The issue of public spending and taxation is central to the political debate in Britain, but the financial crisis that started in 2008, and the prolonged great recession that followed it, didn’t just strain public sector finances in the UK, it dislocated public budgets across Europe. The Institute of Fiscal Studies has just published a special edition of Fiscal Studies which looks at the comparative response of France, Germany, Ireland, Italy, Spain and the United Kingdom to the fiscal problems created by the financial crisis and great recession. In particular the study looks at the evolution of GDP, employment and unemployment rates, and the public finances in the run-up to, and through, the financial crisis; the scale, timing and nature of the fiscal response; and the impact of the reforms on the incomes of different households and on spending on different public services. This means it is possible to compare the response of UK to post-crisis fiscal problems with the response of other major European countries.

Most European countries experienced a significant increase in government borrowing in the wake of the global financial crisis and great recession. Ireland and Spain faced severe fiscal difficulties (requiring Troika bailout programs) and the France, Italy and the UK also saw borrowing rise sharply. For these countries a combination of the reliance on tax revenues related to the financial sector and to (collapsing) asset prices (Ireland, Spain, UK) as well as stickiness in public spending levels, resulted in a large increase in borrowing in the wake of the Great Recession. In addition of course governments had to bail out the banks at great cost. Examining how these countries responded, in terms of the size, timing and composition of the fiscal measures they resorted to, highlights some interesting similarities but also some notable differences.

The impact of the financial crisis on the various economies

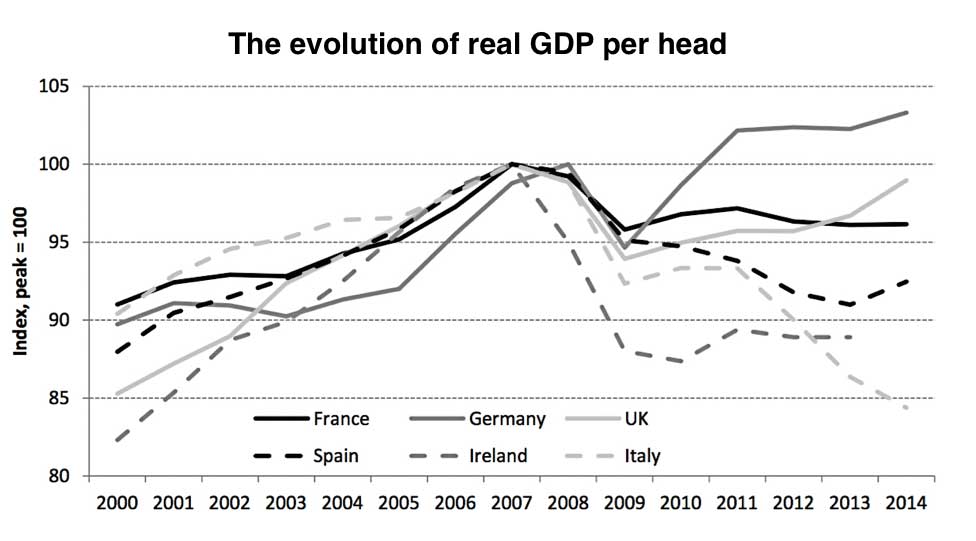

All six countries experienced sustained growth over the pre-crisis period, from 2000 to 2007 (see chart below). Growth in GDP per capita was fastest in Ireland (averaging 2.8 per cent per year) and the UK (2.3 per cent), while the weakest growth was seen in France, Germany and Italy (all below 1.5 per cent per year). All countries experienced a decline in GDP per capita as the financial crisis struck. France, Ireland, Italy, Spain and the UK all experienced contractions from 2008 onwards, while Germany’s economy started to contract a year later. In 2009, GDP per capita was 4–8 per cent below its peak level in five of the six countries, with the smallest drop being in France (4.2 per cent). The outlier was Ireland, which experienced the most dramatic initial decline in GDP per capita: Irish GDP per capita was 12 per cent lower in 2009 than it had been at its 2007 pre-crisis peak.

Even these large drops in GDP per capita understate the decline relative to where countries would have expected to be prior to the crisis happening. The long period of sustained growth prior to the crisis meant that policy makers expected growth to continue into the future and were, on the eve of the crisis, projecting higher GDP in the years ahead. Those countries that had experienced stronger growth before the crisis were most optimistic about future growth. The pre-crisis expectations of future growth were important because it was on the basis of that level of expected future output that the various governments were planning their public finances (in particular, their planned tax structures and levels of public spending) in the run-up to the crisis. This means that the fiscal shock of the crisis was amplified by the fact that the pre-crisis period had seen such inaccurate future projections of future growth, GDP, tax revenues and future social security spending levels.

