The Charter for Budget Responsibility, also known as the fiscal charter, has existed since 2011 when it was first introduced by Chancellor George Osborne under the Budget Responsibility and National Audit Act 2011. The charter sets out the framework under which the government will manage its debt and public finances. Each year, it is reviewed and put before parliament. After the Conservative Party won an overall majority in the 2015 election, and were no longer restricted by the Liberal Democrats in a coalition government, it tightened up the charter by putting into law that governments must target a surplus in their budgets rather than run a deficit. In simple terms the Charter creates a legal responsibility for government to achieve a budget surplus as the ‘normal’ state of affairs, more money must come in than goes out.

But the surplus target will only apply in “normal” times. This is intended to give some flexibility to chancellors facing an economic emergency and who may have to crank up government spending. These targets apply unless and until the Office for Budget Responsibility (OBR) assess, as part of their economic and fiscal forecast, that there is a significant negative shock to the UK. A significant negative shock is defined as real GDP growth of less than 1% on a rolling 4 quarter- on-4 quarter basis. However in normal times the Treasury’s mandate for fiscal policy is to achieve a surplus on public sector net borrowing in each subsequent year.

The introduction of Charter for Budget Responsibility wrong footed the incoming new Corbyn leadership team and, still heavily constrained by the ‘Labour fucked up the finances’ narrative, they were cornered into initially agreeing with the surplus target.

But does running a government budget surplus for a protracted period make any sense?

The argument in favour of a permanent and ongoing budget surplus is also the same argument in favour of austerity and shrinking the state. It is based upon a completely fallacious narrative that equates what is best for managing household finances with what is best for managing a national economy.

The national economy does not work the same way household finances do

One of the reasons that it is been so hard for a lot of people, especially politicians, to understand the imbalances that were at the root of the current crisis is that it is easy to confuse the way household budgets work with the way national and international economies work. We often and mistakenly think of nations as if they were simply very large households. Because we know that the more a household saves out of current income the better prepared it is for the future, and that the more a household saves the more wealth it accumulates, we assume the same must be true for a whole country. But how savings work at an individual household level and how they work at the level of an entire economy, or the global economy, are very different. What makes a lot of sense at an individual level, such as being prudent and building up a good level of personal savings, is not necessarily good or prudent at the scale of whole economies. At the level of an entire economy savings can be the cause of problems rather than a solution, and a government surplus is actually just another form of national savings.

Countries are not households. Countries are huge complex economies in which each day millions of decisions are made to spend, earn, invest and save, in which countless goods are manufactured, sold and bought, and in which income, profits, money, and capital are all flowing around. All that ceaseless throb of economic activity can only work well if the whole pattern of what is happening, the spending, the saving, the investing, are all basically balanced. If those things get out of balance the economy can weaken and even fall into crisis.

To understand how something like savings can be so different at the level of an entire economy compared to a single household consider this imaginary scenario. You want to save up some money and so you decide to reduce your spending for several months and stuff the money under your mattress. As your stash of saved money gets bigger you get wealthier. That may make a lot of sense at an individual level but consider what happens if everybody were to do this at once. Everybody simultaneously decides to stop spending a big chunk of their income and instead saves it by stuffing it under their mattress. Suddenly because people everywhere are spending less and saving more the sales of goods across the entire economy drops. As a result businesses start to contract or go bust. This means workers are sacked, causing their spending to drop, causing more businesses to go bust. The economy starts to get smaller. As you can see at the level of the entire economy increasing savings can actually cause a lot of problems. Too much savings can reduce economic activity and reduce wealth.

What a country needs to get wealthier is not more savings but rather more productive investment. To be wealthier, to have more stuff, the real economy has to grow, and growing the economy means growing businesses, and that requires investment. Domestic savings matter, of course, but only because they are one of the ways, and probably the safest, to fund domestic investment. Saving in itself, however, does not create wealth. It is productive investment that creates wealth. Domestic savings simply represent a postponement of consumption.

