When George Osborne unveiled the first fully Tory budget for close to twenty years just over a week ago it caused a significant degree of disorientation in the Labour parliamentary group and on the left in general. It had been expected that it would be focussed on austerity and more cuts in public spending but instead the austerity narrative was greatly downgraded and instead we got an apparently strange mixture of progressive reforms and old style Tory benefits cuts for the poor. In today’s Guardian Osborne is “Calling all progressives: help us reform the welfare state”. What’s going on?

I think that this budget may mark a very significant shift in the politics of welfare in the UK and it marks the beginning of an attempt by Osborne (who is odds on favourite to be Prime Minister by the end of this parliament) to create a new social policy political space and in the process add to the disorientation, and hence marginalisation, of the Labour Party. In order to understand what is happening it is necessary to place the key reforms of this budget into the bigger picture of how welfare spending has evolved in the UK and the profound changes that occurred in recent decades.

In the run-up to the recent UK general election, 65 professors of social policy wrote to the Guardian a letter entitled “The Tories’ £12bn of further benefit cuts will add to growing poverty”. The article starkly lays out the facts of poverty and inequality in the UK. It includes this statement:

“Now the majority of children and working-age adults in poverty live in working, not workless, households. In other words – and ironically in view of the coalition’s rhetoric – many of those forced to claim the working-age benefits targeted for further cuts are not what the prime minister calls ‘shirkers’ but, in fact, ‘hard working families’

What the academics were talking about in the Guardian piece is the profound, long-term shift in the social security system, and beneath that a shift of the British economy, that has occurred over the last forty years. It is those shifts, in welfare and in the real economy, that Osborne was addressing in his first budget. One can only expect that, if he can avoid being trapped by a return to a generalised crisis in the UK economy, Osborne will continue to reshape the welfare system in a fundamental way for the rest of this parliament.

The historical background

To understand the true significance of this shift we need to go back to two key moments in Britain’s modern history. First is 1795, when the Speenhamland system was introduced when wages deemed to be below those sufficient for subsistence were subsidised through the Poor Law out of taxes (local poor rates). The Speenhamland system was not actually new, nor did it become universal, but its introduction is generally viewed as representing a rejection of the dynamics of the new mass wage labour system of the unfolding industrial revolution and the theories of liberal political economy that were developing alongside it. There was widespread hostility to the Speenhamland system amongst the governing class of the time and especially amongst political economists, who argued that such a system created no incentives for the workers to maximise their wages, nor for employers to pay what was affordable to them. These perverse consequences were held-up as the typical result of well-intentioned but misguided intervention in the labour market. Eventually of course the liberal political economy emerged triumphant and at another key moment, under the Poor Law Amendment Act of 1834, such subsidies were outlawed.

So a central principal of the new political economy was the assumption that wages would not need to be subsidised to provide adequate wages; that waged work would be an effective route out of poverty. Of course there were interventions such as the Wages Boards (later Councils) which imposed minimum pay on certain sectors of the economy but these sorts of interventions did not entail any actual state income subsidy for employed workers.

When the modern welfare stare was built after WWII the Beveridge analysis of the sources of poverty viewed the problem of poverty as being overwhelmingly the result of an ‘interruption to earnings’ (by unemployment, sickness, or age) and to a lesser extent as resulting from families with large numbers of children. The latter was addressed by ‘Family Allowances’. While this analysis always greatly simplified the real conditions of the labour market, not least in its narrow focus on the ‘male-breadwinner household’, its fundamental idea that normally paid work would provide a route out of poverty underpinned most social policy into the 1970s.

The impact of deindustrialization since the 1970s

Since the 1970s there has been a slow but significant erosion of paid employment as a route out of poverty and this was the result of deep structural changes in the UK economy which have resulted in structural changes in the labour market which have in turn brought about profound changes in the social welfare system. What has happened is that the UK has undergone a protracted and deep process of deindustrialisation, and this has in turn unleashed deep social and political change. This has both eroded the foundations of the old Labour movement and at the same time transformed the old Beveridge style welfare system. What has changed in the period of de-industrialisation has been the very great increase in the numbers of people earning very low level wages, and who are as a result dependent on in-work benefits. Effectively we have moved towards a huge ‘new Speenhamland’ system of ‘outdoor relief’ of the employed; or, viewed differently, large subsidies to employers, which has mitigated, but not cured the problem of poverty-level wages.

