The existing Chinese growth model is unsustainable and is coming to an end. This means that deep and large structural adjustments have begun that will change the entire shape of the Chinese economy. The metric currently most used to measure the success and health of the Chinese economy is the rate of growth of GDP. Most commentators report falling GDP growth as a sign that things are going wrong in China and rising GDP growth as a sign that things are going right. There are two things that are wrong with using GDP growth in this way as the main measure of the health of the Chinese economy. The first is that the Chinese leadership lies about GDP growth. They do this because the GDP growth rate has become the main public measure of the success of economic policy in China, so its the quota of success for the ruling elite, and as everyone knows in communist polities quotas must be overfilled. So the Chinese leadership massage and manipulate the data to hide scary declines in growth rates. The second, and more important, reason why GDP growth is a poor indicator is because it is usually read upside down by most observers. The sort of of structural changes that China must make in its economy require that growth rates fall, and a prolongation of high growth rates (say over 5% annually) would be strongly indicative of a failure to restructure and thus a deepening of the structural weaknesses in the economy.

In order to understand what are good key indicators for measuring the restructuring of the Chinese economy it is necessary to understand what is wrong with the current shape of the Chinese economy and therefore what needs to be fixed or changed. Understanding the structural problems will also reveal which social groups will be affected by the restructuring, and thus what some of the political and social implications of a restructuring might be.

The unbalanced structure of the Chinese economy

I examined in some detail the structural problems of the Chinese economy in a recent posting entitled “Thinking about China”. As explained in that article the key characteristic of the Chinese economy is that it is unbalanced, and unbalanced very significantly. Chinese growth is unbalanced because the very rapid GDP growth, especially in the past decade and a half, has relied too heavily on exports and investment, and too little on domestic household consumption. The big adjustment that the Chinese economy will have to make over the coming years is to readjust the balance of its economy so that much more of its output is consumed domestically and much less is either invested or exported. Given the scale of the imbalances in the Chinese economy this rebalancing will be a big, drastic, and probably very difficult adjustment which will be socially and politically disruptive. It will pose significant problems for the Chinese ruling elite.

The proportion of Chinese GDP that goes to domestic consumption is extraordinarily low at around 36%. This low level of domestic consumption is unprecedented in a major economy. If you have a look at the this table of data from the World Bank you can see that consumption as a proportion of GDP is much, much lower than any other major economy.

| Household consumption as percentage of GDP | |||||

|---|---|---|---|---|---|

| 2010 | 2011 | 2012 | 2013 | 2014 | |

| Brazil | 60 | 60 | 61 | 62 | 62 |

| Germany | 56 | 55 | 58 | 60 | 55 |

| India | 56 | 55 | 56 | 57 | 57 |

| Japan | 59 | 60 | 60 | 61 | N/A |

| UK | 64 | 64 | 65 | 65 | 64 |

| USA | 68 | 70 | 68 | 69 | N/A |

| China | 37 | 38 | 37 | 36 | N/A |

What does this low level of consumption mean and how was it achieved? In any economy the income generated by economic activity can be spent on either consumption or it can be saved and spent on investment. In a balanced economy the total national income will be fully spent on on either consumption or investment with nothing left over as this will allow the economy to operate at maximum capacity. If the national savings, the income not spent on consumption, are higher than investment then there will not be enough demand in the economy to buy all the products created by the economy. To avoid excessive savings from causing the economy to shrink, because excessive savings would mean that there was not enough domestic demand to buy all the goods that were made, some of the national GDP can be exported and sold abroad. When this happens it means that demand from abroad is being imported into the economy to replace the missing demand caused by the high rate of savings.

So looking at the the amazingly low rates of consumption in China it is clear that the Chinese national saving rate is very, very, high. Higher than all other countries on earth. It is very important to understand that national savings are not the result of differences in national character or reflections of an impudent or prudent culture. The national savings rate is made up of not just private household savings but also the savings of governments and businesses. It is defined simply as a country’s GDP less its total consumption. The household savings rate may be determined in part by the cultural preferences of ordinary households but even that is also determined by non-cultural factors such as demographics (whether a population is ageing and therefore more likely to save for retirement), the existence and credibility of a social safety net, the sophistication of consumer finance, and so on. The national savings rate, which along with household savings includes the savings of governments and businesses, is not determined by private savings preferences but by economic policies and economic institutions, and it is those factors and not national culture that determines the share of household consumption in the whole economy. National savings rates, in other words, have very little to do with household cultural preferences and much more to do with the impact of specific economic policies.