Perhaps even more striking than the differences in the size of the initial decline in GDP per capita is the divergent paths from 2009 onwards. By 2011 German GDP per capita was already 2.2 per cent above its pre-crisis peak. In contrast, by 2013, France and the UK had regained less than half their lost output. Even less recovery had been seen in Ireland, and Italy and Spain which continued to see declines in GDP per capita in the period after 2008. By 2014, Italian GDP per head was 15.6 per cent lower than its pre-crisis peak; this is the largest decline among six countries studied in the Fiscal Studies paper.

The declines in GDP was reflected reflected in labour market changes where, unsurprisingly, those countries that experienced larger declines in output also tended to see larger falls in employment rates and larger increases in the fraction of the population unemployed. However, there is not a perfect correlation between GDP declines and changes in employment and unemployment. One factor that is likely to have been important in determining how changes in economic output translated into changes in employment rates is the evolution of unit costs of labour in each country. Post crisis the UK, Ireland and Spain saw large post crisis falls in labour costs (for different reasons – see below) but labour costs in France, Germany and Italy continued to track upwards.

The devaluation of sterling against the euro meant that unit costs of labour in the UK (when measured in euros) declined sharply between 2007 and 2009, which helped to improve the competitiveness of the UK compared with its eurozone counterparts. This in itself was, at least in part, the result of different monetary policy choices. The Bank of England (BoE) loosened monetary policy more aggressively than the European Central Bank (ECB) and in addition, the BoE started a programme of quantitative easing in March 2009, whereas the ECB did not do this until much later. Unit labour costs also fell in Ireland and (to a lesser extent) in Spain, although in these cases this decline in labour costs reflected a prolonged period of low (and even negative) nominal wage growth. In both these countries, public sector wage moderation was a significant contributing factor: the Irish government agreed to impose an effective four-year nominal pay freeze for public sector workers as part of its agreement with the ‘Troika’ (the IMF, ECB and EU) in return for financial assistance, while the Spanish government also imposed tighter public sector wage settlements after 2010.

Although these countries saw very different changes in overall employment and unemployment rates, the difference in impact across age groups displays some interesting new patterns common to most post crisis countries. First, in all five countries (excluding Germany), the fall in employment rates (and the rise in unemployment rates) has been significantly larger among those aged 16–29 than across the adult population as a whole. Second, and even more strikingly, the falls in employment rates (and rises in unemployment rates) among those aged 55–74 have been much smaller than those for the adult population as a whole. In four of the five countries (France, Italy, Spain and the UK), the employment rate among older individuals actually continued to grow throughout the crisis and its aftermath. This is in sharp contrast to the experience of younger adults. For example, in Italy between 2007 and 2013, when employment among those aged 16–29 fell by 10.3 percentage points, the employment rate of those aged 55–74 rose by 5.3 percentage points.

This growth in employment among older adults is also in contrast to the experience of many earlier recessions. This pattern may in part be a response to deliberate policy changes, such as increases in eligibility ages for state pensions (as happened in France and the UK from 2010, in Spain from 2011, in Italy from 2012 and in Ireland from 2014). It may also reflect rigidities in labour markets. For example in France legal barriers to renegotiating contracts and barriers to laying off workers made it hard for employers to reduce nominal wages of existing permanent (often older) members of staff and so, in the face of declining productivity and low levels of inflation, French firms preferred to stop recruiting (typically younger) staff or to stop renewing short-term contracts for (also typically younger) staff.

The impact of the financial crisis on public borrowing

The evolution of these six countries over the years running up to the financial crisis, and where they stood on the eve of the crisis, varied somewhat. On the face of it, the weakest fiscal positions were those of France and the UK, which both ran deficits of between 2 and 4 per cent of national income between 2002 and 2007, although both were intending to implement a medium-term fiscal consolidation after 2007. For these countries the deficits in the mid 2000s reflected, in part, repeated over-optimism in the official forecasts for borrowing caused by false expectations of future growth and failure to predict a crisis of such scale.

In the years preceding the financial crisis, Ireland and Spain appeared to have the healthiest fiscal positions out of these six countries, having run overall budget surpluses for at least the preceding three years. And yet it was those two countries that had to seek a bailout program from the Troika. In fact the seemingly healthy government revenues in Ireland and Spain prior to the crisis were actually heavily dependent on unsustainable tax revenues from the property market, and the collapse of the property bubbles in both countries caused a collapse in revenues. At the same time the banking system in both Ireland and Spain, also deeply invested in the collapsing property markets, required a massive financial bailout from the two national governments which hugely increased the strain on the government budgets.