The effect of deindustrialization has been to polarise the labour market and as the old skilled labour aristocracy has disappeared so the labour market has divided into a higher paid top and a much lower paid bottom end. While for those with high levels of formal education the transition to a service economy has provided many opportunities at the same time there has been a proliferation of low-paid work. This has led to much greater income inequality in the last thirty years.

Wage inequality is significantly higher now than it was some thirty years ago. This is true for men and women, and is the case in both the upper and lower halves of the income distribution. It has been calculated (see here and here) that the ratio between 90th and 10th percentiles for the period 1970 to 2009 rose by approximately 50%.

The growth of low skill occupations is illustrated in the table below.

| Growth of low skill occupations, 1979-1999 | |||

|---|---|---|---|

| 1979 | 1999 | Percentage Increase | |

| Care assistants and attendants | 103,837 | 539,407 | 419.5 |

| Bar Staff | 119,455 | 188,319 | 57.6 |

| Shelf fillers | 49,699 | 97,144 | 95.5 |

| Sales assistants | 954,200 | 1,321,251 | 38.5 |

| Retail cash desk and checkout operators | 112,816 | 218,581 | 93.7 |

| Waiters and waitresses | 124,780 | 187,391 | 50.2 |

| Beauticians | 24,536 | 28,946 | 18 |

While in the industrial period employment did not necessarily guarantee an above-poverty income, most poverty was amongst non-workers (the sick and disabled, pensioners, single mothers), or those with unusually large families. In 1960 about 40% of households in poverty (those below 140% of the then National Assistance level) had a working member but these households overwhelmingly had a large number (four or more) children. Recent work suggests that a majority of the poor are now members of households with at least one member in work: “As pensioner poverty is now at low levels, the rate of in-work poverty is the most distinctive characteristic of poverty today”. (Joseph Rowntree trust 2012). A different calculation suggests that whereas in the 1970s 3-4% of employed households were in poverty, the figure by 2000/1 was 14%. Between 1975 and the mid-1990s, the incidence of low pay for men in the labour market has doubled.

The welfare policy response

While this proliferation of low paid work has been taking place, the social policy response has been to incentivise people into work by maximising the gap between unemployment benefits and wages. So reductions in unemployment benefits have been accompanied, since the 1970s, by increasing in-work benefits. This began with the Family Income Supplement in 1971, but greatly expanded with the working Families Tax Credit and Working Families Tax Credit in the 1980s and 1990s. Expenditure per claimant on such benefits has increased from approximately £500 in 1970 to £4,300 in 2000 (see here). In work incomes are also supplemented by housing benefit payments, most of which now goes to the employed.

This historically relatively new terrain, of large numbers of very low paid workers dependent on top up payments from the state, runs counter to analysis of the post Thatcher period as representing the triumph of neo-liberalism. The political narrative (by both supporters and opponents of the status quo) is that we live in an increasingly neo-liberal economy, and yet paradoxically the role of the state in the labour market has in many ways increased over the last 40 years. In addition to the ‘new Speenhamland’ system of extensive in work benefits publicly-financed employment has mushroomed since the 1970s. If the large number of jobs out-sourced or otherwise indirectly publicly funded jobs is included along with the usual public sector jobs within employing bodies ‘controlled’ by the state it is clear that state derived employment has risen rather than fallen. This table shows how the number of jobs inside the state and in ‘para-state’ employment has grown in the UK.

