Oil futures hit a six month low

Following up on my recent post about the impact of low oil prices it is worth noting that the price of crude oil futures touched multi-month lows on Monday. Brent Light hit a low of $48.24 (the the lowest in over six months) and U.S. crude was down to a low of $43.35 in Asian trading. Both benchmarks have been falling for six weeks, hampered by a supply glut. So a rebound of oil prices is not going to help the petro-rentier states anytime soon.

Ordoliberalism

Back in April I wrote a lengthy piece looking at the role Ordoliberalism ideology and theory in the the EU and specifically its impact on the single currency system. John Aziz has just published an article in Pieria online magazine entitled, “The Trouble With Ordoliberalism” and in it he says this:

“Where ordoliberalism distinguishes itself is in its focus upon rules and order, and defining the government’s role in terms of establishing a strict order around which the market can exist and flourish. This, in theory, should make interventions routine and predictable, thus allowing households and firms to plan for the future in a rational manner free from unexpected tax hikes or inflation or other such meddling. This gives birth to notions of rigid monetary policy focused exclusively on price stability, to tough bankruptcy criteria, and to tough anti-trust laws.

It has also given birth to a deeply anti-Keynesian streak (perhaps an extension of the Teutonic notion that debt is sin, and thus borrowing to invest is somehow sinful). As Sebastian Dullien and Ulrike Guérot of the European Council on Foreign Relations argue: “[ordoliberalism] rejects the use of expansionary fiscal and monetary policies to stabilise the business cycle in a recession and is, in that sense, anti-Keynesian.”

And so there are a plethora of rules to prevent indebtedness. As The Economist notes: “In Germany itself, a “debt brake” has been written into the constitution, requiring states to balance their budgets by 2020 and limiting federal borrowing (Germany’s budget is now balanced at what is touted as the “black zero”). Germany has foisted similar rules on other EU countries through the 2012 fiscal-compact treaty, partly to limit its own liability to them.”

Greece

It looks like the Third bail out programme is almost ready to be formally agreed and an article at MacroPolis is suggesting that this will lead to a split in Syriza and snap elections.

Portugal debt sustainability

On July 31, 2015, the Executive Board of the International Monetary Fund (IMF) concluded the Second Post-Program Monitoring report on Portugal and it expressed some concerns about the sustainability of Portuguese debt. Inevitably its proposed remedy was more and deeper ‘reforms’ much of which consists of reducing government spending still further in an attempt to reduce the budget deficit. In the report the IMF says:

“Portugal’s sizable debt burden and gross financing needs continue to pose significant risks to debt sustainability and leave debt dynamics very sensitive to macro shocks.

Portugal’s gross debt trajectory is subject to significant risks, in the context of a sizable debt burden and gross financing needs. Debt dynamics continue to hinge on additional growth-supporting structural effort over the medium term and remain highly vulnerable to adverse yet plausible macro- fiscal and contingent liabilities shocks. Moreover, while staff’s baseline projections reflect the authorities’ current fiscal policies, additional fiscal consolidation remains critical to anchor debt safely on a downward-sloping path, boosting policy credibility and strengthening the country’s resilience to reversals in market sentiment.”

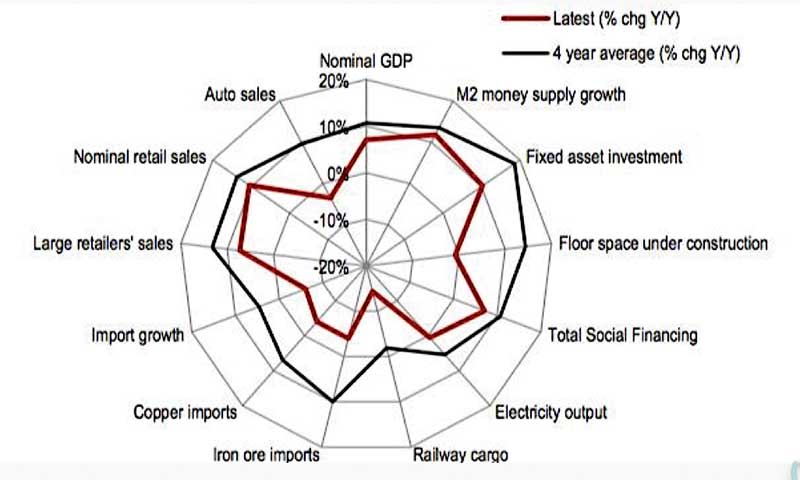

China economy continues to slow down

This chart shows a variety of economic metrics, the outer dark ring shows average growth over the last four years and the inner red ring shows the average growth in the last year. It is clear that all metrics point to a slow down.

Reuters also carried a story about China’s slowing economy and it said this:

“China is under growing pressure to further stimulate its economy after disappointing data over the weekend showed another heavy fall in factory-gate prices and a surprise slump in exports.

Producer prices in July hit their lowest point since late 2009, during the aftermath of the global financial crisis, and have been sliding continuously for more than three years.

Exports tumbled 8.3 percent in the same month, their biggest fall in four months, as weaker global demand for Chinese goods and a strong yuan policy hurt manufacturers.

“Policy focus is definitely the (producer) deflation at this stage,” said Zhou Hao, economist at Commerzbank AG in Singapore.

He said China’s central bank would likely need to further cut interest rates again, having already cut four times since November in the most aggressive easing in nearly seven years.

The gloom may only deepen in the coming week with a raft of economic data forecast to show renewed weakness in factories, investment and domestic spending.

The world’s second-largest economy is officially targeted to grow at 7 percent this year, still strong by global standards, but some economists believe it is growing at a much slower pace.”

UK Productivity Lagging

The UK Office for National Statistics released a report (click here to download) on comparative productivity rates across major G7 advanced economies which showed that output per hour in the UK was 17 percentage points below the average for the rest of the major G7 advanced economies in 2013, the widest productivity gap since 1992. On an output per worker basis, UK productivity was 19 percentage points below the average for the rest for the G7 in 2013.

As far as I can see neither the Tories nor the Labour Party have anything of substance to say about how UK productivity could be improved.