Although suffering a little less severely, France, Italy and the UK also saw their underlying public finances weaken, each by just over 5 per cent of GDP. In other words, had they taken no policy action, they would have ended up borrowing over 5 per cent of GDP more every year forevermore. In the UK the government had to bail out the banking system and both France and Italy had to contribute to the Troika programs in Ireland, Spain and Greece. But other than the contingent fiscal cost of bailouts these three governments also had public finance systems designed on the basis of vastly over optimistic projections of future growth and ill-prepared for the inevitable fiscal strains of a prolonged recession (falling tax revenues and rising social security spending).

Italy had net borrowing persistently above 3 per cent of GDP just prior to the crisis. However, efforts to increase tax revenues in 2007 resulted in borrowing falling to 1.3 per cent of GDP. While this was superficially a sustainable fiscal position, there was concern prior to the crisis that high taxes and stagnant economic growth threatened longer-run sustainability and so the focus pre-crisis was on policies that could stimulate the economy.

Germany was the only country in this group of six whose public finances were, in the long term, unaffected by the Great Recession. Germany was the only one of the six countries for which this looked like a ‘text book’ recession, a temporary increase in borrowing followed by a quick return to normal times. Like Italy, Germany had also already undergone a period of fiscal tightening prior to 2007, having become the subject of an excessive deficit procedure by the European Commission in 2002. Between 2002 and 2006, Germany implemented a series of measures to improve the structural position of its public finances, culminating in 2007 with a balanced budget, which was expected to be maintained in the medium term.

Ironically it was the two countries in this group, Ireland and Spain, who were to be forced into a Troika bailout program who ran significant fiscal surpluses in 2006 (in excess of 2 per cent of national income), following a period of fiscal strengthening between 2002 and 2006. Although both were expecting some fiscal loosening after 2007, their fiscal forecasts still suggested they would remain well within the limits imposed by the Stability and Growth Pact. Both Spain and Ireland also had relatively low levels of government debt on the eve of the crisis (35.5 per cent and 24.0 per cent of GDP respectively).

With the exception of Germany, all of these countries experienced a significant structural weakening of their public finances in the wake of the financial crisis – the scale of which had not been anticipated, and (other than Germany) all experienced an increase in underlying borrowing in response to the crisis, meaning that spending plans and tax systems that were in place pre-crisis would not be sustainable in the post-crisis world.

Germany is a clear outlier from the other five countries. It saw a very small underlying increase in borrowing (just 0.1 per cent of national income), with an increase in underlying spending of 2.0 per cent of national income being offset by an increase in underlying tax revenues of almost the same amount. In other words, for Germany, the recent recession was little different from a ‘textbook’ recession, that is, a temporary period of economic weakness resulting in temporarily high borrowing, which disappears as the economy recovers without requiring policy action.

France and the UK are estimated to have experienced similar increases in borrowing – 7.0 per cent of national income for France and 6.9 per cent for the UK. In France, this is almost entirely due to an increase in spending as a share of national income, with only a relatively modest decline in tax revenues. The UK experienced both a structural decline in revenues as a share of GDP and a structural increase in spending. The decline in tax revenues in the UK arose because of a decline in the fortunes of the financial sector, which pre-crisis had contributed a relatively large share of corporation tax receipts, and a decline in asset prices (both property and stock market) which depressed receipts of capital taxes. The structural increase in spending largely came about because plans for levels of cash spending on public services that had been set out prior to the crisis now constitute a much larger share of national income than had been anticipated.

But these increases in borrowing in the UK and France were dwarfed by those seen in Spain and Ireland. Both countries suffered a collapse in property related revenues, the costs of bailing out their banks, and a Troika imposed austerity program that significantly reduced economic activity and therefore tax revenues. Spain is estimated to have increased structural (i.e borrowing that would be required in the long term to stabilise the budget) by 17 per cent of national income. In Spain’s case, two-thirds of the deterioration in the borrowing position was due to spending increasing as a share of national income, the remaining third came from a fall in revenues as a share of national income, as pre-crisis revenue windfalls unwound.

The underlying deterioration in Ireland’s public finances was even greater than that seen in Spain, with the vast majority of it being due to a fall in tax revenues as a share of GDP (from their already low level relative to the other economies). The drop in revenues is largely explained by a decline in receipts of capital taxes, such as stamp duties, which had grown strongly during the property price increases and associated construction boom in the years leading up to the financial crisis.