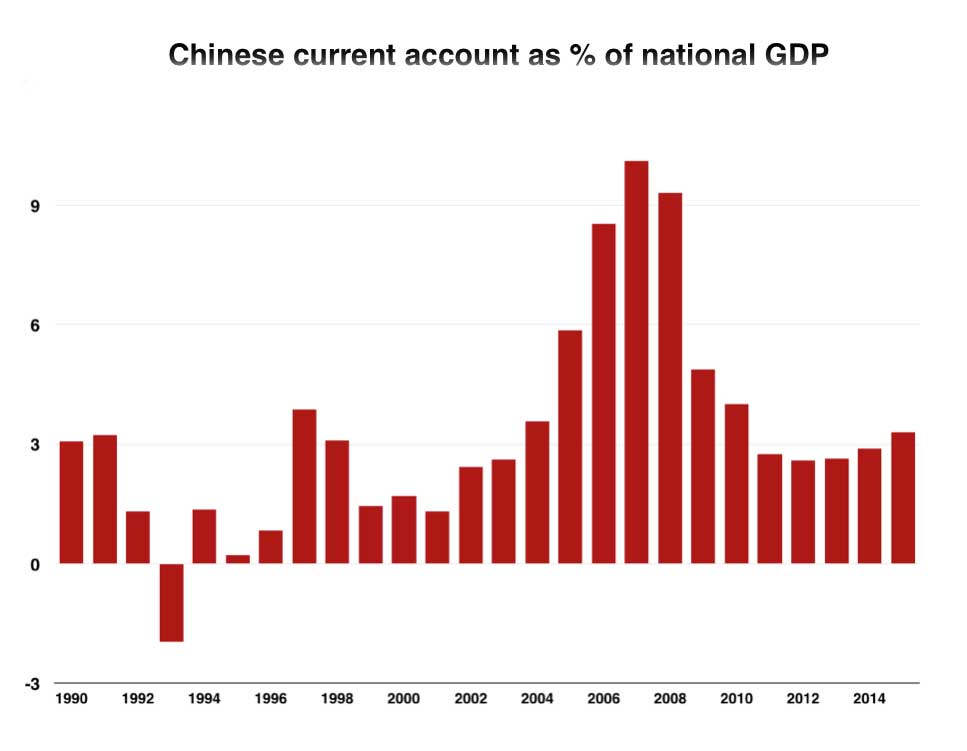

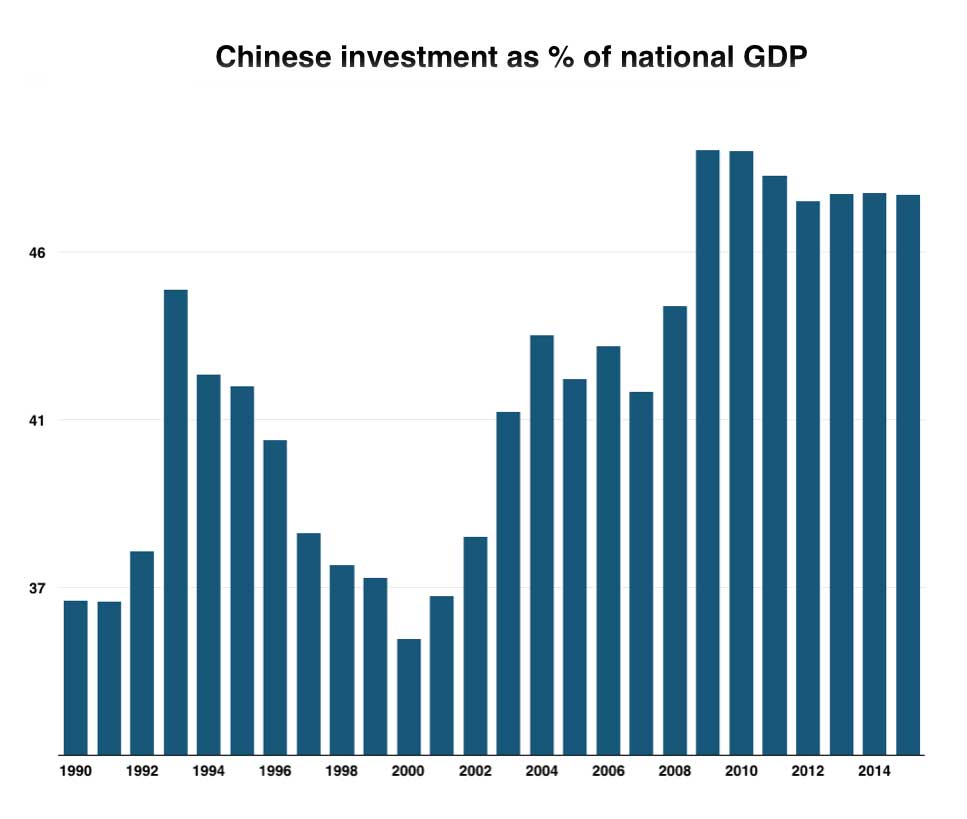

China’s very high rate of savings means that it has been either investing a lot, or exporting a lot more than it imports. In fact it has done both. As the charts below show Chinese growth has been partly based on a large surplus of exports over imports, and even more on very high levels of investment.

