The answer to the question “Is there an alternative to austerity in the eurozone”, is both yes and no. Yes, because technically the policies that are needed during a prolonged deflationary recession have been well known for decades. No, because unfortunately the way the eurozone architecture was designed, and the correlation of political forces it has created, means that those policies are highly unlikely to be implemented in the eurozone.

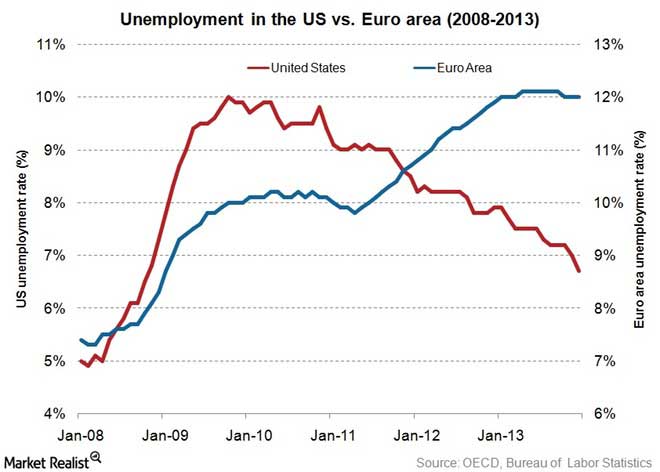

The symptoms of the economic malaise in the eurozone are clear. High unemployment, reaching levels of over 25% in some member states and over 50% amongst young people. Low levels of investment. High levels of debt and a fragile banking system paralysed because its balance sheets are full of poor quality, possibly worthless, assets. Governments institutionally precluded from increasing spending to increase demand and employment. Increasing political shifts to far right and leftist parties and a sharp decline in support for the European Union project.

How we got here

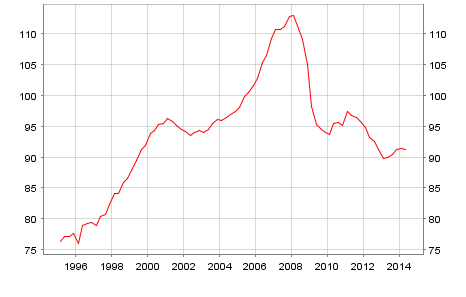

Prior to the crash of 2007 the eurozone had experienced fairly high levels of growth since its creation in 1999. The problem was that most of that growth was based on an unsustainable debt fuelled asset bubble in the periphery countries. The boom, and the assets bubbles, had been fuelled largely by abundant cheap German capital flowing into the European financial system and then into property bubbles and, in the case of Greece, unsustainable government borrowing. The German capital flows were themselves a result of the unilateral decision by Germany to hold down its wage levels and focus on a massive export drive. Unconstrained in the single currency union by exchange rate changes the Germany export machine over powered domestic businesses across the eurozone periphery but this erosion of competitiveness was obscured by the inflowing mostly German capital and the local booms it created. When the global financial crisis hit, and capital and credit flows abruptly stopped, the asset bubbles collapsed and eurozone economies contracted. Without the capital flows the eurozone was extremely deficient in demand, which is unsurprising given the German policy of holding down wages in its biggest economy and thus suppressing demand. All across the eurozone governments, business, banks and individuals were deleveraging, that is paying off their debts by spending less. Under such circumstances it is unsurprising that unemployment has reached such catastrophic levels. It is a classic case of debt deflation.

Eurozone investment levels remain very low. Even in countries that supposedly are ‘very competitive’ such as Germany and the Netherlands, investments by corporations are low and falling. The corporate sector in the eurozone is operating in a very high savings mode as their profits are not being invested in the eurozone but parked as liquid assets inside the global financial system. In the last year alone, Europe’s companies added 50 billion euro to their 1 trillion euro cash pile. It is the corporate surpluses that drive most of the Eurozone’s ever-growing current account surplus. With low inflation, pockets of deflation and no growth, cash becomes the superior investment.

The obvious policy response to the crisis should have been for the eurozone governments with big economies and who can borrow cheaply, above all Germany, to operate a counter cyclical fiscal policy, that is boost government spending to counter the decline in private demand. This would increase levels of public debt but allow the eurozone to grow and this in turn would eventually allow the debts to be reduced. There is nothing catastrophic about government debts as long as the markets will lend money at a reasonably low level of interest. At the same time, given their low starting level, German wages could be encouraged to increase also boosting demand across the eurozone. None of this happened, in fact what did happen was pro-cyclical economic policy, that is policies were adopted that actually deepened the recession and reduced demand and economic activity. This was the result of the flawed architecture of the European Monetary Union.

What’s wrong with the Euro

European Monetary Union (EMU) was implemented in a dangerously unbalanced way with deep flaws in its design. EMU was always seen by it champions amongst the EU elites as primarily a mechanism for driving political union. In the form that it was implemented in 1999 there were simply no built in mechanisms for addressing the sort of grave imbalances which have actually developed. Many of the EMU architects understood this but thought that the resulting inadequacies would be the driver for further EU political union and this would complete the architecture of the EMU and of the Union. Unfortunately the first big test for this flawed architecture was the largest global financial crisis since the Great Depression and the stresses of that event opened up the fault lines in the EMU system into deep fissures which have actually done the reverse of what was hoped, rather than driving member states together it has driven them apart.

