In the popular discussion of economics, in the media for example, some things are always assumed to be good and some are assumed to be bad. So trade surpluses are always good and deficits are always bad. Export are good and imports are not so good. Government budget surpluses are good and budget deficits are bad. If a country, such as Germany, is exporting a lot and running a big trade surplus then that is seen as an indicator of economic virtue, as economically healthy and as something that others should emulate. In fact that’s simply not true. Running a big, and persistent, trade surplus is actually the sign of an unbalanced economy and it can cause all sorts of problems.

If a country has an economy that is in balance then it should consume and invest the same amount as it produces. If it consumes and invests less than it produces then there will be excess production, unsold goods, businesses will contract and the economy will shrink until consumption plus investment once again equals production. A country like Germany that consumes and invests less than it makes can export the surplus goods and thus avoid economic contraction but that just exports the problem to another country because in order to sell more more goods than it imports some other country (or countries) have to be running a matching deficit, they have to be consuming and investing more than they are producing. How all that works is explained in more detail in two articles I have just posted on this website – you can see them by clicking here.

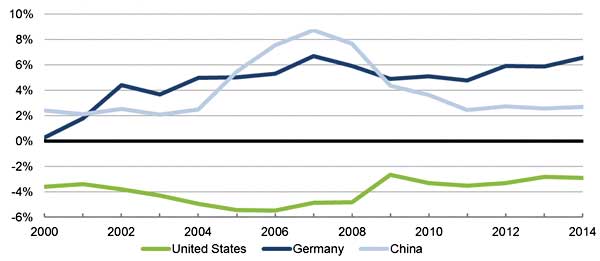

In the last decade and half the world has seen some very, very large trade imbalances develop. These imbalances have involved some countries, such as the USA and the peripheral countries of the eurozone, running very big deficits and some countries, notably China and Germany, running really big surpluses. Remember all surpluses are matched by equal deficits somewhere. These large imbalances played a pivotal role in creating the conditions for the great financial crisis of 2007-08 and it has long been recognised at a global level that these imbalances are unhealthy and that international trade needs to become more balanced, that surplus countries need to reduce their surpluses and deficit countries need to reduce their deficits.

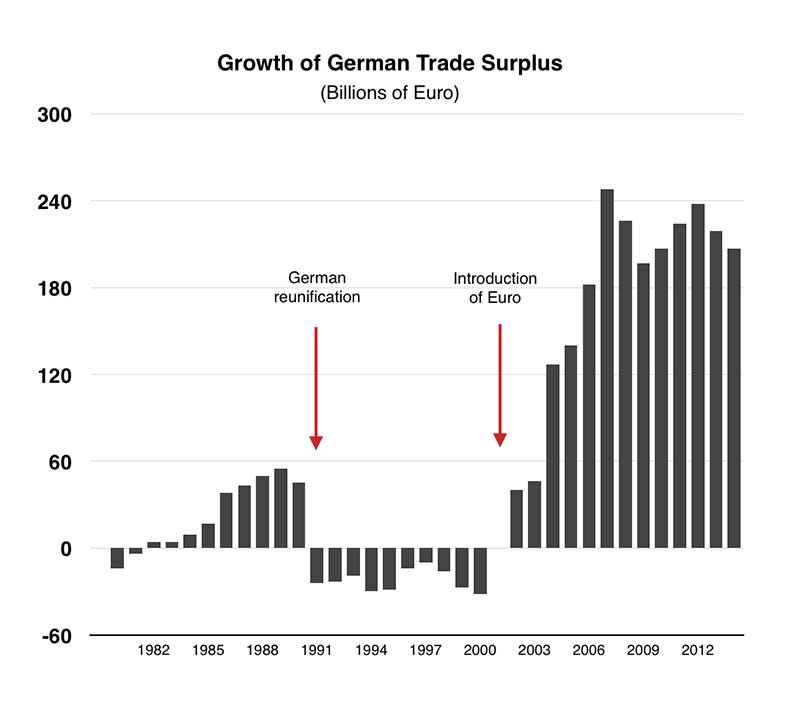

China, which kept its exchange rate undervalued to promote exports, came in for particular criticism for its large and persistent trade surpluses. However, in recent years China has been working to reduce its dependence on exports and its trade surplus has declined accordingly. The distinction of having the largest trade surplus, both in absolute terms and relative to GDP, is shifting to Germany. In 2014, Germany’s trade surplus was about $250 billion (in dollar terms), or almost 7 percent of the country’s GDP. That continues an upward trend that’s been going on at least since 2000 (see below).

Why is Germany’s trade surplus so large? Obviously Germany makes high quality products that foreigners want to buy. For that reason many point to the trade surplus as a sign of economic success. But other countries also make and export well made products without running such large surpluses. To run a surplus a country such as Germany doesn’t just have to export more but it has to import less, so the reason why a country runs a surplus include reasons why its exports sell well, but must also includes reasons why its imports are low.

