Economic and financial crises often lead to an increase in the the concentration of capital, killing off the weaker firms and making big players bigger. In an economic crisis the weaker enterprises fail and either disappear, opening up market opportunities for the survivors, or are acquired by their more successful competitors. This process of post crisis consolidation also happens to finance capital and the 2008 crisis saw banks and finance companies disappear and taken over as the sector consolidated. However as well as increasing the weight of some big banks one extra consequence of the financial crisis of 2008 has been to change the balance of power within global finance capital. Europe’s banks are in retreat from playing a global investment banking role and the US big banks are increasing their global role. In order to understand why this has been a consequence of the 2008 it is necessary to understand the threat that the biggest banks posed to their host economies in 2008.

The 2008 crisis was very dangerous

The reason the 2008 crisis was so scary, potentially catastrophic in the eurozone, was because a lot of the assets these banks were holding were piss poor loans and unsustainable debt in the property asset bubbles in the periphery countries, and the banks had become heavily dependent on keeping their operations afloat by over-night money from the repo markets backed by eurozone government bonds. In 2008-10 first the over night repo credits markets seized up strangling the banks source of liquidity, then large numbers of loans made to the peripheral property markets turned into worthless bad debts, and then the value of the eurozone government bonds held by the banks as financial reserves collapsed in value. Its was triple whammy and in a short space of time numerous banks, including some very big one, found themselves in very serious trouble.

The rapidly depreciating assets held by the eurozone bank in 2008-10, the asset bubbles loans and the government bonds in the periphery, didn’t all have to go to zero of even lose a lot of value to create a severe problem for the banks concerned. Under the Basil regulatory system banks have to keep a certain proportion of their capital as so called tier-one capital, that is in the form of rock solid and highly liquid assets. This tier-one capital could, under the Basil rules operating at the time, be as little as 2 per-cent of a banks assets. When a bank is very highly leveraged it doesn’t take a big chunk of its investment portfolio to go bad, especially when cross-border liabilities and contagion risks are factored in, before the tier-one capital is destroyed, at which point a bank becomes insolvent and either shuts down or is bailed out.

Given the size of the banks in relation to the GDP of their various host national economies its easy to see that they were already too big to bail. They were so big that if they went bust they could take down the entire host national economy. And all this mountain of giant risk was building up inside a currency union where the new European Central Bank didn’t have an explicit duty to act as lender of last resort, where the national central banks could no longer print money at will to deal with a liquidity crisis and where governments could no longer let their currency devalue.