Why a continuous government budget surplus is a bad idea

One of the most significant developments in the UK economy, and indeed in the developed economies in general, is that after the crisis of 2008 and the subsequent recession growth rates have not returned to their ‘normal’ rate. This long term reduction of growth is something new and unusual in the developed economies (although Japan suffered a similar collapse in long term growth rates after its crisis in the early 1990s). Since the ‘Great Recession’ growth has been very low by historical standards, unemployment has been high and levels of investment have remained well below pre-recession levels. The reasons for this are complex, part of the reason is because of the sheer scale of debt and bad debt that had built up inside the financial system prior to the crash which means deleveraging (paying off the debt) is going to take a long while and in the meantime credit remains tight, but another reason why growth has been so low is because the eurozone and in the UK (together the biggest economic bloc in the world) have been committed to austerity and to containing, and actually shrinking, public expenditure.

The narrative in the UK and in the eurozone is that budget deficits are bad and surpluses are good. However the results of implementing the austerity policy has not been good, a glance at the unemployment rate in the eurozone will confirm that austerity has been a failure. In the UK we have had intermittent austerity, and as result the UK growth rate has been somewhat above that of the eurozone (although low by historical standards) and unemployment has been lower, but this has been largely the result of increasing private sector household expenditure funded by private debt.

So why has austerity failed? Because the whole premise behind it—that governments should strive to run balanced budgets—is false. And it’s easy to explain why with a simple thought experiment. Divide a country into two sectors: the private sector and the government sector (ignoring the external trade sector for now). in order for the economy to work at full capacity, and therefore to grow and for unemployment to fall, the private sector and the government sector between them has to buy the entire output of the economy.

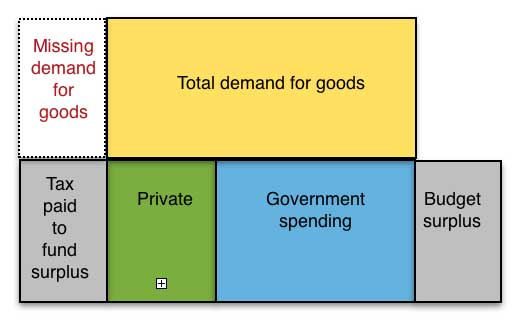

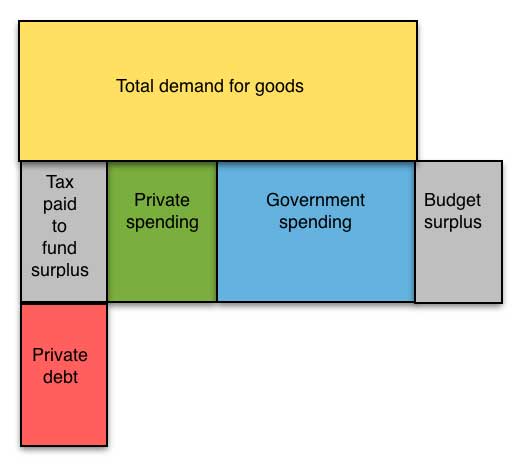

Imagine that the government decides to run a surplus—so that government taxes on the private sector exceed the money spent by the government. What is happening is that the government is taking money from the private sector, in the form of taxes, and – to use the metaphor from the earlier description of savings – stuffing it under the mattress. A government budget surplus is just another form of savings so if a government chooses to run a surplus over time it is actually raising the national rate of savings which in turn contracts demand in the economy.

Where is the private sector going to get the money needed to finance the government surplus? It could run down its existing stock of money, but that means a shrinking private sector—which is the opposite of why governments choose to run surpluses, since they believe that running a surplus is “good economic management”.

So for the economy to continue to operate at full capacity while running a surplus, the private sector has to somehow produce not only enough money to finance the government surplus, but also enough to allow the economy to grow at the same time. How can it do this? Leaving foreign trade out of the equation for the moment there is only one method: the private sector has to borrow money from the financial system. So for the government to run a surplus, and for the private non-bank sector to grow at the same time, the banking sector has to run a deficit meaning that new lending (money going out of the banking sector) has to exceed loan repayments and interest (money coming into the banking sector). In other words whilst a government surplus exists, and if the economy is to grow and not contract, there has to be a continuous flow of new credit (matching the size of the ‘missing demand removed by the surplus) from the financial system into the private sector. This means that for the government to run a continuous surplus without shrinking the economy private sector debt has to also grow continuously.

