While Brexit has taken all our attention across the globe Japan continues to stumble into uncharted territory. In many ways Japan is the pioneer for the rest of the global economy, its on the same journey just much further along. Now Japan is having to cope with an influx of hot money fleeing post Brexit London pushing up its currency – exactly what it doesn’t need.

Japan had its own giant debt and credit bubble, largely focussed on property, which burst in1990s. Since then its economy has stagnated and it initially responded by borrowing unprecedented amounts of money and using it to prop up banks and construction companies. That didn’t work, so Japan invented Quantitative Easing and created record amounts of new money which merely pushed Japanese interest rates into negative territory in an attempt to devalue its currency. But this — amazingly — didn’t work either. The Japanese currency has actually grown stronger and the inflation that the Japanese government and central bank hoped to generate never materialised.

I have included at the bottom of this page a wonderfully entertaining film about Japan’s recent economic history, from post war miracle to the property bubble crash, based on the book “Princes of the Yen: Japan’s Central Bankers and the Transformation of the Economy” by professor Richard Werner. Do watch it – its an astonishing story, and professor Werner was working for the Japanese central bank at the time so his is an insiders account.

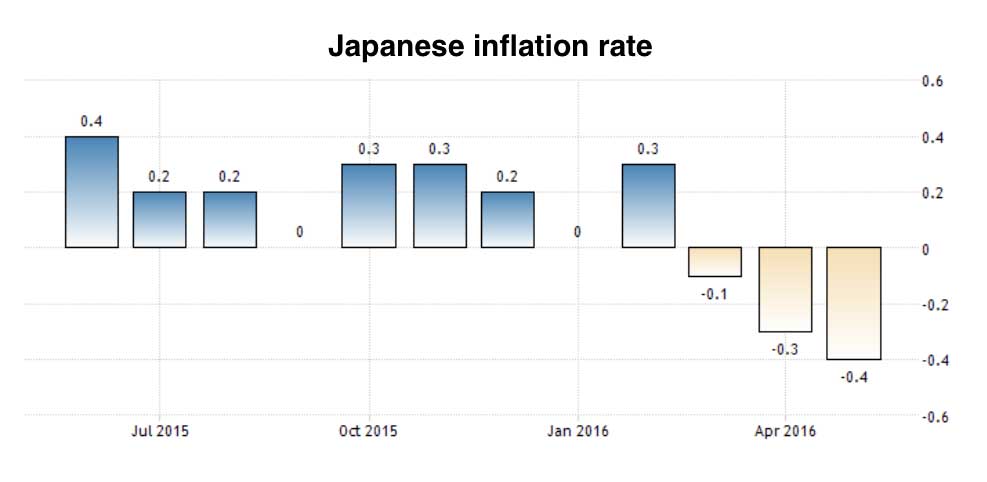

Where is the Japanese economy heading and what can be done that might restart economic growth? Is there even anything left to try, or is it simply time to stand back and let the current system melt down? Those are the questions facing Japan, and the answers are not obvious. Here, for instance, is its inflation rate two years into the largest major-country money creation binge since Wiemar Germany:

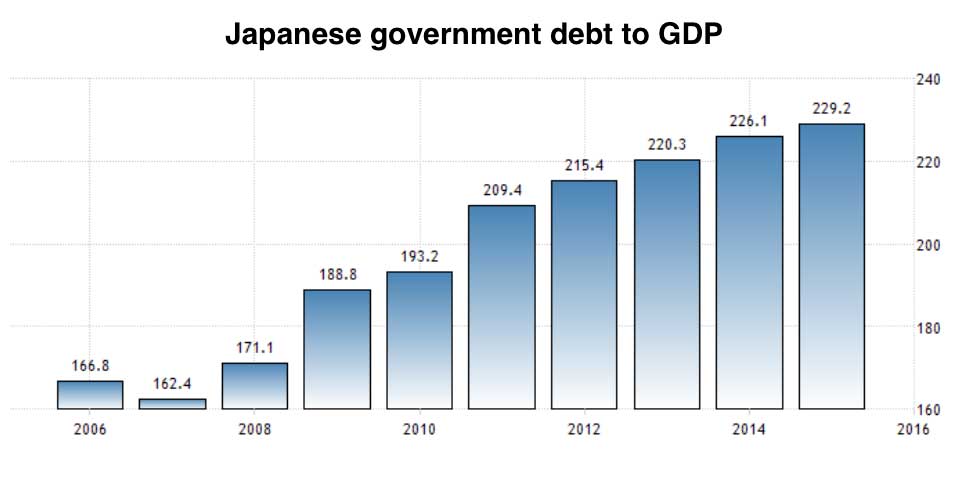

Deflation is to be expected and even desired in a well-run country where debt is minimal, money is sound and rising productivity makes things continuously cheaper. But in an over-indebted financial system, deflation is death because it magnifies the debt burden and raises the odds of an existentially threatening financial crisis. To continue to borrow money under such circumstances is to court disaster. And yet Japan is still at it: here is Japanese government debt to GDP ratios, and note that the debt panic in the UK is based on a debt ratio of around 85% – Japans is past 230% and rising.

Contrary to every mainstream economic theory, debt monetisation and full-throttle currency creation have resulted in a rising yen and falling prices. The Bank of Japan buying up even more assets has done nothing to weaken the yen as had been intended. Brexit, which briefly sent the yen beyond the ¥100 mark against the dollar last week, is once again strengethening.That means more money looking for a place to hide, some of which will choose yen-denominated bonds. So Japan’s already-negative interest rates will fall even further, which is catastrophic news for the Japanese banks and pension funds now suffocating under the current yield curve.

The Bank of Japan is likely to move rates from negative 0.1 per cent to minus 0.3 per cent come the end of July, increase its holdings of financial assets and currency reserves from ¥3.3tn to ¥6.3tn as well as its purchases of Japanese property bonds from ¥90bn to ¥200bn, economists at JPMorgan in Tokyo predict.

Surveys suggesting companies plan to invest have failed to materialise: in April core machinery orders, the best proxy for capital expenditure, dropped 8.2 per cent from the previous year, while exports fell in May with the trade surplus down 32 per cent compared with the previous month.

The entire global finance system, which is becoming saturated with ultra low and negative interest rates, is now awash with huge piles of capital looking for a return, any return. The movement of these funds can be very destabilising. The UK was an attractive location but the Brexit vote caused capital flight and pushed down the pound. It will be a while before London becomes attractive again. The money that has flooded into Japan will almost certainly flood out again at some point and the logical next place for it to go is the US and into US Treasuries. Rising foreign demand will push down Treasury yields, threatening to kill off numerous US banks, pension funds and insurance companies but giving the remaining solvent Americans a chance to refinance their mortgages at 1%.

The global financial system is now behaving in such a strange way, where every policy move seems to produce counter intuitive reactions, that there little confidence now that anyone knows where it could be heading.

Oh – and George Soros response to Brexit was to take out a £100 million bet against Deutsche Bank.