European banks had become too big to bail

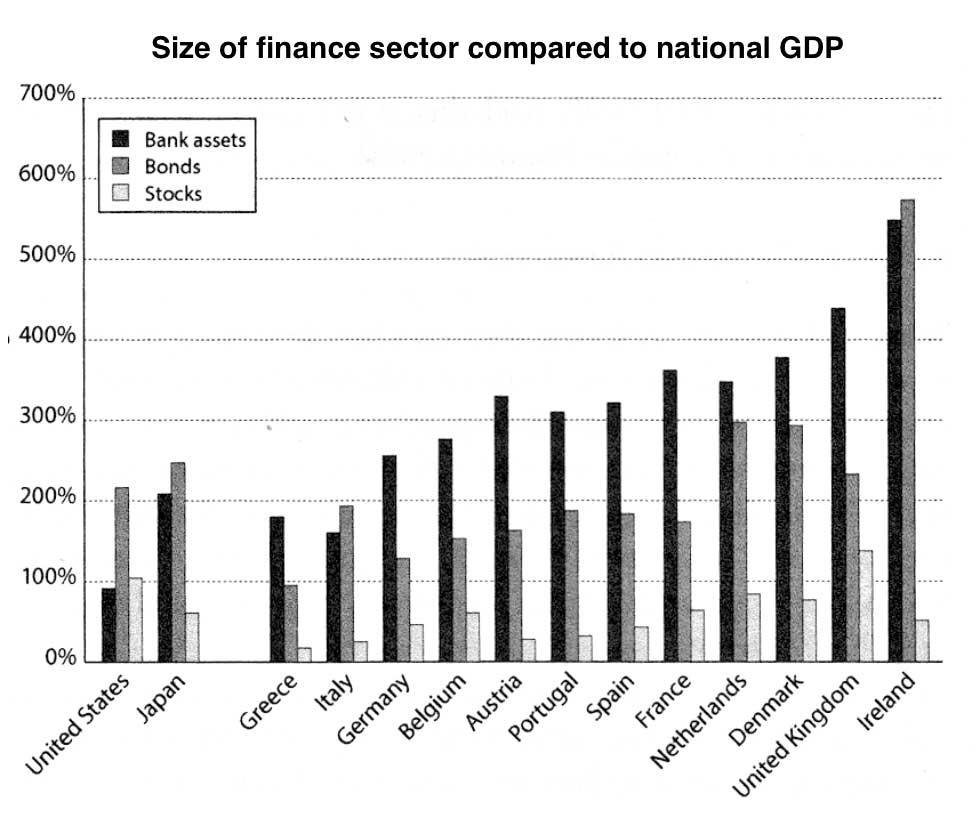

Although an important reasons that the 2008 was so damaging was that the largest banks had become disproportionately huge in relation to their host economies the weight of banks within the host economies was different for the US compared to the various European host economies.