This situation is obviously not sustainable forever. In order for the economy to grow the private sector—the part of the economy that produces GDP—is forced by the government surplus to grow its cumulative indebtedness to the banks. In other words, running a government surplus in not “good economic management”. Instead, it is a way to set up a future economic crisis when the ever increasing quantity of debt reaches a size that means the private sector can longer sustain debt repayments and the the private sector has to stop borrowing.

When the private sector borrowing slows or stops what happen? At some point the mountain of growing debt, which is being continuously increased by the continuing government budget surplus, reaches the limits of what the private sector can sustain, debts cannot be repaid when due and interest on loans can no longer be paid. At that point private sector borrowing shrinks, growth slows, the economy contracts and there is a debt fuelled recession. Faced with a recession the government can of course shrink the surplus or even go into deficit but its previous policy of running a surplus has actually made the economy unstable, it has actually caused, and deepened, a damaging debt fuelled recession. And the more debt that has built up the deeper the recession will be and the longer the recovery will take.

Alternatively the government can, perhaps because of an idealogical commitment to the notion of a ‘balanced budget’ and the belief that running a deficit is bad and running a surplus is good, continue to run a surplus and avoid a deficit even though the economy has reached it debt limits and the counterbalancing creation of new debt has slowed or stopped. If the debt growth has stopped the private sector will be paying off its debts and with the government running a budget surplus the only way to balance the books with both banks and the government sector taking money out of the private sector, is for the private sector to contract— economic growth has to fall and the economy will either stagnate of even start to contract.

This is not just a hypothetical exercise: it is what austerity in Europe has achieved. Insisting on a government surplus while the private sector is reducing its debts can only work if the economy shrinks. And the economies of Spain and Greece in particular have shrunk as both government surpluses and private sector deleveraging have taken money out of the economy. In contrast, government deficits and net lending in America are injecting money into the economy, enabling it to grow. It must be noted that the US arrangement is also probably not sustainable in the long run as it is merely compensating for the major imbalances in the global economy, which is another story, but at least the US policy has not actually made the recession worse – unlike the eurozone.

Where does money the banks lend come from?

As we have seen a government surplus either causes the economy to contract or it forces the private sector to borrow money. A sustained government surplus will drive up private debt over time until the private sectors capacity to manage the debt is reached at which point there will be a credit crisis, an eruption of bad debt and economic contraction. Where does the banking system find all this money to lend out as private debt?

The neo-classical school of economics views banks and the financial system in general as basically just an intermediary, merely connecting savers with investors. This view of banking as being merely financial intermediaries is common in the media and amongst politicians. In this view banks collect up savings and then lend a proportion as loans whilst keeping a proportion as reserves, and if they are prudent, don’t lend too recklessly and get their calculations right their reserves will be large enough to cope with any situation that might arise. This is actually not really how banks operate. In fact banks create money out of thin air. They create it by just typing figures into their computers. When a bank makes a loan or gives a customer an overdraft facility what the bank actually does is change entries in their computerised accounts system and this creates new money which in turn increases the supply of money in the economy. The total quantity of money created in the economy is not planned but is the result of the aggregate behaviour of the banking system. Governments and central banks, under the modern liberalised and unregulated financial system, only have very weak and indirect tools for managing the process and scale of money creation. Those tools hinge on the control of interest rates but because interest rates are so very low (by historical standards) and are likely to remain low, zero or even negative for a long time to come, the central bankers now have very poor control of the banking system.

It is important to realise that as the banks create new money, they are also creating new credit and loans, which means they are also increasing debt levels. So under the modern financial system there is no regulated limit to how much debt the banking system can create and gigantic credit/debt booms are possible, this is what happened before the 2008 crisis when a huge global credit bubble inflated. And every boom or bubble is followed by a bust. Once a boom is underway and a credit bubble starts to inflate causing asset prices to inflate then it is inevitable that money will be lent for bad investments and so every credit bubble also creates a lot of bad debt. The bad debt appears sound right up until the eruption of the crisis at which point it is transmuted into bad debt as asset prices crash.

