“The eurozone crisis is as much a tale of excess bank leverage and poor risk management in the core as of excess consumption and wasteful investment in the periphery”

Why stricter rules threaten the eurozone

Simon Tilford and Philip Whyte

The global financial crisis began in 2007 and by 2008 it was causing a series of huge bank failures in the US and the UK requiring massive public bailouts. At first the crisis seemed to be mostly confined to the ‘Anglo-Saxon’ financial world and eurozone politicians and officials could hardly hide their schadenfreude as the tacky US and UK bankers came a cropper. “The US will lose its status as the superpower of the world financial system,” said Peer Steinbruck, Germany’s finance minister. Merkel lauded the values and prudence of an archetypical Swabian housewife in discussing how to clean up the mess made by the US and UK banks, “She would give us some short and correct advice. You cannot live beyond your means in the long run”. The French President Sarkozy felt France should now instruct Britain and America about how to sanitise the financial system, in November 2009 he told Le Monde ‘its the first time in fifty years that France has had this role”.

But then the eurozone crisis erupted in 2010 and it turned out that the eurozone banks had been much less prudent than their apparently reckless anglo-saxon cousins. That crisis has been reported almost exclusively as a crisis of public finance and debt, and is being played out as a conflict between the various nations of the eurozone. In fact the crisis began inside the eurozone banking system and the resulting systemic problems of eurozone banking has enfeebled European investment and credit systems, and is a major factor in the continuing economic weakness in the zone. Other than in Greece the eurozone crisis was not initially a crisis of public spending but rather a crisis of reckless lending by banks, but because of the faulty design of European Monetary Union (EMU) it became a crisis of government debt, of EU economic policy and of poisoned relations between member states. Its aftermath is a very weak European banking system, deflation, massive unemployment and a profound loss of European solidarity. Here is how it happened.

How basic banking works

Banking is an inherently risky business. Banks borrow money, usually short term and more or less instantly redeemable on demand, and lend it long term. Banks that take in customers deposits for example theoretically have to be able to pay back all their customers deposits on demand. At the same time the loans and investments that banks make in order to earn money and turn a profit are usually by nature longer term and illiquid, they can’t often be easily and quickly be turned back into cash. So all banks are vulnerable to bank runs, a sudden rush of customers seeking to withdraw their deposits which causes the bank to run out of cash before it can cash in its loans which triggers a fresh rush of panic and more withdrawals until the bank runs out of money and has to close.

Bank have to balance the risks of making loans against the risk of of not making any or enough profits. Obviously the safest way to ensure against a bank run and a liquidity crisis is to just keep a lot of cash on hand. However Banks don’t just hold other peoples cash but are set up with capital invested in the bank by its shareholders (known as equity) and banks are just another capitalist enterprise created to make a profit for their shareholders. The way a bank makes money is by lending money so the more a bank lends the more money it can make. Cash on its books does not make money for the banks, its dead capital which is earning nothing. So all banks want to maximise the amount they lend against the amount of capital they keep in reserve. The ratio of loans to reserves is known as the leverage of a bank and when a bank has a high ratio of loans to reserves it is known as highly leveraged. The higher the leverage the more profits the bank can make but a high leverage also means low reserves which means higher risks.

Assuming that a bank is going to run at a maximum leverage in order to make maxim profits it will want to insure against running out of the money by having some form of safety net. The banks have a series of safety nets. One way to ensure safety is to make sure that a prudent proportion of its investments can be turned back into cash quickly. Government bonds are usually easy to sell and are considered to be so low risk that holding a chunk of a bank’s investment portfolio in government bonds is considered a basic prerequisite of prudent banking. In fact this preference for government bonds was enshrined in the so called Basil international banking regulatory system (its named after the Swiss town where it is run from) which lays down basic operating rules for banks about what sort of investments are considered high risk or low risk and what proportion of what sort of low risk investments a bank has to keep on its books as reserves. Government bonds are considered very low risk and when the European single currency was set up in 1999 the EU successfully lobbied to have the Basil rules changed so that eurozone government debt held by eurozone banks was considered zero risk and therefore could be used for maximum leverage. Holding government bonds was therefore very attractive to banks because it seemed safe and, most importantly, allowed maximum leverage. Even a small quantity of government bonds could act as security, as collateral, for the banks to make a lot of loans, to operate highly leveraged, and so make lots more money.

