For the first time in public an official from the IMF has admitted what most observes have known all along, that the various Greek bailouts were not for the Greeks at all. ”They gave money to save German and French banks, not Greece,” said Paolo Batista, one of the Executive Directors of International Monetary Fund in an interview with Greek private Alpha TV on Tuesday.

Batista then went on to strongly criticise not only the eurozone and the European Central Bank but also the IMF and the Fund’s managing Director Christine Lagarde for imposing an impossible debt burden on Greece whilst allowing the banks that had made irresponsible bad loans to have most of their losses written off. Batista said ”The Greek issues were not the best handled by The IMF… They put too much of a burden on Greece and not enough of a burden on Greece’s creditors”

Here is the entire interview, which is in English.

This is what happened. Germany ran a persistent, and deliberately engineered, current account surpluses through much of the last decade, meaning that its households and businesses, in aggregate, earned more than they spent. That meant, inevitably, that Germany accumulated huge savings. German households and businesses deposited their financial surpluses at German banks and fund managers. Those institutions then used these savings to buy assets abroad. Most of them were invested across the eurozone. These included all manner of assets, ranging from the debt of Irish banks, to Spanish real estate firms, to Greek equities. It was largely German banks that helped inflate the various property and asset bubbles that eventually exploded across the eurozone with such disastrous consequences. A lot of the lending to the southern periphery of the eurozone was done via French banks because of their long history of operating in that region but the capital being used for that lending originated as saving in German financial institutions.

Irresponsible borrowers can’t exist without irresponsible lenders. Germany’s banks were Greece’s enablers. German capital fuelled the disastrous property booms across the eurozone.Thanks partly to lax regulation, German banks built up very precarious exposures to Europe’s peripheral countries in the years before the crisis. That was not prudent.

The financial crisis which broke out in the summer of 2007 meant that the various speculative and property bubbles across the eurozone, which had been inflated by German lending, burst. This caused a massive wave of defaults as the creditors of the German banks went bust. German banks had lent a far higher amount compared to their capital base, and were much more dependent on short-term interbank lending in order to stay liquid, than either American or UK banks or indeed those in other member-states of the eurozone.

The German banking regulation system rules allowed German banks to accumulate effectively unlimited international assets in relation to their capital as long as those assets were triple-A rated. The 2007 crisis exposed that many, many loans that were rated as triple A were actually junk. The credit crunch that started in 2007 also saw most interbank lending stop abruptly. As a consequence the short term inter-bank credit that was keeping the German banks afloat suddenly dried up at the same time that it was revealed that the balance sheets of German banks were full not only of worthless sub-prime mortgage-backed securities, but also high risk government and bank bonds issued in the periphery of the eurozone, a region that was experiencing a sudden collapse from boom to bust caused by the cessation of capital flows from Germany. Many German banks were insolvent unless a way could be found to make sure the money they were owed, money that had been lent imprudently on a massive scale, was repaid.

When the euro zone crisis began in October 2009, it was German and French banks that were most exposed in the periphery. More than 40 per cent of the foreign claims on the periphery of Greece, Ireland, Portugal, Italy and Spain were French and German, and the proportion was much higher when considering only members of the euro zone itself. Much of the French bank bad debt was linked to capital that had come from German banks and so if the French loans were written off that would have involved losses for German banks. The German banks were particularly and directly exposed in Spain, Italy and Ireland. By December 2009, according to the Bank for International Settlements, German banks had amassed claims of $704 billion on Greece, Ireland, Italy, Portugal and Spain, much more than the German banks’ aggregate capital. In other words German banks had lent more than they could afford. That was not prudent.

Although German politicians, led by Angela Merkel, have put considerable effort into framing the eurozone’s problems as a crisis for debtors in the periphery, it was just as much a crisis of creditors in the core, especially Germany and France. Although the eventual German moves to support bailouts for Greece, Spain, Ireland and Portugal were portrayed domestically as acts of sacrifice to save the periphery from the consequences of its own fecklessness, they were in reality moves that protected the German banking creditors from default.

The German government had in May 2010, when it supported the first Greek bailout, a simple choice. Either to contribute to a repayable loan to Greece (followed by similar loans to Spain, Italy and Ireland) which would be used to bailout the German banks and which because it was made at a pan-european level would spread the costs spread across the eurozone. Or Germany could directly fund the bailouts for its banks at the national level, a bailout that would not have been repayable, and thus carry all the costs of saving its banks.

By taking the first route, of bailing out the various national governments at a pan-european level, Germany both shared the costs of savings its own national banking sector and did so in the form of intergovernmental loans which could (theoretically) be repaid.

