I have explained in previous posts that the various national bailouts that happened across the eurozone were actually bailouts of the banks. The way this was done, via bailing out national governments so they could in turn bailout the banking system, means that what was a bad debt incurred by reckless lending in the banking sector has been transformed into public debt, and the banks have seen almost all their bad loans paid off. Sometimes the bailout of the banking system in one country, Germany for example, has been routed via a bailout of another country’s government, in this case Greece, so that saving the German banks has resulted in massive Greek indebtedness.

Normally when an entity such as an individual, a company or a country, goes bankrupt the cost of that bankruptcy is borne by both the bankrupt debtor and the relevant creditors. The debtor suffers a loss of access to credit and perhaps a period of ongoing financial supervision, and the creditors take losses on their loans. In the case of a company the bankrupt entity often ceases to exist but bankrupt individuals and countries continue to exist and the bankruptcy process makes their lives difficult but can be done in a way that is sustainable and which leads back to a position of financial health. This is achieved by a writing off of some of the debt burden. In my personal experience of being a creditor in two company bankruptcies the amount written off is usually very high and creditors usually only get a small proportion of their money back.

The problem the eurozone faced when the property bubbles in places like Ireland and Spain collapsed was that if a normal process of bankruptcy had been allowed to take place then the impact on the entire financial system would have been disastrous. If the cost of writing off the loans of the many private debtors rendered bankrupt by the property collapse had simply been borne by the creditor banks, then systematically important parts of the banking system would have collapsed. This was broadly the same situation in the UK. It was also the same situation with regard to the potentially massive bad public debt caused when the costs of public borrowing for heavily in debt countries like Italy and Greece shoot through the roof. If allowed to take the form of a debt write off inside the banking system these mountains of bad debts would have combined to cause a massive failure of the banking system in Europe and this in turn would have caused a 1930s style economic collapse. So the banks had to be bailed out.

The problem for countries like Greece is that as a byproduct of bailing out the banks its national bankruptcy was prevented from occurring so that it could be used as a conduit to channel bailout funds to the banks, most of whom were German. And this meant not only no debt write off but a continuing stream of additional loans, the very thing a bankrupt does not need, in a process that Varoufakis has termed “pretend and extend’. Pretend that Greece is not bankrupt and thus preclude deb forgiveness, and extend this pretence with further loans thus deepening the hole that the country is in.

How much did bailing the bank out actually cost?

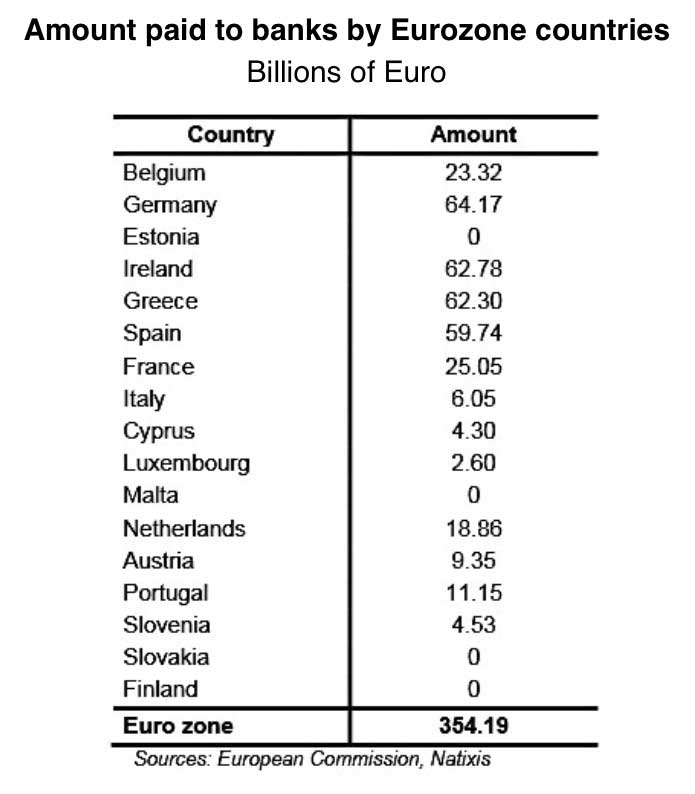

In some Eurozone countries staggering amounts of money have been paid to save bankrupt banks. In Ireland, this amounted to about 40,000 euro per household, in Greece to 17,000 euro in Spain to 3,000 euro. This includes households with no bank accounts, households where every adult is unemployed and, in Spain, the tens of thousands of households being evicted from their homes. The high cost of the bank bailout can be seen in countries like Spain and Greece which face unemployment rates of 23 and 26%. Paying back this money of course depresses the economy as it’s not recirculated. At the same time, in Cyprus the Troika pushes for mass evictions based upon a creditor centered valuation system which will not only cause social harm but which also lower asset prices. That’s what debt deflation looks like.

