Back in 2000 a large number of countries in the EU decided to embark on a grand and strange experiment. What would happen happen if you had a monetary union without a political union, a shared currency without a shared government? What happens when you have a central bank with no government behind it and national governments with no supportive central bank behinds them?

It turns out you get a union of unemployment and deflation.

The reasons the eurozone has turned out to be a union of unemployment and deflation are the result of some basic design flaws that are pretty straightforward.

Design flaw one: It is very easy to get into debt

A country in the Euro has no control of its monetary policy. Even if a country has a credit system spiralling out of control, even if the country is awash with cheap capital pouring across its borders and into dubious investments, it cannot control the monetary system and it cannot, therefore, stop credit bubbles inflating. For example when Greece had what were in effect negative real interest rates during the boom time, there was nothing it could do to prevent people borrowing money. When added to a government also borrowing to appease special interests, this can be disastrous. The Greek crisis is often presented as being a result of the special weaknesses of Greek political institutions (and those weaknesses certainly made matters worse) but the problems in Greece are the result of deeper weaknesses in the design of the eurozone, weaknesses that have damaged other countries such as Spain and Ireland which developed severe problems even whilst running government budget surpluses.

In addition to not controlling monetary policy a country in the eurozone has very little control over fiscal policy due to the rules determining how much governments can borrow and save. So even if a government wanted to combat loose monetary policy with correctly tight fiscal policy, it couldn’t. There was literally nothing within the rules that for example Spain could have done to prevent the situation it is in now, with around 25% unemployment.

The designers of the eurozone were very worried, even obsessed one could say, about government money creation because they did not want to debase the value of the Euro. But they didn’t bother worrying about private bank money creation and in a modern developed economy the vast bulk of money creation takes place in the private sector, primarily by banks. So when, for example, Ireland’s banks built up huge books of loans, greatly increasing the money supply, nothing was done to stop them. Until it was too late. And the ECB forced Ireland’s taxpayers to pay for it rather than the banks shareholders.

To add to this, one country in the Euro made it a policy to run huge trade surpluses by reducing worker incomes to subsidise exporters. As this was the German economy, the largest in the Eurozone, these surpluses had a large impact on the rest of the countries in the union, notably the less competitive ones. The excess savings from Germany flowed into the poorer countries and, as Michael Pettis wonderfully explains (here and here), there was little they could do other than take on debt. In economic history there is no example of any country or economy which when flooded with vast amounts of cheap credit has not engaged in foolish and unsustainable investment activity.

So overall in the eurozone it was pretty easy to get into debt.

Design flaw two: Once in debt it is impossible to get out of debt

There are three main ways a government has historically gotten out of debt. The first is economic growth; a growing economy means that debt to GDP ratios go down as GDP rises. The second is inflation; if a government’s debt gets too large it can always resort to the printing press to help it out. The third is outright default. None of these options are open inside the eurozone.

Public debt, when it is incurred in the eurozone, is not allowed to be defaulted upon as this is against the EU rules. A limited default was allowed for Greece but this was when the holders were largely Greek banks and pension funds that the Greek government had to recapitalise (i.e bailout) anyway so it didn’t help much. Recently it has been made very clear that Greece will not be allowed to default on its government debt. Although the possibility that there may be some Greek debt relief at some point in the future has been hinted at by the Troika in the meantime the Greek nation has had to endure a ‘Great Depression’ magnitude loss of output and mass impoverishment so any future debt relief will come after the damage has been done. Defaults by nations are not that uncommon, usually such defaults or debt rescheduling are essential elements when a country that has got into difficulties is working to get out of difficulties. But inside the eurozone countries are forbidden, and prevented, from defaulting.

Inflation is also verbotten inside the eurozone. Inflation in Weimar Germany is cited as the reason why Germans are so anti-inflation, and it was German fear of inflation thats was transmitted via the Bundersbank to shape the design of the eurozone and institutions. Whilst the Weimar episode was horrible for people with money, the collapse of the economy caused by payments of reparations is what caused most of the the damage and not the inflation. In fact, the wiping out of all internal debt by the massive inflation in the 1920s helped Germany recover more quickly afterwards. It seems to have been forgotten that it was the depression after 1929, caused by the deflation (due to the attempt to keep to the gold standard), that actually brought Hitler to power. Even after the great Weimar hyperinflation in 1924 The Nazi vote was only 3%, but when the great deflation got underway (caused by a commitment to the Gold Standard which produced a toxic policy of austerity via mechanisms very similar to the austerity mechanisms in the current eurozone) the Nazi vote exploded to over 30% within two years. The important lesson from the inter-war period about money supply was that deflation is really bad, but people seem to only remember only that inflation was bad.