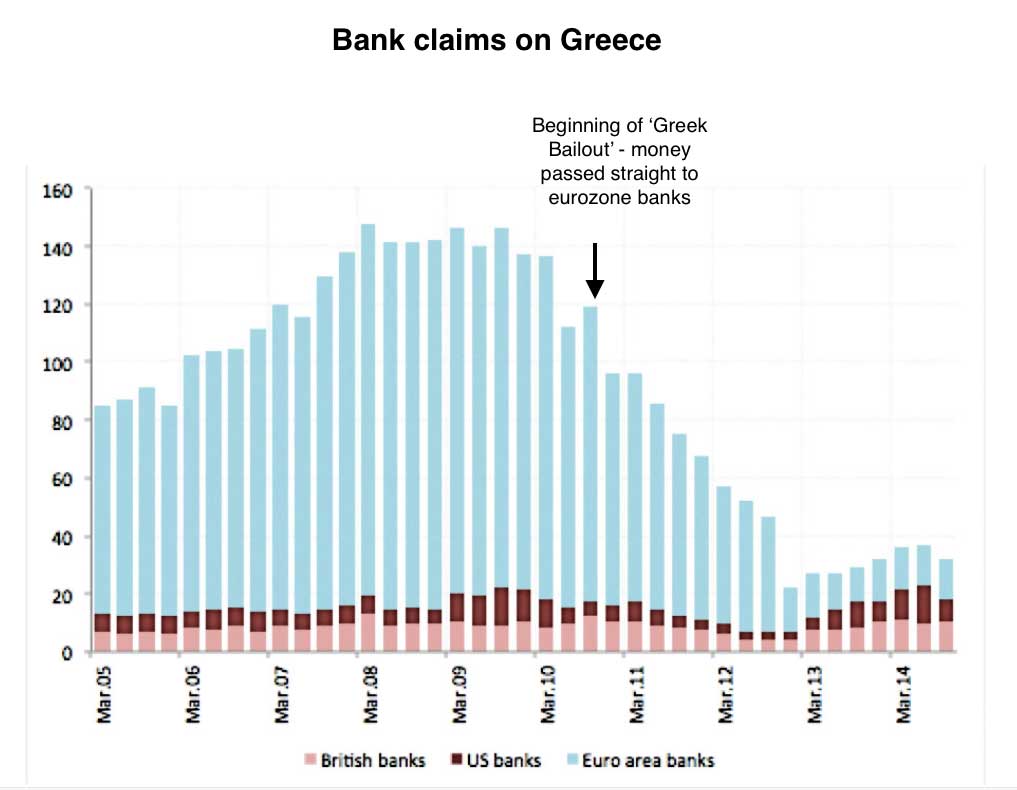

Since the financial crisis and the subsequent bail out there has been a large-scale withdrawal of French and, particularly, German capital out of the periphery. Between the third quarter of 2009 and the fourth quarter of 2012, German exposure to the periphery fell by more than 50 per cent. This was not an accidental consequence of the eurozone crisis. It was what the actions taken at euro-zone level, both by EU governments and the European Central Bank (ECB), made possible.

When the European Union and the European Central Bank stepped in to bail out the struggling countries, they made it possible for German banks to bring their money home. As a result, they bailed out Germany’s banks as well as the German taxpayers who might otherwise have had to support those banks if the loans weren’t repaid. The creditors, the German and French banks, never had to ask for or be given a bailout. They were just repaid automatically as a result of the bailout of the various national governments. The massive bailout of German banks, paid for by other eurozone countries, the ECB and the IMF, was largely invisible because it took the form of debts being repaid by creditors.

It’s hard to quantify exactly how much Germany has benefited from its European bailout. One indicator would be the amount German banks successfully pulled out of other euro-area countries since the crisis began. According to the Bank of International Settlements, they yanked $353 billion from December 2009 to the end of 2011. Another indicator would be the increase in the Bundesbank’s claims on other euro-area central banks. That amounts to 466 billion euros ($590 billion) from December 2009 through April 2012, though it would also reflect non-German depositors moving their money into German banks.

By comparison, Greece has received a total of about 340 billion euros in official loans to recapitalise its banks, replace fleeing capital, restructure its debts and help its government make ends meet. Only about 15 billion euros of that has come directly from Germany. The rest is all from the ECB, the EU and the International Monetary Fund.

This migration of capital back to Germany has of course had a massive depressive effect on the peripheral debtor countries, just as they are required to start generating surpluses so as to be able to repay their bailout loans.

Every bad debt involves an imprudent lender as well as an imprudent borrower. When a debt goes bad both the creditor and the debtor usually suffer consequences. When massive imprudent lending and massive imprudent borrowing occur it is not because of national cultures of prudence or recklessness, it because of large scale economic events, usually in the form of structural imbalances, which cause massive flows of capital to occur.

The EU bailout prevented Greece from defaulting and as a result German banks were saved at a greatly reduced cost to the German tax payer and Greece was loaded with a massive debt burden stretching decades into the future. The result was that Greece did not have what all bankrupts have, which is debt forgiveness.

It was right that the banking sector as a whole was saved from collapse in 2007-2008. The cost of saving those banks has to borne by someone, somewhere. Under the present arrangement the costs of preventing a German banking collapse are being borne by the weakest economies in the eurozone. That doesn’t seem right.