At the end of last year the US government announced that it had made a profit from its bank bailouts. The UK, on the other hand, probably won’t. So what did the Americans do right and the UK do wrong?

The U.K. government, which owned 78.3 percent of RBS following its 2008 bailout, recently sold 5.4 percent of the bank for $3.3 billion (note all values are denominated in US dollars in this article in order to make comparisons easier). That values RBS at $66.1 billion and the remaining government stake at $44.5 billion. Yet British taxpayers poured $71 billion into RBS, making a net loss.

The U.K. did better nationalising a 41 percent stake in Lloyds Banking Group, which had been allowed to buy distressed Halifax Bank of Scotland, and two other failing banks, Northern Rock, and Bradford & Bingley. The U.K. plowed $32 billion into the bank at today’s exchange rate and has so far recouped $21 billion through gradual selloffs that brought the nationalized stake down to 15 percent. That stake is now worth about $13.8 billion, so on paper, the British taxpayer is better off.

Of course, these figures only refer to the nominal cost of the stakes that British taxpayers bought in the two banks, and not the financing costs of the investments. The National Audit Office explained last year that the cost of funding the Lloyds bailout had not been recouped. And overall, the British taxpayer faces a net pure loss on the collective sale of the two banks: It is at this point unlikely that all of the government’s initial cash outlay of $190 billion at today’s exchange rate will be recovered.

The U.S. government, by contrast, actually made a small profit (again, ignoring funding and opportunity cost) on its Troubled Asset Relief Program, or TARP. It invested $426.4 billion and recovered $441.7 billion by the time the bailout program shut down late last year. Only a handful of small banks haven’t yet paid back about $700 million in government assistance.

At the time the two bailouts were hastily put together, the British one was praised for its decisiveness. Economist Paul Krugman wrote in The New York Times that the Labour government of Gordon Brown had “shown itself willing to think clearly about the financial crisis, and act quickly on its conclusions.” He criticised U.S. Treasury Secretary Henry Paulson for his slowness to embrace bank nationalisation.

The U.S. did eventually inject capital into 707 banks, but in exchange for noncontrolling stakes and without replacing the banks’ managers. The biggest recipients of such aid, the likes of Goldman Sachs, JP Morgan Chase and Morgan Stanley, felt humiliated and hastened to exit the so-called Capital Purchase Program (CCP), part of TARP, paying back the taxpayer funds and dividends. By the end of 2009, only small community banks, held to stricter standards, remained in the CPP (stakes in these banks were later auctioned off, mainly to private funds).

The U.K. approach was more stringent. At RBS, the government has changed chief executives twice since the bailout as it tried to beat the lender into shape. In the three months to the end of June, the bank showed a profit of $457 million, yet this turnaround took more than six years to materialise. The U.S. had no taste for such experiments and has better results to show for its seemingly more hands-off approach.

So why did the US recoup its money, and make a profit, whilst the UK made a loss?

The reason for this has much to do with the relative size of the banks and the country’s economy. The US has some big banks but also a very big economy on which its banks are dependent. The UK has some big banks but it is a much smaller economy and its banks are international.

Pepper Culpepper of the European University Institute and Raphael Reinke of the University of Zurich have written a fascinating paper called Structural Power and Bank Bailouts in the United Kingdom and the United States. It’s worth reading the whole thing but here are some quotes from the paper.

Moments of political crisis throw into relief the underlying power conflicts in society. The colossal transfer of risks from big banks to US and British taxpayers in 2008—in the service of preventing a financial meltdown—is perhaps the best recent example of this phenomenon.

This, at least, is the conventional story of the American and British bailouts.2 It is wrong, both in its claims that the UK government drove a better bargain for taxpayers with its large banks and that the US bank bailout reflects the domination of the US government by large financial institutions. In fact, the US government got a better deal from its banks than did the British government, and it did so because American banks wielded less power than their British counterparts. Why has the conventional wisdom so misunderstood the character of the American and British bank bailouts? Observers have focused on the generosity of bailout terms, including the firing of the chief executives of weak banks—those on the brink of insolvency. However, the important difference between the British and American bailouts lies in the terms imposed on healthy (clearly solvent) large banks. Financially strapped banks could not challenge the government in either country. They had to accept whatever policy the government offered, because only with government aid could they have survived. But healthy banks were not dependent on state aid. Healthy banks in Britain were in a better position to resist the state, and they drove a better deal for themselves than did US banks. As a result, the British government absorbed more risk than the US government and lost taxpayer money, while effectively providing a costless subsidy to its healthy banks, which benefited from the stabilization provided by the bailouts. In contrast, the United States made a profit from its bank bailout, because it was able to bully healthy large banks such as JP Morgan and Wells Fargo into a collective recapitalisation plan.