In any case, for whatever reason, the German government and the ECB has shown by its actions that it would watch the Eurozone starve before abandoning a low inflation target. The inflation route has therefore been eliminated.

Then there is the growth route for getting out of debt. Unfortunately that too is out of the question inside the eurozone.

Design flaw three: Once in debt, and unable to get out of debt, economic growth becomes very difficult

In order to have economic growth, the economy needs fresh sources of demand and this means fresh sources of money. Since 1945, typically in the West this has been provided by credit growth, both by the government sector and the private sector. Another method could be printing new money. Whatever the route taken a growing economy needs growing demand and that means more money and more credit. There has been some convincing research that has shown that private debt in the medium to long term is not an efficient way to inject more demand into an economy (the research strongly suggests that for every 100 EUR of private sector debt taken out, only 13 EUR gets added to the demand in the economy). The only effective way to safely inject extra money and credit into an economy is via the expansion of public debt, in fact a healthy growing economy requires a certain level of government borrowing in order to sustain demand. Unfortunately inside the eurozone it is very difficult for governments to safely take on additional debt, and the regulatory structures of the eurozone and the accompanying treaty and legal obligations, are all designed to contain and drive down government debt.

Governments, chastened by the experience of Greece and knowing that they are effectively borrowing in a foreign currency, can not borrow much more. A sovereign nation would have no problem issuing 150% or 200% debt to GDP. The central bank would support them and they would know that real interest rates could not get too high. Not so a borrower of a foreign currency. As soon as there is a fear that debts can not be paid, the interest rates can skyrocket and the economy can be destroyed (this is what happened when the eurozone crisis first erupted in 2010). Greece only had around 100% government debt to GDP in 2007 but the internal devaluation and higher interest rates made it unpayable.

So no sane government inside the eurozone will now borrow much money to run a moderate deficit. In any case, they are bound by the eurozone regulatory structures to a budget deficit upper limit of 3% of GDP, which would in a sovereign currency be a ridiculously low level for a debt limit. Even more insanely Greece is bound to run a primary surplus – they are taking money out of the economy every year.

The private sector is already over-leveraged. Even in the UK and US it is difficult to encourage much borrowing, despite interest rates being at the zero lower bound. The situation is accentuated in Europe because deflation will increase the values of the loans each year and real interest rates, especially in the periphery, are very high. So the private sector will not borrow.

There is therefore very little new money added to the economy from credit and the result is low growth.

The necessity of running a trade surplus

There is one other source of new money each year, and this is the only one available to Greece now. It is foreign trade. Countries must run a trade surplus if they are to get any growth because when a country is running a trade surplus it is effectively importing demand from abroad to make up for deficient demand at home. This, in fact, seems to be the German idea of a perfectly functioning Euro. One where everyone runs a trade surplus. It is certainly the only Euro that is viable without debt disasters.

The policy of the eurozone becoming dependent on running trade surpluses to drive growth is problematic for several reasons.

The first problem is that the only way to run a trade surplus, since tariffs are not possible, is by reducing internal demand. This means effective internal devaluation and reduction of wages. This is a very slow and extraordinarily painful process if done in a world of low inflation. In an economy with inflation it is possible (although often quite difficult politically) to impose a general wage freeze and as inflation bites over time the real value of wages will be eroded. Without inflation it is much harder to erode wages because it requires actual cuts in wage levels. In reality there is plenty of empirical evidence that shows that both wages and prices are quite sticky and that as demand is reduced, prices and wages are very slow to react. Unemployment comes first and takes most of the impact. For example if average Eurozone inflation is 0.5% then a 2% reduction in wage costs (in order to reduce internal demand and create a surplus to be exported) per year means 1.5% deflation is required. The effect on the economy of this is huge and dire.