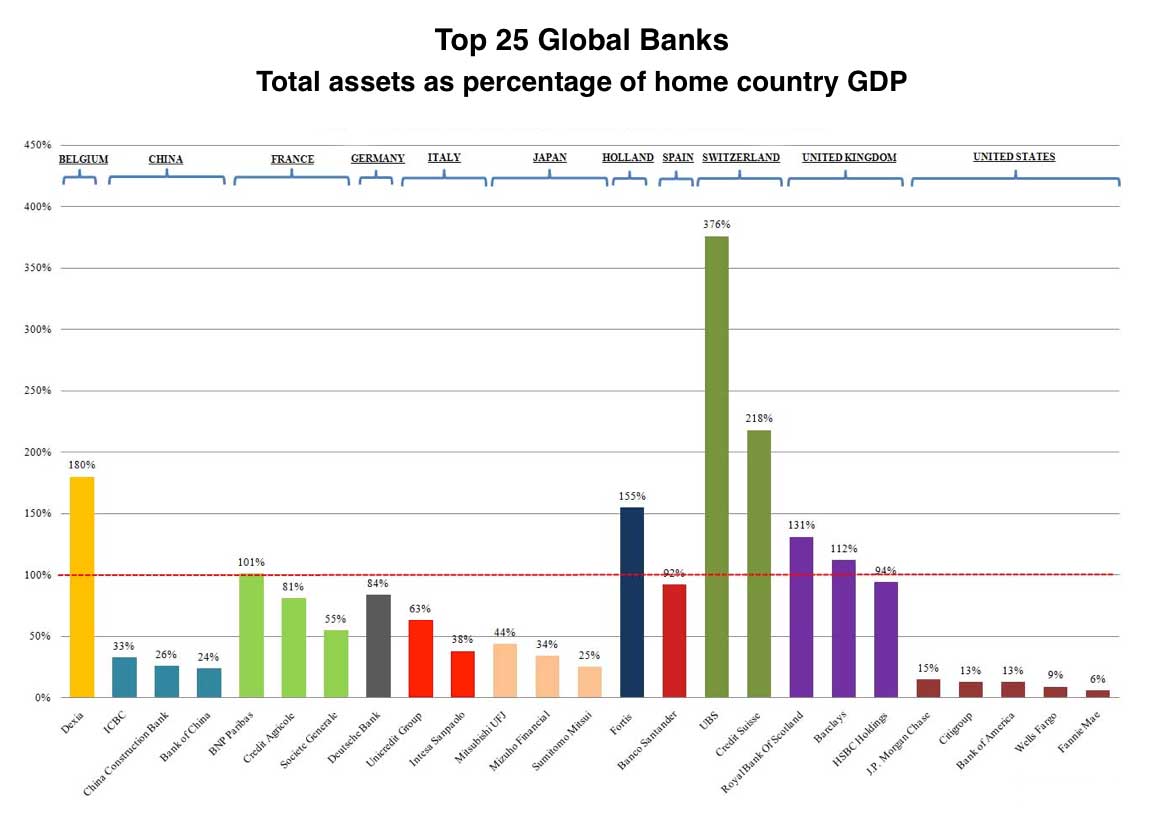

Europe is the most financialised region on earth. The total assets of banks in both the eurozone and the EU as a whole are about three and half times the region’s entire annual GDP. Europe’s top ten banks alone hold assets worth 15 million euro or 122% of the EU’s GDP. In the USA that ratio is 44% (and all US bank assets put together only reach 78% of US GDP). The disproportionate size of Europe’s banks looks even worse when compared with the size of individual host nations. Each of the biggest European banks has enough debts on its own to match or exceed the host countries annual GDP.

If you take the combined assets of the top six US banks in the third quarter of 2008 and add them together, it comes to just over 61 percent of US GDP. Any one of these banks, on average, could then claim to impact about 10 percent of US GDP if it failed. Add the risk of contagion, that one giant bank collapsing might bring down others, and you have what the US authorities saw as a too big to fail problem. When the US authorities did actually let the giant financial firm Lehman Brothers go bust in 2008 it triggered a wave of panic and bank failures, and was seen retrospectively as having been a huge mistake. Although some eurozone banks failed in 2008 most of the immediate post Lehman Brothers damage happened in the anglo saxon financial system, in New York and London, and things in the eurozone seemed better.

However the scale of financialisation was much bigger in Europe than in the US. Remember that there was no unified system of European banking system regulation and support, no EU-wide deposit-guarantee scheme, no EU-wide bailout mechanism for banks, so the costs of supporting banks that went bust in the eurozone would all fall on the national governments. This means that the measure of financialisation, the amount of risk posed by the size of individual banks, must be calculated by reference to the size of national host economies. It is the the proportionate weight of the big banks in the host economies that is the key risk factor. In the fourth quarter of 2008 the result of calculating the size of banks in the various European national economies, and therefore the risks posed by their failure, was pretty scary. Compared to the US the European banks posed a much, much bigger risk to the various European host economies.

In 2008, the top three French banks had a combined asset foot-print of 316 percent of France’s GDP. The top two German banks had assets equal to 114 percent of German GDP. Even after the crisis in 2011, these figures were 245 percent and 117 percent, respectively. Deutsche Bank alone had an asset footprint of over 80 percent of German GDP and runs an operational leverage of around 40 to 1.56 This means a mere 3 percent turn against its assets impairs its whole balance sheet and potentially imperils the German economy and government. One bank, ING in Holland, has an asset footprint that is 211 percent of its sovereign’s GDP. The top three Italian banks constitute 115 percent of GDP. In the apparently financialised UK the top four banks have a combined asset footprint of 394 percent of UK GDP but eurozone banks were running much higher leverage ratios, 35% more than the leverage ratios in the UK and 65% more than the US ratios.

Europe moves to regulate the banks

Having been faced with, and only just avoided, the very real threat of a disastrous cascading collapse of the entire financial system, which would have led to a giant debt deflation depression, Europe moved to reform the banking system to ensure that the danger of an existential banking crisis could be avoided in future. In the UK the Independent Commission on Banking (The Vickers Report & the Parliamentary Commission on banking standards) proposed a fundamental change in the way that banks in the UK are organised. The main change was that a ‘ring fence’ would separate retail ‘utility ‘ banking work from a range of investment banking and corporate finance activities. It also proposed that banks retain higher capital and loss absorbing reserves than was currently required under the Basel rules. The government accepted the Commission’s main proposals. Many of the recommendations of Vickers and of the Parliamentary Commission on banking standards were given effect by provisions in the Financial Services (Banking Reform) Act 2013.

