The Remembrancer is not some weird character in the Game of Thrones, the Remembrancer is real. The Remembrancer is the title of an almost completely unknown but powerful functionary who, when Parliament is sitting, has a special seat to the right of the Speaker in the House of Commons. He also has a mirror image seat in the Lords. His sole purpose is to scrutinise and influence legislation relating to the City of London, and hence any legislation that relates to banks and banking. Nobody elected this representative into our parliament.

The current Remembrancer is Paul Double, a former barrister, and he has been in the role since 2003. In that time, he has not provided a single interview to the media. He has a budget of £5.3m, and a £500,000 staff which includes six lawyers.

The City of London Website describes his activities and duties as thus:

“The City Remembrancer’s Office is one of the City’s traditional offices and dates from the reign of Elizabeth I. The Office holder is one of the City’s Law Officers as well as being a Parliamentary Agent and its Head of Protocol. The Remembrancer is charged with maintaining and enhancing the City’s status and ensuring that its established rights are safeguarded. As long ago as 1685 an order was made for the Remembrancer “to continue to attend Parliament and the offices of the Secretaries of State daily, and acquaint the Lord Mayor with the public affairs and other business transacted there, relating to the City”. In the contemporary context, this work encompasses day to day contact with officials in Government departments responsible for developing government policy, the drafting and promotion of legislation and responsibility for relations with both Houses of Parliament and their Committees including briefings for debates in which the City Corporation or its associated bodies have an interest. The Office also tracks the work of the GLA Assembly, and the GLA’s associated bodies.

The Office [of Remembrancer] acts as a channel of communication between Parliament and the City. In the contemporary context, this means day to day examination of Parliamentary business including examination of and briefing on proposed legislation and amendments to it, regular liaison with the Select Committees of both Houses and contact with officials in Government departments dealing with Parliamentary Bills. Liaison is also maintained with the City Office in Brussels and other Member States’ permanent representations in relation to draft EU legislation.”

In short, while having no vote, the Remembrancer is granted direct access to decision makers and legislators in order to lobby for the interests of the City. Nicholas Shaxson, author of the definitive investigation of the City of London ‘Treasure Islands’, refers to his role as the “world’s oldest institutional lobbyist”.

The City of London (The Square Mile) is the only area of the UK over which parliament has no authority. Instead, it is the Corporation that imposes on Parliament, with the Remembrancer.

There are 25 electoral wards inside the boundaries of the City. In four, the 9,000 people living there are permitted to vote. In the remaining 21, the other 32,000 votes are controlled by corporations, mostly banks and other financial companies. The bigger the business, the bigger the vote: a company with 10 workers gets two votes, the biggest employers get 79. It’s not the workers who decide how the votes are cast, but the bosses, who “appoint” the voters.

The UK is the global leader in financialisation

The problem for the UK, and for any reformer of the City, is that it is now the financial services sector that is essentially holding up the UK economy.

One of the glaring but oft-overlooked ironies of the Brexit debate is the fact that the UK has been one of the biggest beneficiaries of the creation of the euro, despite not being a member of the Eurozone and the UK economy has certainly benefited more than most Eurozone economies.

Since 2001 Britain’s share of key financial markets has exploded. London is now home to almost one-half of the entire global interest-rate OTC derivatives market, compared to 35% in 2001. Its share of global forex turnover increased from 33% to 41% between 2001 and 2014. And its share of global hedge fund assets doubled, from 9% to 18%.