Here is a chart showing amount of money that each country has pumped into the banking system in order to prevent a banking collapse.

Hi Tone,

How much did Britain bail the banks out?

xx

The National Audit Office has looked into this, here is the link to their report. It shows the level of financial support given by the government to the Banks since 2009. The report tries to make an assessment of how much they still owe us now, after repayments, fees and interest. The headline figure is £456.33bn, down from £612.58bn in March 2010. The peak was a mighty £1.162 trillion. The total outstanding support is 31% of March’s GDP. That is what it looked like at its peak in 2009.

Actual money is the smallest part: £123.93bn was provided in the form of loans or share purchases, which required a transfer of cash from the Government to the banks. Another £332.40 billion is in the form of guarantees, where the Government will only provide cash if things go badly wrong.

If you want to read a good non-technical book on the bail out try this one: Making it Happen: Fred Goodwin, RBS and the Men Who Blew Up the British by Iain Martin.

Hi Tony, article passed on to me by Geoff. Can you add me to your list? My only query is that on the one hand you seem to accept that the bank bail out was necessary to avoid a total crash ) though indeed this involved the nationalisation of private debt) but equally point out the disastrous consequences for countries such as Ireland, but in particular Greece. How to square this circle? Take control of (at least some) the banks and create investment banks to relaunch the economy? Bail out the banks but wipe out much of Greek debt?

Good point and what I would say in response is this:

a) When the Greeks revealed that their previous government had lied about the size of the Greek budget deficit it enraged a big chunk of the EU elite particularly the Germans. Many in the elite were at this point beginning to see the serious flaws in the single currency system and were also beginning to feel trapped inside it with the basket cases like Greece and Italy. Former U.S. Secretary of Treasury Timothy Geithner describes a meeting of the Group of Seven (G7) in February 2010, where finance ministers from European countries said they planned to punish Greece for overspending before the financial crisis of 2008.

“We’re going to teach the Greeks a lesson. They are terrible. They lied to us. They suck and they were profligate and took advantage of the whole basic thing and we’re going to crush them,” Geithner describes the European ministers, adding that the finance ministers “wanted to take a bat to them [the Greeks]” for “borrowing all this money,” adding that the European ministers “were mad and angry.”

This punitive attitude has become deeply rooted.

b) It was right to bail out the banks but is it fair that a mountain of banks debts were written off, because to not do so would have been disastrous for the economy, but public debt cannot be written off even though it is socially disastrous? Its a question of who pays and for what. Bankers made hundreds of billions of bad loans and now its the poorest in Europe who are paying.

c) Deflating the economies of the eurozone, so public surpluses can be generated to pay off the debts, is exactly what is not needed at a time of general stagnation and high unemployment. Its as if the lessons of the 1930s and the work of Keynes have been entirely forgotten.

d) What’s needed now is growth because when economies grow their old debts get relatively smaller and if economies shrink old debts get bigger (a process called debt deflation).

e) The real structural problems of the single currency system won’t go away if Greece pays off all its debts, its a deeply flawed design and I fear further crisis down the line or at best decades of low growth and high unemployment.

Dear Tony,

I am working on an article trying to explain why some governments spend more money on bailouts than others. In this context, I am interested where you got the data you refer to in this article from. I would especially interested in data coding tax money spend as % of GDP on bank bailouts cross-nationally in the OECD area and/or simple dummy variable coding bank bailout or not.

Could you help me with this?

Much thanks in advance,

Sam

This ECB report has a lot of data

https://www.ecb.europa.eu/pub/pdf/scpsps/ecbsp7.en.pdf

This may also be of interest

http://ec.europa.eu/economy_finance/publications/publication15887_en.pdf

and this

https://www.ecb.europa.eu/pub/pdf/other/financialstabilityreview201405en.pdf

Comments on this entry are closed.