The core issue around the Greek debt burden is how quickly and how fast it can repay its debts. The central Syriza position is that trying to squeeze too much too quickly out of the economy has shrunk the economy and thus made finding the money to repay its debts harder. It has also caused a humanitarian disaster. Continuing to insist that the Greek government runs a large 4% surplus on its budget so that it can meet immediate debt repayments, as the Troika demands, will at best prevent growth and at worst possibly shrink the economy further.

What Syriza wants is to be able to address the severe humanitarian problems caused by austerity, something it claims will not actually cost a great deal, and to grow the economy and thus make debt repayment easier. Syriza says it cannot do those things and at the same time start generating a 4% surplus on its budget in order to repay all the debt repayments scheduled in the near future. Something has to give. There are suggestions from Syriza that it thinks that the immediate repayment obligations to the ECB and the other EU governments should be deferred, and that if those debts repayments were deferred it could repay the IMF, deal with the humanitarian issues and start to grow the economy.

Paying its debts

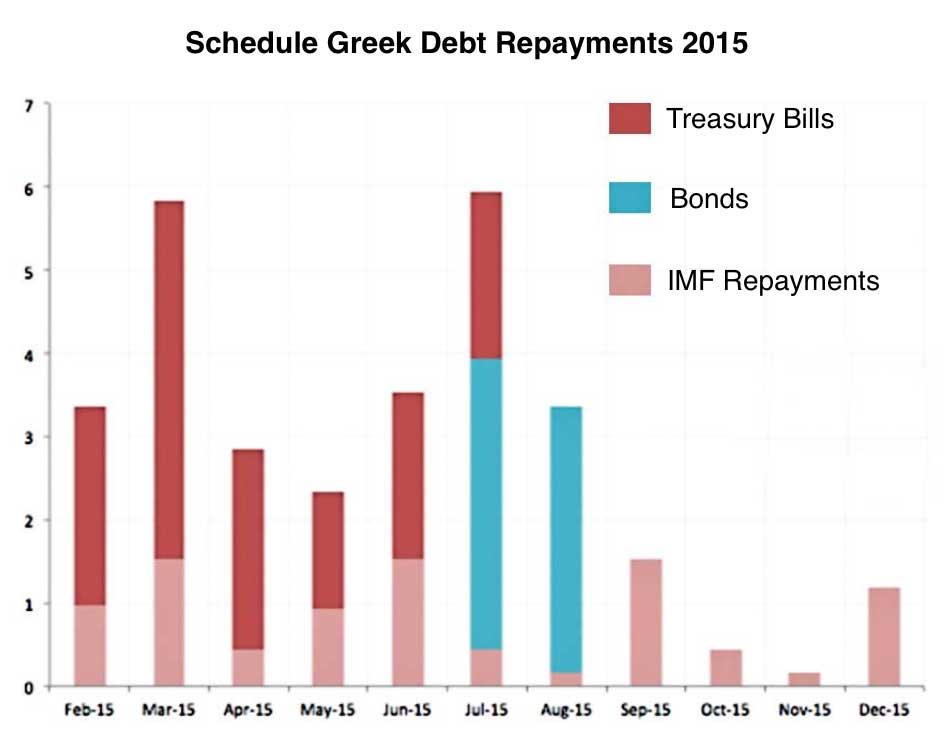

The coming year sees a fairly relentless timetable of debt repayment – see here for a full schedule of those repayments due in 2015.

Greece has to repay a lot of its creditors in 2015. The coming year will be dominated by repayments to the IMF, paying off expiring government bonds (known as Treasury Bills ), and in July and August, repayment of bonds held by the European Central Bank (ECB). In March, Greece has repay 1.2 billion euros to the IMF, in three tranches: 335 million will be due on the 13th of March, 558 million on the 16th of March and 335 million on the 20th. On top of this, Greece will need to repay 1.3 billion of Treasury-Bills expiring on March 13th and 1.6 billion on March 20th. Once the March deadlines have passed, April and May will be relatively quiet, before funding challenges resume in June, and most importantly in the summer with the big tranches of payment due to the ECB.

