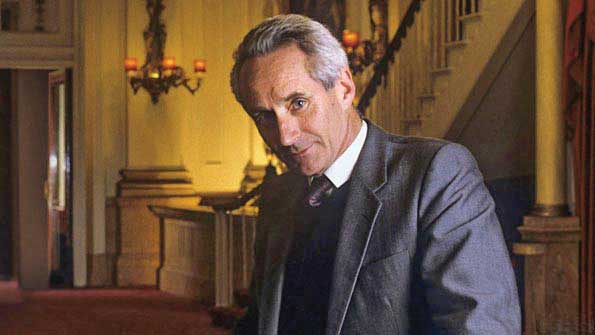

The great British economist Wynne Godley who died in 2010 (his Guardian obituary written by William Keegan is here) wrote a short article in the London Review of Books in 1992 entitled “Maastricht and All That”. The article is an astonishingly prescient critique of the deep design flaws in the plans for European Monetary Union as contained in the Maastricht Treaty. Here are a few excerpts:

The central idea of the Maastricht Treaty is that the EC countries should move towards an economic and monetary union, with a single currency managed by an independent central bank. But how is the rest of economic policy to be run? As the treaty proposes no new institutions other than a European bank, its sponsors must suppose that nothing more is needed. But this could only be correct if modern economies were self-adjusting systems that didn’t need any management at all.

I am driven to the conclusion that such a view – that economies are self-righting organisms which never under any circumstances need management at all – did indeed determine the way in which the Maastricht Treaty was framed. It is a crude and extreme version of the view which for some time now has constituted Europe’s conventional wisdom (though not that of the US or Japan) that governments are unable, and therefore should not try, to achieve any of the traditional goals of economic policy, such as growth and full employment. All that can legitimately be done, according to this view, is to control the money supply and balance the budget. It took a group largely composed of bankers (the Delors Committee) to reach the conclusion that an independent central bank was the only supra-national institution necessary to run an integrated, supra-national Europe.

The power to issue its own money, to make drafts on its own central bank, is the main thing which defines national independence. If a country gives up or loses this power, it acquires the status of a local authority or colony. Local authorities and regions obviously cannot devalue. But they also lose the power to finance deficits through money creation while other methods of raising finance are subject to central regulation. Nor can they change interest rates. As local authorities possess none of the instruments of macro-economic policy, their political choice is confined to relatively minor matters of emphasis – a bit more education here, a bit less infrastructure there.

I recite all this to suggest, not that sovereignty should not be given up in the noble cause of European integration, but that if all these functions are renounced by individual governments they simply have to be taken on by some other authority. The incredible lacuna in the Maastricht programme is that, while it contains a blueprint for the establishment and modus operandi of an independent central bank, there is no blueprint whatever of the analogue, in Community terms, of a central government. Yet there would simply have to be a system of institutions which fulfils all those functions at a Community level which are at present exercised by the central governments of individual member countries.

Another important role which any central government must perform is to put a safety net under the livelihood of component regions which are in distress for structural reasons – because of the decline of some industry, say, or because of some economically-adverse demographic change. At present this happens in the natural course of events, without anyone really noticing, because common standards of public provision (for instance, health, education, pensions and rates of unemployment benefit) and a common (it is to be hoped, progressive) burden of taxation are both generally instituted throughout individual realms. As a consequence, if one region suffers an unusual degree of structural decline, the fiscal system automatically generates net transfers in favour of it. In extremis, a region which could produce nothing at all would not starve because it would be in receipt of pensions, unemployment benefit and the incomes of public servants.

What happens if a whole country – a potential ‘region’ in a fully integrated community – suffers a structural setback? So long as it is a sovereign state, it can devalue its currency. It can then trade successfully at full employment provided its people accept the necessary cut in their real incomes. With an economic and monetary union, this recourse is obviously barred, and its prospect is grave indeed unless federal budgeting arrangements are made which fulfil a redistributive role.

If a country or region has no power to devalue, and if it is not the beneficiary of a system of fiscal equalisation, then there is nothing to stop it suffering a process of cumulative and terminal decline leading, in the end, to emigration as the only alternative to poverty or starvation.

I sympathise with the position of those (like Margaret Thatcher) who, faced with the loss of sovereignty, wish to get off the EMU train altogether. I also sympathise with those who seek integration under the jurisdiction of some kind of federal constitution with a federal budget very much larger than that of the Community budget. What I find totally baffling is the position of those who are aiming for economic and monetary union without the creation of new political institutions (apart from a new central bank), and who raise their hands in horror at the words ‘federal’ or ‘federalism’. This is the position currently adopted by the Government and by most of those who take part in the public discussion.