Large banks in the United States could not defy regulators, because their future income depended on the US market. In Britain, by contrast, one bank succeeded in scuttling the preferred governmental solution of an industry-wide recapitalisation, because most of its revenue came from outside the United Kingdom.

Both governments, effectively, insured their banks against losses, providing debt guarantees and capital injections while charging a fee. Insurance is a profitable business if nothing goes wrong. That’s why insurers try to cherry-pick the best clients and discourage the riskier ones. The US government forced all its banks to participate in the bailout, even those banks that were not in trouble. This was, after all, about restoring confidence in the banking sector as a whole. Therefore, so the argument went, even the healthy banks would benefit so they too should pay.

The British government wanted to do something similar but HSBC refused to participate, as Culpepper and Reinke explain:

The UK government wanted to include HSBC in the recapitalization plan, but HSBC refused. Multiple figures associated with the bailout repeated in interviews with us that the UK government had no tools to force HSBC to take state capital, even though it was the government’s first preference.

So did Barclays:

Barclays never wanted state capital, but when the government negotiated the plan, it was unsure whether it could raise capital privately. Once HSBC quickly announced it would not take state capital,47 Barclays made clear it would go to extraordinary lengths to refinance itself through its share- holders rather than taking state money.48 Barclays kept the option of state capital open until, a few days later, it succeeded in raising the required capital. By then, the government had announced its debt guarantee programs, which eased funding for Barclays and helped the bank to convince investors to provide capital.

This quote from former Deputy Governor of the Bank of England John Gieve is blunt and very revealing:

[Barclays] played us very cleverly, in that they managed to negotiate a sum of capital, which they had to raise and that they could raise from their friends in Singapore and the Middle East and so on. And thereby pass our test, while still getting the benefit of the overall government guarantee.

In other words, they benefitted from the improved confidence in the banking sector that came from the government’s bailout without actually having to pay into it.

To stretch the insurance company analogy, rather than cherry picking the good clients, the British Government was left with just the basket cases. The US government, by contrast, was able to charge all its banks fat fees for insuring them and sell off its shares at a profit once the sector recovered. It incurred some losses from the bailout but it more than covered them with its gains, like any good insurer would.

With its funding structure, capital injections and warrants, the US government could recoup its money. It allowed the government to internalise some of the positive external effect of its rescue program. Getting the warrants in the nine major banks generated over $4 billion, and $3 billion of that sum was paid by banks that did not need capital injections: Wells Fargo, JP Morgan, and Goldman Sachs.

How did the US government get its banks to play ball? It bullied them.

US regulators could make Wells Fargo and JP Morgan an offer they could not refuse. In the decisive meeting between the CEOs of the nine major banks and senior US government officials—Paulson, Bernanke, Tim Geithner of the New York Fed, Sheila Bair of the FDIC, and Comptroller of the Currency John Dugan—this regulatory threat was explicit, and it was repeated. In the talking points prepared for the meeting on October 13, 2008, recalcitrant banks got this message: “If a capital infusion is not appealing, you should be aware that your regulator will require it in any circumstance.” After Paulson’s presentation of the plan, which reiterated the unpleasant consequences of not accepting the aid, the CEO of Wells Fargo complained to the other CEOs “Why am I in this room, talking about bailing you out?” Paulson’s response was a threat of regulatory consequences: “Your regulator is sitting right there [pointing to the head of the FDIC and the comptroller of the currency]. And you’re going to get a call tomorrow telling you you’re undercapitalised and that you won’t be able to raise money in the private markets.” This is an explicit threat from a regulator against a financially healthy bank. The regulator could make trouble for the bank in unsettled markets—the regulator knew it, and the bank’s CEO knew it.

The US regulators were not people the banks wanted to mess with.

None of this was because Hank Paulson was a hard bastard and Alistair Darling wasn’t. This different policy was not a matter of different governmental preferences in the two countries. It was simply a reflection of the relative power of the banks and their governments.The power relationship was structural.