It was a similar story in the eurozone. In February 2012, the Commission established a High-level Expert Group to examine possible reforms to the structure of the EU’s banking sector. In agreement with President Barroso, Commissioner Barnier appointed Erkki Liikanen Governor of the Bank of Finland and a former member of the European Commission, as the chairman. On 29 January 2014, the European Commission adopted a proposal for a regulation to stop the biggest banks from engaging in the risky activity of proprietary trading.

The explicit intention of the the various European post crisis reforms and the new regulations was to rein back the scale of European investment banking to a more supportable level. The main concern has been that a medium-sized European country such as the UK or Switzerland or even a larger country like Germany, let alone a tiny country like Iceland or Ireland, would find a global investment bank to be too large and too dangerous to support, should it get into trouble.

The problem Europe faces is that so long as it is a collection of dispirit states, each of which might have to theoretically carry the costs of baling out a very large bank that it happens to host, the size of European banks have to be constrained for reasons of prudence. The EU, of course, has a much larger scale than its individual member countries, its combined economy is larger than that of the US. But it does not have sufficient fiscal competence, financial integration or a working system of pooled risk . Even with the European banking union and European Stability Mechanism, the limits to the mutualisation of losses, e.g. via deposit insurance, mean that the bulk of the losses would still fall on the home country. Moreover, there is intense rivalry inside the EU as countries compete to become the homes for large financial institutions and as part of its commitment to creating a level playing field there are constraining institutional EU regulatory systems limiting state aid and the establishment of a monopolistic institution which prevent, or at least hinder, state aid to banks and this means that the ‘safe’ size of a European bank is limited compared to the US banks. The recent and deeply flawed EU banking Union https://fromtone.com/the-eus-banking-union-is-a-recipe-for-disaster/) failed to really mutualise the potential costs of bank bail outs and so European investment banks will continue to be size constrained as part of a risk management process.