There are two important reasons for Germany’s trade surplus.

The first reason is that the Euro, in relation to Germany, is very undervalued. The value of the Euro is set in relation to the entire 19 country eurozone but it is too weak (given German wages and production costs) to be consistent with balanced German trade. In July 2014, the IMF estimated that Germany’s inflation-adjusted exchange rate was undervalued by 5-15 percent. Since then, the euro has fallen by an additional 20 percent relative to the dollar. The comparatively weak euro is an under appreciated benefit to Germany of its participation in the currency union. If Germany were still using the Deutschemark it would presumably be much stronger than the euro is today, reducing the cost advantage of German exports substantially.

It has been calculated that the Euro gives Germany about a 20% price advantage compared to what it would have had if it was still using the Deutschemark, this means that Germany, by basing its exports in Euros, has the largest foreign exchange advantage of any country in the world, with the possible exception of China. This in turn means that Germany has been a huge benefactor from its membership in the EU, far beyond its €74 billion bail-out commitments in relation other eurozone countries such as Greece.

The second reason German has such a large trade surplus is that it has successfully suppressed domestic demand in a major way and for a long time, and suppressing domestic demand curtails imports.This has been achieved by running very tight fiscal policies and by holding down wage levels.

Germany has been heavily constraining its public expenditure for some time, and as the crisis and worries of the eurozone have continued so it has become ever more focussed on running a government budgetary surplus. Germany recorded an €18 billion budget surplus across all government levels last year last year, according to figures released today by Destatis, the Federal Statistics Office, which works out as 0.6% of German GDP in 2014, up from 0.1% GDP in 2013. The surplus has been achieved by significantly reducing public investment to such an extent that there are now widespread worries about the decaying state of German infrastructure. Der Spiegel ran a series of articles about the state of German infrastructure which you can see by clicking here, here and here, and the Washington Post and the Financial Times have reported on the decay of Germany’s railway and transport infrastructure. By holding down public investment, to a degree that causes infrastructural decay, Germany is sucking demand out of the European and global economy at a time when the major international economic problem is lack of demand.

The commitment to runing a budget surplus is difficult to understand given the obvious lack of demand in the eurozone, the declining infrastructural stock and especially given the fact that Germany can borrow money at zero or even negative interest rates (that means incredibly that lenders pay the German government for the privilege of lending to it).

As well as heavily restricting government spending Germany has also held down wage levels, this makes German exports very competitive (especially when combined with the under valuation of its common currency) but it is also sucking demand out of the eurozone economy. German workers have not seen their real world income increase for over a decade. The low wage policy was created by the labour market reforms announced by the Social Democratic under Chancellor Gerhard Schröder in 2003 which were known as Agenda 2010. The result is a trade surplus but that does not translate into any tangible benefit for German workers and consumers as their incomes stagnate. As well as directly suppressing demand in the wider eurozone and global economy because German consumers are not buying imports, low wages also reduce domestic German demand as consumers have less money to spend, this in turn reduces domestic investment by German firms supplying the home market and this once again pulls down overall demand.

The main problem of the global economy is low growth and a lack of demand. This is not surprising following a major financial crisis that has left such high levels of personal, corporate and government debt in its wake. As debt is paid off, as the economy deleverages to use the jargon, all economic players, such as consumers, firms and governments, spend less. This means that there is not enough demand and so the global economy runs below capacity and there is a widespread problems of both unemployment and low growth.

In a slow-growing world that is short of aggregate demand, Germany’s trade surplus is a major problem. Several other members of the euro zone are in deep recession, with high unemployment and with no “fiscal space” (meaning that their constrained fiscal situations in the eurozone system does not allow them to raise spending or cut taxes as a way of stimulating domestic demand). Despite signs of recovery in the United States, growth is also generally slow outside the eurozone. The fact that Germany is selling so much more than it is buying means it is importing demand from its neighbours (as well as from other countries around the world), reducing output and employment outside Germany at a time when monetary policy in many countries is reaching its limits. When real interest rates fall below zero there are no longer any ways to stimulate the economy through monetary policy, there has to be a fiscal boost to increase demand, old fashioned Keynesianism. Germany is doing the exact opposite of what a large economy with sound finances should be doing, it is literally sucking demand out of the world economy, and in particular our of the rest of the eurozone, at precisely the time when what is desperately need is more demand. And Germany is one of the few major economies in a position to easily and cheaply increase demand.