The Chinese current account surplus, the excess of its exports over its imports, grew very strongly after 2000 up until the financial crisis of 2007 and then it fell sharply. This reveals a problem with relying on a trade surplus to soak up the lack of demand caused by high savings, which is that it is dependent on the willingness or ability of other countries to finance a deficit and continue to import Chinese exports indefinitely. In 2007 the sharp contraction in the developed economies caused a drop in demand for Chinese exports and the chart below shows that the Chinese trade surplus fell sharply after 2007 and has remained at a lower level ever since. With no other adjustments, and with a continuing low level of domestic demand, this would have meant a fall in demand for Chinese products and this would have meant a contraction of economic activity in China. What actually happened is that the Chinese government deployed a major stimulus to the economy by ramping up the already very high level of investment spending. The Chinese government could do this because it had much greater direct control of investment spending compared to the far less control it has over how much foreigners spend on China’s exports.

The level of Chinese investment has been very high for a long time and in fact investment spending has been the major motor driving high Chinese GPD growth for decades. China has by far the highest rate of investment of any major economy. Beijing has engineered extremely high and growing investment rates in China (mostly through state control of the banking system and state owned enterprises) for the previous twenty-five years, and this made a great deal of economic sense at the beginning of the reform process, after 1978, when China was seriously and obviously underinvested for its level of social development. But after so many years of furious investment growth, China had become by 2005 over-invested, perhaps even massively over-invested. It was on top of this very large existing investment program, that was already causing bad investment and rising debt, that Beijing mandated even higher investment in order to stimulate the economy and prevent a contraction after the 2007 crisis and the fall in exports.

Most of the growth China has experienced has come from capital fixed investment where the Chinese government supplies massive amounts of money to investment projects. The amounts have been growing since 2005, and in 2008 even before the major stimulus program fixed assets investment was estimated at $2.52 trillion per annum. Most of this is directed by the state, which currently owns 60% of all capital stock. The investment program is financed largely through the main banking system in China which is state controlled and the bulk of the official banking credit and investment funds goes to the big state owned enterprises (SOEs) sector. The private sector (i.e non state owned enterprises) which now accounts for the majority of output in China mostly receives credit and funding from the non-state shadow banking system.

Once its is clear that the most important imbalance in the Chinese economy is the very low share of consumption in GDP then its follows that raising the share of consumption in GDP is the most important adjustment that is required. It also follows that in order for consumption to increase its share of GDP consumption has to grow faster than GDP. If GDP growth is, say, 6% then in order for consumption to increase its share it would have to grow above 6%, and in order to make some sort of meaningful adjustment at anything other than a snails pace then consumption must grow quite a bit faster than the GDP growth rate. So it also follows that the higher the GDP growth rate the more consumption would need to grow in order to overtake it and so high growth rates makes it much harder to achieve the sort of adjustment that China must make. This comes back to the point I made at the beginning of this article about commentators reading the growth rate upside down. Once the urgent need to raise the share of consumption is understood as the primary issue facing the Chinese economy then it is also clear that high growth rates make that adjustment harder rather than easier because higher growth rates raise the amount that consumption must grow to trigger an adjustment, conversely lower growth rates make it easier to increase consumption as a share of GDP.

The mechanisms for suppressing Chinese consumption

The astonishingly low level of Chinese consumption, as a proportion of GDP, is the result of a number of mechanisms that have acted together to force down consumption and force up investment and exports. In order to rebalance the Chinese economy the mechanisms that have previously acted to suppress consumption and promote investment and exports must be fundamentally changed so that they do the opposite. If that is the case then it is changes in these mechanisms that are the best indicators of a restructuring process in China.

So what are the mechanics that have driven down Chinese consumption levels? There are three main mechanisms that act together to force down consumption in the Chinese economy.

Low Wages: Wage growth has been constrained to well below the growth in worker productivity in China. Worker productivity has grown much faster than wages, especially during the past decade, when workers’ wages have slightly more than doubled while productivity nearly tripled. There are many reasons for the gap between the two. One reason may have to do with the huge pool of surplus labor in the countryside available to compete for jobs, thereby keeping wages low. Another reason may be that independent trade unions are banned under the one party rule system and so workers do not have effective tools to press for higher wages. Additionally migrant workers were until a recent reform unable to get residence permits, called hukou, and without hukou what limited protection workers may have was sharply reduced since living in an urban area without the proper hukou is tolerated but technically illegal and this encourages casualised exploitative labour systems.

The important point in relation to analysing the Chinese growth model is that, whatever the reasons, lagging wage growth in China represented a transfer of wealth from workers to employers. An increasing share of whatever workers produced accrued to employers, and this effective subsidy allowed employers to generate excess profit or cover losses. The fact that productivity grew much faster than wages acted like a growing tax on workers’ wages, the proceeds of which went to subsidise employers.

The impact of this hidden wage tax has on the relationship between GDP growth and household income growth is that by effectively subsidising employers at the expense of workers, it boosted the competitiveness of businesses, increased overall production, and constrained household income, and with it, household consumption.