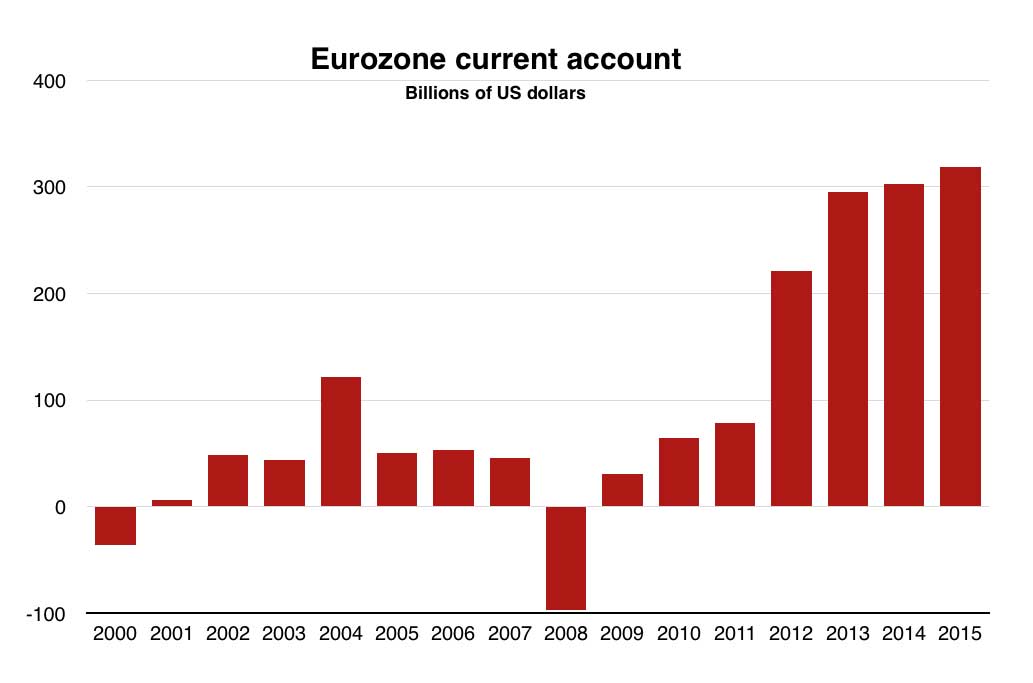

The second problem with the whole of the eurozone shifting over to using a trade surplus as a driver of growth is that Germany already has a huge trade surplus (a structural change enacted during the boom times when it was much easier) and shows no signs of giving up on it. This means that the Euro is already too high for the rest of the Eurozone and the German exports are cheap relative to the rest of the Eurozone. Therefore the level of internal devaluation and wage reductions required across the rest of the eurozone in order to get a trade surplus is very high.

A third problem is that the rest of the world will have to be happy running a deficit to cope with the huge surpluses of the whole Eurozone. As it is a parasitic policy, bringing debt in the countries it sucks demand out of, they may object to this and retaliate or simply contract shutting down the source of eurozone external demand..

This leads to the biggest problem with the eurozone becoming dependent on trade surpluses which is that the more that each country does this, the more the other countries in the Eurozone (and indeed the rest of the world) will react by doing the same. As one country reduces domestic demand so that they buy fewer imports, another country must have fewer exports. That country then needs to reduce internal demand to reduce its imports. This then affects the first country that then needs to further reduce internal demand. This leads to a spiral of internal devaluations and unemployment that could last for many years. In fact it is precisely this mechanism that is a major underlying cause of the post 2008 low growth and stagnation. It is very hard to see how the eurozone is going to generate higher growth anytime soon.

Design flaw four: Inside the eurozone there is no limit to how far a national economy can decline

This fourth design flaw is the worst of them all.

To illustrate the problem consider a poorer region in the UK such as Wales, which has an average income of just £16,600 compared to the UK’s richest region London which has an average income of £43,500. Wales is inside the sterling area currency union. The sterling area however has, unlike the eurozone, a national government and a single integrated national system of taxation and expenditure.