Another way a bank can deal with a short term liquidity problem is to borrow money from other banks to balance out its day to day cashflow, and this interbank short term lending is now global and vast. Hundreds of billions of euros/sterling/yen/dollars are lent and borrowed across the global finance system between banks every day in a giant web of short term (often only overnight) loans which are used to make sure that banks don’t run out of cash. This system is absolutely essentially to the operation of the modern financial system It was parts of these short term inter-banking credit systems that froze up in the global financial crisis in 2007-8, and again in the eurozone in 2010-11, in a series of sudden stops which triggered liquidity and solvency crises across the financial system.

For example imagine a bank has lent someone the money to buy a house with a 25 year repayment timetable, a simple mortgage. The collateral for the bank issuing the mortgage is the value of the house, if the borrower defaults the bank can seize and sell the property, and property is (or rather was) considered a pretty safe sort of investment because it usually retains its value. Property was considered so safe that in the Basil regulatory system it was rated only a little more risky than government bonds so banks could lend a lot against their property based assets such as mortgages and so could operate highly leveraged and thus make more money. But mortgages are long term loans and if the creditors of the bank, such as its depositors, suddenly want a lot of their cash back then the bank cannot cash in the mortgage easily so instead it goes to the short term inter-bank credit system and borrows some short term money.

This interbank very short term lending system is known as the ‘Repo Market’ because it is based on the very short term sale and repurchase (hence ‘Repo’) of securities. What happens is that a quick agreement is made via the special repo market mechanisms for a bank that needs cash to sell an asset it owns to another bank that has cash but with the legal proviso that the asset will be repurchased the next day for a slightly higher price. So Bank A sells an asset to Bank B for a 100 Euro (Bank A now has the cash it needs) and then next day Bank A buys back the asset for 101 Euro. Everybody benefited because Bank A got hold of the cash it needed overnight and only paid a low fee for borrowing, and Bank B made a profit on its cash holdings. Of course the whole deal hinges on how safe the asset being used in the deal really is. If for some reason Bank A cannot repay Bank B the next day then Bank B needs to know that it can easily and reliably sell the asset it bought for an amount that will will cover the money it paid to Bank A.

Traditionally the asset type overwhelmingly preferred for this sort of repo market deal was government bonds because they are seen as highly liquid (easy to sell) and almost risk free (governments very rarely default on their loans). However the supply of government bonds is limited by the amount that governments are borrowing and as the scale of international financial transactions grew in the boom years before the crisis the demand for collateral for the repo market also grew. The result was that banks began to use other sorts of assets as collateral in the repo markets and the sort of asset most commonly used was known as Collateralised Debt Obligations (CDOs) which is a fancy name for taking a lot of debts, say lots of mortgages being slowly repaid over 25 years, and bundling them together into one big pile, chopping them up into bonds paying an annual interest, and selling them. These Mortgage Backed Securities or (MBS) were flooding onto the market in the years before the crash and as asset based securities became ever more popular amongst banks assets other than property, such as credit card debts, were also used to create securities in a process known as securitisation, and these new sorts of securities were also being used as collateral in the repo market..

So to sum up: government bonds and asset based bonds, both allow high leverage bank lending and are also ‘fuel’ for the repo market by being used as collateral for the very short term (overnight usually) borrowing that keeps the whole credit system liquid and thus functional.

Here are a couple of videos, the first explains the repo market and the second explains how Mortgage Backed Securities work.

