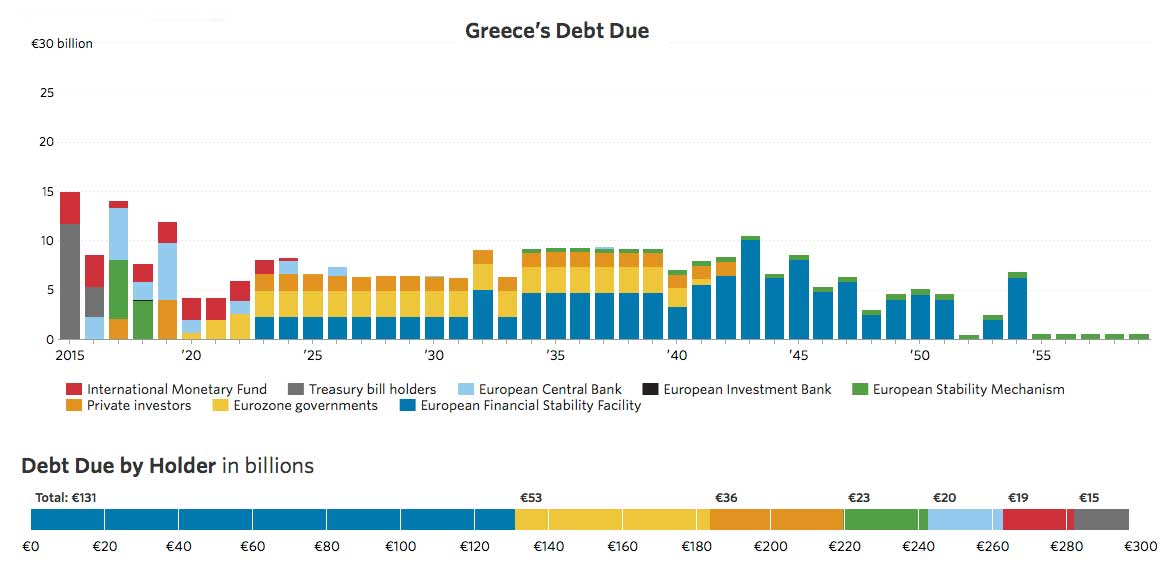

Here is the updated Greek debt repayment scheduled. Note that it stretches until 2059 and involves Greece making multi-billion Euro repayment every year until then. This means that Greece will have to be able to generate a sizeable surplus on its state budget (collect more taxes than it spends), amounting to several €billion, every year for over four decades. How can any rational person believe that such a thing is possible?

Also note how the most pressing repayments are to the IMF, holders of Greek Treasury Bills (who are almost certainly mostly Greek Banks), and the ECB. I believe that the EU will ensure, through additional funding if necessary, that those tranches of debt are indeed paid off. The portion of debt most likely to be restructured are the two largest blocks which are owed to the European Financial Stability Facility and debt directly owed to other EU governments.

The chart and the data are from a useful Greek debt reference page on the Wall Street Journal website – which is here – and the page also includes a year by break down of how much must be repaid every year until 2059. The final payment to the ESM is due on August 20, 2059 and is for €608,400,000.

Its worth noting that Germany repaid the last of its World War One debts in September 2010 when it made final payment of £60 million. Germany was Europe’s largest debtor and debt defaulter during the 20th century. On 27 February 1953, an agreement was signed in London which resulted in the cancellation of half of Germany’s (then West Germany’s) debt: 15 billion out of a total of 30 billion Deutschmarks. Those cancelling the debt included the United States, the UK and France, along with Greece, Spain. But there was a clause in the 1953 London Debt Agreement that interest on multi-million pound foreign loans taken out in the Weimar Republic era, to pay off the reparations bill, should themselves be repaid if Germany were ever reunited. Payments on this interest began again in 1996.

The German debt came from two periods: before and after World War II. Roughly half of it was from loans Germany had taken out in the 1920s and early 1930s, before the Nazis came to power, which were used to meet payments ordered by the Treaty of Versailles in 1919. They were a legacy of the huge reparations forced on the country after defeat in World War I. The other half of the debt originated from reconstruction following the end of World War II. By 1952, Germany’s foreign-owed debt was around 25% of national income. This is relatively low compared to debtor countries today: Spain, Greece, Ireland and Portugal’s debts to foreign lenders are all over 80% of GDP.

Meanwhile Yannis Varoufakis has responded to the often made claims that during his time as Greek Finance Minister he, and the Syriza Government “had no plan for reforming Greece”, by publishing two key documents that were tabled by the Greeks during the negotiations. The first is a document that was tabled on 11th May 2015. It was entitled: “A Policy Framework for Greece’s Fiscal Consolidation, Recover and Growth“. The second is a comprehensive program tabled on 11th June, entitled “Ending the Greek Crisis: Structural reforms, investment-led growth and debt management“.

Both documents were sent to key Eurogroup members. Both were ignored.

Read them and decide for yourself if the Greeks lacked plans for reform.

A POLICY FRAMEWORK FOR GREECE’S FISCAL CONSOLIDATION, RECOVERY AND GROWTH – 11th May 2015