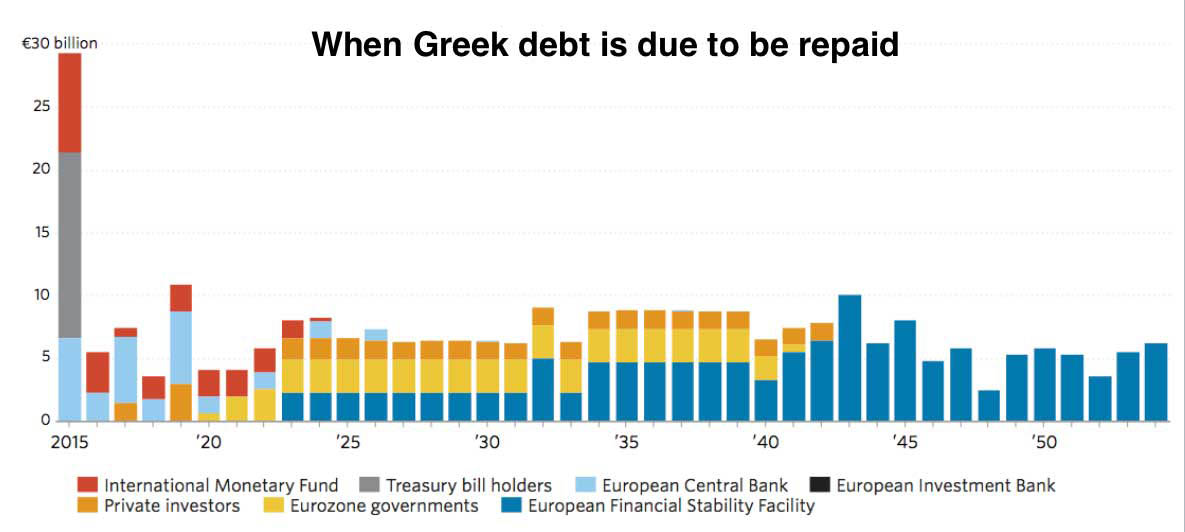

This is the daunting repayment schedule Greece faces stretching into the middle of the 21st century.

Paying for ordinary government spending

According to the 2015 budget published in November 2014 the ordinary primary expenditure at the State level is expected to be about 42 billion for the entire year. Total expenditures are expected to be 56 billion at the State level.

About 78% of the State ordinary primary expenditure is accounted for by payments of wages, salaries and pensions as well as of insurance, health care and social protections. A projected monthly schedule of expenditures provided in the 2015 budget suggests that in March the government will need to pay about 1.5 billion in salaries and pensions and 1.3 billion in insurance, healthcare and social protection (with similar payments foreseen over the following months). These are expenditure items that are not easy to avoid or reduce in the case of liquidity shortage, at least not without having a significant social and economic impact.

Since Syriza came to power along with the large capital flight that has threatened the solvency of the Greek banks there has also been a decline in tax receipts putting a squeeze on the government budget. Data for January showed a significant underperformance of revenues compared to the targets set. According to the Ministry of Finance, this was mainly due to the extension of a VAT payment deadline until the end of February 2015. According to a recent interview, finance minister Varoufakis suggested that the situation is not as rosy as previously thought: “I can only say that we have money to pay salaries and pensions of public employees….For the rest we will see”. The General Accounting Office has blocked any state expenditure not related to salaries and pensions. The same article reports a government official as saying that the budget has 4,772 expenditure categories – not salary-related – and that a review has allegedly saved about 180 million.

The Greek government could rely on a number of sources in the very short term. Following two recent ministerial decisions, it could utilise cash reserves of 250 million euros from OPEKEPE, an organisation responsible for managing Common Agricultural Policy aid, and 114 million from the Hellenic Telecommunications and Post Commission. On top of that, the Bank of Greece’s financial accounts show that the profits for 2014 amount to 641 million euro which were also transferred to the government at the end of February. Possibly another 500 million more could come from a fund in the Hellenic Financial Stability Facility.

Its going to be a difficult year for Greece.