US investment banking grows as European investment banking shrinks

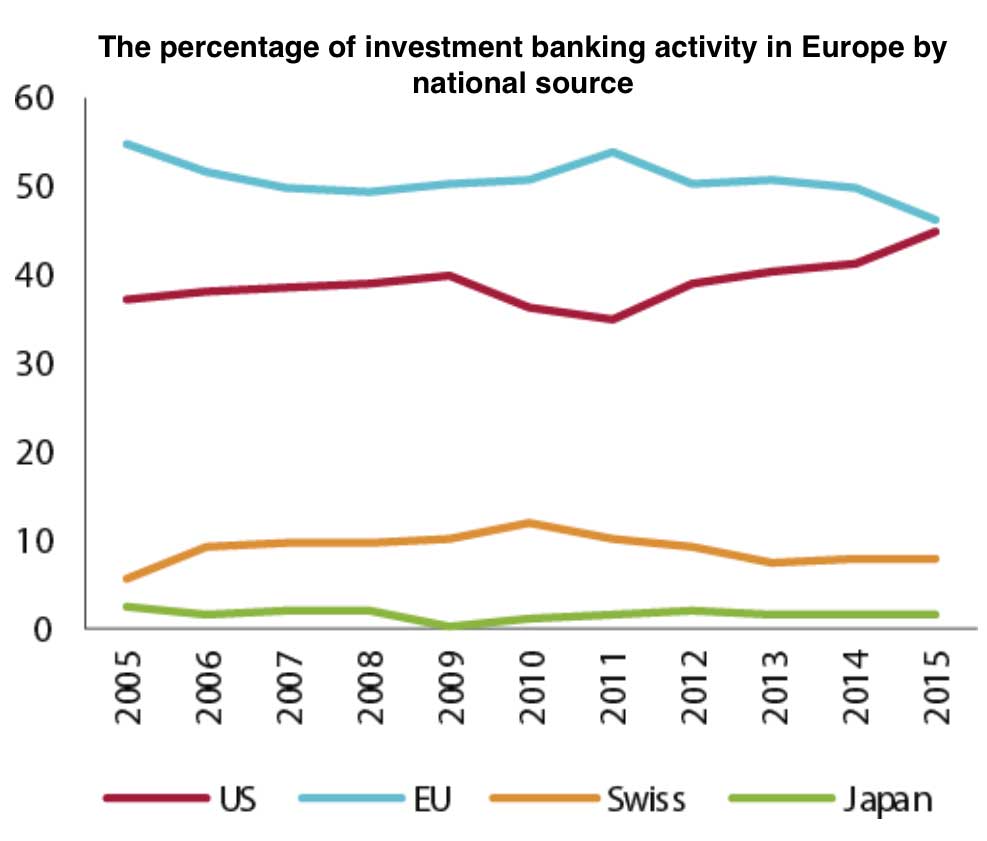

The result of the 2008 shock and the follow up regulatory changes designed to ensure that no European bank would be too big to fail or bail, has been a retreat by European banks from global investment banking. Because the US banks sit inside a much large integrated host economy they can safely grow much bigger than the European banks, and so as European banks have retreated from a global role so the US banks have advanced. The withdrawal of European banks from a global investment banking role is likely to continue. This will leave the five US ‘bulge-bracket’ banks (Goldman Sachs, Morgan Stanley, JP Morgan, Citigroup, and Bank of America Merrill Lynch) as the sole global investment banks left standing. The most likely result is a four-tier investment banking system.

The first tier will consist of these five US global giants. The second tier will consist of strong regional players, such as Deutsche Bank, Barclays, and Rothschild in Europe and CITIC in the Asia-Pacific region. HSBC is in between, with both European and Asia- Pacific roots. The third tier consists of the national banks’ investment banking arms. They will service (most of) the investment banking needs of their own corporates and public sector bodies, except in the case of the very biggest and most international institutions (which will want global support from the US banks) or in cases of complex, specialist advice. Examples of this third tier are Australian and Canadian banks, which support their own corporates and public sector bodies without extending into global investment banking. The fourth tier consists of small, specialist, advisory, and wealth management boutique banks.

Why should it matter if in all the European countries the local banks investment banking activities retrenches to this more limited local role? After all, there are few claims that Australia and Canada for example have somehow lost out by not participating in global investment banking. One area of concern is the growing size and power of US investment banks inside Europe. It appears that the US investment banks are about to surpass their European counterparts in the European investment banking market. This means that in the future it is likely that it will be US banks which largely control the EU investment finance markets.

The Thomson Reuters investment bank league tables rank investment banks by market share and covers four major segments: mergers and acquisitions, equity, bonds, and loans (i.e. syndicated loans). The market share of EU and Swiss investment banks in the European investment markets has declined since 2010/11, while the share of US investment banks (the big five and Lazards) increased from 35% in 2011 to 45% in 2015. It should be noted that the evolution of the regional market shares reflects partly the broader banking crisis dynamics. US investment banks were the first to be hit in the Global Crisis and declined from 40% in 2009 to 35% in 2011, but recovered after the decisive recapitalisation exercise enforced by the US Treasury. The Swiss decline set in in 2010 and the EU decline in 2011. For the time being the European share of the investment banking market remains significant but there is likely to continue to be a divergence between the size of the largest banks in the US compared to Europe.

As the chart above shows shows there is an an underlying structural trend, whereby EU and Swiss investment banks are downsizing. If the trend were to continue, US investment banks would take the prime spot from their EU counterparts soon, possibly already in 2016.

Concerns for Europe

What are the consequences of the rise of US investment banks and the decline of their European counterparts? Why should it matter if in all the European countries, the local banks’ investment banking roles retrench to a more limited local role?

There are perhaps three inter-related arguments why leaving global investment banking to the big five American banks might be problematic:

The first is that this could leave Europe at greater risk from possibly ill-advised American political or regulatory intervention.

In the last crisis, American banks came under intense pressure to reduce their European assets. Having banks able to finance European companies is an essential part of the EU’s economic sovereignty. Europe’s industrial champions will be at a serious disadvantage if they cannot rely on access to capital when their rivals in America and China can. While this danger exists, it was already present before the withdrawal of European banks from global investment banking. Since the US dollar and US financial markets play the central role in the financial system, the US is in a position to enforce its demands on, and to dominate, for good or ill, the international monetary policy scene, whether or not the big five US banks are the only global ‘bulge-bracket’ banks left standing.