The British government also recognised the virtues of a collective plan that would have forced all large banks to take government money. Yet the British government faced a powerful opponents, over which it held limited leverage. HSBC for example is a large player in the British market, but is a bank based in Asia, which does just twenty per cent of its business in the United Kingdom. HSBC was able to reject the proposal of the Labour government that it take public money, because it was in a position in which UK regulators could do only limited damage to its future prospects. This contrasted with the case of the healthy American banks: JP Morgan earned more than 70 per cent of its revenue in the US, and Wells Fargo 100 per cent. Banks so heavily dependent on the US market were unable to defy the threats of American regulators, given the costs those regulators could impose on them in the future.

The story of these bailouts is indeed one of the power of banks. Yet the power that matters is a function of the economic footprint of banks, not their lobbying strength. The different fate of the two bailouts should lead economists and policymakers to pay increased attention in the future not merely to the lobbying muscle of banks, what political scientists call their “instrumental power”, but equally to the way in which their role in national economies gives them “structural power” in dealings with government.

A big country can bully big banks. A small country can only bully small banks. Big banks in small countries can resist governments much easier. Why did the US make a profit on its bailouts and the UK (and most other countries) probably won’t? In the end, it all comes down to one word. Power.

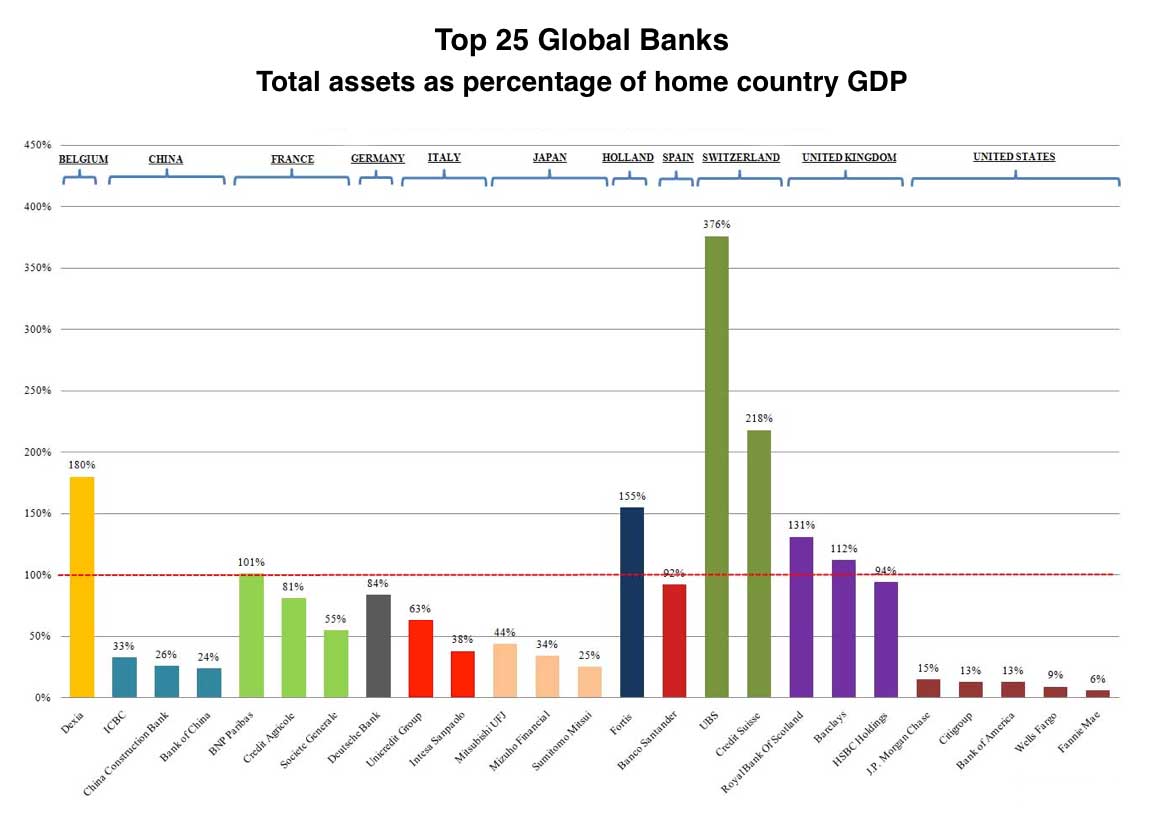

In 2008, Barclays, HSBC and RBS were three of the biggest banks in the world. Based on assets, RBS was the biggest, based on capital it was HSBC. The US banks were up there too but, relative to the size of their country’s economy, they didn’t loom anywhere near as large, as this chart shows.