Imagine that for whatever reasons the Welsh economy suffers some sort of severe setback, and that as a result almost all its businesses are forced to close, the private economy essentially collapses, Welsh unemployment shoots up and as a result Welsh tax revenues collapse. Even under such dire conditions there is a lower limit to how far the Welsh economy can fall. Because the UK has a national system of taxation and expenditure, public spending continues in Wales because it is not dependent on local Welsh tax revenues but is funded nationally. So expenditure on social security, pensions, health care, education can all continue uninterrupted and unconstrained by the collapse of the local economy. Local teachers, doctors, nurses civil servants, police, etc all continue to be paid, Welsh pensions and social security benefits continue to be paid. This in turn means that there is local spending in businesses, shops, pubs, entertainment venues. That means local businesses can survive and that means even more local job opportunities, which means even more local wages. The existence of a national system of taxation and spending in the UK prevents the complete collapse of the Welsh economy no matter how bad the local economy gets, and this is done with invisible transfers because there is no special funding for Wales, everything is done in the background via an integrated tax collection and spending system. This means that generally there are no explicit bailout funding programs for Wales, and this means that there are no big political controversies in the rich regions of the UK about the money that flows everyday from the rich regions to the poor regions. The internal transfers from richer to poorer regions in the UK are all but invisible.

Now compare this to the situation of a poor country in the eurozone that suffers an economic setback or crisis. In the eurozone there are no transfers because there is no integrated taxation and spending system. Every member state (which are just regions of the eurozone) has to find all the money internally for its social security, health care and education. When a member state in the eurozone suffers an economic contraction expenditure goes up (because of greater social spending) just as tax revenues fall, and when the member state cuts its spending to keep its deficit within the limits set by the rules of the the currency union the local economy contract even more. The extreme example of this in the eurozone is of course Greece, where the economy has shrunk over a third, more than a quarter of the population is unemployed, all forms of social security have been drastically cut and malnutrition is now a significant health problem.

Given the political realties of the eurozone, whose already thin political and social cross border solidarity has actually been weakened by the crisis of the single currency, it is simply not feasible that a fully comprehensive pan-eurozone integrated fiscal system is going to be in place anytime soon. Such a project is years, more likely decades, away and will probably never happen. And without an integrated fiscal system where most of the taxation and spend currently done by national governments was shifted upwards to pan-european institutions, there is also no prospect of permanent and substantial cross border transfers of wealth from the richer to the poorer member states. So there is no prospect of a fiscal safety net which would prevent or soften the economic decline suffered by economically weaker and peripheral member states. The social consequences of that are disastrous and profound.

Back in 1992 the great British economist Wynne Godley, has this to say in an article entitled “Maastricht and All That” in the The London Review of Books.

“Another important role which any central government must perform is to put a safety net under the livelihood of component regions which are in distress for structural reasons – because of the decline of some industry, say, or because of some economically-adverse demographic change. At present this happens in the natural course of events, without anyone really noticing, because common standards of public provision (for instance, health, education, pensions and rates of unemployment benefit) and a common (it is to be hoped, progressive) burden of taxation are both generally instituted throughout individual realms. As a consequence, if one region suffers an unusual degree of structural decline, the fiscal system automatically generates net transfers in favour of it. In extremis, a region which could produce nothing at all would not starve because it would be in receipt of pensions, unemployment benefit and the incomes of public servants.

What happens if a whole country – a potential ‘region’ in a fully integrated community – suffers a structural setback? So long as it is a sovereign state, it can devalue its currency. It can then trade successfully at full employment provided its people accept the necessary cut in their real incomes. With an economic and monetary union, this recourse is obviously barred, and its prospect is grave indeed unless federal budgeting arrangements are made which fulfil a redistributive role.

If a country or region has no power to devalue, and if it is not the beneficiary of a system of fiscal equalisation, then there is nothing to stop it suffering a process of cumulative and terminal decline leading, in the end, to emigration as the only alternative to poverty or starvation.”

Conclusion

The only way the eurozone can avoid debt crises is by suppressing government spending and deflating the economy of the entire bloc. This has been what has been happening since 2010. So the single currency project has created a low growth zone characterised by high unemployment, stagnant living standards, public sector austerity, downward pressure on wages, deflation and the slow strangulation of social democracy.