Europe experienced twin crises, one in its economy and the other in policymaking. The IMF shares responsibility for both. Its systems for analysing and monitoring the finances of the eurozone did not anticipate the crisis, and its programmes for dealing with the crisis when it erupted made the situation worse. The inaccuracy of its forecasts, given its decades of experience of national defaults, are staggering. The errors of the IMF, which have costs the people of Greece particularly dearly, reflect deep failures of governance and structure at the Fund.

How did it all go wrong for the IMF?

The Fund made many costly and avoidable errors particularly arising from its inadequate pre-crisis analysis of the weaknesses and flaws of the eurozone architecture, its willingness to break its own rules in lending to Greece, and its willingness to accommodate for political reasons the refusal by Eurozone’s politicians to reform the eurozone structures, and the eurozone economy as a whole, reforms that were essential in order to limit the economic implosion in the south of Europe.

The biggest error the IMF made was that it broke one of its most essential rules by supporting a programme in Greece from May 2010 which was inadequate to secure debt sustainability. The Fund is governed by a written constitution and a rule book that means that the Fund is simply is not allowed to lend money to countries if their debt burden is unsustainable. To break the rule is to throw good money after bad, it not only delays the inevitable debt restructuring but by piling more debt on top of bad debt it makes the situation much worse. With every passing IMF Greek progress review since 2010, the Fund has needed to make ever more fanciful policy and growth assumptions to continue the pretence that the debt was sustainable so that the programme could continue.

IMF Greek GDP Projections

| IMF Forecast | Actual Outcome | |

|---|---|---|

| 2010 | -4.0 | -4.9 |

| 2011 | -2.6 | -7.1 |

| 2012 | 1.1 | -7.0 |

| 2013 | 2.1 | -4.2 |

IMF Greek Unemployment Projections (%)

| IMF Forecast | Actual Outcome | |

|---|---|---|

| 2010 | 11.8 | 12.6 |

| 2011 | 14.6 | 17.7 |

| 2012 | 14.8 | 24.3 |

| 2013 | 14.3 | 27.3 |

The IMF did not just get its forecasting wrong about Greece. The IMF’s downward forecasting revisions in the three-year period from April 2010 are astounding for several Eurozone economies. In ascending order, the forecast errors by country were Germany, -7%; France, -7%, Portugal, -10%, Ireland, – 11%, Italy, -11%, Spain, -13%, Greece, -27%, and Cyprus, -27%.

Worse still, the pretence that Greek debt was sustainable took place when everything, including the IMF’s own numbers, was pointing in the opposite direction. Even by their own arbitrary definitions of debt sustainability (120% of GDP by 2020), the Greek programme was unsustainable between the second review (December 2010) until the fifth review (December 2011), which incorporated for the first time PSI (Private Sector Involvement, jargon for a haircut for private sector holders of Greek debt involving debt write off).

The IMF chose over-optimism on debt sustainability rather than making a commitment to making Greek debt sustainable now or in the future, and this pushed Greece into a dire predicament. There is an old IMF rule of thumb that concerns financing a programme, which recognises a simple trade-off between adjustment and financing. The more finance that is made available to an indebted nation, the less adjustment needs to be undertaken. It is sometimes very hard to strike a balance. If the imposed adjustments kills the economy then there may be no equilibrium; things just get worse and worse until the outcome is catastrophic. The problem was that the IMF was encountering a situation in the eurozone which meant that traditional way to escape the vicious circle – through devaluation and private sector debt relief – was much harder because of the currency union. Ultimately the IMF’s attempt to pretend that the Greek debt was sustainable and to avoid debt restructuring was fruitless, private lenders to Greece suffered a scalping, Greece did not have a banking system that could offer any credit to the private sector between mid-2011 and mid- 2013, youth unemployment reached 60%, and the ECB had to intervene massively to keep swathes of the European banking system afloat.

The only circumstance in which the IMF’s rulebook would allow it to lend into an unsustainable debt burden is when there is a commitment to make it sustainable, which in practice means accepting that the unsustainable debt will be partially or complete written off. Had there been greater realism at the start of the Greek programme there would have been a good case for the IMF going along with it. It would have run along the lines of “we expect the Greek authorities and Eurozone to make debt sustainable by first review, and implement by second review”. That would have indicated that a restructuring was on the horizon; markets would have been warned, and the contagion once default occurred reduced by preemptive actions by the ECB.