In this video Professor Richard Werner director of the University of Southampton’s Centre for Banking, Finance and Sustainable Development describes how modern banking really works and how money, and debt, is created. Werner is the economist who, when working for the Japanese Central Bank, coined the term “Quantitive Easing’. He was a co-author of the excellent “Where Does Money Come From?: A Guide to the UK Monetary & Banking System”

Running a trade surplus to compensate for a budget surplus is difficult, impossible for some and not a very good idea long term

The only way that a prolonged government budget surplus and austerity can avoid shrinking the economy is if the external trade balance—which we’ve ignored till now—is in surplus. If a government insists on running a persistent budget surplus it is removing demand from the domestic economy, and if the economy is to continue to operate at full capacity and not contract, the only alternative to using domestic debt to sustain demand is to import demand from abroad. That is what happens when a country sells exports, it is utilising demand from other countries in order to sell part of its GDP, and if it is running a trade surplus then that means it is selling more abroad than it is buying abroad which means the trade surplus is acting to import extra demand into the domestic economy.

Germany is an example of an economy that has reduced its internal demand by holding down public spending and at the same time holding down wages, and it compensates for this loss of internal demand by importing a huge proportion of its demand from abroad by running a huge trade surplus. Its not entirely clear how that has benefited the German people whose living standards have stagnated and whose government has slashed public investment. But the German example does show that it is possible to use a large trade surplus to supply the demand sucked out of the economy by running a budget surplus (although part of the cost is suppressed domestic investment, suppressed living standards and a low rate of growth).

So why cannot everybody be like Germany and run a trade surplus and run a budget surplus? The problems is that not everyone can run a trade surplus at the same time because every trade surplus has to be matched by a matching deficit somewhere in the global economy. And deficit countries are not just importing another countries exports but they are also importing unemployment as their domestic demand is used to buy goods from abroad instead of keeping its own workers employed.

Running a permanent budget surplus and then using exports and a trade surplus to make up for the resulting missing demand in the economy is almost as risky as coping by running up private debt because the system only works so long as other countries are willing and able to absorb the exports and continue to run a trade deficit. Depending on a permanent and significant trade surplus to balance the economy is risky because other countries could, out of choice or because their own economies are in trouble, just stop running a trade deficit and the market for the surplus countries exports would dry and their economies would shrink. The large trade surpluses created by countries such as Germany and China, and the matching deficits in countries like the USA and the UK, are a very significant factor in creating instability in the global economy and were a key cause of the 2008 crisis.

In the case of the UK the idea that the loss of domestic demand caused by a government surplus could be compensated for by running a permanent trade surplus is pretty far fetched. The UK has been a deficit trader for a very long long time and it is in fact currently running a big trade deficit which means that imports are sucking even more demand out of the economy. This means that increasing private debt in the UK has to compensate for both reduced government and spending on imports.

Similarly compensating for the reduction in demand caused by the cutting of public expenditure in the eurozone by all its member states running a trade surplus is also a big ask, and in Europe it is made all the more difficult by the Euro. If Greece or Spain had its own currency, then they could devalue and make their exports (and service industries) more competitive. But by being locked into the Euro, the only way that Spain and Greece can use price competition to increase their exports and reduce their imports is if prices in Greece and Spain fall compared to prices elsewhere—in other words, if they experience deflation. But deflation makes the debt burden worse, and it is a policy outcome that the European Union is trying to avoid. Predictably, with the misguided policy of austerity, deflation is one outcome that the EU is actually achieving: the rate of inflation across the whole Euro area is just half a per cent and heading down, while Greece, Spain and Italy are all in negative territory.

Conclusion

The idea that running a prolonged budget surplus is a good idea, that its the prudent thing to do, is based on a misunderstanding of how the economy as a whole works. It is based on confusing what is good for a household or an individual (saving money) with what is good for an entire economy. Running a permanent surplus is a bad idea because it results in either, or both, rising private debt and a shrinking economy. Running a permanent surplus actually destabilises the economy and it is therefore anything but prudent. Unfortunately the Labour Party allowed this fallacious narrative to become the new common sense of politics and changing the debate without appearing financially reckless is now very difficult for the party.

Great article.

How do we rationalise the rise in private debt in the UK in the run up to the financial crisis?

Given that the Government was running a deficit for much of this period (from the late 1990s onwards) are we saying that the trade deficit was the main driver of the increase in private debt?

Comments on this entry are closed.