Having had the strongest fiscal positions in 2007, Ireland and Spain experienced the most dramatic deteriorations in their fiscal positions as the crisis hit, revealing the extent to which they had been reliant on unsustainable forms of economic activity and sources of revenue. The UK also suffered a decline in revenues as the income previously received from taxing the financial sector and asset transactions dried up. For France and Italy, the main difficulty for the public finances (which affected the other countries too) came from inertia in public spending, as their economies shrank relative to pre-crisis expectations while spending plans set pre-crisis took time (and active policy decisions) to adjust.

Public finance responses

The size of the damage done to the public finances in France, Ireland, Italy, Spain and the UK by the 2008 crisis and its aftermath meant that some response was required to stabilise public spending, although how much of a response was required and how quickly is still very much open to debate. Unlike the other countries in this group Germany did not need to make any net fiscal adjustment in response to the crisis.

By 2014, all of the countries (except Germany) had made some progress towards implementing a raft of tax rises and spending cuts to reduce public borrowing, but none had done enough to bring borrowing back down to pre-crisis levels. France, Italy and the UK have all so far implemented sizeable, and similarly- sized, fiscal tightenings in response to the crisis, amounting to between 5 and 6 per cent of national income. Spain has done a larger fiscal tightening, approaching 9 per cent of national income. Ireland has gone much further, complying with the plan agreed with the Troika and implementing measures totalling 18.5 per cent of national income by 2014, which led to the country successfully exiting the financial assistance programme in December 2013.

The composition of measures chosen has differed across the countries. France and Italy have, so far at least, relied relatively heavily on tax rises (comprising 65 per cent and 58 per cent of measures, respectively). Ireland, Spain and the UK have reduced borrowing mainly through reductions in public spending (comprising 64 per cent, 63 per cent and 82 per cent of measures, respectively). This pattern is notable given that France and Italy saw essentially no decline in tax revenues relative to national income as a result of the crisis, while the other countries did. This means that, up to 2014 at least, the net effect of the crisis and post-crisis measures was to move France and Italy towards being higher-tax economies than they were pre-crisis, while Ireland, Spain and the UK have become lower-tax economies than they previously were.

None of the countries (except Germany) has yet implemented a large enough fiscal tightening to offset all of the rise in public borrowing that happened as a result of the crisis. In other words, all five countries have, at least up until the end of 2014, chosen to allow borrowing to remain higher than was expected pre-crisis. However further fiscal consolidation is planned beyond 2014 in France, Ireland, Italy, Spain and the UK; in all cases, this consists mostly of further cuts to public spending rather than further increases in taxation. For some countries (France, Italy and Spain), this will still leave public borrowing at a higher level than was intended pre-crisis; for the others (Ireland and the UK), current fiscal plans imply borrowing falling to significantly below the levels planned pre-crisis.

Germany has implemented only a modest net tightening since the start of the crisis, with spending cuts being used mainly to finance net tax cuts. This modest package of measures also includes a number of changes that had already been planned prior to the crisis or that were simply due to following earlier judgements by the Federal Constitutional Court, so they are not strictly a response to the crisis.

Tax and benefit changes

Although the size of tax and spending measures implemented in each of the countries has varied a lot, there are some similarities in the types of measures that France, Ireland, Italy, Spain and the UK have relied on, as well as some noteworthy differences.

All the countries except Germany have used increases in the main rate of VAT to boost revenues. France increased the main rate from 19.6 per cent to 20 per cent and the intermediate rate from 7 per cent to 10 per cent; Ireland increased its main rate from 21 per cent in 2010 to 23 per cent in 2012; Italy increased its main rate from 20 per cent to 22 per cent; Spain increased the main rate from 16 per cent to 21 per cent and the reduced rate from 7 per cent to 10 per cent; and the UK increased its main rate from 171⁄2 per cent to 20 per cent. All five of these countries have used increases in social security contributions (including mandatory pension contributions) to boost revenues as well.

A number of countries have also made changes to their income tax systems to focus revenue-raising more heavily on higher-income individuals. France increased the top marginal tax rate from 40 per cent to 45 per cent and introduced an additional tax on incomes above €150,000 and the temporary (two-year) 75 per cent marginal tax rate on earnings above €1 million. Italy introduced a new ‘solidarity tax’ on incomes above €300,000, while reducing the tax burden for low-wage workers and increasing tax credits. The UK introduced a new 50 per cent top rate of income tax on incomes over £150,000 (later reduced to 45 per cent), while increasing the tax-free personal allowance (and tapering this away from those with incomes over £100,000). Spain increased the top marginal tax rate from 43 per cent to 52 per cent, deepened the progressivity of the income tax code and eliminated a number of uniform tax credits. Ireland is something of an exception to this pattern, having implemented a number of income tax changes that will have increased the tax burden on lower-income, as well as higher-income, individuals.

