“I can’t spend all my money on women and drink and then at the end ask for your help,” Mr Dijsselbloem, head of the euro area’s finance ministers, was cited as saying in an interview with German newspaper Frankfurter Allgemeine Zeitung published a few days ago, alluding to the solidarity northern euro countries had shown with southern countries during the region’s crisis. “This principle holds at the personal, local, national and also at the European level.”

Whether the remarks attributed to Mr Dijsselbloem were accurate or not the story has resonance because a lot of people, including people at the top of the EU system, believe the same thing. The common view is that countries are just like people and if they spend too much, develop trade deficits and get into debt they do so because they lack the discipline of the countries that run trade surpluses and which don’t get into debt. When a person spends way too much on their credit card and cannot repay their debts, and they have to borrow money from charitable friends who are more prudent and have some savings, then the lenders have a right to give their friend a bit of lecture about how to mend their ways. The common sense view is that the same sort of thing applies to entire national economies, that if a country gets into debt it’s their own fault and they can’t rely forever on being bailed out by loans from their prudent neighbours, and that they really should save more and spend less.

That’s the common sense view of the debt problems in the eurozone but it is also completely wrong. The reason it is wrong is because national economies and the system of international trade work nothing like personal and household budgeting or the finances of a firm. In fact applying what seems to be common sense lessons from private household finance to national and international economic policy leads to disastrously wrong conclusions. Unfortunately these sorts of comparisons between household and national finances seem like common sense, are easy to understand, easy to communicate and are thus dangerously seductive. The real way national economies and international trade work is actually counter intuitive and requires some careful thought to work out, so the reality is quite hard to communicate, especially in a headline grabbing phrase.

How economies and trade really work

To understand why the common sense view and the use of household finance metaphors are so wrong lets look at a hugely simplified model of how a national economy works, then we can look at how the system of trade between national economies works, and finally we can explore how imbalances and debt builds up between nations and what causes such problems.

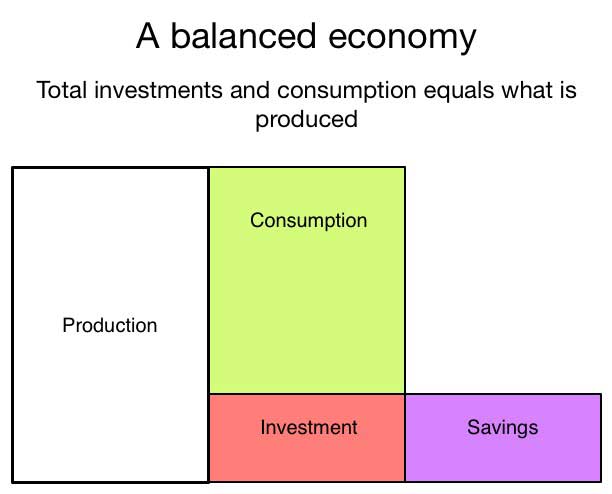

Lets start with a simple model of a country called Northland. This country doesn’t have any external trade, it just has a national economy. How does a national economy work and how does it stay roughly in balance? If we imagine for the sake of simplicity that the Northland economy produces 1000 euros worth of goods a year then in order for the economy to continue to function, and to avoid any contraction in economic activity, all those 1000 euros worth of goods have to be sold. Lets also assume that Northland consumes about 800 euro worth of goods a year. This leaves about 200 euros that are saved each year, i.e not used for immediate consumption. By savings we don’t just mean money saved by private individuals but everything that is not spent on immediate consumption. If 200 euros is not spent each year then there would a shortfall of demand in Northland’s economy and 200 euros worth of goods would not be sold, which would cause economic contraction and a rise in unemployment. However Northlands economy can remain in balance if the 200 euros not spent on consumption are actually spent on investment (public or private). If all savings are spent on investment then Northlands economy can run in a balanced ways.

Now lets imagine there are two countries, one called Northland and one called Southland, that trade with each other and that both share a common currency called the euro. Each imports 100 euros worth of goods and each exports 100 euros worth of goods. If the exports and imports of Northland and Southland are in balance, and neither country are running a trade deficit or surplus, then the international trade between them does not affect the balance of their respective national economies.

When a country’s trade is in balance its exports are the same value as its imports so the export/import trade has no impact on the overall balance of the economy. Although a country is under consuming some of its own products (not using some goods for either local consumption or local investment) in order to sell them abroad it is at the same time importing some goods from other countries. So in our example under the system of balanced trade out of total production of 1000 euros of goods Northland is now consuming just 700 euros worth of its own goods, saving 300 euros worth and only investing 200 euros but it can still operate at full capacity because Southland is buying 100 euros worth of its goods. By exporting its surplus goods Northland is actually importing demand from Southland to rebalance its economy. Meanwhile Southland is doing exactly the same thing, and both the economies of Northland, Southland, and the balance of trade between them, are all in balance.