Persistent trade imbalances within the eurozone are also very unhealthy, as they lead to financial imbalances, imbalances which played a major role in the crisis of the eurozone, as well as to unbalanced growth. In theory, or least the theory of the dominant ‘austerian’ consensus, the weaker economies in the eurozone (pretty much everyone outside the northern block) should be cutting wage costs to make themselves more competitive. In a eurozone with a reasonable rate of inflation that might, theoretically, be possible because with prices rising steadily it might be possible to freeze wages and thus lower wage costs. But in the real eurozone of zero inflation and even deflation (falling prices) to cut wage costs means that actual wage rates must be reduced. So far, even with massive unemployment across the eurozone periphery, wage rates are not really falling, all that is happening is that millions upon millions of people are being impoverished through unemployment. And of course the economic contraction has reduced demand even further causing more contraction causing more unemployment. It is pretty clear that it is the more or less explicit program of the EU elites is to force down wages through massive unemployment, but in a world with low and falling demand in the economy all that suffering could be for nought.

Systems of fixed exchange rates, like the euro union or the gold standard, have historically suffered from the fact that countries with balance of payments deficits come under severe pressure to adjust, while countries with surpluses face no corresponding pressure. The eurozone treaties and regulatory systems contain many clauses about reducing deficits and none about reducing surpluses (see this recent post). The gold standard of the 1920s was brought down by the failure of surplus countries to participate equally in the adjustment process. The current situation in the eurozone is oddly and sadly similar to that of the 1920 and 1930s when countries built their entire economic policy around rigid currency rates and defending ‘sound money’, and thus inevitably when the currency could not adjust the real world economy had to by contracting. The difference is that at least back then the gold standard was based on something that actually had value, now the ‘euro standard’ is just based on paper.

As the IMF also recommended in its July 2014 report, Germany could help shorten the period of adjustment in the euro zone and support economic recovery by taking steps to reduce its trade surplus, even as other euro-area countries continue to reduce their deficits.

Even constrained as it is by the overarching eurozone system Germany has several policy tools at its disposal to reduce its trade surplus—tools that, rather than involving sacrifice, would actually make most Germans better off. Here are three examples.

Investment in public infrastructure. Many studies show that the quality of Germany’s infrastructure—roads, bridges, airports—is declining, and that investment in improving the infrastructure would increase Germany’s growth potential. Meanwhile, Germany can borrow for ten years at less than one-fifth of one percentage point, which, inflation-adjusted, corresponds to a negative real rate of interest. Infrastructure investment would reduce Germany’s surplus by increasing domestic income and spending, while also raising employment and wages.

Raising the wages of German workers. German workers, after a decade of stagnant living standards, deserve a substantial raise, and the cooperation of the government, employers, and unions could give them one. Higher German wages would both increase the production costs of export goods (and therefore their prices) and increase domestic income and consumption. Both would tend to reduce the trade surplus.

Germany could increase domestic spending through targeted reforms, including for example increased tax incentives for private domestic investment; the removal of barriers to new housing construction; reforms in the retail and services sectors; and a review of financial regulations that may bias German banks to invest abroad rather than at home.

These sorts of measure would actually raise German living standards, increase investment and build a healthier and more balanced national economy as well as giving the wider eurozone and global economy a major boost by significantly increasing demand. German is uniquely placed to make this sort of move, it can easily afford it and it has no real domestic costs for the German nation. There is no down side unless one is obsessed witness achieving surpluses for their own sake.

The pressure on Germany is growing to change direction and begin to reduce its surplus. The US Treasury has just presented a report to Congress which is highly critical of the German policy of maintaining a very large trade surplus. It is highly critical of Germany, China, Japan and Korea (in that order) for generating huge current account surpluses, due to their reliance for growth on exports, rather than domestic consumption and investment. In other words, it implicitly accuses them of yet again exporting big debts to the rest of the world, to deficit countries like the UK and the US. The US Treasury points out that domestic demand in Germany last year rose “only” 1.3%. And it argues that “key to the adjustment process” in the eurozone is “achieving stronger domestic demand growth”, that “reducing stubbornly high unemployment will not be possible otherwise” and “achieving sustainable public finance will be more difficult as well”.

This argument, that Germany’s obsession with generating surpluses and refusal to stimulate domestic expenditure is needlessly and dangerously holding back recovery in the rest of the eurozone, was also made this week by the Greek finance minister Yanis Varoufakis. When the top US economists and a politician from a leftist Greek party both argue for the same thing then one senses a coalition of pressure building around Germany. In a few weeks, the International Monetary Fund and other international groups, such as the G20, will meet in Washington and I expect the problem of the German surplus will be very much on the agenda.

The German model, low wages, low domestic demand, high exports, is precisely the model that is being imposed on much of Europe by the eurozone system. It is founded on a belief that the whole of Europe can become a giant version of Germany, become one vast export orientated economic block founded on low wage costs. Leaving aside that such a model would result in a low wage European economy, would the rest of the world stand by and watch its largest trading block become a mass exporter of deflation and unemployment, watch as the EU sucked demand out of the global economy? I doubt it.

Germany, and Europe, need to change direction.