The People’s Bank of China announced this week over several days a series of devaluations of the China’s currency, the renminbi or RMB. These were each the largest single-day devaluations in the RMB since 1994 and the entire package of devaluation constitutes a Chinese policy move that has important implications for the world’s two largest economies, that of China and the United States, and for the global economy as a whole. It also sends some worrying signs about Beijing’s policy regarding the slow down of the Chinese economy and way it is planning the big adjustments that are coming (see my recent article).

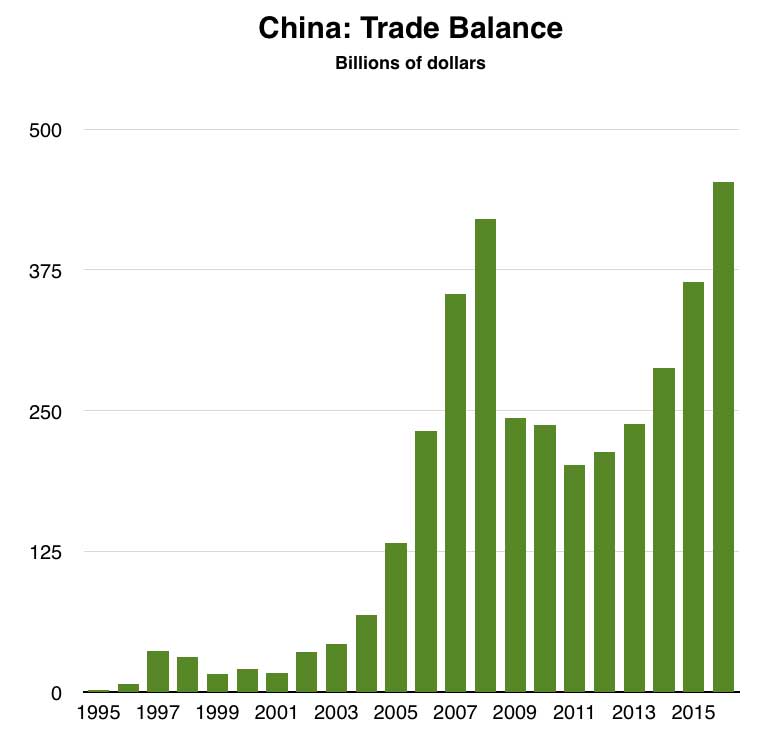

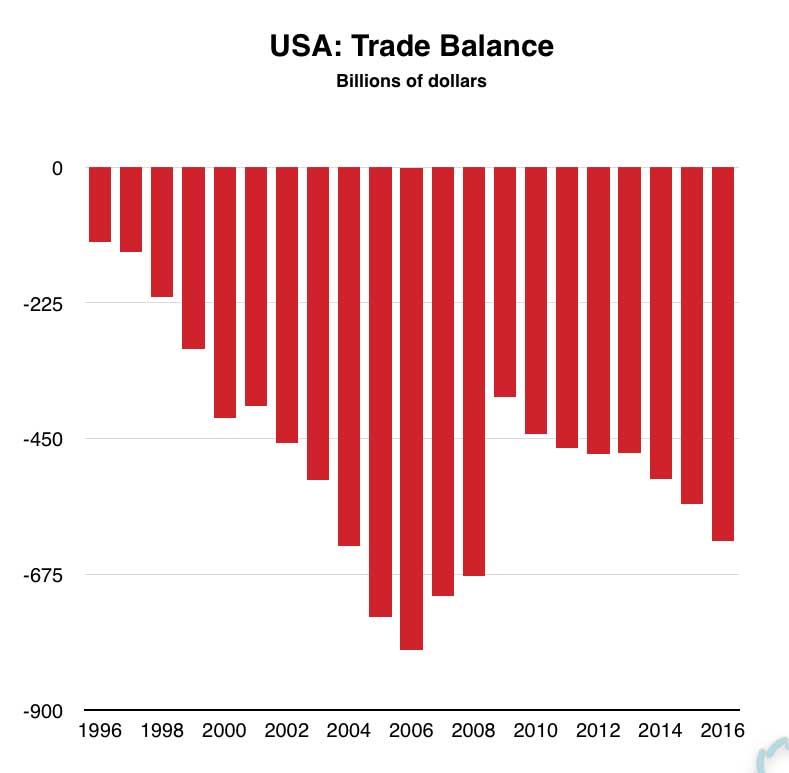

The context for the devaluation is the massive trade imbalances that exists between China and the USA, and that imbalance forms just a part of the general global imbalances that are destabilising the global economy.

In the last decade and half a number of countries, notably China, Germany, Japan and the major oil producing countries, all built up very large trade surpluses. At the same time very large matching deficits developed, notably in the US, the UK and the eurozone periphery. These trade imbalances were not being countered by shifts in the value of currencies, as one might expect based on classical trade theory, because in the case of the dollar and the Euro there are a number of factors forcing up their value even in the face of a massive trade deficits and surpluses.

Because the dollar is the global reference currency, every time oil (and more or less every other type of commodity) is traded anywhere in the world by third parties dollars are used for the transaction even if the US is not involved, so there is a perpetual demand for dollars and this helps keep the dollar strong. Even more important is the policy commitment of countries like China and Japan to work to hold down the value of their currencies against the dollar so as to support their export based economies. This means that both counties, via their central banks, have been willing to buy an almost unlimited amount of foreign currency, mostly dollars, and sell their own currencies, thus keeping down the value of their own currencies and keeping the dollar high. Part of the way that the central banks of China and Japan did this was by buying vast quantities of US government debt, in the form of US Treasury Bills (the US equivalent of UK Gilts), and so China and Japan have been lending the US the money it needs to run its huge government budget deficit and in turn run its large balance of payments deficits. Between them China and Japan hold about 3 trillion dollars of US Treasury Bills.