The second big error, an error that was ultimately political in nature, was that the IMF treated the Eurozone as a partner to be accommodated wherever possible, not as a patient to be cured. As a consequence of this mind-set the IMF enforced asymmetric adjustments imposed only to the peripheral eurozone countries suffering a debt crisis, and ignored both the broken central institutions of the eurozone and the role of the eurozone core surplus countries in the destabilisation of the zone as whole. Late in the day, the IMF made some softly-spoken requests for reform of the Eurozone’s institutions and crisis management systems, such as banking union, fiscal coordination, requests that the European Central Banks (ECB) conduct so called Open Market Transactions (where the central bank buys government debt in the open market), and requests for changes to Eurozone wide policy settings, including the aggregate eurozone-wide fiscal and monetary stances.

Basically the IMF program should have been for the Eurozone as a whole, not just for some of its component parts. Instead, having programs for individual states within Eurozone has entrenched imbalances and given credibility to dysfunctional institutions. Treating the whole Eurozone as the program “country” would have forced the EU to deal with eurozone imbalances and improve institutional structures but it would have been politically explosive. For the IMF to point the finger at the entire eurozone project would have been deeply unpopular in Europe and would have been been viewed as scandalous. This would have been very problematically for the Managing Director of the IMF, Dominique Strauss-Kahn, who had political ambitions within the eurozone.

When the Troika (the EU, the ECB and the IMF) first assembled in 2010 the arrangements were, from the IMF point of view, more than unusual, they were highly irregular. Although the Fund has a long history of lending alongside other official creditors, such as the World Bank and regional development banks, it had always insisted previously on the understanding that it maintains final say, at least concerning the issues in which it has expertise. In the Greek case, not only has the Fund played junior partner to the European Commission it was also sitting alongside the ECB at the negotiating table, facing the Greek team. In typical negotiations with a country seeking an IMF loan, the Fund’s negotiators usually sit opposite from the central bank and finance ministry, in the expectation that the conditions of the loan will oblige the central bank to adopt certain policies. By contrast, the Fund had to acclimatise itself to being the ECB’s confederate in the Athens negotiations and qualms abounded as the first Troika meetings got underway. “This has the makings of a strange dog’s breakfast,” Morris Goldstein, a former deputy director of the IMF’s research department, told the Financial Times. “If a regional grouping can set IMF conditionality, what is the point of the Fund anyway? This could set a very dangerous precedent”.

Part of the problem for the IMF in the Troika arrangements was that the Fund has always been a junior lending partner in the eurozone. The Eurozone has never needed Fund financing for its bail out programs, instead the IMF was brought aboard for political reasons to give weight to the rescue program and for the funds technical know how in running such programs, and without the authority of being the largest funder the Fund’s political position within the troika was weakened.This technical know how, laughably, included the expertise of the Fund in making accurate economic forecasts. The EU institutions always insisted that the Fund play a junior and subservient role to the EU institutions and the ECB.

If the IMF had been involved as the leading partner it would have been in a far stronger position to impose a more coherent package of reforms spanning the entire eurozone, to secure simultaneous adjustment between crisis stricken peripheral countries and the core eurozone countries such Germany and the Netherlands whose massive trade surpluses were a key component in the unbalancing of the eurozone. If, as was the usual situation in IMF interventions, the Fund had been sitting on one side of the table facing the EU, all the eurozone countries, and the ECB on the other side of the table, its could have addressed the structural imbalances that lay at the root of the eurozone crisis and dictated the way the ECB had to change and adapt to deal with the problems of the eurozone and its banking system. With the IMF on one side of the table it could have, for example, challenged Germany about its economic policies which were a key factor in the destabilisation of the eurozone as a whole. But because the funds for the eurozone rescue programs, in Spain,Ireland, Portugal and Greece, were primarily coming from the EU itself the relationships were skewed by the arithmetic. From the Fund’s perspective the impossibility of running the programme using someone else’s money meant it could never position itself in the driving seat. Given that the EU institutions didn’t actually need the IMF funds it would have been far better for the IMF to have not been involved in the first place, which would have meant that when the poorly designed EU program went horribly wrong in Greece the IMF could have been on the outside and better positioned to freely express publicly criticism about how the program was designed. As it is the IMF is now trapped inside the tent and can only piss outward.

As a result of the political comprises and structural defects in the way the IMF role in the Greek crisis was constructed the Fund has acquiesced in allowing the overall reform program in the eurozone to drag along in a lethargic and uncoordinated fashion. The lack of urgency and focus in the eurozone response to the general crisis in the zone and to the specify Greek crisis was largely the result of having too many people around the table when decision need to be made, this tendency to bog down decision making in the EU through the inertia resulting from over large committees was made worse by the ECB and the IMF joining the show.