| State and 'para-state' employment in the UK 1978-2008 | |

|---|---|

| 1978 | 5.6 million |

| 1987 | 6.2 million |

| 1997 | 6.7 million |

| 2008 | 8.0 million |

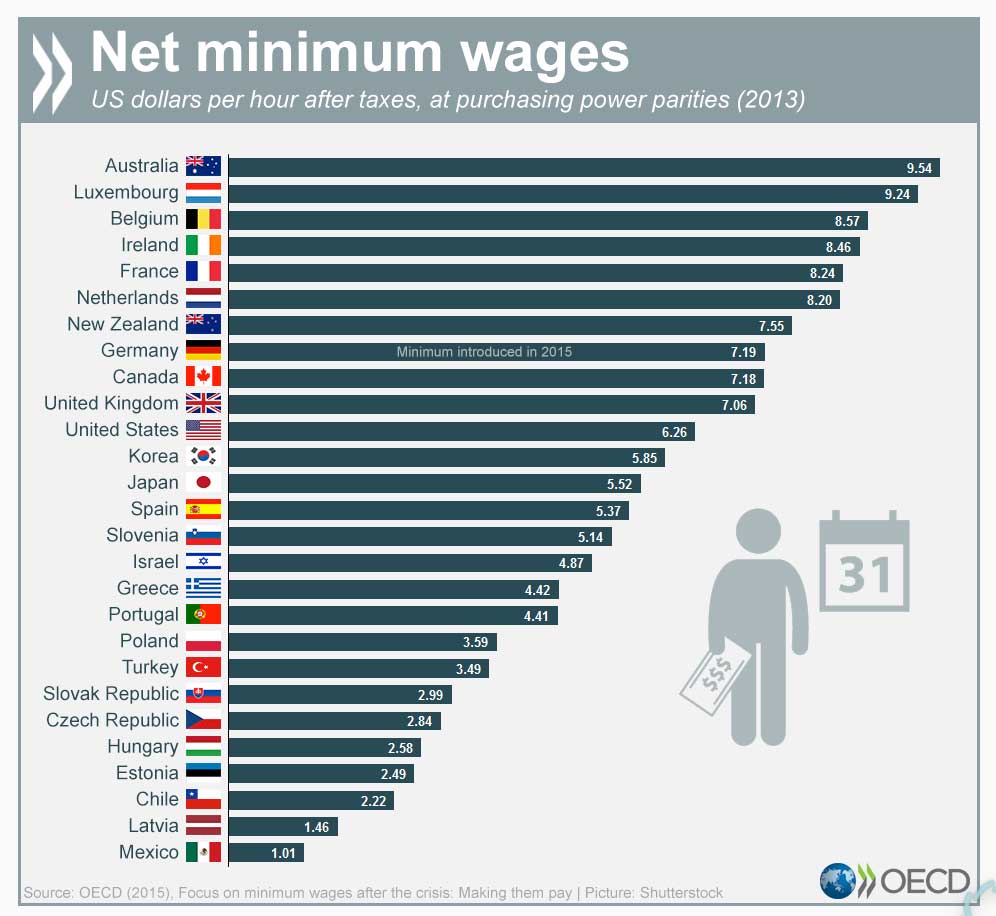

It is within this context of a massive increase in state financing of workers income and increasing state activities in the labour market that Osbornes budget ’reforms’ must be understood. I think it is clear Osborne wants to dismantle the new ‘new Speenhamland’. In the budget he announced his intention to significantly increase the minimum wage in a program of stepped increases starting next April and with an annual increase in the mimnum wage level by 6% every year with a target to reach a level of £9 an hour by the end of this parliament. If the minimum wage does rise to £9 per hour it may well mean the UK will have the highest minimum wage of any developed economy (see the chart below – note that it is denominated in US dollars and that a minimum wage of £9 would, at todays exchange rate, be the equivalent of around $14).

Alongside the minimum wage there were accompanying announcements in the budget about reductions and restrictions on in work benefit.

In the Guardian article Osborne lays out his strategy and agenda very clearly.

“These reforms are a central part of a new contract for Britain between business, the public and the state to create the higher wage, lower welfare, lower tax economy our country needs to see.

We are saying to working people: our new national living wage will ensure you get a decent day’s pay, but there are going to be fewer taxpayer-funded benefits. We’re saying to businesses: we’ll cut your taxes, but in return you must pay higher wages and train our young people for the challenges of their generation. And to the country, we’re saying: we will spend less, but we’ll finally live within our means and deliver economic security.

I believe this settlement represents the new centre of British politics,”

So one can expect a series of Osborne crafted budgets to implement a step by step dismantling of significant portions of the existing in work benefits system and a steady rise in the minimum wage. One can safely assume that the Tories will be less concerned by the losers in this scenario but the strategy will be a tricky one for the Labour to engage with (hence Osborne’s canny invitation for progressives to back his reforms). The Labour Party helped build a massive public subsidy for low wage employers and has never shown any real appetite for questioning or dismantling it. So the radical challenge once again has come from the right. It is hard for progressives to not support the argument that workers should receive a living wage paid by their employers, and that ultimately the state should not subsidise low wages just so employers can cut wage costs. This all means a new terrain of social policy is being created and falling back on old slogans and positions just won’t work. The result, as Labour drifts without leadership or direction after its election disaster, is that once again the party looks hopeless and lost.