An Undervalued Exchange Rate: The second mechanism that suppress consumption in China, a mechanism that is common among Asian development model countries, is the deliberate holding down of the foreign exchange value of the Chinese currency in order to boost exports. Most analysts acknowledged that after the massive devaluation of the renminbi in 1994, followed by soaring productivity (which increases the real undervaluation of a currency), the renminbi was seriously undervalued for much of the past two decades, possibly by up to 30%. The effect of this undervalued currency is that Chinese products are ‘cheap’ abroad and so are highly competitive and thus sell very well. This boosts profits for the enterprises but the obverse effect of an undervalued currency is that imports are made more expensive. The net effect of an undervalued currency is to transfer income from workers (who can buy fewer expensive imports or goods made with foreign inputs that are imported) to enterprises (who can sell more products and make more profit) and so an undervalued currency acts to suppress domestic demand. The undervaluation of the exchange rate is a kind of consumption tax imposed on all imported goods, and everyone in China who is a net importer—which includes all households except perhaps subsistence farmers—must pay this very large implicit tax.

Chinese manufacturers in the tradable goods sector, heavily concentrated in Guangdong and the coastal provinces, receive the opposite “negative” tax, or subsidy, in the form of lower domestic costs relative to higher foreign prices for their goods. The impact this hidden consumption tax has on the relationship between GDP growth and household income growth is that by raising the cost of foreign imports, it puts downward pressure on real household income in China. But by subsidising Chinese exporters, thus increasing their competitive strengths relative to foreign competitors, the undervaluation of the renminbi boosts domestic production. An undervalued exchange rate is simply another powerful mechanism for increasing the gap between what a country produces and what it consumes. This not only affects the trade account, but if high GDP growth is created through high investment growth, an undervalued currency also creates domestic imbalances in the way growth is generated.

Financial Repression: The third mechanism for creating the domestic imbalances, and probably by far the most powerful, is financial repression. Financial repression (which is not unique to China) is the process whereby interest paid on deposits (savings) is held at an artificially low level and a big gap (spread) opens up between what savers get paid and what interest banks can charge on loans. Its a way of generating large amounts of very cheap capital but the net effect is to transfer wealth from consumers to financial institutions and borrowers of capital. Its a sort of tax on savers.

The “invisibility” of the financial repression tax, of course, is one of its most important features—and one most welcome by fiscal authorities everywhere. The Chinese financial system is severely repressed. Almost all household savings in China are in the form of bank deposits, and the banks are controlled by the monetary authorities, who determine the direction of credit, socialise the risks, and set interest rates. In China, the central bank, the Peoples Bank of China, following the instructions of the State Council, sets both the maximum deposit rate, above which banks cannot pay, and the minimum lending rate, below which they cannot lend. Because the central bank sets both rates very low, it is effectively transferring a large share of resources from depositors to borrowers.

How large a share? In the past decade nominal lending rates have averaged little more than 6 percent even as the economy grew nominally by 14 to 16 percent annually. Even if we accept that annual GDP growth has been overstated by 2 to 3 percentage points, it still implies that borrowers received a hugely disproportionate share of growth at the expense of depositors. With lending rates 4 to 8 percentage points below adjusted GDP growth rates, and with household deposits (including farm deposits) equal to anywhere from 80 to 100 percent of GDP, the total transfer from households to state-owned enterprises, infrastructure investors, and other favoured institutions amounts to anywhere from 3 to 8 percent of GDP annually.

In China, as in many of the countries that followed the Asian development model, not only have interest rates been set extremely low, but the minimum spread between the deposit rate and the lending rate is set very high, thereby guaranteeing the banks a large, and very safe, profit. This also comes at the expense of depositors. In a country where household income accounts for approximately 35 -50 percent of GDP, these combined interest-rate-related transfers, of 4 to 9 percent of GDP, represent a very high hidden tax on households. A recent International Monetary Fund (IMF) paper, using a different methodology, similarly calculates the effective cost of the transfer to be at least 4 percent of GDP.

Depositors, however, cannot opt out. There are significant restrictions on their ability to take capital out of the country, and for the most part only the very rich can exploit foreign investment opportunities. Nor are there are many domestic investment opportunities. Local stock and bond markets are rudimentary, highly speculative, and rife with insider activity—which effectively transfers profits from non-insiders to insiders while leaving the former with the full risk. In China, there are few other legal and safe alternatives to the banking system. The most common alternatives include property development and investment, and the so-called informal banking sector, both of which generally offer higher rates of returns for savers/investors but which also have a very much higher level of risk. Depositors, in other words, have little choice but to accept very low deposit rates on their savings, which are then transferred through the banking system to banks and borrowers who benefit from these very low rates. Very low lending and deposit rates create a powerful mechanism for using household savings to boost growth by heavily subsidising the cost of capital.