This balanced trade scenario is the one which features in analysis based on the Ricardian idea of ‘Comparative Advantage (where trade benefits all through the international division of labour and national specialisations) and in the serene world of neo-classical economics, where everything balances around the optimum through the operation of self correcting market forces, it is balanced trade that is portrayed as being the norm. In fact the global trading system is fraught with persistent and deep imbalances and is very rarely balanced.

Now lets imagine that the trade between Northland and Southland becomes unbalanced. Northland is continuing to sell 100 euros of exports to Southland but Southland is not selling anything to Northland. So the Northland economy can continue at full capacity because all its goods are being sold, including the 100 euros worth bought by Southland. But Southland’s economy is in trouble because although it is making 1000 euros worth of goods each year it is actually spending some of its income on 100 euros worth of goods from Northland so now 100 euros worth of its locally produced good are unsold. The result is that the economy of Southland contracts and unemployment rises. Meanwhile although Northland is not consuming or investing a 100 euros worth of goods each year, which it is selling abroad, it is still getting a 100 euros worth of income from selling those goods to Southland so its stock of savings is piling up.

This sort of unbalanced trade produces two problems. One is that the economy of Southland is forced to contract and its unemployment rises because it is importing a 100 euros of goods a year instead of buying its own goods internally, and this means it’s is not selling 100 euros of goods a year (because it cannot successfully export them), so the economy of Southland’s will be forced to contract. Meanwhile Northland it is exporting 100 euros of goods a year that it is neither consuming nor investing locally so the income from those sales is piling up and sitting in bank accounts doing nothing.

This scenario of systematically unbalanced trade (inside a currency union where there can be no correcting exchange rate changes) would not be sustainable for very long because the economy of Southland would just continue to shrink until it reached a point where it was no longer able to afford imports. This would mean that Northland’s economy would also shrink because demand for its exports to Southland would fall and it could no longer sell all its goods.

There is a simple but dangerous solution to this problem which allows trade imbalances to be sustained over quite long periods of time. Given that one symptom of the unbalanced trade is that savings are piling up in Northland, while in Southland there is not enough money to buy all its goods, Northland could lend its saved money to Southland. This way Southland could continue to buy imports from Northland and not shrink its own economy, and at the same time Northland would have a place to invest all those savings its made from its export trade and there would continue to be demand for its exports.

This is exactly what happened inside the eurozone in the years leading up to the 2008 financial crisis. Big trade surplus countries like German (which has one of the largest trade surpluses in the world) lent its excess savings to the countries of the eurozone periphery who were running persistent trade deficits. These capital flows from the surplus to the deficit countries in the eurozone were mediated in incredibly complex (and actually dangerously obscure) ways via the international finance system so the debts being incurred were chopped up, rerouted, repackaged and hidden, but underneath all the arcane complexity of international banking the pattern was fairly simple. Money flowed from the trade surplus countries to the trade deficit countries where debts levels began to increase steadily.

For almost a decade after the introduction of the euro none of this seemed to cause any problems: the economies of surplus and deficit countries were all booming, there was loads of very cheap credit flooding into the periphery, the surplus countries could sell all their exports, the economy of the eurozone seemed to be doing just great and the single currency seemed to be a big success.

The problem was that trade deficit countries by definition probably lack many opportunities for productive investment, after all the reason they are running a trade deficit is because their goods are not very competitive. So if you flood a trade deficit country with masses of cheap loans it is highly likely that a lot of those loans will find their way in to unproductive activities like speculative asset bubbles of one sort or another, private debt to fuel consumption, and into unproductive government borrowing. So the debt levels go up but because a lot of the borrowed money is not going into productive investment the underlying economy is not getting any stronger. So when the asset bubbles popped (Spain, Ireland) or the markets panicked when they realised the scale of government debt (Greece) suddenly the entire recycling mechanism, which had been piping savings from surplus countries to deficit countries, broke down, and the economies and debt mountains of the deficit countries crashed pushing the entire eurozone economy into recession.

Who is the blame?

I am not going to explore what happened when the Eurozone crashed or how private debt was turned into public debt in order to save the banks (see here and here), instead I want to return to the remarks of Mr Dijsselbloem because we have to work out whose fault all this was. Mr Dijsselbloem view is fairly clear, its those feckless imprudent borrowers who are to blame, its the deficit and debtor countries that caused all the problems

Hopefully it is clear now that the underlying problem inside the eurozone was one of trade imbalances, these imbalances led to large scale capital flows into the deficit countries and this led in turn led to a debt crisis. The final stage was a debt crises but the underlying cause was unbalanced trade.

So how do trade imbalances arise? Who is to blame?

Lets go back to our imaginary example of Northland and Southland. A persistent trade imbalance arises between them because every year Northland exports 100 euros more to Southland than it imports. So every year Northland is producing 100 euros more than it is consuming or investing, it has to do that in order to have the surplus goods to export. Every year it is piling up unspent income from the exports and lending that money to Southland so that country it can continue to afford to buy its exports. Every year Southland is buying 100 euros more than it is making and using borrowed money to do so.

