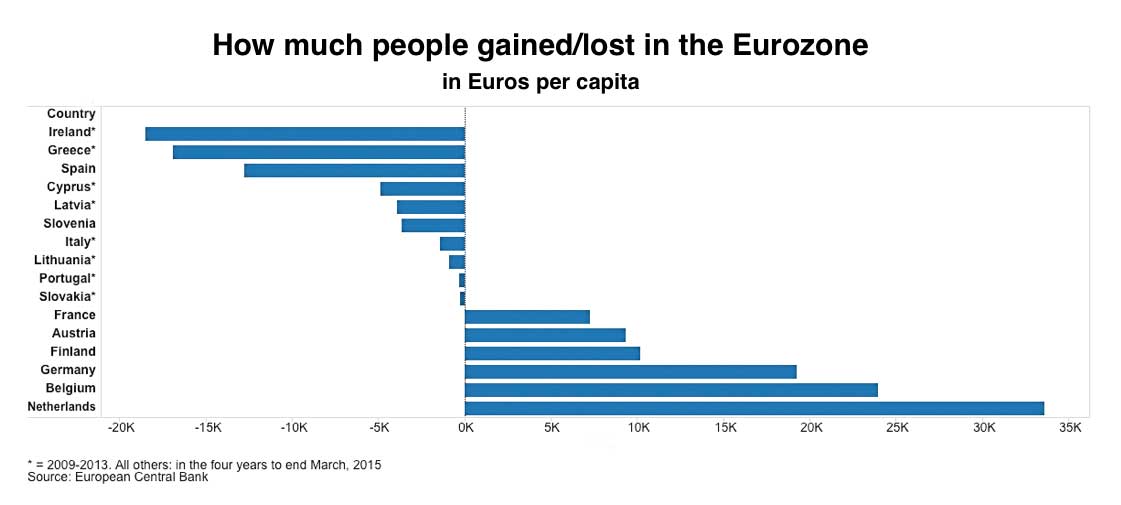

The Irish, Greeks and Spanish lost more personal wealth than any other population in the eurozone in the aftermath of the financial crisis, according to fresh data on household wealth from the European Central Bank.

The research, published ahead of the issuing of a new Household Sector Report next month, shows that Greece lost on average 16,909 euros per person in the four years from 2009 to 2013.

This loss is almost entirely due to the collapse in the domestic housing market and in the sharp depreciation in the value of personal homes.

During the same time frame, the Irish lost on average €18,474 in notional wealth, while in Spain it fell by 12,780 euros in the four-year period up to the start of 2015.

Personal wealth also fell in Italy and Portugal, the two remaining members of the so-called PIIGS periphery, by 1,386 and 307 euros, respectively.

On the other end of the scale, people living in Germany, Belgium and Holland saw substantial rises in their personal wealth in the four-year period up to the start of 2015, by 19,277 euros, 24,005 euros and 33,621 euros, respectively, due in part to a boost in financial investments over that time.

Although overall, the personal wealth increased 6,570 euros on average in the eurozone what actually happened was a polarisation within the eurozone, the periphery got poorer and the northern core got richer. This is exactly what one should expect in a single currency zone with no pan-zone central government and no significant internal transfers. As Wynne Godley pointed out, without more or less full political and financial union the process of impoverishment of the poorer regions in the eurozone could continue indefinitely or until a severe political rupture occurs.