The lack of return on saving deposits in the official banking system explains the attractiveness in China of the shadow banking system, the stock market and speculative investment activity like property development. Savers desperately seeking a return above the pittance paid by the banks chase every investment opportunity available. This leads to dangerous speculative bubbles and makes savers very vulnerable to large stock market adjustments and deflating property bubbles. The ruling elite had sought to reform the financial system by allowing the development of a parallel market based system of savings and investment, and hence a more widely based and rational system for generating capital for investment, through structures like stock markets. But as the recent stock market crashes have shown the elite could not take the risk of allowing these mechanism to truly operate and self adjust because the political costs (in terms of social stability) of allowing the savings of tens of millions of Chinese savers to be wiped out was too large and so the elite was forced to intervene with massive bail out operations.

Not surprisingly, the enormous transfers of funds from households made possible by the repressed financial system has made it very profitable for governments, businesses, and property developers to invest in infrastructure and manufacturing capacity, even if the real returns on the projects did not justify the costs. In so doing they ignited an investment boom. The hidden tax on savings by lowering borrowing costs substantially encourages investment, primarily in property development, infrastructure building, and of course in manufacturing capacity (in China there is very little consumer financing). But by reducing the amount of income from interest that depositors receive, the hidden tax reduces the overall income that household savers can earn, and this is especially noticeable in a country where savings are so high and income so low as a share of GDP. This is certainly a powerful mechanism for increasing the gap between what a country produces and what it consumes

This mechanism of financial repression explains one of the common misunderstandings about the Chinese economic model. Western commentators often explain the growth rates in China, and the general success of Chinese exports, as being the result of its comparative advantage in having a huge pool of cheap and disciplined labor. But in fact this doesn’t seem to be reflected in the economy. If China’s comparative advantage were cheap labor, we would expect its growth to be heavily labor-intensive as businesses loaded up on the most efficient input. But China’s growth is actually heavily capital-intensive. It is in fact among the most capital-intensive in the world and far more so than any other developing country, even countries that are far richer and with higher wage levels. Chinese businesses behave, in other words, not as if labor is the cheapest input they have but rather as if capital were the cheapest input. They are right. Labor may be cheap, but for most large borrowers capital is free or may even have a negative cost.

The Chinese growth model is unsustainable

Although these three mechanisms (lagging wage growth, an undervalued currency, and repressed interest rates) distribute the costs and benefits in different ways to different groups among households and producer they all do the same thing. They effectively tax household income and use the proceeds to subsidise producers, infrastructure investors, property developers, local and provincial borrowers, central government borrowers, anyone, in fact, who has access to bank lending, who employs workers, or who manufactures tradable goods, whether or not the goods are actually exported.

For the past decade China has been growing at a very high rate, often by as much as 10 to 12 percent annually, and household income, and with it household consumption, grew 7 to 9 percent annually. In a sense it seems like a free lunch. Household income is ‘taxed’ heavily (via the mechanisms outlined above) in order to generate tremendous growth. This growth causes employment to surge, and as workers move from subsistence living in rural China to the factories and development sites of the cities, their income surges. So rapidly does household income grow that even after the huge hidden ‘taxes’ are deducted, the wealth and ability to consume of the average Chinese grows at a pace that is the envy of world. So why not continue this growth model forever?

Because the model cannot be sustained. There have been plenty of other examples of ‘growth miracles’ in the past and almost of them are based on very high rates of state directed investment funded by low household consumption. The Chinese model simply replicates on a larger scale other similar investment led growth miracles (Germany in the 1930s, the USSR in the 1930s and 1960s, Brazil in the 1960s and 1970s, Japan in the 1980s) so there is plenty of empirical evidence about how this sort of situation develops. It is worth noting that just as in the previous ‘growth miracle’ episodes (the Soviet Union, Nazi Germany, etc) that have coincided with periods of depression or recession in the developed liberal democracies, there are radical intellectuals in the west who are convinced that somehow the Chinese model has escaped the limits of real world economics and that the Chinese model, like previous ‘growth miracles’, can be sustained indefinitely. I believe they will be disappointed.

There are two primary reasons the Chinese model cannot be sustained. On the one hand sustained levels of very high investment inevitably lead to the exhaustion of viable investment opportunities, and on the other hand the ability of the rest of the world to continuously absorb Chinese exports is limited.

Eventually the large quantities of the ultra cheap capital flowing out of the repressed financial system begins to flow into wasteful and unproductive investment, that is investment which cannot generate a return on the capital invested. As the amounts being invested in unproductive investment increase it is possible for a while for the financial system (especially in a country like China with a high degree of direct state and political control over the banking system) to absorb the losses. The unproductive investment appears in the financial system as non-performing loans, as bad debt, as unproductive investment projects fail to repay the capital that was borrowed to finance them. With plenty of cheap capital flowing through the financial system for a while these bad debts can be rolled over and written off but they will keep increasing because productive investment will have been become exhausted. Eventually there are no more superhighways, new cities, airports, property developments, stadiums, hi-speed rail links that can be built. And once the investment process slows the entire unbalanced economy becomes unstable and growth slows.