Moreover, the European Commission has started to put clauses in directives to give themselves the powers to recognise or not the equivalence of US, Swiss and other countries’ regulation and supervision (e.g. in the Financial Conglomerates Directive). The European Commission and the US authorities therefore set up an EU-US Regulatory Dialogue to discuss bilateral regulation issues. In some cases, the parties reached consensus (e.g. exemption of European banks from the leverage ratio for their operations and recognition of US prudential regulation and supervision as equivalent for financial conglomerates). In other cases, there is no consensus. A case in point is the accounting rules. While Europe adheres to the IFRS (International Financial Reporting Standards), the US sticks to its US GAAP (General Accepted Accounting Principles). With the decline of European banking (both in general and specifically investment banking), will Europe’s negotiating hand in the EU-US regulatory dialogue be diminished?

Another concern is a general one about potential cartelisation if large scale global investment falls into the hands of just five large US banks.

Five big global players is not a large number.So, a second argument is that this will leave global investment banking much more concentrated. Is this not potentially dangerous? Perhaps, but these five banks are still competing quite ferociously, so margins are not rising all that much. The current economic pressures, especially of much greater capital requirements, impact the US banks just as much as on European banks through the Basel 3 framework. What would happen if one, some or all of these US banks decided to follow the European banks and to withdraw from providing global investment banking services in Europe, especially in London?

To a great extent, greater concentration, higher margins, and less liquid markets are the inevitable cost of imposing much higher prudential requirements. If much more capital is required to backstop risk-taking in such activities, then margins must rise until the capital employed in such activities earns the (risk-adjusted) equilibrium rate. This means that weaker competitors must depart, and concentration rises until equilibrium is restored. What would happen if if one or two of the US big five also packed up and left and global investment banking fell under the control of just three or less big US banks while European banking became just parochial? How would this effect geo-political balances?

The third argument is that current developments are inducing European banks more and more to concentrate on their national roles and clients in their investment banking operations rather than taking a wider European stance.

Deutsche Bank and Barclays are the only Europeans left in the top seven for the EMEA market. But they are likely to lose their positions because Deutsche Bank is currently undergoing a major reorganisation and Barclays is in the process of executing the Vickers split. In the investment banking field, the only pan-European banks will all soon be American. This has the corollary, for good or bad, that European national and EU- level authorities, such as the European Commission, will have rather less direct control over them. A key part of the European financial system is slipping out of the grasp of the European authorities.

It seems anomalous that, at a time when the European authorities are trying to establish a banking union and a capital markets union, the effect of their regulatory reforms has been to cause EU banks to concentrate their focus on their national roles, leaving the US banks as the only pan-European actors on this particular stage. But does it matter that the European authorities are left dependent on banks over which they have less ability to subject them to their demands?

There are concerns about the possible deleterious effects of US dominance in European investment banking related to information advantages and soft relationships, whether US investment banks as outsiders are sufficiently knowledgeable about European corporates to be able to operate efficiently or even effectively as organisers of pan European investment projects. Moreover, what is the loyalty of these US banks to European corporates in times of distress? Next, there are concerns about corporate culture. Not long after successfully taming the Global Crisis, US financial firms resumed their practice of paying high salaries and bonuses. In contrast, Europe enacted caps on bonus payments. The large US investment banks are already trying to exempt their high-flyers in London from these EU rules, by arguing that these managers have a ‘global’ role and should therefore be remunerated by international rather than European standards.

The European banking system is downsizing, partly because of on-going problems with balance sheets that are still damaged following the 2008-10 crisis, and partly because Europe is just overbanked. But one consequence is that the big US investment banks will probably become leaders in the global investment banking market, as the Europeans, including the Swiss, retreat. The big five Americans are getting into pole position in the European investment banking market and it is likely that large pan-European investment projects will be increasingly dominated by US fianance capital.

It is unfortunate that the evolution of the EU, and especially the dysfunctions of the flawed currency union system, has managed simlatanoulsy to both weaken and constrain the space for social democratic politics and weaken European finance capital. That’s quite an achievement.