One of the main obstacles to a Greek deal is the demand by the Troika (the EU institutions, the ECB and the IMF) for further cuts to Greek pensions. The Syriza government in Athens has been refusing to cut pensions any more arguing that they have been cut enough, that a large number of the unemployed who no longer receive any welfare payments are dependent on the pensions of older relatives to survive, and that cutting pensions does absolutely nothing to get Greece growing again which is the only way the debt will ever be repaid. The Troika counter argument is that the Greek pension system is way too generous, especially for a bankrupt country.

So what are the facts about Greece’s complex pension system. At first glance, it might seem too generous. But dig a little deeper, and the picture becomes more complicated.

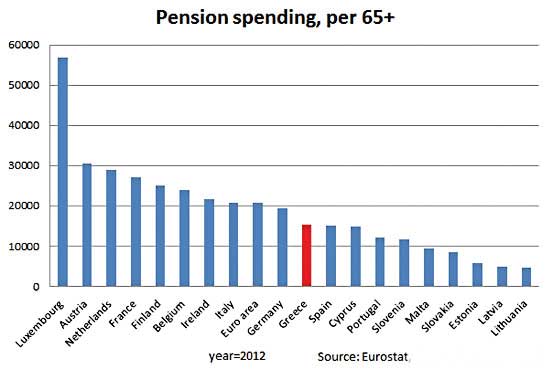

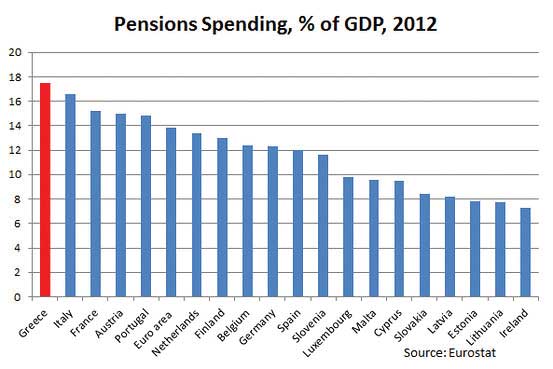

First, how much does Greece spend as percentage of GDP on pensions? The data from Eurostat looks like this as of 2012, with Greece expenditure easily highest in the eurozone as a percentage of GDP:

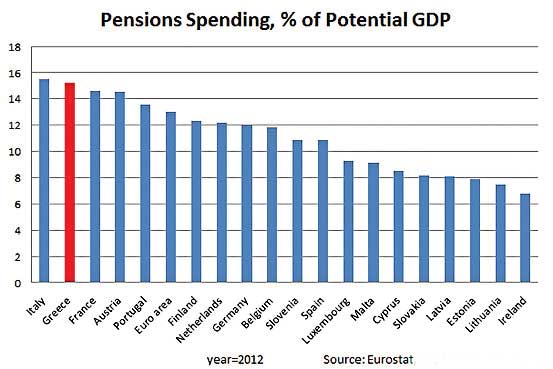

But part of that is due to the collapse in GDP suffered by Greece during the crisis. Suppose you look at pension expenditure as a percentage of potential GDP, the level of economic output were eurozone economies running at full capacity:

Greece is still near the top, though it’s not so far from the eurozone average. Moreover, Greece’s high spending is largely the result of bad demographics: 20% of Greeks are over age 65, one of the highest percentages in the eurozone. What if instead you attempt to adjust for that by looking at pension spending per person over 65 (see note below chart):

Adjusting for the fact that Greece has a lot of older people, its pension spending is below the eurozone average. The below average pension spend per head is the result of the major cuts imposed on the pension system by the Troika and the pension system now does not seem to be overly generous by eurozone standards. It remains unclear how or why taking pensioners incomes down another notch is going to increase growth in Greece, and increasing growth is the only way the Greek financial situation is going to improve.

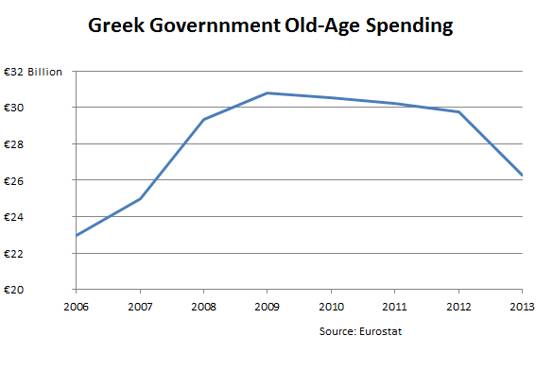

One area where Greece can clearly do better is by simplifying its pension system. As a Greek pension official described in a speech in November 2013, Greece in 2008 had 133 separately administered public pension funds. Overhauls begun in 2008 and continued during the reform programs imposed by the Troika which were supposed to cut this number to below 13.

When interpreting Greek pension statistics it is very important to realise the statistical effect of the simplification and reforms of the pension system. Only recently has the government gotten a true picture of how much it spends on pensions by assigning all pensioners a social security number. Those administrative reforms led to a significant upward revision of the pension spending that Greece reported to Eurostat (EU Statistics Office) in 2012 and it is the revised data which is appears in the graphs above.

The Syriza government has said that consolidating these various pension funds is one of the reforms pursued by the previous government that it will continue.

Thanks, Tony. Are the first 3 charts based on Greek stats before or after the revision you refer to in the penultimate paragraph?

As far as I know they include the revisions

Comments on this entry are closed.