Italy is the weak link in the eurozone system. The continuing stagnation of the eurozone economy means that the position of Italy in the eurozone system continues to weaken. Italy’s public debt pile of €2.14 trillion is the largest in Europe in absolute terms as well as the second largest in relative terms after Greeceʼs twice bailed out economy. At the beginning of April Italyʼs coalition government slashed its growth forecast for the Italian economy in 2019 to 0.2% – the weakest forecast in the Eurozone – from a previous forecast of 1%. Italy is already in a technical recession after chalking up two straight quarters of negative GDP growth in the second half of 2018.

The governmentʼs budget for this year was based on the assumption that the economy would expand by 1% this year. Now, it seems the economy may not grow at all; it could even shrink. One direct result of this is that Italyʼs budget deficit for 2019 will be substantially higher than the 2.04% of GDP Italyʼs government pledged to stick to late last year, and means that once the EU elections are out of the way and a new Commission is in office there will be renewed tensions between Rome and Brussels over the direction of fiscal policy.

Rome recently forecast that Italian public debt would hit a new record high of 132.6% of GDP this year. That record is unlikely to last very long given Italyʼs stagnating economy and the Italian governmentʼs determination to cut taxes, reduce the retirement age and introduce a citizensʼ basic income.

The Italian economy’s problems are chronic and deep seated.

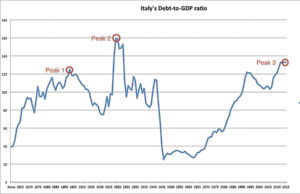

There have been three peaks of Italian government debt since reunification. The first debt-to-GDP ratio peak (Peak 1 on the graph below) of 125% of GDP was experienced throughout the first decades following Italy’s unification in 1861. The new-born national state had to take upon itself the public debt of the various pre-unification nations. At the same time, the kingdom had to finance the military effort for the so-called Wars of Independence against foreign powers, combined with an extraordinary internal struggle against southern rebels opposing unification.

The second debt-to-GDP peak (Peak 2 on the graph) corresponds to the World War I period. Not only did state subsidies and protectionism become a normal tool used by the national industrial policy – as happened in many European states – but military spending also relied mainly on an expanding monetary base and rising public debt. This contributed to the highest debt-to-GDP ratio (159%) in modern Italian history, reached during the six-year period between 1919 and 1924. This was also the period of the fascist revolution in Italy.

After WW2 a period of strong growth rate labelled “the Italian Miracle”, meant a sharp decline in public debt which reached the lowest debt-to-GDP ratio in Italian history during the seven-year period between 1960 and 1967.

Italian public debt’s present third peak (Peak 3 on the graph) has no unification or state-building process behind it, no extraordinary infrastructure programme and no military build-up or war in sight. With the ending of the post war growth episode in the late 1960s and with escalating and deep political tensions caused by the growth in support of the Italian Communist Party, debt fuelled public expenditure in Italy grew quickly. Public expenditure rose from 33% of the GDP in the second half of 1960s to 41% of the GDP in 1975; with stable public revenue, the debt-to-GDP ratio rose from 38% in 1970 to 57% in just five years. Most of the public expenditure in Italy – from the 1970s to today – has not been to pay for public investments but rather to pay for social programs that were in turn driven by the need to secure political support in a fragmenting political system. Welfare spending mostly benefited older people and not the unemployed or the poor, while self-employed workers and those employed by large firms were privileged compared to other groups.

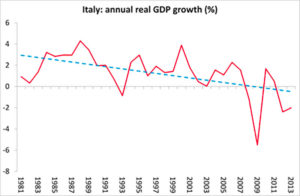

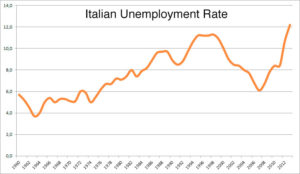

During the 1970s Italian public debt was managed through very high inflation rates and constant currency devaluations, however the rate of unemployment crept continuously up as the Italian economy became uncompetitive, and this in turn exacerbated the very political tensions that the deficit spending had been intended to defuse. By the 1980s the Italian governing and financial elite were committed to ending the dependency on high debt and high inflation by tying Italy’s currency to the currencies of the EU northern block – in particular Germany – via the various precursor systems of the euro such as the European Exchange Rate Mechanism (ERM) and then later to being in the first tranche of member states to join the new single currency.

