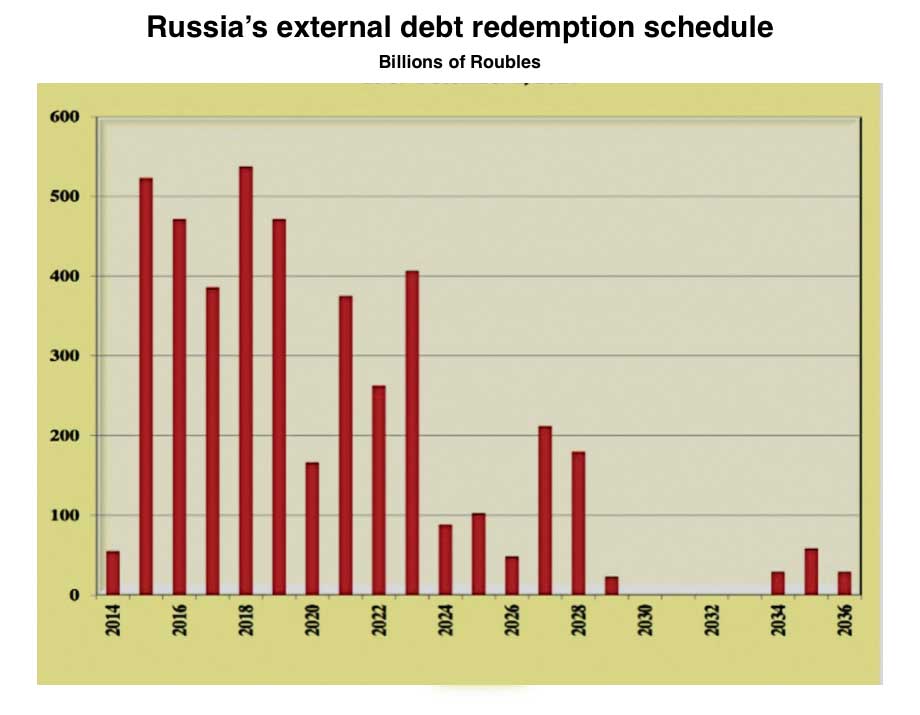

The Russian authorities have deployed the resources of the Federal Reserve (stabilisation) Fund, built up during the years of abundant oil revenues, on a range of anti-crisis measures. These measures were substantial, in February 2015 alone they used 500 billion roubles. Assuming the crisis continues through 2015, and more cash injections are needed, by the end of 2015, the Federal Reserve Fund, currently valued at 5.8 trillion roubles, will be depleted. With no incoming capital, sharply reduced opportunities for borrowing and the peak of debt repayments to international creditors falling between 2015 and 2016, it is quite possible that there will be a Russian default. The graph below shows that there are some big external debt repayments looming in the near future.

The key issue for the Russian authorities faced with the unfolding crisis is how to sustain domestic demand and household incomes without abundant oil revenues greasing the wheels of state spending and with domestic credit being choked off by the crisis in the financial system. At the same time a generalised collapse of the financial system has to be avoided but this will require the extensive deployment of state reserves just as the federal budget slips heavily into deficit. And all this must be accomplished with mostly domestic financial resources as the sanctions bar Russia from accessing international capital markets to any significant degree.

Any serious medium to long term plan of restructuring of the economy which could boost demand will require large-scale investment. This brings us to the third major aspect of Russian political economy, and another crisis transmission mechanism, namely, the problem of capital flight, and more specifically, the offshore nexus of Russian capital.

Capital flight and the offshore Russian investment system

The international sanctions and capital flight that escalated in 2014 laid bare the reality of Russia’s appeal to international investors. Although nominally part of the BRICS and deemed an emerging market with great potential for capital, Russia had never really become successful in attracting foreign investment.

Although the years 2006-07 saw a net inflow of capital into Russia, disaggregating the data with respect to geographical origins of foreign investors in Russia reveals that the top foreign investors in Russia have consistently been Cyprus, the British Virgin Islands (BVI), Bermuda and the Netherlands.

In turn the key destinations for Russian investment was Cyprus, the Netherlands, the British Virgin Islands (BVI) and Luxemburg.