In contrast to these consistent patterns of tax changes, there was a lot of variation in the role played by changes to benefits across the countries. Benefits were virtually unchanged in Spain, and in France and Italy benefits for some groups were actually increased. In contrast, Ireland and the UK have implemented significant benefit cuts, in both cases focusing cuts on benefits for those of working age rather than benefits for older individuals. For example, benefit cuts made in the UK are thought to have reduced spending by around 1.7 per cent of GDP relative to unchanged policy, with much of this coming through less generous indexation of benefit rates.

In France, overall, the measures look straightforwardly progressive on average, with the lowest income decile actually seeing a net increase in household income from the measures modelled here. In contrast, in the UK, the biggest losses as a share of income were, with the exception of the highest-income tenth of the population, seen in the bottom half of the income distribution, as a result of the benefit cuts described above. In Ireland, the pattern outside the highest-income tenth of the population is less clear, with losses looking, if anything, fairly constant as a share of income across the income distribution. In Italy, there were losses, on average, across the income distribution among households with children. However, these were smaller than the losses among households containing an individual aged 65 or over.

Cuts to spending on public services

In France, Italy and Spain, virtually all of the reduction in public spending has been brought about by cuts to spending on public services (as opposed to welfare benefit cuts), while Ireland and the UK have implemented significant cuts to public service spending on top of their cuts to benefit spending. The scale of these cuts is significant and they vary in their timing and composition. For example, in 2014–15, spending on public services in the UK was 9.2 per cent lower in real terms than it had been in 2010–11. In France, while the initial cuts to public spending were limited, central government spending is planned to be 8.7 per cent lower in real terms in 2017 than it was in 2010. In Ireland, there were only relatively small changes to spending on health and education (of +3 per cent and –3 per cent respectively), cuts of 13 per cent to spending on justice and deep cuts of 30 per cent or more to many other areas of government between 2007 and 2014.

All of these countries, to a greater or lesser extent, have used nominal freezes to public sector wages as a way of limiting public spending growth.

Some reductions are intended to be brought about by reducing inefficiency. For example, Spain has focused on reducing duplication between tiers of government, while Italy has abolished provinces (the intermediate tier of government between municipalities and regions) and France has replaced its previous 22 regions with 13 new ones, with a similar objective.

However, it is implausible that all of the spending reduction across these countries will come entirely through efficiency savings and the removal of duplication; some of it will be reflected in fewer and/or poorer-quality services. Exactly which services have been targeted for cuts reflects both the preferences of the governments in each country and the public spending mechanisms in place, which affect how easy it is for central government to constrain spending in particular areas.

One example of the importance of the degree of central control over spending can be seen by contrasting the examples of the UK and Spain. The UK central government imposed a significant part of the desired spending cut on local government services. This was possible because local governments in the UK are severely constrained in their ability to borrow (and to raise additional revenue locally) and so reductions in the grant from central government to local government feed directly into reductions in local government spending. In contrast, the cuts seen to public spending in Spain up to 2011 were much smaller than intended because of significant spending slippage by regional governments resulting from a lack of transparency and misreporting of their budgets, while as of 2012 strengthened national fiscal rules led to significant spending cuts in regional spending, mainly on education and health.

Another example is apparent from comparing spending on health care in France and the UK. France has a social insurance health care system, meaning that, subject to meeting the contributory and eligibility criteria, individuals can receive health care on demand from (private and public) providers, who are then reimbursed by the public health care insurance based on prices set by the government. Therefore, the only way for the French government to limit health spending is indirectly by explicitly changing the eligibility criteria or the rates at which it reimburses health care providers for different treatments. This contrasts with the UK, where health care is largely publicly provided, with health authorities essentially rationing care throughout the year to stay within fixed budgets.

Bearing in mind these potential differences in the ability of each government to control spending in different areas it is possible to see which services fared better or worse in each country. France and the UK both afforded relative protection to spending on schooling and health, in contrast to Italy and Spain where cuts to these services were larger than average. Also, Ireland, Italy, Spain and the UK have all chosen to cut investment spending by more than day-to-day spending.