Catalonia’s newly elected regional government announced a road map to independence from Spain in November last year. The response of the Madrid government was to threaten to cut off the financial supply lines to the region. With an acutely cash-strapped Catalonia facing over €4.6 billion of bond redemptions in 2016 this threat from the central government was a high risk declaration of economic war.

Madrid’s strategy was the economic of Mutually Assured Destruction (MAD) because Catalonia’s economy accounts for 20% of Spain’s GDP. International investors would become very alarmed if roughly one-fifth of Spain’s economy suddenly plunged into a deep recession or became ungovernable. Which in turn might prompt investors to question the ability of the Spanish government to service its over €1 trillion in debt, provoking a renewed debt crisis in Spain and probably across the entire weak southern periphery of the eurozone.

Now, that financial and fiscal doomsday scenario might be in the process of coming true. The words “bankrupt” and “default” are being used with disconcerting frequency in relation to Catalonia. The words are even making their way into the headlines of national newspapers, as fears grow that the region could be on the verge of descending into a Greece-like debt spiral. The Catalan government, is trying to persuade Spain to release regional aid money due from 2014 and according to Regional President Carles Puigdemont earlier in March, Catalonia has already missed payments on at least two bank loans.

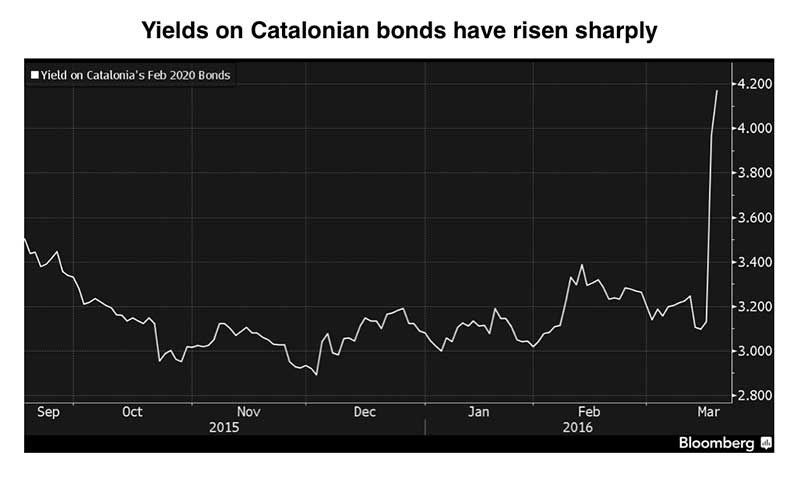

Because the interest payment on government bonds are calculated on their original face value if the price of a bond being traded in the market falls then the rate of return (the yield) rises. For example if a €100 bond is paying 2% interest then it pays €2 a year. If the price of the bond falls in the market to just €50, but it is still paying €2, then the yield on that bond has now risen to 4%. Rising yields in the sovereign bond markets are indicators that the market is losing confidence in the ability of the government in question to manage its debt. Even more damagingly governments have to match the yields in the market place when setting interest rates on any new bonds it is selling (and all governments are constantly selling bonds in order to roll over existing and maturing debt) so a result of the markets losing confidence in the ability of a government to manage its debt is that the price of serving the debt starts to rise sharply. The anxieties of the markets can easily become self fulfilling.

This means that any government with a large debt burden can find its debt becoming unmanageable very quickly if the markets shift against it. This is what happened across the weaker eurozone periphery in 2010 following the eruption of the Greek crisis. The markets suddenly realised that not all sovereign debt in the eurozone was equally safe and the costs of servicing debt in Italy, Spain, Portugal, etc suddenly shot through the roof. Eventually the ECB calmed the financial markets and yields fell but recently eurozone peripheral yields have once again started to creep up.

Catalan bonds maturing in February 2020 plunged last week after it was reported that the region could be placed on selective default by credit rating company Standard & Poor’s. The yield on the debt rose by 21 basis points to 4.18 percent on Thursday after jumping by 84 basis points during the previous session. Similarly dated Spanish debt yields 0.36 percent.

