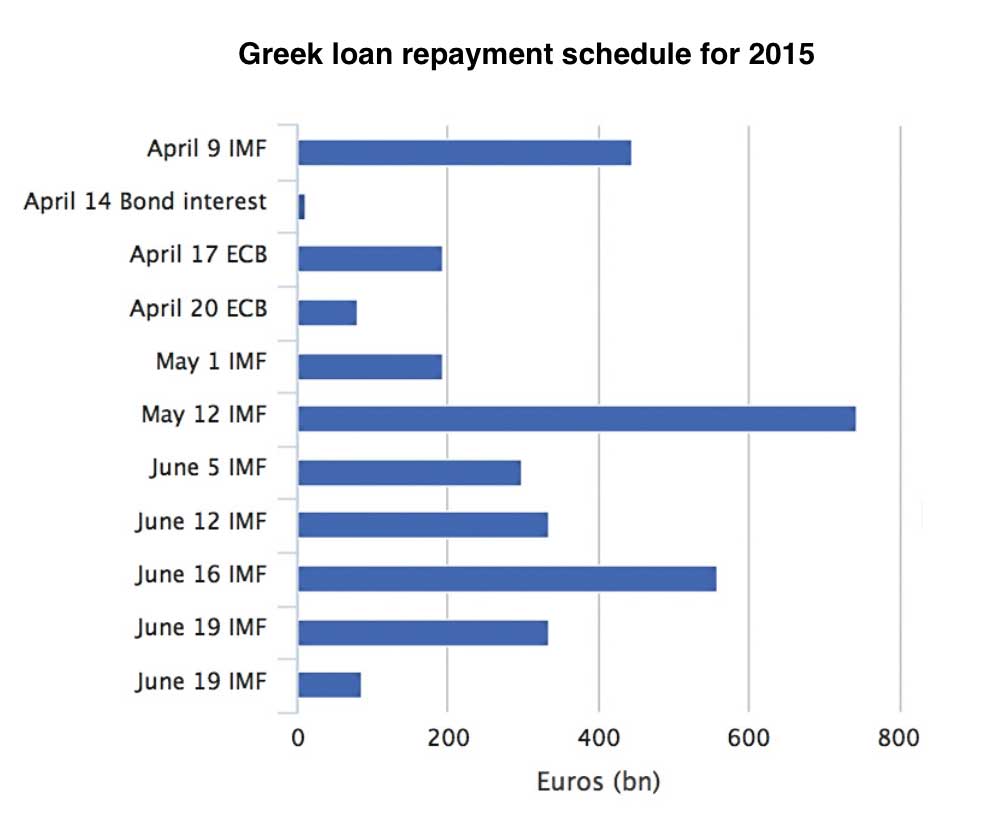

One of the sad ironies of the Greek debt fiasco is that it is the IMF, which has the reputation of being the iron hand of international finance, that is the most conciliatory of Greece’s creditors. The IMF, against it’s better judgment was carried along at the time the Troika was assembled in 2010 by the punitive line taken by the EU member states and institutions, in particular the European Central Bank. Since then the IMF has taken a somewhat softer line and accepted, more or less, that a restructuring of Greek debt is not only desirable but inevitable. The problem is that so long as Greece’s main EU creditors are insisting on a full and prompt repayment then the IMF will find it hard to allow any restructuring or rescheduling of it’s repayments from Greece. If you look at the schedule below of Greek loan repayments that are due this year you can see that most of them are to the IMF, with the exception of two repayments that are due to the European Central Bank in later April. So if Greece does default this year it could well be a default on a repayment to the IMF.

