Greek proposals to the Eurogroup

16/02/2015

This what the Greeks appear to be offering at today’s meeting.

Scrap 30% of the bailout programme in exchange for 10 new reforms agreed with the OECD (meaning 70% would be kept).

Reduce Greece’s primary surplus target from 3% of GDP to 1.5% this year, and keep it around this level for the medium term (as opposed to increasing it to 4.5% as currently planned).

A swap plan for the loans to Greece. This is likely to focus around the previous proposals of turning Eurozone loans to Greece into GDP linked loans or bonds and asking the ECB to swap its current holdings of Greek bonds for ‘perpetual bonds’.

Allow (if not support) Greece to tackle its humanitarian crisis.

Funding will come from €1.9bn in profits on Greek bonds held by the Eurosystem being transferred to Greece and an increase in the limit of T-bills (short term debt) issued by the Greek government of €8bn.

Other potential funding lines include tapping into the €7.2bn tranche of EU/IMF/ECB Troika funding waiting to be released or using the €11bn leftover in the bank recapitalisation fund.

The plan would run until September and allow time for negotiations over a “new deal” on Greece’s debt

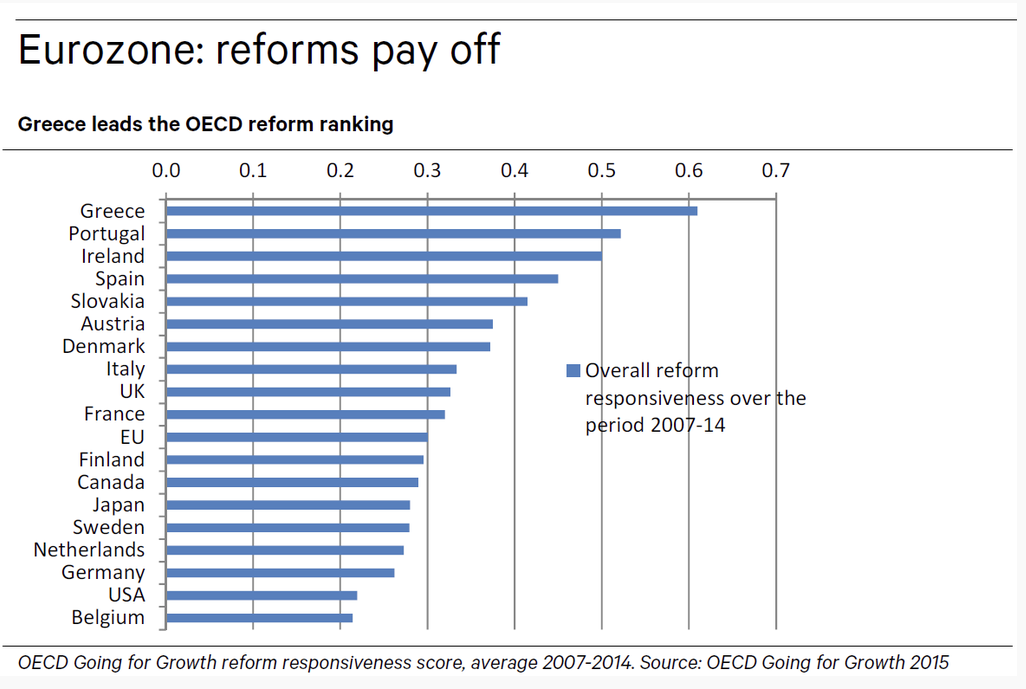

Its useful at this point to have a look at this chart (with its original title) from the OECD report “Going for Growth 2015” showing which countries have done the most since 2007 to reform their economies:

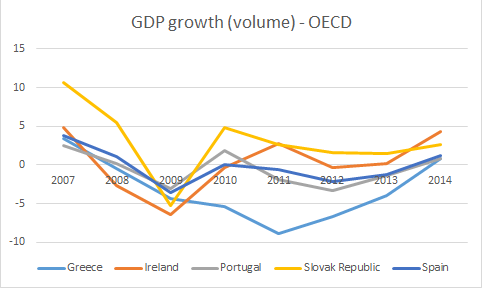

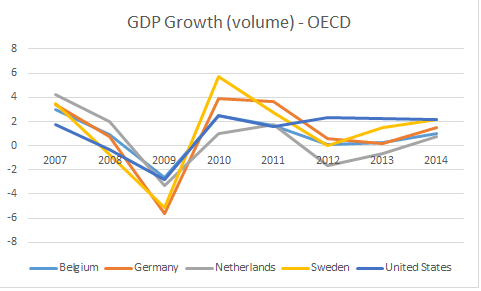

Its also worth having a look at these two charts from the OECD’s Economic Outlook dataset for November 2014

Here is the GDP growth of the five best reformers since 2007:

Here’s the GDP growth of the five countries that have done the least reform since 2007:

Since the GDP growth in 9 of the 10 countries is actually lower in 2014 than it was in 2007, and the tenth country (the USA) has made no significant reforms, it is not evident from these charts that “reform” makes any difference at all.

Very helpful and illuminating.

Many thanks.

Comments on this entry are closed.