The rating agency Fitch just warned (Google translation) that Catalonia has grave liquidity problems that will require “proactive management of the debt” and “close collaboration with the central state”. Such collaboration in the current political situation is very difficult.

The rating agency Standard & Poor’s downgraded (Google translation) Catalan long-term debt to B+ and its short-term debt to B, with a negative outlook, thus pushing it deeper into junk (emphasis added):

In the next 12 months the political tensions between Spain’s central government and the regional government could escalate, adversely affecting the financial relations between both.

(I)n our opinion, Catalonia’s management of its short-term risks represents a much greater risk than we had previously thought and we have serious doubts about the region’s ability to cope with the short-term liquidity pressures it faces.

Our rating also reflects Catalonia’s weak budget management and high level of indebtedness. We believe that its liquidity levels are inadequate, due to its limited capacity to generate liquidity, which is compensated by the support of the central government…

In our base scenario, we estimate that Catalonia’s internal capacity to generate cash will cover only 40% of the liquidity needs it will have over the next 12 months…”

While none of the rating agencies have downgraded Spanish debt, it doesn’t exactly take a leap of imagination to realize that Catalonia’s liquidity problems could very quickly become Spain’s, especially with the central state directly funding over 60% of the region’s debt. It’s not as if Catalonia is the only region of Spain with serious funding issues. Two out of every three euros of new debt created last year went to the regions, which increased their total debt exposure by 10.3%. The worst offenders — Extremadura and Aragon — increased their respective debt piles by over 15%.

Most of the regions took advantage of the near zero-interest-rate autonomous liquidity fund (FLA, for its Spanish acronym) offered by Madrid’s central government to help cover their financing needs. In the case of Catalonia, the amount of debt it now owes the FLA (€72 billion) represents over 35% of its GDP, 3.5 times more than before the financial crisis, in 2008. But then the scandal-tarnished regional government of Valencia at last count owed the equivalent of 41.3% of its GDP.

The situation has grown so serious that it’s begun to draw the attention of EU institutions. Last week the European Commission broke its silence over the scale of both Spain’s external and internal debt, warning (inevitably) that a new round of austerity will be needed to reduce the economy’s public deficit to the target rate of 3%.

Then, two days later, in a perfect illustration of the absurd contradictions at the heart of Europe’s economic and monetary system, ECB Chairman Mario Draghi unleashed yet another round of extreme monetary measures aimed at making debt even cheaper for European banks, corporations and, yes, countries like Spain.

As the price of debt gets cheaper, it’s hard to resist taking on more. But even with historically low interest rates, the price of servicing the debt can get out of control. Between 2011 and 2015 Spain’s central government managed to spend a whopping €121 billion – the equivalent of 12% of annual GDP – on interest payments. And still, the debt mountain grows, particularly at the regional level. If investors begin to worry about the sustainability of Catalan — and by extension, Spanish — debt, the cost of servicing the debt could explode.

This debt dynamic gives Catalonia an invaluable bargaining chip in its negotiations with Madrid. Barcelona is counting on Spain to step in and supply the funds they need to meet loan repayments coming due this year, betting the central government will be forced to back down because the costs of a default would be greater for the Spanish sovereign.

The calculation in Barcelona is that the more Catalonia struggles to pay, the more concessions it can expect to extract from Madrid — even if the money it receives is then used to pay for its push for independence from Madrid. It hopes to persuade Madrid to drop the interest rate on its FLA debt to 0%, to convert short-term debt into long-term debt and to refund a budget surplus from 2014. Its a big ask, but Catalonia probably has less to lose than Madrid, and the central government will have the weight of the eurozone institutions bearing down on it to force concessions in order o head off a destabilising Spanish sovereign debt crisis.

And it seems to be working, late last week after a meeting (Google translation) between Spain’s Treasury Minister Cristóbal Montoro and Catalonia’s Economic Counselor Oriol Junqueras, Catalonia received part of the budget surplus payments.

In other words, for a brief moment, Madrid blinked.