At the beginning of 2016 a lot of observers and economists were expecting a global downturn. The reason a recession was expected was because of shifts in the Chinese economy. The reason that the global recession did not occur was because China changed course and reversed its reform program. Its reform program had been designed to restructure and rebalance its economy because the growth model of the Chinese economy is not viable in the long run. The decision to reverse the reforms deferred a global recession in 2016 but it is storing up trouble for the future, China must rebalance and the longer it delays rebalancing the more painful the process will be.

During the Great Recession which followed the financial crash of 2008 most of the developed economies suffered significant falls in economic activity and their GDPs actually shrank, but globally this was compensated for by a surge of economic growth in China. The Chinese policymakers responded to the 2008 crisis by encouraging an investment boom fuelled by a vast expansion in credit and debt. The post 2008 Chinese credit and growth surge led to a gargantuan investment program and this in turn sucked in all sorts of imports (particularly of raw materials) from other countries and this drove economic growth in those countries.

In previous articles (see here and here) I explored the nature of the Chinese growth model. Although it has its own significant peculiarities because of the unusual degree of direct state control exercised by the post-communist state and party system, the Chinese ‘growth miracle’ is actually very similar to other growth miracles in the past in other countries. Basically Chinese economic growth since the 1980s has been dependent on holding down internal consumption and channelling a large proportion of national output to exports and internal investment programs. In this process the state sponsored creation of huge amounts of very cheap and easily obtained credit has played a critical role. Because national GDP was growing so fast the incomes of the Chinese people could increase quite a lot even though as a proportion of national output they were falling. If China devoted the same proportion of national output to personal consumption as do most all the other major economies then Chinese incomes would be twice as big as they currently are.

When the financial crisis struck in 2008 China’s export markets weakened and in order to prevent a slow down in growth the Chinese government unleashed a huge surge in domestic investment spending fuelled by cheap credit. This took the proportion of GDP spent on investment to levels never before seen in major economy. The result was continuing strong GDP growth but the Chinese government was aware that the growth model had to change, because as more and more was spent on investment so the investment became less and less viable or productive. This in turn meant that an ever growing proportion of Chinese internal debt, debt that was growing at a very, very fast rate, was actually bad debt, debts that could never be repaid because the investment the debt had financed could not generate a return on capital.

Generally the continuing high GDP growth rate in China is reported as a sign of continuing health in the Chinese economy but actually it is the reverse, it is a sign of the failure of the rebalancing and the continuation of the unsustainable growth model.

There is a big difference between China’s sustainable growth rate, based on rising demand driven by household consumption and productive investment, and its actual GDP growth rate, which is boosted by massive lending to fund investment projects that are driven by the need to generate economic activity, (even if unproductive) and employment. This failure to recognise the problematic use of simple GDP growth rates as an indicator of economic health arises because a country’s GDP is not a measure of the value of goods and services it creates but rather a measure of economic activity. In a market economy, investment must create enough additional productive capacity to justify the expenditure. If it doesn’t, it must be written down to its true economic value. This is why GDP is a reasonable proxy in a market economy for the value of goods and services produced.

But in a command economy, and China is still in many ways a command economy, investment can be driven by factors other than the need to increase productivity, such as boosting employment or local tax revenue. What’s more, loss-making investments can be carried for decades before they’re amortised, and insolvency can be ignored. This means that the Chinese imbalances can be extended to a degree and for a length of time which would be unsustainable in a truly market economy. How long China can sustain its current imbalances is not clear but what is clear is that the amount of debt required to achieve any given amount of economic activity and GDP growth is rising all the time, the Chinese economy is like someone running up an accelerating down escalator, when will it run out of steam?

The Chinese government is apparently committed to rebalancing the countries economy and under Xi Jinping it had attempted to reign in credit and debt levels and start the painful process of rebalancing whilst trying to avoid precipitating instabilities that might manifest as a socially and political dangerous increases in unemployment. By 2011 the Chinese government began to scale back on the flow of cheap credit and this meant building fewer apartment blocks and airports in the middle of nowhere and this in turn meant less need to accumulate the necessary industrial commodities and raw materials. That explains the gradual but relentless decline in global demand for iron, coal, oil and copper during that period.