Worker productivity and wages are much lower in China than in the developed world. In addition, weak legal systems and the current institutional framework discourage the most productive use of resources (it is hard to set up businesses in China, good connections are a greater cause for success than efficiency, legal structures are complex, local governments regularly intervene for non-economic reasons, innovation is discouraged, corruption is endemic and institutional, and so on). This means that the economic value of infrastructure in China, which is based primarily on the value of wages it saves, is a fraction of the value of identical infrastructure in the developed world. It makes no economic sense, in other words, for China to have levels of infrastructure and capital stock comparable to those of much richer countries because this would represent wasted resources, like exchanging cheap labor for expensive, labor-saving devices. Because risk is socialised, that is, all borrowing is implicitly or explicitly guaranteed by the state, no one needs to ask whether the locals can use a highway and whether the economic wealth created is enough to repay the cost.

Politically the benefits of investment projects accrue over the short term and within the local power base of the local leader who makes the investment decision but the costs are spread widely through the national banking system and over many years, during which time, presumably, the leader responsible for the investment will have been promoted and moved on. With very low interest rates and other subsidies making it hard to determine whether investments actually reduce value or create it, and with the political success and fraud opportunities arising from delivering large investment projects, the Chinese system ensures that further investment in infrastructure is always encouraged.

The problem of over investment is not just an infrastructure problem. It occurs just as easily in manufacturing. When a manufacturer can borrow money at such a low rate that it effectively forces most of the borrowing cost onto household depositors, the manufacturer doesn’t need to create economic value equal to or greater than the cost of the investment. Even factories that systematically destroy value can show high profits if the interest rate subsidy is large enough. And there is substantial evidence to suggest that China’s state-owned sector in the aggregate has probably been a massive value destroyer for most if not all of the past decade but is nonetheless profitable thanks to hidden subsidies provided by households.

At some point, in other words, rather than creating wealth, the system that produces the endless torrent of ultra cheap capital available for investment begins to destroy wealth, but the unproductive investments nonetheless show profits by passing more than 100 percent of the losses onto households. The very cheap capital especially means that a very significant portion of the cost is forced onto depositors in the form of low interest rates. This is effectively a form of debt forgiveness granted, unknowingly, by depositors. Under these circumstances, it would take heroic levels of restraint and understanding for investors not to engage in value-destroying activity. This is why countries following the investment-driven growth mode and many other smaller countries—have always over invested for many years leading, in every case, either to a debt crisis or a “lost decade” of surging debt and low growth.

The other mechanism for transferring income away from consumption, the artificially low exchange rate and the resulting export surplus, also has barriers that means it cannot be sustained indefinitely. Unlike the investment system the level of Chinese exports is not decided by decisions internal to the Chinese elite but depend on the ability and willingness of the rest of the world to absorb Chinese exports. As Chinese manufacturers created rapidly expanding amounts of goods, the transfers from the household sector needed to subsidise this rapid expansion left them unable to purchase a constant share of the goods being produced. In other words the very mechanism that created the successful exports goods depressed domestic consumption. The result was that China needed to export a growing share of what it produced, and this is exactly what it did, especially after 2003.

As long as the rest of the world, primarily the United States and the trade deficit countries of Europe, were able to absorb China’s rising trade surplus, the fact that domestic households absorbed a declining share of Chinese production didn’t matter much. A surge in American and European consumer financing allowed those countries to experience consumption growth that exceeded the growth in their own manufacture of goods and services, and so they had spare (debt financed) income to spend on buying Chinese goods. By 2007 China’s trade surplus as a share of global GDP had become the highest recorded in one hundred years, perhaps ever, and the rest of the world found it increasing difficult to absorb it. To make matters worse, the global financial crisis in 2007-8 (caused to a significant degree by global imbalances such as the Chinese trade surplus) sharply reduced the ability and willingness of other countries to maintain current trade deficits and this caused a very sharp reduction in Chinese exports as many developed economies sank into recession.

So China has hit both constraints: capital is wasted, perhaps on an unprecedented scale (this constraint in fact may have been hit a decade or more ago), and the world is finding it increasingly difficult to absorb excess Chinese capacity. For all its past success, China now urgently needs to abandon the development model because debt is rising furiously and at an unsustainable pace. Once China reaches its debt capacity limits, perhaps in the next few years, growth will inexorably come crashing down.

What needs to change in the Chinese economy?

The basic thing that has to happen is that incomes have to rise faster than the growth of GDP so that incrementally consumption gets to be a bigger and bigger share of GDP. For example if GDP rises 5% in a year then incomes would need to go up by 7% or 8% in order to make consumption grow in a meaningful way as proportion of GDP. During the recent fast growth phase of the Chinese economy, the last two to three decades, incomes have continuously risen, sometimes by as much as as 7% per annum. So people have been getting better off year after year and this has helped contain the social tensions arising from rapid economic and social change such as large-scale industrialisation, mass migration and urbanisation. But during the fast growth phase incomes always grew slower than GDP so the proportion of GDP spent on consumption, which is the key metric of the imbalance, actually fell.