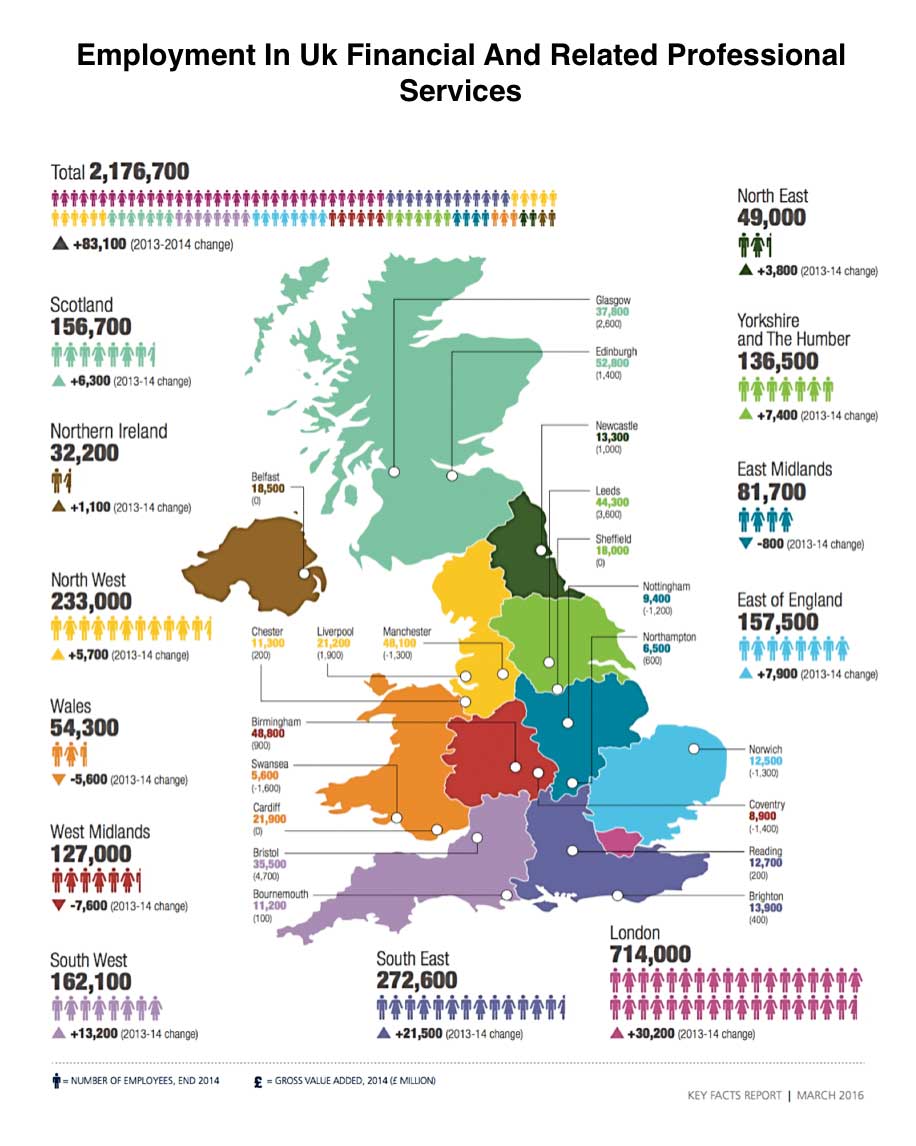

Almost 2.2 million people work in financial and related services such as accounting and law, two-thirds of them outside London, reports a study by the financial services lobby group CityUK. They produce nearly 12% of the UK’s GDP of £1.2 trillion, 11% of its tax take, and a net trade surplus of £72 billion ($104 billion).

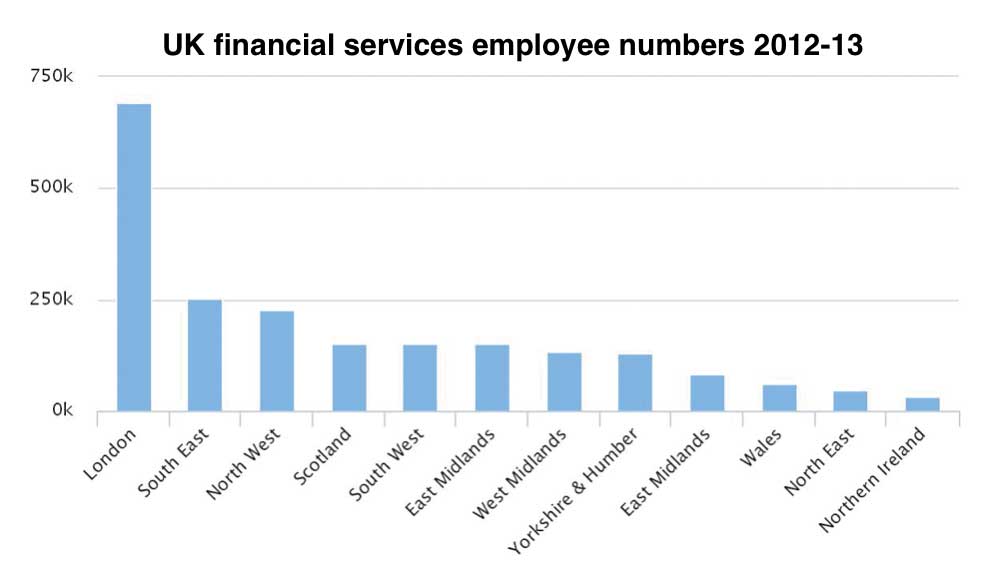

London dominates employment in the industry, with a total of 692,500 working in the sector in 2012/13, up 16,300 on the previous year. However, TheCity UK said that almost half – some 15,000 – of the new jobs created in the industry over the year were in the North West, in total, the North West has 227,300 people working in the sector.

Financial services have taken a third of foreign direct investment in Britain since 2007, most of it coming from the EU. These are some of the reasons why The Economist magazine recently identified the City of London as the place with arguably most at stake in the Brexit debate, especially with its two biggest rivals, Paris and Frankfurt, vying to take a piece of the action.

The fact that Frankfurt is already home to the European Central Bank’s lavish headquarters makes it the most likely contender.

“In the unlikely event that the UK were to leave, Frankfurt would clearly be a main beneficiary,” says Hubertus Vaeth, who runs Frankfurt Main Finance, the industry association for the city’s banks. “Quite a few actors have prepared. Don’t ask me for names, because nobody wants to be quoted on that – but we do know from quite a few players that they have plans for such an unlikely event.”

The square mile has another major attraction: its almost non-existent approach to financial regulation. By having a large base in the City, global financial institutions get the best of both worlds: they get both EU “passporting rights” — that is, the ability to trade across Europe — as well as the ability to engage in activities that would be unimaginable in most other financial jurisdictions, including New York.

It’s no coincidence that London has been home to just about every major global financial scandal of the last decade, including Libor, Forex, MF Global, the London Whale and rampant gold and oil-price rigging.