The general problem that the leadership faces is that it needs to relinquish central control but every time it does so some sort of major market adjustment, such as the crash of the Chinese stock markets in 2015-16, forces it back into heavily intervening to ‘correct’ the markets. The huge levels of debt and credit creation in China has also spawned a large shadow banking sector and many independent wealth protection hedge fund entities, all of which work to sidestep attempts by the government to restrain credit creation.

The other great problem for Xi Jinping is that a strategy of rebalancing means challenging the vested interest of large sections of the party elite whose wealth depends on the current system of cheap credit and massive investment projects. This struggle between the leadership and the wider party elite is manifested as a general drive against corruption and a wider crack down on any dissenting voices. Sustained persecution of political opponents both real and imagined encouraged many wealthy Chinese to move their money out of the country, placing downward pressure on the currency (and in passing driving up property prices in places like London). The government responded by selling some of its foreign reserves and tightening domestic monetary policy. While this helped prevent much further depreciation, it also slowed the economy and encouraged additional capital flight.

Additionally there is a major problem in local government which is now almost completely financially dependent on massive debt fuelled property and infrastructure developments. This has inflated a huge property bubble in China and debts levels in local government are very, very high. Should the property bubble burst then large parts of Chinese local government would find itself without a revenue base, and much of the wider Party regional and local elites depend for their wealth on on milking extensive debt fuelled local government projects.

By 2016 the Chinese leadership lost its nerve and abandoned its earlier policy of restraint by reopening the credit spigots. Easier financing conditions led to greater investment, which in turn led to a big uptick in imports for the necessary materials and components. That directly helped a lot of other countries that were in trouble in 2016, such as Brazil, while boosting commodity prices and easing global credit conditions.

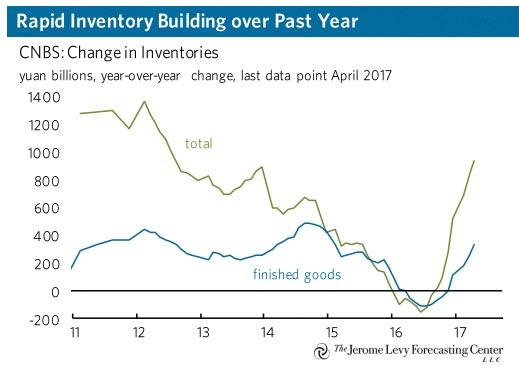

This is illustrated by the chart below where the impact of the uptick in credit on Chinese inventory purchases can clearly be seen.

As a result, China went from drawing down its stock of inventories at an annual rate of almost 200 billion yuan in the first half of 2016 to accumulating additional inventories at an annual rate of almost 1 trillion yuan by the middle of 2017. That’s an enormous swing in an incredibly short time.