The data suggests that it is the capital of Russian-owned structures, recycled out of Russia through a chain of offshore jurisdictions that has been recycled back into Russia and labelled as foreign direct investment. A very significant proportion of the largest privately owned companies in Russia, 14 out of 20 privately owned companies on Russia’s Forbes list, are owned by companies registered in offshore havens. Eight of such firms are from Cyprus, four from the Netherlands, and one each from Switzerland and the BVI.

| Russian external capital flows 2011 (Millions of dollars) | |||

|---|---|---|---|

| Inward Capital Flows | Outward Capital Flows | ||

| Cyprus | 128,816 | Cyprus | 121,596 |

| Netherlands | 59,745 | Netherlands | 57,291 |

| British Virgin Islands | 56,442 | British Virgin Islands | 46,137 |

| Bermuda | 32,545 | Switzerland | 12,679 |

| Bahamas | 27,089 | Luxembourg | 11,599 |

| Luxembourg | 20,316 | UK | 10,662 |

| Germany | 18,741 | USA | 9,501 |

| Sweden | 16,088 | St.Kitts & Nevis | 7,035 |

| France | 15,420 | Jersey | 6,692 |

| Ireland | 8,893 | Germany | 5,701 |

| TOTAL | 455,904 | TOTAL | 361,738 |

While tax avoidance is a common driver for offshore schemes around the world, in Russia, the use of overseas offshore havens has a distinct purpose. Typically, in advanced economies, offshore structures are used to conceal profits flows. In Russia, intricate chains of offshore based entities are constructed with the aim of hiding the ultimate ownership of assets. In Russian offshore “envelopes,” Cyprus has historically been a popular centre for the initial incorporation of the offshore entity, which in turn would have financial and legal links to other financial havens in order to be able to tap into the onshore financial systems of Europe and North America.

The offshore system worked for the Russian elite for a long time, it supported the domestic social contract and it allowed income from corruption and the exploitation of nominally state owned entities to be recycled back into Russia. Essentially the offshore Russian operation was a giant money laundering machine which kept the revenues flowing back into the domestic economy, allowed the elites to enrich themselves with impunity and generated impressive looking data on the scale of Russian capital transactions and foreign direct investment.

It is hard to overestimate the role of the offshore havens network for both for the Russian owners of capital, as well as for Western financial centres through which the funds flow. Access to offshore ownership envelopes has enabled some Russian owners to avoid the post-Crimea sanctions. The problem is that as the crisis has unfolded, as the rouble has fallen in value and above all as western sanctions made it dangerous to lock up assets inside an isolated Russia so the recycling flow has turned into a simple and damaging outflow of capital which is sucking liquidity our of an already strained Russian financial system. Capital is leaving Russia via the offshore safe havens but it has stopped flowing back in. This changed pattern of Russian capital flow via offshore havens has benefited the City of London in the current crisis, as money flowing out of Russia is not being recycled back into Russia but is invested in Western financial and property assets.

The only exception to the drying up of recycled capital inflows has been in the Crimea which in 2014 saw an upsurge of foreign investments from Cyprus, the British Virgin Islands and other offshore havens, led by inflows from Guernsey which accounted for a staggering 80 percent of all foreign direct investment into Crimea post the 2014 annexation. One can only assume this funding was being driven by elements of the Russian political elite intent on making the Crimean annexation an economic success story.

Not surprisingly, now that the capital inflow has more or less ceased and there is just a damaging capital outflow, President Putin has identified the offshorisation of the Russian economy as a problem that needs to be addressed. There is a new anti-offshore law that requires that a Russian business owning 10 percent or more of a foreign company has to declare this ownership to Russian tax authorities. (In December 2014 Putin also offered amnesty on all ownership by civil servants, their relatives and former relatives). Also, if a Russian citizen owns, directly or indirectly, 50 percent or more of a foreign company, they will have to pay tax on its profits. It remains unclear how effective such laws and regulations will be as as many previous attempt to stop capital flows in many countries (China is example right now) often prove ineffective as ways around the restrictions are usually found. This will be especially true in a system such as the Russian one that is founded upon money laundering, immunity to legal restraints, endemic corruption and sophisticated criminal networks. The new laws seemed to be having some impact, but in the first half of 2015 Russia remained a net exporter of capital, albeit at a lower rate than in late 2014.

Russia’s offshore-led mode of financial integration into the global economy highlights how the system in the past fifteen years, utterly dependent on oil revenues, has obscured the inherent weakness of the Russian economy. Russia is considered a part of the BRICS, based on its apparently its impressive growth rates generated by the expanding consumer market in 2000-14 (which as we have seen was built on redistributed oil revenues and a financialised system of cheap credit). As an investment opportunity, however, Russia has mostly been attracting Russian capital, with few non-Russian investors (although there were a handful of high-profile deals with foreign multinational companies in the 2000s). Russian round-trip investors have tended to favour flows into the service sector, tended to establish manufacturing firms in resource-based industries and supported the development of corruption in Russia by investing in corrupt Russian regions. Cumulatively, lack of investment, shrinking internal market potential and an unfavourable external economic environment pose serious political-economic risks.