Like China and Japan, Germany also has not suffered a currency correction of its huge trade surplus because it is sheltered inside the single european currency zone. This means that the deficit countries of the eurozone drag down the value of the euro making German exports cheap and its imports more expensive, and this means Germany can continue to run a vast and uncorrected surplus. If Germany had its own currency it would appreciate rapidly and significantly in value and this would help correct the surplus by making its exports far more expensive. It is thus the weaker economies of the eurozone that allow the Germany export machine to run at such a high level.

It was because of these persistent and massive global trade imbalances, some countries running huge surpluses some running huge deficits, were sustained by large and persistent capital flows that caused the global financial system to became destabilised. Essentially what is happening is that China, Japan and Germany are all continuously lending the deficit countries very large sums of money to continue to be able to buy their exports and thus the deficit countries build up very large amounts of debt. Its was the bursting of the debt bubble in 2007 that set off the financial crisis but the underlying trade imbalances were not actually corrected by the 2007 crisis and capital flows and debt levels have continued to get bigger. This is not a good.

If a country consumes less than it consumes and invests at home, in theory it can export its savings as capital and invest that capital productively in other countries, in which case large capital flows can be sustained for a long time and not cause instability in the financial system. This is what happened for example for much of the 19th century when the UK’s surplus was exported as capital for productive investment in the USA, which was running a persistent deficit for decades, and the incoming capital paid for the economic development of America. This was possible because the unification of the US and its peopling by incoming migrants streams offered almost infinite productive investment opportunities (even so the scale of the capital flows led occasionally to financial crisis – bankers can behave like idiots even in the good times). The problem now in the global economy is that deficit countries, who are consuming more than they make, are by definition likely to have limited productive investment opportunities in which case the inflowing capital from the surplus countries is very likely to be invested in speculative asset bubbles and other forms of unproductive debt such as borrowing to sustain consumption.

The huge trade surpluses of countries like China and Germany are only possible because of the very high level of national savings in each of those countries (another way to express it is to say that high exports require a high national surplus). Essentially both China and Germany consume much less than they make and thus they have to import demand from abroad to make sure they can sell their products. They make this happen by lending the rest of the world the money it needs to buy their exports. Overall the impact of the decision of China and Germany to run large trade surpluses (and thus high national rates of savings) is to suck demand out of the global economy. This lack of demand has been overcome through a global increase of debt fuelled global consumption. All of this is not healthy, sustainable and will inevitably lead to more financial and debt crises.

As I explained in a previous article (Thinking About China) the Chinese economy is enormously unbalanced because so little of what it produces is consumed inside the country. The Chinese consumption rate is lower than the rate seen in any other country in modern history, only about one third of what it makes is consumed inside China by the Chinese people, the rest of what China produces is either invested domestically or exported abroad. The internal investment program in China is rapidly running out of productive investment opportunities and as the investment program begins to invest in ever less productive projects so the debt levels inside the Chinese financial system (much of it under state control) are rapidly increasing. In order to rebalance the economy, somehow the Chinese investment drive has to slow down significantly and the economy has to reorientate to serving the consumption needs of the Chinese people. But this means the incomes of the Chinese people have to increase and the slowing of the investment program will cause the economy to slow and possibly even contract, causing unemployment to rise and incomes to stop growing. Make the transition from an economy depending on investment for its demand to one depending on consumption, without crashing the economy, is going to be very tricky.

Similarly the Chinese economy has to in the future become less dependent on exports because the ability and willingness of the rest of the world to absorb very high levels of Chinese imports without suffering depressions of their own economies is limited. The whole pattern of world trade is grotesquely unbalanced and the only way for the global economy to stabilise is for these imbalances to unwind, which means that the surplus countries have to boost their internal consumption rates and the deficit countries have to reduce their dependence on borrowing to consume. However in the short term maintaining or even increasing its trade surplus is attractive to China as it guarantees continuing demand for its products as it starts to wind down its internal investment programme. Maintaining its trade surplus is therefore an attractive option but it is bad in the long run (because China needs to export less and consume more) and its very bad for the balance of the global economy.

Given the scale of the Chinese surplus, and the US deficit, one should expect to see the renminbi appreciate in value and the dollar to fall in value but the Chinese are now acting to push the currencies in the opposite direction. This means that for reasons of strictly national self interest, in order to cope with the immediate affects of the slowing in growth caused by the beginning of its great internal rebalancing, China is pushing the exchange rates in the opposite direction they should be moving and thus actually entrenching rather than reducing the great global imbalances. And where China goes so goes many of the other great surplus economies such as the Japanese.

So the world wants the US to become consumer-of-last-resort again. This didn’t end well last time.

The global economy needs to rebalance and the single biggest lesson of the Great Depression is that any attempt to only adjust deficit countries without adjusting surplus countries will fail. In fact the lesson of the 1930s is that it is precisely the surplus countries who must carry most of the burden, and most of the costs, of the rebalancing. The other lesson of the Great Depression is that without global leadership, which means in practice without a global economic hegemonic power willing, capable and powerful enough to construct and impose a globally coordinated strategy, the rebalancing of the global economy becomes almost impossible because each of the major economies will manoeuvre to secure their own national economic self interests. What the global economy needs in the medium to long term is a far more balanced system of global trade but what it needs really urgently is a global surplus recycling mechanism that is not based on volatile capital flows and massive debt mountains. Volatile capital flows and massive debt mountains are just a recipe for disaster.