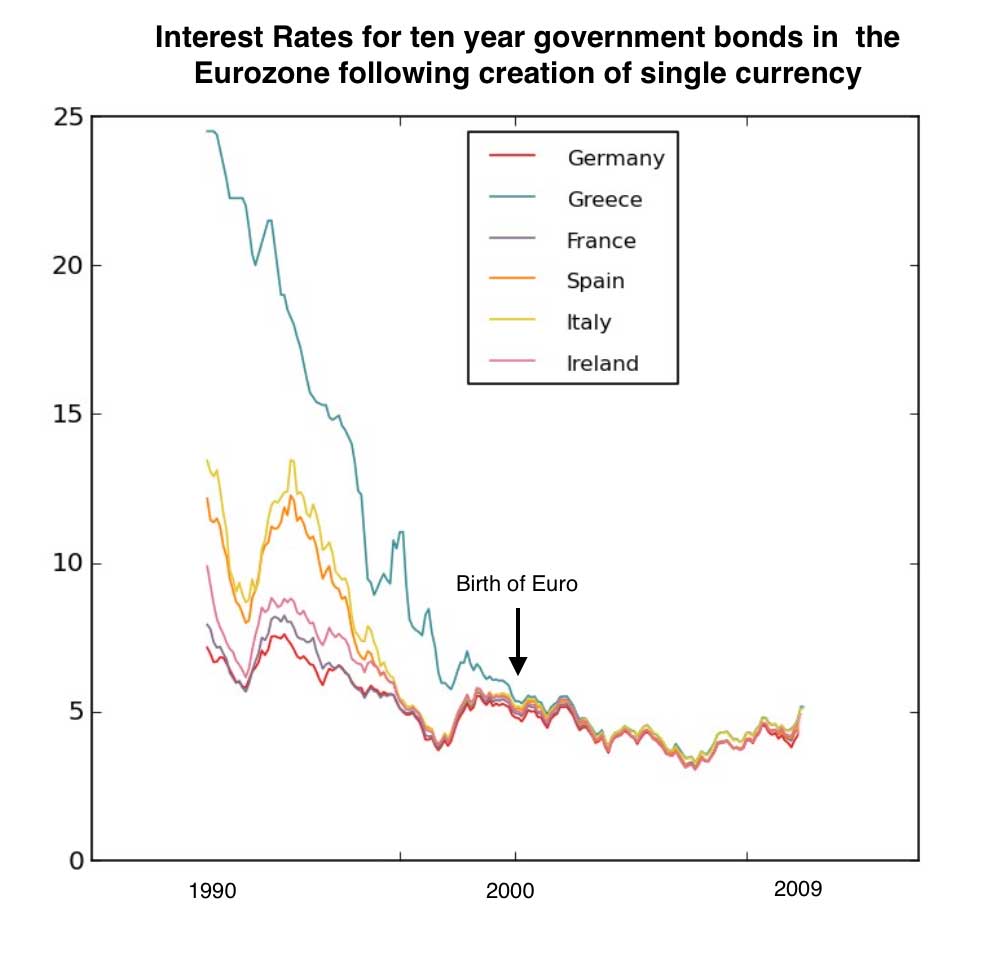

European banking before the crisis: building the doomsday machine

When the eurozone came into existence in 2000 financial markets assumed that the risk of lending money to governments across the eurozone was now pooled, that a Greek, or Portuguese government bond was now as good (as risk free) as a German or Dutch government bond. The result was that very quickly the yields on government bonds across the eurozone harmonised, that means that the cost of borrowing for all governments across the eurozone became almost the same. The graph below shows this process of harmonisation of bond yields, note that Greece joined the euro a little later that the other founding members and so its interests rates harmonised a little later.

Although the European banks are not exactly fans of falling interest rates they saw this new supply of low interest and apparently risk free eurozone government bonds as a really big business opportunity and so they loaded up on them, buying them as fast as they could, thus pushing interest rates on eurozone government bonds even lower. These eurozone bonds had a lot of attractions for the banks. Because under the Basil regulations eurozone bonds were denominated as risk free banks holding them could use them to drastically increase their leverage, and therefore their profits, by lending many multiples of any bonds they held. Also, as we have seen, government bonds were fuel for the repo market and banks holding a lot of such bonds could borrow huge amounts of overnight money at very cheap rates and then lend it long knowing (or at least believing) that they could endlessly roll over the cheap over-night funding. As the 2000s progressed, those supposedly conservative European banks increasingly switched out of safe, local, deposit funding and loaded up on as much short term internationally sourced debt as they could find. After all, it was much cheaper for banks to borrow short term in the repo market than convincing Joe Blogs to deposit their savings by offering higher interest rates on savings accounts.