As a result efforts to encourage bank-recapitalisation in the Eurozone were too timid and too begun way too late, the IMF only finally published its blueprint for euro-wide banking supervision in February 2013.That was clearly too late by a couple of years, and given its centrality to the success of the single currency project it is arguable that banking union should have been in place when the eurozone was first created. The IMF should have flagged up the need for immediate action on a banking union from day one of its involvement in the Greek program.

The Fund’s endlessly adjusted economic projections also reveals a deeper analytical incoherence at the Fund, which reflects a long-standing internal confusion about the circumstances in which austerity works.

The problems caused by the flawed ‘dogs breakfast’, whereby the IMF only sat opposite the Greeks, was compounded by the fact that the Fund has consistently and unequivocally praised German supply-side reforms such as stringent wage restraint, even though the resulting trade surplus was in the context of the flawed eurozone architecture a key cause of the euro-imbalances. This reflects an incoherence and deep flaws in its entire analysis of the eurozone crisis.

The IMF’s inadequate response to the failures of the Greek program

The result of the IMF’s agreement to a flawed program for the Greeks in 2010 has been the devastation of the Greek economy and the impoverishment of the Greek people. The Troika funding for Greece in 2010 and 2011, delivered without any debt restructuring and with no haircut for the creditors, actually made the Greek crisis worse by piling more debt on top of bad debt. There is a strong case to be made that the bail-out, by prolonging the crisis without taking firm action, did more harm than good, and an equally strong case that this should have been expected by the IMF based on its experience of many such national defaults in the past.

In mid-2013 the IMF published a significant and unusual staff report that raised concerns about the quality of the Fund’s work on the Greek bailouts, which began in 2010. Most significantly, the report appeared to acknowledge that the IMF broke one of its most essential rules by supporting a lending programme to Greece from May 2010 that was inadequate to secure debt sustainability.

The IMF’s rejection of its own staff’s mild criticism was both shocking and cavalier. The official IMF response to the staff report was contained in a single paragraph inn the minutes of its Executive Board meeting.

“Directors … agreed that [the report] provides a good basis for all parties to draw valuable lessons … noted … overly optimistic assumptions, including about growth … [and] noted the benefits of a timely restructuring of sovereign debt with the necessary safeguards to contain spillover risks and moral hazard.”

That’s the entire official IMF response to the Greek Debacle. The self critical IMF staff report report was just binned.

Senior IMF management and staff also went on record as publicly rejecting key parts of the criticism of its own staff. In the Wall Street Journal article that broke the story, Christine Lagarde, by then Managing Director of the International Monetary Fund, argued that if the IMF had not tweaked its rules, “it probably would have meant no IMF support at that time.” The head of her Greek team Poul Thomsen reflected “If we were in the same situation… we would have done the same thing again.” And Olli Rehn, economics chief at the European Commission, bluntly rejected the report, noting in an interview with the Wall Street Journal that an earlier Greek public debt restructuring would have jeopardised the euro.

As the Greek disaster has unfolded the IMF has continually rewritten the history of its involvement in an attempt to rationalise and justify its shifting positions. Remember that the in 2010 the programme proceeded on the premise that, on balance, Greek debt was sustainable. This was the clear position of IMF chief Dominique Strauss-Kahn at the time, and of the head of the Fiscal Affairs Department in September 2010, as expressed in a Staff Position Note with the preposterous title of “Default in Today’s Advanced Economies: Unnecessary, Undesirable, and Unlikely”. Instead of restructuring of debt Greece got instead an imposed massive, and ultimately devastating, fiscal and structural adjustment that was designed to be big enough to secure sustainability without a restructuring. Good on paper, very bad in Greece.

Fewer than 18 months after the publication of that position note, the IMF was insisting on a 70 per cent haircut on Greek debt at which point the IMF’s rationale for not restructuring the debt at the start of the program was that restructuring in 2011 could have destroyed the eurozone banking system because the zone lacked proper financial shock absorbers. French banks in particular were highly exposed to Greece. If that was the case, if the IMF had truly judged that the necessary conditions for stability in Europe to have been absent in 2010, why did they not demand at the time that the European authorities take steps to put those conditions in place, as formal criteria for the original loan to Greece? The IMF is simply not authorised to lend on a huge scale when it believes that structural defects will not permit sustainable recovery.

The deeper reasons for the debacle

An immediate complicating problem for the IMF intervention in Greece and the eurozone was that its Managing Director Dominique Strauss-Kahn was widely expected to be the Socialist Party candidate in the looming French Presidential election. With that in mind the last thing Dominique Strauss-Kahn wanted was to be seen as publicly rubbishing the eurozone architecture or imposing politically embarrassing pan-zone structural reforms that would have been deeply unpopular amongst the European elites, particularly in France and Germany. So kicking the Greek can down the road, which fitted neatly with the prevailing culture of the EU, and by denying the need for an immediate debt restructuring and by ignoring the need for structural change in the eurozone, was irresistibly convenient in relation to Dominique Strauss-Kahn’s presidential election ambitions. The cost was of course the impoverishment of the Greek people.

