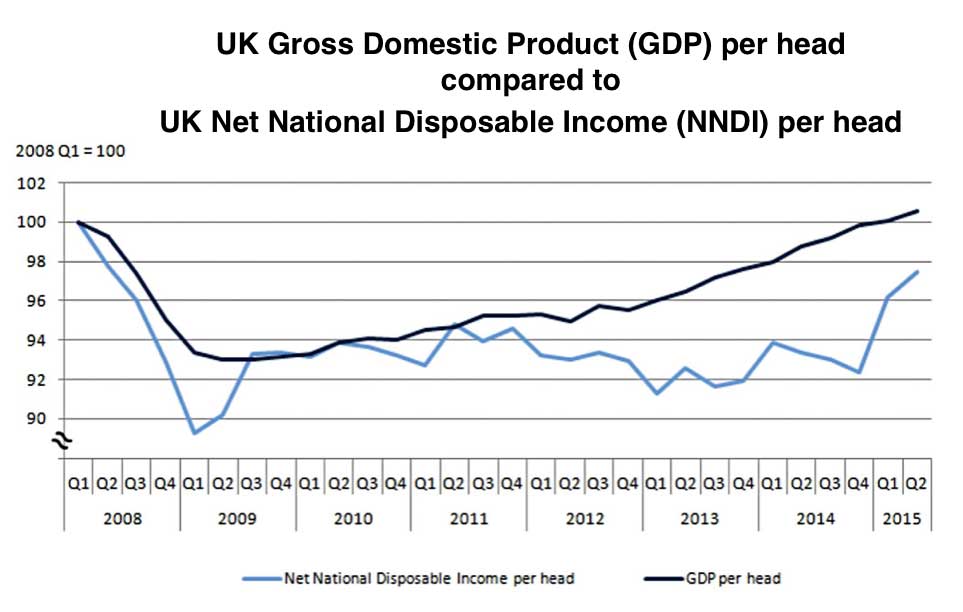

According to the official statistics UK per capita Gross Domestic Product (GDP) is now finally back above its pre-crisis level. Has the damage of the Great Recession of 2007-08 been undone and are the people of the UK now beginning to see their incomes finally grow above their pre-crisis levels? Not quite.

As well as calculating the UK’s GDP the Office for National Statistics also calculates something called Net National Disposable Income (NNDI) which is effectively the national GDP minus income owed to foreign residents plus income from abroad owed to UK residents. Not all income generated in the UK is payable to UK residents, some of the capital employed will be owned by non-residents and they will be entitled to the return on that investment, meaning some of the national GDP will flow abroad. Conversely, UK residents receive income from production activities taking place elsewhere, based on their investments overseas. Calculating the balance of these flows and adjusting the calculation of per capita GDP accordingly produces Net National Disposable Income (NNDI) which gives a more accurate figure for actual income.

According to the Office for National Statistics figures, per capita NNDI is some way below per capita GDP and still short of where it was before the recession. In Q2 2015 NNDI remained 2.5% below its pre-economic downturn level; this is compared with GDP per head which was 0.6% above its pre- economic downturn level in the same quarter. So on balance people’s real incomes are still below the pre-crisis levels even though the per capita GDP figure is higher. This clear in the chart below which shows that while UK GDP per head is finally nudging above the pre-crisis level the Net National Disposable Income figure is still lower. People in the UK are actually still worse off than they were before the crisis.

As the ONS explains in its report “Economic Well-being, Quarter 2 Apr to June 2015” published on 30th of September:

“Since late 2011, there has been a fall in the net earnings of foreign direct investment (FDI) (the difference between earnings from direct investment abroad and from foreign direct investment in the UK). This fall has resulted in net UK foreign direct investment earnings becoming negative for the first time since Q4 2008. This deterioration is attributed to both subdued earnings for UK residents from direct investment abroad and an increase in foreign earnings on direct investment in the UK.”

This means that although UK GDP did indeed go up, once foreign residents took the profits from their investments, the amount left for everyone did not gone up by as much because more of the UK’s income was leaving the country than was flowing into the country.