European banks bought so much short term repo market money that by June 2011, $755 billion of the $1.66 trillion dollars in US money-market funds was held in the form of short-term European bank debt, with over $200 billion issued by French banks alone.These euro banks banks were borrowing overnight to fund loans over much longer periods. Which is a bit risky to say the least. The whole thing only works if the banks borrowing the money on the over-night repo market are sure that they can go back to the market the next day and find banks who are happy to repeat the over-night deal again and again, day after day.

Besides being funded via short-term borrowing on US markets, it also turned out that those apparently conservative, risk-averse European banks hadn’t missed the US mortgage crisis after all. One of the key ingredients of the general financial crisis was the way the system had been destabilised by the spread of complex assets based securities usually made up of packets of property mortgages which, when the US property market collapsed, turned out to be toxic junk. These bizarre and dangerous new financial instruments were usually managed by banks via Special Purpose Vehicles (SPV) which were subsidiary corporations designed to serve as a mechanisms for dealing in, and holding, asset based securities. Over 70 percent of the global SPVs were set up by European banks. Via this new trade the European banks became loaded with US sub-prime junk mortgages. The whole thing was of course obscured by the complexity of the financial system. A Dutch saver didn’t know that the value of their pension fund now hinged on the property market in Wyoming, and German savers didn’t know that their savings earning interest in their local banks were actually being used to to fund property bubbles in Spain.

As we have seen a big part of the repo market short term cheap borrowing, which was the juice that kept the whole system going, depended on banks holding government bonds which they could use as collateral. The arrival of the eurozone had harmonised, and lowered interest rates on government bonds across the zone and banks looked around for ways to increase their income from the bonds they were holding. Although interest rates on government bonds across the eurozone had largely harmonised compared to the wide spreads that had existed prior to monetary union there was still a small but significant difference in yield between the bonds of Northern European governments and those of the periphery.

So, if you swapped out your low-yield German and Dutch debt and replaced it with as much PIIGS (Portugal, Ireland, Italy, Greece and Spain) debt as you could find, and then turbocharged that by running very high leverage ratios by borrowing vast amounts of cheap overnight money, rolled over every night, and then you lent this long to property developers in Ireland and Spain, you would have one heck of a money machine. And the whole thing was apparently guaranteed by the new European Central Bank, based in Frankfurt, which was viewed by the banks as being as good as the German Central Bank writ large, so in other words it was seen as being safe as houses.

Meanwhile the German drive to turn its economy into a low wage export machine meant that the huge German surplus was entering the european banking system as a flood of cheap abundant capital looking for ways to earn a return on investment. This flood of cheap capital was fed into the government-bond-secured-cheap-repo-market sausage machine and out poured even more cheap capital which flooded into the peripheral countries where it was used for property booms, and cheap government and personal borrowing, which sucked in more German imports and so the wonderful money making machine could feed on itself and everybody seemed to be getting richer.

Times were good for the bankers. As the the debt fuelled asset bubble booms inflated in the periphery so more German imports were sucked in causing more German capital to flood into the banks and this could be used to buy the abundant government bonds from PIIGS which the banks could use as collateral to borrow lots more capital dirt cheap in the overnight repo market, lend it long in the periphery, operate a massive leverage ratio, and count the money pile up. What could possibly go wrong?

Too big to bail

The way the financial system grew in size, complexity and weight in the economy in the decades before the crash is known as financialisation. A way to measure the scale of financialisation is to look at the scale of the largest banks in relation to their host country’s GDPs. The size of any one big bank bank in relation to its host economy is a good measure of the scale of potential damage that failure of that one big bank might do to the real economy. If a bank becomes so big that its failure might trigger a systemic failure in the banking system, and deliver a serious blow to the host economy, then it becomes ‘to big to fail’. This means that once banks get to a certain size in relation to their host economy no government will let them fail, they become immune to the normal risk of business failure and bankruptcy and as a result can begin to act even more recklessly, knowing that if it all goes tits up the government will bail them out.