The response of the Russian government

The main response of the Russian government to the current crisis was formulated in the anti-crisis programme signed by Prime Minister Dmitry Medvedev in winter 2015. It included a detailed set of measures primarily aimed at sustaining domestic demand. This is to be done mainly by compensating for the loss of oil revenues through investments financed by the sovereign funds such as the Federal Reserve (stabilisation) Fund and the National Welfare Fund. The programme also calls for development of efficient mechanisms of import substitution, to wean Russian businesses off their dependence on imported production components, and measures to support to small and medium businesses. The baseline scenario underpinning the plan is based on the calculation that by the end of 2016, oil prices will recover and stabilise at around 70 dollars per barrel, which would spur a Russian economic recovery. Currently oil price futures in global markets do not support that scenario.

The anti-crisis programme was not a development strategy, there was little long-term planning in the document, and so the long term strategy of the Russian government in response to the generalised crisis of the Russian political economy precipitated by the collapse in oil prices is not yet in place. The anti-crisis programme did demonstrate that the economic bloc in the government (in contrast to the more political siloviki clan) has learned some lessons from dealing with earlier crises (1998 and 2008/9). However the three pillars of the crises outlined above (the erosion of domestic demand, the financial crisis caused by financialisation and the collapse of capital inflows caused by the breakdown of the offshore capital recycling mechanism) are not addressed in the currently announced anti-crisis programme.

Currently the main instrument for addressing the fiscal and financial crises have been Russia’s sovereign wealth funds but these reserves are at risk of being exhausted quite soon, and some painful choices about which industries (firms, banks and social programmes) to favour in rescue measures, will have to be made. These decisions will produce their own winners and losers, and may add to the rifts already present in the ruling elites in Russia.

The anti-offshorisation campaign launched by Putin, while apparently aimed at raising state revenues, can also be interpreted as the state’s drive to further control the key centres of Russian business. Perhaps because of this, the initiative is not likely to generate tangible extra revenue for the budget (according to some reports, most Russian businessmen plan to become non-residents of Russian for tax purposes in 2015, simply to avoid having to comply with the new law). The idea of an amnesty on state bureaucrats’ firms, in turn, has already created problems for the Russian authorities as a sweeping amnesty contradicts the principles of the Financial Action Task Force (FATF) and would put Russia on FATF’s black list, isolating it even further from international capital.

The deepening financial crisis is likely to claim more casualties among banks and corporations. Indicatively, in December 2014, the Duma passed a law on personal bankruptcy. With recession already under way, most people will see their real incomes shrink further, especially if the authorities choose to monetise the deficit order to ease credit conditions.

The only element of the Russian political economy that has remained relatively resilient so far in the current situation is the social contract between the population and the ruling elites. President Putin remains highly popular, and while more and more Russians feel the effect of the sanctions and the economic crisis on their personal lives, they are not associating the economic problems with the governance system in the country or Russia’s foreign policy stance. This stability and the credibility of the regime are a vital resource for the Kremlin, which it carefully nurtures. Meanwhile the pressure on sovereign wealth funds is prompting a search for alternative sources of funding. As shown above, Russia has mostly been attracting Russian investment, and Putin’s Russia has few friends with purchasing power.

The key question for the medium term, therefore, is whether there are enough resources in Russia’s sovereign wealth funds to sustain the popularity of the regime, and maintain the social contract while waiting for oil prices to recover and indeed whether oil prices will recover in the near future.

Against this background, Professor Anastasia Nesvetailova, has proposed that there are four possible (and not mutually exclusive) long-term scenarios for development of the current crisis. All of them are speculative, some pose serious risks for the ruling elites in Russia with the possibility of a rupture in the social contract with unknown political consequences.

Scenario One (short- to medium-term): oil prices rebound to 70-80 dollars per barrel, and Russia’s consumption and growth stabilise at a lower level.

This scenario is consistent with the assumed baseline oil scenario (70 dollars per barrel) of the Russian government’s anti-crisis programme. While this scenario can potentially ensure the continuity of the current political and economic system through the 2016 (parliamentary) and 2018 (presidential) elections, oil revenues alone will be not sufficient (and indeed may prove counter-productive) to the efforts to diversify Russia’s economicy. Even if oil prices do recover to 70-80 dollars per barrel therefore, unresolved structural issues and finite financial cushions will continue to put economic pressure on Russia’s political economy.

Scenario Two (medium- to long-term): the situation in the hydrocarbon markets continues to worsen, Russia is financially rescued by China and becomes a (resource) satellite of China leading to a global realignment of power and geopolitics.

Some developments indicate that such a re-alignment has already began. It is not unreasonable to think that generally, an interim solution to the unfolding state revenue crisis may be found in the privatisation (full-scale or partial) of some of state companies. It may very well be that some foreign buyers broadly, and Chinese firms specifically, would be keen to invest in Russia despite the current economic climate and political risks. In February 2015, Russia’s Deputy PM Dvorkovich suggested that Russia’s oil reserves might be offered to the Chinese under partnership agreements as 50 or 51 percent stakes. In July 2015, the Russian Ministry of Natural Resources and Environment proposed a draft law that would allow foreign companies to develop the Russian reserves they discover, a deregulation move that marks a significant change to the restriction on foreign companies access to Russia’s natural reserves that were deemed a protected part of the national wealth.

