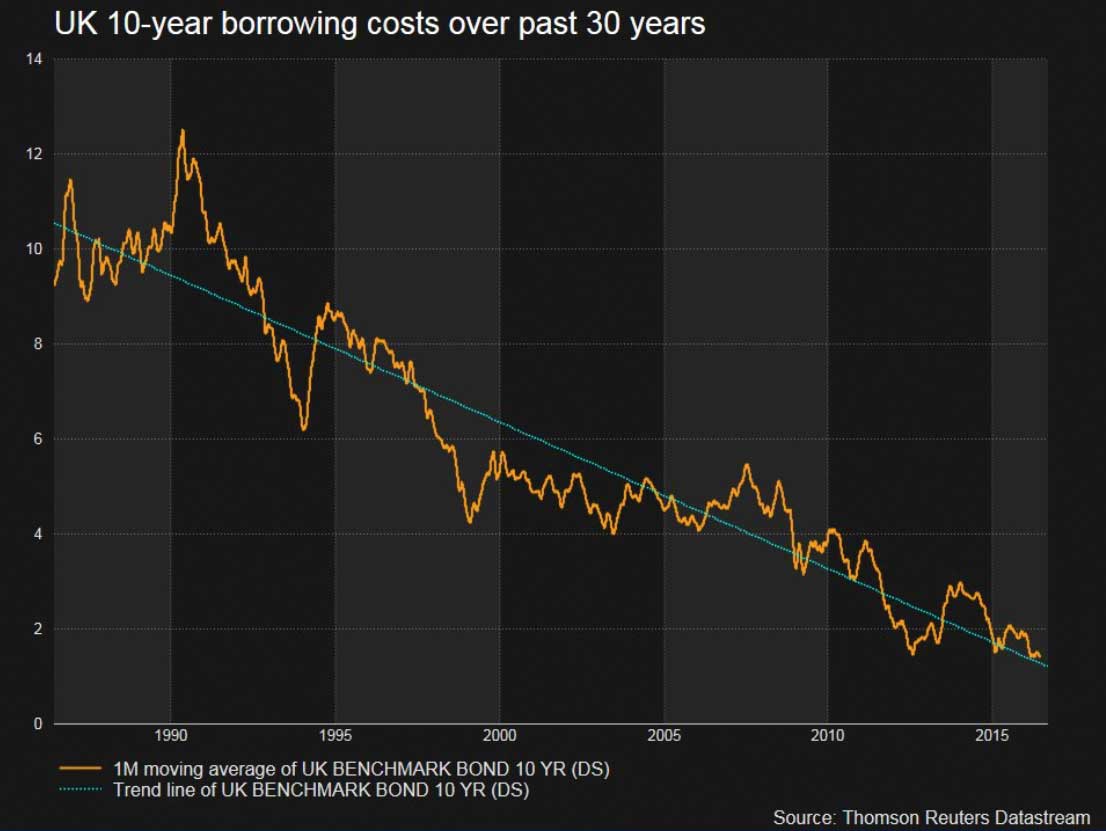

This chart shows that the cost of UK government borrowing has been falling for decades. This means that paying for the defict is cheap and borrowing for investment to promote growth would make sense as it is only by growing the economy (and a return to a gentle rate of inflation) that existing debt can be resolved.

It is sluggish economic growth that undermines wage growth, weakens tax revenues, and makes it impossible for governments to pay down their debts. Among the biggest drags on growth today is fiscal austerity. The more governments cut their deficits, the faster growth slows – and the further out of reach debt-reduction targets become. Thus runs the self-defeating cycle of fiscal austerity.

In the UK a committment to austerity and spending cuts has not delivered debt reduction, with gross public debt increasing from 85.3% of GDP in 2012 to 89.3% of GDP in 2015 (see the previous article as why in the context of QE this figure is an over statement). And in the US, the debt ratio rose from 102.5% to 105.8% over the same period.

Consider the eurozone, the place most committed to austerity and controlling budget deficits. In 2012, eurozone leaders signed a fiscal compact aimed at controlling public debt – which, in total, amounted to 91.3% of GDP, according to the International Monetary Fund – by forcing countries to cut spending and raise taxes. By 2015, the eurozone’s budget deficit, as a share of GDP, had fallen by two-thirds from its peak in 2010. Yet gross public debt in the eurozone has actually increased, to 93.2% of GDP. While Germany has managed to reduce its gross public debt, from 79.7% of GDP in 2012 to 71% last year, debt ratios in France and Italy have continued to rise, despite tight fiscal controls (especially in Italy).

This is not always how austerity works, sometimes, in certazin circumstances, reducing deficits is the right thing to do. In the inflation-plagued 1970s and 1980s, when investors’ demand for inflation-risk premiums pushed up long-term borrowing costs, larger deficits tended to boost long-term interest rates further, while smaller deficits reduced them, so keeping deficits low made sense.

It was this experience that caused policymakers after 2010 to assume that reducing government demand would help to boost private investment. (In the eurozone, it should be noted, arguments for fiscal austerity were also fuelled by mistrust among governments, with creditor countries demanding that debtors endure some pain in exchange for “gains” like bailouts.)

But times have changed. For starters, we are no longer living in an inflationary era. On the contrary, Japan and some eurozone countries face deflation, while inflation in the UK is essentially zero. Only in America is inflation picking up – and only gently. Moreover, long-term borrowing costs are at historic lows, just as they have been throughout the last five years. Pursuing austerity in this context has resulted in a drag on growth so severe that not even the halving of energy prices over the last 18 months has overcome it.