Increasing incomes and thus increasing consumption is a complex process and there is a limit to how fast this can happen so the idea, that, for example, incomes might grow by 10% per year is probably unrealistic. If there is a limit to how quickly incomes can grow then there is a limit to how much GDP can grow before it starts to increase rather than decrease the structural imbalances. If GDP were to continue to grow at the recent rate of 7% it would be very hard for incomes to grow faster, and if consumption does not grow significantly faster than GDP then consumption as proportion of GDP would not increase and the structural imbalance would not be rectified. Continued fast GDP growth would mean that the imbalances in the economy would not be resolved and would actually grow bigger. So when commentators say that continued high Chinese GDP growth is a sign of economic health they are wrong. GDP growth has to fall, probably down to a more ‘normal’ 3-4% range, so that rebalancing can occur.

In order for consumption and incomes to grow, and to reduce the excessive growth rate, the proportion of GDP spent on investments has to fall, and fall by a large amount. High levels of investment have been the prime driver of growth in recent decades and after the 2007 crisis and resulting slump in world trade the rate of investment was actually accelerated. The bulk of investment in China has been in large scale industrial and infrastructural projects but alongside the infrastructural investments there has been a colossal investment in property development in China in the last decade and half. Part of that has been the result of very rapid urbanisation but now a large part of the property market is simply a massive property bubble.

If China were to reduce investments to 40 percent of GDP from its current level of 50 percent, and 40 percent is still very high, what has to happen? Clearly Chinese investment must grow more slowly than GDP for this to happen. How much more slowly?

The arithmetic is simple. It depends on what we assume GDP growth will be over the next five years, but investment has to grow by roughly at least 4.5 percentage points less than GDP for this condition to be met. If Chinese GDP grows at 7 percent, in other words, Chinese investment must grow at 2.3 percent. If China grows at 5 percent, investment must grow at 0.4 percent. And if China grows at 3 percent, which is much realistic level of GDP growth in the context of restructuring, investment growth must actually contract by 1.5 percent. Only in this way can investment drop by 10 percentage points as a share of GDP in the next five years.

Any meaningful rebalancing in China’s extraordinary rate of over investment is consistent only with a very sharp reduction in the growth rate of investment, and perhaps even an outright contraction in the amount of investment. If this contraction in investment growth itself pushes down the growth rate of household income, by causing an a generalised economic contraction, then investment will have to drop even further for the economy to rebalance.

Given the current growth model is causing investment to be significantly misallocated and that the current system cannot resolve the problem, and that in order to rebalance the economy consumption must become a greater share of GDP over the next five to ten years that must mean increasing the household income (or wealth) share of GDP.

China, in other words, must stop transferring income from households to the state and in fact must reverse those transfers. As Chinese household income and wealth become a greater share of the overall economy, so will Chinese consumption. The key is that after three decades during which household income declined as a share of the economic pie and the state sector (which is a sort of proxy for the wealth of the political elite), increased its share, China must now engineer a development model in which household income rises as a share of the economic pie.

Given the three mechanisms outlined earlier (low wages, high exports and financial repression) that work together to reduce consumption as proportion of GDP, in order to reverse this process then those same mechanisms have to work in the opposite direction in ways which mean that China can most easily, or least painfully, absorb the costs and adjust its economy.

Although difficult, transferring wealth from the state to the household sector is not impossible. There are various ways in which this transfer can take place can and here are six possible mechanisms for doing this:

1. The current system could continue to maintain its high investment growth rates, until it reaches its debt capacity limits, after which a debt fuelled general crisis causes economic growth to stop which in turn forces a drastic drop in investment which in turn forces up the household share in GDP. This scenario implies a period of economic contraction followed by a longer period of much lower growth. This would be the most socially and political destabilising option because even though consumption would increase as a proportion of GDP a generalised contraction might mean stagnating or even falling household incomes.

2. Beijing could quickly reverse the transfers that created the imbalances by, for example, raising real interest rates sharply, forcing up the foreign exchange value of the currency by 10 to 20 percent overnight, and pushing up wages, or by lowering income and consumption taxes. Although household income as a proportion of GDP might grow (the desired outcome) it might be in conditions of stagnant or even negative income growth. This would also be a form of shock therapy for the economy, it would probably cause a great deal of economic and social disruption with unknown consequences.

3. Beijing could do everything as in option 2 but do it slowly, reversing the transfers in the same way but over a longer period of time so that the economy has time to adjust and economic contraction could be avoided. The problem is that there may not be enough time to implement a slow incremental rebalancing program before the current unbalanced system runs into the buffers and a generalised debt fuelled financial/growth crisis erupts. Beijing really has to get moving on a substantial rebalancing reform program as a matter of urgency.

4. Beijing could directly transfer wealth from the state sector to the private sector by privatising assets and using the proceeds directly or indirectly to boost household wealth. The large State Owned Enterprise (SOE) sector is central to both the misallocation of investment, the current unbalanced economic system and the basis of the wealth and power of a significant fraction of the ruling elite. Dismantling the SOE sector and passing the proceeds to the household sector is both politically and technically difficult.