If we simplify things a bit we can see that there are two options here, either Southland is causing this persistent trade imbalance or Northland is.

If Southland is causing this imbalances it has to do two unlikely things, it has to induce Northlands to raise its rate of national savings, in order to create a surplus of 100 euros of goods it can export, and then it has to induce Northland to lend it the money in order to buy those goods. Given that currency exchange rate manipulation is out of the question (as both countries are in the euro area) its hard to see how Southland could ever force Northland to raise its savings rate or make constant capital transfers. If there was full demand inside Northland for all 100% of the goods it was producing then there wouldn’t be any goods available for export, and with a fixed shared currency how could Southland force Northland to reduce its internal demand in order to make surplus goods available for export? And even if Southland could in some way force Northland to consume and invest less so as to be able to export a constant surplus how could it force Northland to lend it the money to finance a persistent trade deficit?

If we turn to how Northland can induce a persistent trade imbalance then things are clearer and more plausible. If Northland wants to create a persistent surplus, and thus a persistent trade imbalance, it can do so by holding down wages and/or holding down its investment spending. Both would create surplus goods available for export. If wages are held down then those surplus goods could be offered at very competitive prices making them attractive to buyers in other countries. This is especially true if Northland is in a currency union with Southland so the imbalance cannot be fixed by exchange rate changes.

In order to sustain the persistent imbalance in trade Northland would have to finance Southland’s trade deficit by lending it its earnings from the surplus exports. The decision to lend money to Southland is ultimately a decision taken in Northland and not Southland. Quite what its lending is actually financing in Southland might be fairly opaque given the byzantine nature of the modern financial system but in the end the important thing for Northland (at least until a debt crash) was that it was getting a return on its lending and Southland was continuing to buy its export surplus. There are few examples in history of a country where nobody is willing to take on reckless or excessive debt if offered enough cheap and abundant credit and once the flow of cheap credit from Northland set off asset price bubbles in Southland the whole things would take on a powerful financial dynamic as the escalating rewards of asset bubbles alway sucks in ever more funding, that is until the bubbles pop.

Northland could see nothing wrong with the way it was going about things, all it was doing was being prudent, keeping inflation low, running an efficient economy by holding down wages, and selling lots of goods.

All this actually happened in real life. Germany undertook a very significant restructuring of its Labour market in the Hartz reforms between 2003-4 which have held down German wages level up until the present day. Germany has also held down both public and private investment levels and along with lower wages all this has had the effect of holding down internal German demand thus making a space for a very large export sector. The debt bubbles in the Eurozone were funded to a large extent by German capital.

So as you can see Mr Dijsselbloem is entirely wrong to blame the debtor nations of the eurozone for creating the imbalances and the problems. Counterintuitively it is the surplus countries that drive trade imbalances and not the deficit countries. It is the lenders of credit that precipitate asset and debt bubbles.

How can trade imbalances be fixed?

It would also be wrong to place the burden for fixing the imbalances on the deficit countries, although this erroneous approach is currently the official policy of the eurozone. To see why lets revisit Northland and Southland one more time.

Northland and Southland have imbalanced trade, Northland is running a trade surplus and Southland a trade deficit. If all the onus for fixing this is placed on Southland then the only way it can be done is to suppress the internal demand for imports, and the only way to do this is to hold down internal demand and turn off the flow of cheap credit. The result of taking this approach would be a shrinkage of the Southland economy and rising unemployment, bankruptcies and poverty. This is what has happened across the eurozone periphery in places like Spain, Ireland, Portugal, Italy and Greece. This is hardly a progressive policy.

Another way to achieve a rebalancing would be if Northland pushed up its internal demand and started to consume more of its own goods rather than exporting them. It could do this by increasing internal investment (public and private) and/or by pushing up wage levels. If wage levels rose its goods would become more expensive and thus less attractive to buyers in Southland but increased wages would mean higher internal demand for goods and perhaps higher demand for goods from Southland. If done carefully such an adjustment would help resolve the trade imbalance while the citizens of Northland could enjoy the benefits of high wages, and an improved national infrastructure, and all at the cost of a bit of gentle inflation. Surely this is what a progressive solution to trade imbalances should look like?

The primary surplus countries in the world are China, Germany and Japan, and as in the 1930s it is actually the surplus countries that drive the development of trade imbalances, and hence drive the creation of trade deficits in other countries, via deliberate (and correctable) economic policies. It is the imbalances in trade that have fuelled the debt problems in the eurozone periphery. Unfortunately the dominant narrative in the eurozone is that not only is everything the fault of the deficit countries but that painful adjustments must be forced upon the deficit countries in order to correct imbalances that are actually created in the surplus countries. This narrative of misplaced blame and mis-located adjustment is powerful because it is both very convenient for the surplus countries, who after all hold most of the power in the European Union, and also because it is seductively simple and it seems to chime with common sense. The predictable result has been a prolonged period of stagnation, mass unemployment and an unravelling of solidarity.