Eventually Dominique Strauss-Kahn’s hobby of sexual predation caused his resignation as the IMF Managing Director at which point he was replaced by Christine Lagarde another leading French politician. This swift swapping of one French politician for another is a symptom of another great problem at the IMF, the weight of western european countries on its board and the domination of its top management posts by western europeans.

Given the domination of the IMF by the countries of the eurozone it was always unlikely that the IMF would rock the boat politically by trying to address the structural weakness of the eurozone architecture. The current management of the IMF is dominated by the western european nations who hold over 40% of the votes on the IMF board. Since its creation in 1946 all eleven of its managing directors have come from a small group of western European countries (one from Belgium, one from the Netherlands, one from Spain, One from Germany, two from Sweden and five from France). BTW the quid pro quo for the domination of the IMF by the western Europeans is that the World Bank has always been led by someone holding USA citizenship.

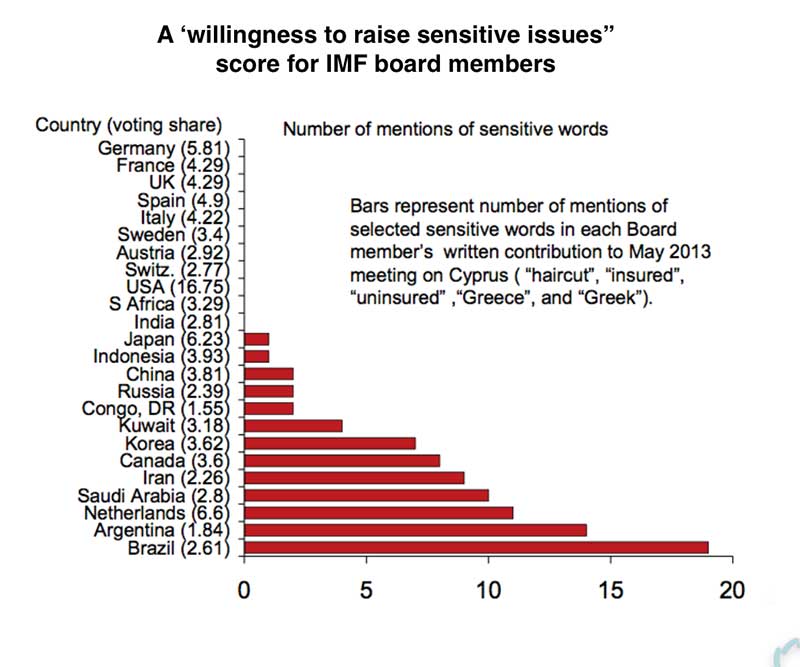

The domination of the IMF by the political appointees from the core countries of the eurozone meant that its decision making in relation to the eurozone crisis and the Greek issue would always be primarily driven by political considerations. With the advent of the euro, eurozone members formally decided to speak with one voice at the IMF Board on virtually all matters. This turned out to deeply hinder the ability of the IMF board in seeing the weakness of the eurozone in advance of the crisis, nor did it help with providing a coherent response to the crisis when it erupted. In a revealing episode the minutes leaked of the discussion in the IMF board about the Cyrpus bail out program, a program closely connected to the Greek one and which was even more draconian (it involved an extraordinary attempt to seize a proportion of private savings held in Cypriot banks). A word-count of these minutes is revealing. None of the statements written by any European Director (other than Cyprus’s representative), or the United States, contained the words “haircut”, “insured”, “uninsured” or “Greece”, (the “insured”, “uninsured” terms relate to the proposed seizure of private savings).

Along with domination by western european appointees and the excessively political nature of the of the IMF governance the actual decision making at the IMF is non transparent. Fundamental rationales behind some of its biggest decision are simply not made public. Why has the Fund pulled the plug on some countries with clearly unsustainable debts (e.g. Ecuador, Russia and Uruguay), yet delayed pulling the plug on others (notably Argentina and Greece)?

The IMF role in the crisis in the eurozone and in the Troika managing the Greek austerity program has exposed the many weakness of an institution long overdue for reform and modernisation. It is hardly surprising that one of the medium term aims of the Syriza government is too convince the EU to use the European Stability Mechanism (ESM) to ‘buy out’ debts held by the European Central Bank and IMF. The involvement of the IMF at this stage is just noise in the system and its removal from the Troika would simplify the political process of coming to some sort of sustainable deal on Greek debt.