The great missing component of EMU was fiscal union, without a single eurozone taxation system and without a single eurozone economic policy the eurozone has been managed by an ensemble of nation states all running their own taxation system in separate silos and with no commitment to the sort of transfers between richer and poorer regions that takes place in other currency zones. In fact there is a deep aversion amongst the rich countries like Germany to any notion of transfers. So welfare and pension systems, wage levels, government budgets, etc all remain managed in a fragmented way by the various member states national government. At the same time the central banks of those EMU member states were brought under the control of the European Central Bank. So the members states were left running their own budgets and economic policies but they had lost control of monetary policy, because they don’t have control of their own central banks, and they cannot control their own exchange rates because they have no longer have their own currency.

Instead of a full fiscal union, which of course would require a full political union, the architects of EMU decided on a sort of generalised regulatory framework. Unfortunately this framework is bonkers. Not only did they build the new currency system on regulations based on the worst aspects of the fairly discredited and narrow economic consensus of the previous three decades (the abandonment of Keynesian fiscal demand management and the reducing of all economic policy to an obsession with reducing inflation through monetary mechanisms) but took it a stage further because what was most feared in the new single currency union was public overspending and inflation. So when the corrective regulatory architecture was built, which is known as the Excessive Imbalance Procedure (EIP), because of these deep fears of the debauchment of the new currency, it was turned into simple binary morality play: Debt and deficits are bad, financial assets and surpluses are good. High wages bad, low wages good. Rising currency good, falling currency bad. However, the way the whole thing is calibrated doesn’t solve imbalances, it deepens them.

Using the EIP, the Commission can force countries into austerity when deficits and sovereign debts are too high, but can’t force them into stimulus or tax cuts when surpluses are high. It can force countries into wage moderation and real wage declines when wages rise too rapidly, but is powerless when wages rise too slowly. EIP will kick in when a country has a negative international investment position greater than -35%, but a high positive position goes unnoticed. It kicks in when inflation is too high, it does nothing when inflation is too low. Every indicator in the EIP is biased this way.

This is not a system that creates a benign equilibrium of healthy growth and full employment. It’s a deflation machine. It works towards an economy with perpetual current account surpluses and suppressed domestic demand, leaving exports as the only possible growth engine, under conditions that put constant upward pressure on the exchange rate of the Euro.

For an economy the size of the Eurozone, that is not a sustainable model. The eurozone cannot become Germany writ large, and anyway that’s not a model for enhancing living standards (nor is it sustainable in the long run). Exports account for only roughly 15% of the Eurozone GDP. Growth of Eurozone exports in line with the worlds international trade and economic growth adds only 0.5% to GDP growth and works to undermine incentives to invest in the (far larger) domestic orientated economy. Under an exclusively export oriented policy regime sectors that service domestic demand have little incentive to invest because export economies are built by suppressing domestic demand, by keeping wages down. With exports at best only taking 15% of eurozone output that means 85% of the economy has no real reason to invest.

What could be done

The problems of the eurozone are fairly clear. A weak banking sector incapable of fuelling economic growth through credit. Insufficient demand caused by massive deleveraging, high unemployment and low wages. Very low levels of investment as firms hoard cash. Governments deploying pro-cycle deflationary economic policy and thus making things worse.

So what’s needed is clear. Higher levels of investment both private and public, an increase of demand within the eurozone and the development of some sort of mechanism to reduce the burden of anti-poverty programs in the weaker regions of the zone.

This would require the following:

Germany should increase its government spending and run a big deficit, this would be relatively inexpensive as yields on German government bonds (Bunds) are currently negative. People are currently paying the Germans to lend to them.

Germany, and the other smaller surplus countries such as the Netherlands, should encourage an upward movement in their wage rates. This will reduce their competitiveness and cause inflation to rise but given the scale of the German trade surplus (the largest in the world) and the development of deflation (falling prices) across the eurozone there is nothing to be afraid of about a smaller trade surplus, an increased deficit, rising prices and increased wages.

Both these measures, increasing German government spending and increasing German wages, would significantly boost demand across the eurozone. This would increase demand for the products of the rest of the eurozone allowing their economies to grow.

At the same time the Excessive Imbalance Procedure (EIP) of the European Commission needs to be completely restructured to avoid forcing pro-cyclical policies on eurozone governments, and should include measures to reduce excessive trade surpluses. This would free eurozone governments to pursue expansionary budget increase even if this results in higher debts, and stop governments from running low wage based giant surpluses.

The shortfall of investment is trickier and until the banking system has completely deleveraged and recovered from the excesses of the pre-crisis period, a process that may take a decade, private investment levels may lag. Yanis Varoufakis has proposed replacing the current Quantitate Easing program (whereby the various eurozone central banks buy governments bonds in the market place) with an ECB financed investment bond program delivered by the European Investment Bank (EIB).

Finally some form of new anti-poverty program should be developed to funnel resources from the richer countries to the poorer countries, that is to the countries whose economies are undergoing the most wrenching social changes induced by an inability to devalue inside the single currency. As well as addressing the humanitarian scandal of acute poverty in Europe it would also increase demand.

The problem is that none of this is going to happen. The Germanys won’t tolerate running a bigger government deficit, it won’t tolerate deliberately reducing its competitiveness by increasing wages and it won’t tolerate funding a pan-EU antipoverty program. The deflation machine known as the Excessive Imbalance Procedure (EIP) won’t be reformed. Instead the long economic malaise of the eurozone will probably continue until it causes a political rupture.

As Paul McCulley and Zoltan Pozsar recently pointed out “The lesson of the 1930s was that orthodoxies are never abandoned by central banks and fiscal authorities voluntarily: when orthodoxies were in conflict with democracy, orthodoxies were overruled by elections and political decisions.”

The problem is that the political rupture could come from the right as much as from the left.