5. Beijing could indirectly transfer wealth from the state sector to the private sector by absorbing private-sector debt. Whether this could be done on the scale that is required, whilst ensuring the integrity of the financial system is not clear and this scenario would also see a reduction in state wealth and this again would undermine the wealth of the party elite.

6. Beijing could cut investment sharply, resulting in a collapse in growth, but mitigate the employment impact of this collapse by hiring unemployed workers for various make-work programs and paying their salaries out of state resources. This scenario would also see a reduction in state wealth, because the need to redistribute state funds to households, and this again would undermine the wealth of the party elite.

Notice that all of these options effectively have China doing the same thing: in each case, the state share of GDP is reduced and the household share is increased. There are, however, very big differences in how the changes are distributed among various parts of the household and state sectors, and in what type of social, economic and political tensions that would result.

The political difficulties and dangers of the restructuring

Given that any rebalancing is going to involve a significant reduction in the rate of investment certain sectors such as construction, steel, etc will be hard hit. Factories, employment and SOEs rooted in the old investment model will contract. This is already happening and one of the impacts has been a sharp fall in the price of global commodities (not least oil) and a slow down in a number of emerging economies whose prior growth had been built on servicing the Chinese investment program. The slow down in investment will be disruptive in specific sectors and regions in China but shifting from investment to consumption does not necessarily imply a generalised deterioration in the economic well being of the population (unless the restructuring is badly managed and slips out of control).

The core of the rebalancing process is going to be a transfer of income from the state to the household sector. Even if the rebalancing results in a big fall in the GDP growth rate and even it is disorderly and involves financial crises, household income growth could be quite robust, which means that fears of popular social instability arising from direct economic forces as Chinese growth slows are probably exaggerated. If a Chinese growth slowdown occurs with real rebalancing, household income can continue to rise strongly. Because rebalancing implies an asymmetry in growth rates of the different sectors, more specifically a reversal of the process by which household income growth lags behind GDP growth to one in which it leads GDP growth, slower GDP growth does not mean symmetrically slower growth across the board.

But, and this is an important political point, this is not the only consequence of the asymmetry. The real cost of the rebalancing will by definition fall on the state sector, and this will constrain and effect the choices that Beijing must make. For the past twenty years, and especially the past ten, the state and business share of a rapidly growing economic pie was also growing, which meant extraordinary growth in the value of assets controlled by the state sector and the economic elite. The household share of the growing economic pie, of course, contracted, but the rapid growth in the pie ensured that household income grew quite rapidly nonetheless, even as the household share of total income declined.

If this process is reversed, as it must in order to ensure a rebalancing, any slowdown in GDP growth may be minimally felt by the household sector (if the rebalancing is managed in an orderly way), but even a scenario of very high GDP growth must result in much slower growth in the value of state-sector income and assets. Of course if, as is more likely, GDP growth actually slows sharply the growth in the value of state sector assets will drop even more sharply and perhaps even turn negative.

This is the political problem confronting the Party leadership and the change in the growth rate of the state sector will almost certainly be at the heart of the political and economic choices, and difficulties, that Beijing will be forced to address in the next few years. It was always likely to be much easier to keep political leaders and factions happy when the value of the state sector was growing comfortably in the double-digit range, as it has for much of the past decade when GDP grew in the low double digits. It is likely to be much more difficult as GDP growth slows and the state sector slows even more, growing in low single digits, or even contracting.

The adjustment from a rapidly growing China, with even more rapid growth in the value of assets controlled and exploited by the political elite, to a more slowly growing China, with slower or negative growth in the value of assets controlled and exploited by the political elite, is likely to be controversial inside the party and much resisted by vested interests (especially those associated with the economy of the old high investment model with SOEs).

In fact, the real political instability resulting from slower GDP growth as China rebalances will not necessarily be focussed on the household level and on popular discontent. Political instability is far more likely to be caused by discontent at the level of political elites, and such high level instability could then spill over into more popular political upheavals. It is this fear of instability and dissension within the elite, and its possible impact on the stability of the entire political system, that underlies Xi Jinping crack down on corruption and the general hardening of repression, greater centralisation of power and intensified discipline within the Party since his accession to power. It is likely that significant sections of the elite, those with the most to lose in the restructuring process, will fiercely resist the reform program, and it is within the party and governing elite that the restructuring drama will initially be played out.

“People of privilege will always risk their complete destruction rather than surrender any material part of their advantage. Intellectual myopia, often called stupidity, is no doubt a reason. But the privileged also feel that their privileges, however egregious they may seem to others, are a solemn, basic, God-given right. The sensitivity of the poor to injustice is a trivial thing compared with that of the rich.”

John Galbraith “The Age of Uncertainty”

Note: Much of the analysis in this article is derived from the work of Michael Pettis, a Beijing-based economic theorist and financial strategist. He is a professor of finance at Guanghua School of Management at Peking University in Beijing.

I highly recommend his blog ‘China Financial Markets – Global imbalances and the Chinese economy’

Here is a short video of Michael Pettis talking recently about China