The problem with this strategy is that it did not lead to better economic growth, instead growth rates drifted downward and even before the global financial crisis, the resulting Great Recession and the economic shock of 2008-10, Italy’s economic growth rate was low by EU standards. However the great tide of credit unleashed by the single currency (which led to the gigantic property bubbles in Spain and Ireland, and huge public debt in Greece) seemed to carry the Italian economy for a while and mask its underlying weakness. Unemployment began to fall and the strategy of currency union with the north, shutting off the temptation to devalue and inflate, seemed to be working. Then came the 2008 crisis and the Great Recession which exposed the continuing structural weakness of the Italian economy which violently contracted causing unemployment to soar. Although unemployment has declined somewhat in the years since 2008 the economy has never recovered to its pre-2008 peak. As the OECD points out, real GDP in Italy is still well below its pre-crisis peak. Italy is also the only OECD country where incomes (as measured by GDP per capita) are no higher than in 2000. By contrast, in France, Spain, the UK and Germany they have risen during the same period by 13%, 17%, 21% and 23 respectively.

The IMF now envisages Italyʼs public debt ratio ratcheting up to 134.4% of GDP in 2020 to 138.5% in 2024. As the debt increases, so too will the interest payments on the debt. That is unsustainable, especially with much of that debt scheduled to fall due in the next few years. In 2019 alone, Italy has an eye-watering €250 billion of bond redemptions to fund, which is roughly the equivalent of all other Eurozone bond maturities this year.

Since 2015 the European Central Bank (ECB) has more or less kept the Italian government debt afloat by buying up over half of the bonds it issues via the ECB Quantitative Easing program, and most of the rest of the bonds were bought by the very sickly Italian banks. However the ECB’s QE program has come to an end and it will no longer be buying new Italian bonds, foreign banks are actually shedding Italian debt as fast as they can with a net €69 billion of Italian government bonds sold since May 2018, when the right-wing League and anti-establishment 5-Star Movement took the reins of government, and Italian banks are in no financial position to expand their already bloated holdings. So who will buy the new Italian bonds that must be sold to service the Italian debt mountain? The danger is that with weak demand for Italian bonds in the market yields will climb too high, at which point bond vigilantes will take matters into their own hands, as happened in 2012 when the yields on Italyʼs 10-year bonds soared to 7%. With interest rates like that the Italian debt could become unsustainable and unstable very rapidly, tipping Italy, and probably the eurozone into a major financial crisis, one that could be bigger than the 2010 crisis.

Italy is home to an extremely fragile financial sector with the highest Non-Performing Loans (i.e bad debt) ratio and lowest return on assets of any of the major European economies. The French government has already warned that an economic recession in Italy could pose as great a risk, if not greater, to the EU than Brexit. And it makes sense for the French government to be worried. The economies of both Italy and France are tightly interwoven, with annual trade flows of around €90 billion. More important still, French banks are, by a long shot, the largest foreign owners of Italian public and private debt, with total holdings of €311 billion as of the 3rd quarter of 2018, according to the Bank for International Settlements. If Italy defaulted, French banks would take an almighty hit to their balance sheets. Given the already volatile political situation in France if the French banking system needed yet another large bail out the political consequences could be momentous.

If Italy had its own currency and were in control of its own monetary policy, it could try to inflate the debt away — whatever that might do to its own currency. But it isnʼt and it canʼt. Alternatively, it could, like Greece, default on its debt, with dire consequences for holders of that debt, including Italian households and domestic and foreign banks.

The one other option open to Rome is one that has also already been tried by Greece which is to slash public spending, hike taxes, privatise public assets, squeeze the informal economy, and impose a harsh austerity regime. This is the path recommended by the OECD, but it would virtually guarantee electoral suicide for Italyʼs coalition government partners who will do whatever they can to avoid alienating the very voters who gave them their first real taste of power.

Both the parties making up the Italian coalition government are committed to an anti-austerity program and both are critical of the current European project, with memberships that contain strong currents of anti-euro and anti-EU opinion. The coalition parties will resist instructions from Brussels to reduce the deficit and the position of both government finances and the banking system are very unstable so things could spiral out of control very quickly.