There have also been some serious political moves recently driving Russia’s economic orientation closer to China. In late 2014, Russia and China signed a (very unfavourable to Russia) gas deal for transporting Russian gas to China. Its construction began later in 2015. Also in late 2014, Putin signed a Law on the Territories of Advanced Development, mostly concerning Russia’s Far East. The law designates several large territories as special economic and governance zones which could be leased on a long-term basis to foreign investors. The document also makes provisions for Russian law (federal and local) to be suspended in the territories leased out to foreign proprietors. The law was signed on the 31st of December 2014, traditionally a busy holiday in Russia, and thus received little public attention. A large-scale loss of territory to China will not be popular with the Russian electorate. Also, a drastic redistribution of resources is likely to upset the current oligarchs and may open up further tensions among the political elites in Moscow.

Of course this scenario is based on the premise that the Chinese elite can manage the wrenching restructuring of the Chinese economy, which is already underway, in a way that allows the political space and economic resources to prop up and hegemonise an ailing Russia.

Scenario Three (mid- to long-term): Russia returns to the Western fold and an inevitable modernisation path. Theoretically, this can be the outcome even if Putin remains leader, or could result from a more significant realignment in the Kremlin.

Since 2012, Western powers, led by the USA, have been extremely reluctant to work closely with the current regime in the Kremlin. This reluctance may prove to be an unsurmountable hurdle for Russia’s liberal economic clan and policy-makers, who would be most keen to pursue this scenario, but potentially, in a worsening economic situation, it could become a factor prompting a realignment in the Kremlin in 2018.

Some commentators and scholars suggest that, even though he is the personification of absolute power to many Russians, Putin is, in reality, the arbiter between the different elite factions, and has to make choices between the liberal economic clan, and the more conservative nationalistic security bloc. Many in Russia, including some analysts close to the Kremlin, comment that most substantial internal political damage inside the elite of the current crisis so far is that it has exposed that the result of the misguided nationalistic drive that thrived on the back of hydrocarbon prosperity has been merely to intensify the country’s self-isolation from the West at a moment of intense economic vulnerability. These critics reiterate that, historically, any progress in Russia, at any point in time, has only been possible due to the adoption and internalisation of Western (European) institutions of modernity, such as principles of economic organisation, democratic political systems, non-corrupt legal structures, robust and non-oppressed civil society, etc. Retreat from modernisation has tended to coincide with regression, wars and crises. Theoretically, therefore, an incremental return to modernity and economic openness is possible even if Putin is re-elected in 2018.

Scenario Four (short-term): The Kremlin attempts to distract attention from the deepening economic crisis by entering into another security conflict, either by further escalating the ongoing war in Ukraine, or by heightening the security tensions domestically through internal militarisation of politics and the deployment of pro-Kremlin militia.

In support of this dark scenario, some analysts interpret recent political appointments and legislative changes as groundwork for further political repression. Military expenditure remains ring-fenced in the new, crisis budget for 2015. The 2015 military budget is at a record high, at 4.2 percent of GDP, compared to some 2-2.5 percent of GDP in the 1990s. There have been many visible anti-NATO gestures, such as large-scale war games launched by the Russian Army and Navy in the northwest and west of the country, as well as the new Russian naval doctrine articulated by Putin in July 2015. A pro-Kremlin militia has been supported by the regime, and part of it has been institutionalised as an Anti-Maidan movement. To what extent these are controllable developments, and to what extent they represent the real attitude of Russia’s military establishment are questions that are increasingly difficult to answer. Any balance between economic reform and military escalation depends on the constellation of forces around the Kremlin, and the mechanisms of mitigation of the economic pressures analysed above.

Looking forward to 2015-16, it is becoming clear that, unlike the previous 2008-09 crisis, the ongoing crisis will not be V-shaped but will instead evolve as a protracted recession. During such a recession, the things to watch out for include banking and corporate failures; shifts within and around Kremlin circles and the security forces; privatisation, including partial privatisation, of some state companies and banks. At the same time, despite the way the numerous crisis transmission mechanisms are causing problems on many different fronts, and the deep economic and financial fragility, there is no clear linear link between the unfolding economic crisis and political change in Russia. Most short to mid-term scenarios outlined above do not assume a need for drastic change in Moscow’s political elite. The Putin regime has been masterful at building a system of authoritarian rule built on top of popular passive consent through a clever social contract, but whether such a system can survive the ending of the revenues flows, that were used to construct and maintain it, is the big question.