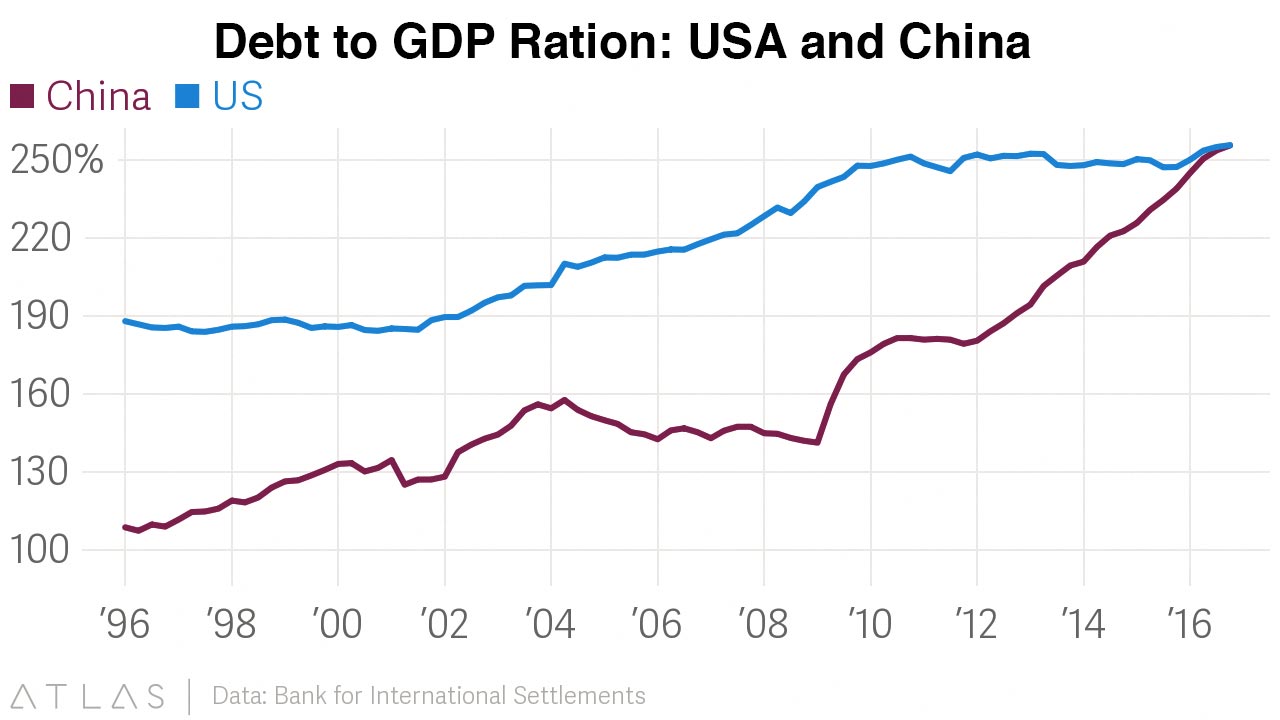

As a result of the 2016 relaxation of credit restraint by the government, and now fuelled by a non-state and shadow banking system that has slipped partially free of government control, Chinese debt is ballooning. One of the cautionary notes in the Bank of England’s Financial Stability Report this week related to China. The Bank warned that indebtedness in China was “pronounced” and posed a potential risk to the UK economy. Chinese debt is now at almost $33 trillion, with domestic debt having quadrupled in the past 9 years. To give some perspective, China’s total debt has now surpassed 300% of GDP. This is over three times the debt to GDP ratio in the UK. China is now overtaking the US in terms of debt levels. Debt in China now accounted for roughly one-half of all new credit created globally since 2005.

At the end of May 2017 Moody’s reduced China’s rating one notch to A1 from Aa3, while changing its outlook to stable from negative. The downgrade reflects the rating agency’s expectation that “China’s financial strength will erode somewhat over the coming years, with economy-wide debt continuing to rise as potential growth slows,” it said in a statement.

In the first quarter of 2017, China added debt equal to more than 40 percentage points of GDP — an amount that has been growing year after year. In 2011, the World Economic Forum predicted that China’s debt would increase by a worrying $20 trillion by 2020. By 2016, it had already increased by $22 trillion, according to the most conservative estimates, and at current rates it will increase by as much as $50 trillion by 2020. These numbers probably understate the reality.

Much, if not most, of China’s 6.5 percent GDP growth is simply an artificial boost in economic activity with no commensurate increase in the capacity to create goods and services. It must be fully reversed once credit stops growing. To make matters worse, if high debt levels generate financial distress costs for the economy — as already seems to be happening — the amount that must be reversed will substantially exceed the original boost.

To manage its rebalancing China requires substantial transfers of wealth from local governments to ordinary households to boost consumption. This is why China hasn’t been able to control credit growth in the past. The central government has had to fight off provincial vested interests, who oppose any substantial transfer of wealth. Without these transfers, slower GDP growth would mean higher unemployment.

Whether Chinese regulators can succeed in once again reining in credit creation this time is ultimately a political question, and depends on the central government’s ability to force through necessary reforms. Until then, as long as China has the debt capacity, GDP growth rates will remain high. Given that so much of the debt (around 50%) is owed by one state entity another it is unlikely that the imbalances, debt and adjustments will manifest themselves as outright bank failures or a generalised financial crisis but China is now essentially fuelling economic growth through activity which is not adding real wealth to the country. The leadership is aware of the imbalances and is formally committed to a major rebalancing.

Any significant Chinese rebalancing will have major global impacts. Exporters of raw materials and minerals are heavily dependent on the Chinese investment program. Most of the property bubbles around the globe, from Toronto and San Fransisco to London, are driven by capital flight from China as the Chinese elites look for places to safely park their wealth. China now accounts for nearly 7% of German exports and with another 8% of German exports going to the UK the country could face a double hit if a Chinese investment slow down coincides with Brexit trade disruption.