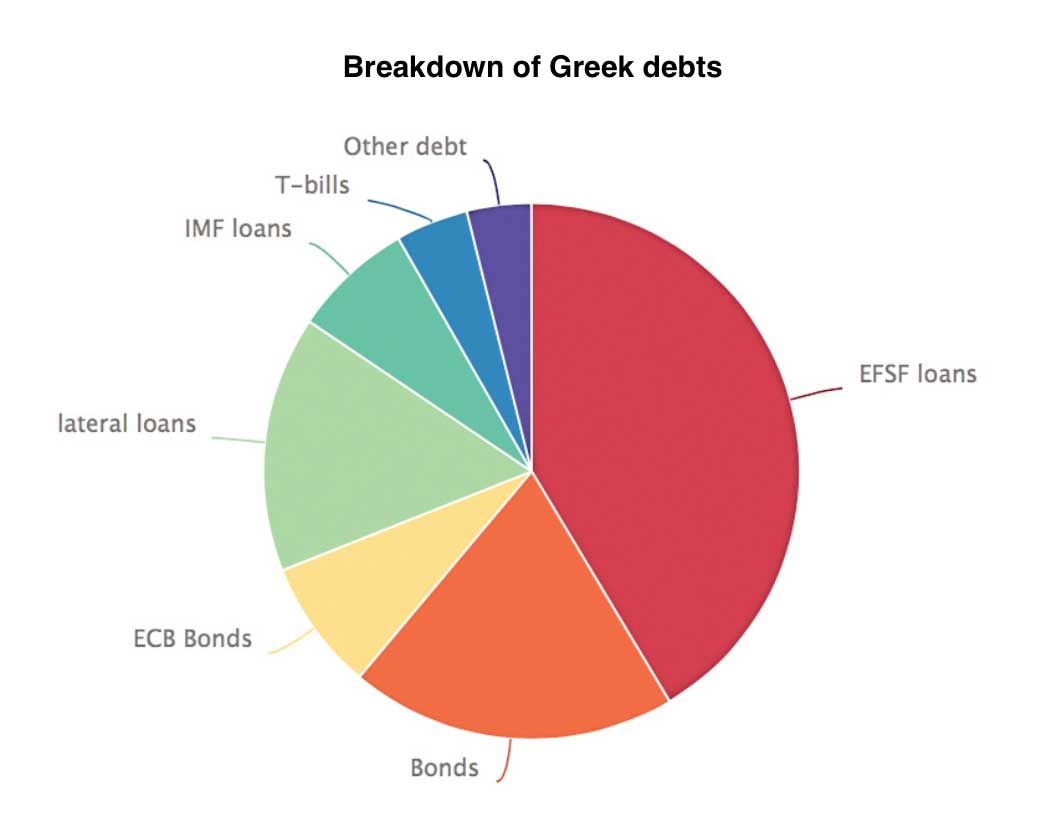

The chart below shows that the total amount Greece owes the IMF is dwarfed by the amount owed to other EU governments (‘lateral loans’ in the chart), to the European and to the EFSF (The European Financial Stability Facility ) and ECB (the European Central Bank). The IMF loans are smaller but, as is usual in national bail out programs, they get priority in the repayment schedule.

The other crunch repayments are when Greece has to roll over (redeem and resell) a big batch of its expiring Treasury Bonds on April 14 (€1.4bn) and on April 17 (€1bn). China has already bought €100m of T-bills as a show of moral support. and it will interesting to see if Russia steps in and buys any, the Russians have been expressing a keen interest in the buying the Greek ports of Piraeus and Thessaloniki and a show of support through a Treasury Bill purchase may be a Russian sweetener – if the Russians can find the money.

Even if Greece manages to cobble together enough money to meet rolling demands through the Spring, it seems highly unlikely that it will be able to cover the €6.7bn in bond redemptions to the ECB in July and August unless there is a fresh bail-out programme.

Meanwhile Greek bank deposits have plummeted in recent weeks as Greeks send their euros abroad fearing a Grexit. Capital flight on this scale can quickly crash the Greek banking system and the ECB is only preventing its collapse through its Emergency Liquidity Support (ELS) system, a tap it can turn off at a moments notice. An indicator of a possible Grexit will be imposition of capital controls.

Its going to be a tough year for the Greeks.