Before the crisis the process of financialisation was seen as a primarily anglo-saxon phenomena, something mostly happening in New York and London, and there had long been a desire by the French, supported by the Germans, to reign in the ‘dangerous’ bankers in London. However financialisation was not just a problem in the anglo-saxon world

If you take the combined assets of the top six US banks in the third quarter of 2008 and add them together, it comes to just over 61 percent of US GDP. Any one of these banks, on average, could then claim to impact about 10 percent of US GDP if it failed. Add the risk of contagion, that one giant bank collapsing might bring down others, and you have what the US authorities saw as a too big to fail problem. When the US authorities did actually let the giant financial firm Lehman Brothers go bust in 2008 it triggered a wave of panic and bank failures, and was seen retrospectively as having been a huge mistake. Although some eurozone banks failed most of the post Lehman Brothers damage happened in the anglo saxon financial system, in New York and London, and things in the eurozone seemed better.

In fact the process of financialisation was worse in Europe than in the US. Remember that there was no unified system of European banking system regulation and support, no EU-wide deposit-guarantee scheme, no EU-wide bailout mechanism for banks, so the costs of supporting banks that go bust in the eurozone all falls on the national governments. This means that the measure of financialisation, the amount of risk posed by the size of individual banks, must be calculated by reference to the size of national host economies. In the fourth quarter of 2008 the result of calculating the size of banks in the various European national economies, and therefore the risks posed by their failure, was pretty scary.

In 2008, the top three French banks had a combined asset foot-print of 316 percent of France’s GDP. The top two German banks had assets equal to 114 percent of German GDP. In 2011, these figures were 245 percent and 117 percent, respectively. Deutsche Bank alone had an asset footprint of over 80 percent of German GDP and runs an operational leverage of around 40 to 1.56 This means a mere 3 percent turn against its assets impairs its whole balance sheet and potentially imperils the German economy and government. One bank, ING in Holland, has an asset footprint that is 211 percent of its sovereign’s GDP. The top three Italian banks constitute a mere 115 percent of GDP. In the apparently financialised UK the top four banks have a combined asset footprint of 394 percent of UK GDP but eurozone banks were running much higher leverage ratios, 35% more than the leverage ratios in the UK and 65% more than the US ratios.

Remember that a lot of the assets these banks were holding were piss poor loans and unsustainable debt in the property asset bubbles in the periphery countries, which was all being kept afloat by over-night money from the repo markets backed by eurozone government bonds. Yikes!

These risky assets, the asset bubbles loans and the government bonds in the periphery, being held by the eurozone banks don’t all have to go to zero of even lose a lot of value to create a severe problem for the banks concerned. Under the Basil regulatory system banks have to keep a certain proportion of their capital as so called tier-one capital, that is in the form of rock solid and highly liquid assets. This tier-one capital could, under the Basil rules operating at the time, be as little as 2 per-cent of a banks assets. When a bank is very highly leveraged it doesn’t take a big chunk of its investment portfolio to go bad, especially when cross-border liabilities and contagion risks are factored in, before the tier-one capital is destroyed, at which point a bank becomes insolvent and either shuts down or is bailed out. Given the size of the banks in relation to their GDP its easy to see that they were already too big to bail. And all this mountain of giant risk was building up inside a currency union where the new European Central Bank didn’t have a duty to act as lender of last resort, where the national central banks could no longer print money at will to deal with a liquidity crisis and where government could no longer let their currency devalue.

2010 and the wheels come off

The financial doomsday machine swings into action.

After the big shocks of 2008 the eurozone banking system had become very, very fragile indeed, it was a mass of dodgy loans held together by a Heath Robinson system of massive over-night borrowing which was dependent on banks being able to offer eurozone government bonds as acceptable collateral. The eurozone banks had taken big hits in the Mortgage Backed Securities markets, credit flows were weak but the repo markets were still working to keep the over-night juice flowing, eurozone government bond interest rates were spreading apart but only gently. Greece seemed to be borrowing heavily and having some difficulty raising money in the bond markets but nothing too drastic. Meanwhile Ireland had offered its six top banks, all of which were in trouble as the Irish property bubble began to burst, an unlimited bail option but the full impact and size of that offer was not yet apparent. Most of the bank failures arising from 2008, and all the big ones, had happened in New York and London and, fingers crossed, if nothing else went wrong then the eurozone elites hoped that they would muddle through. That’s what the EU had been all about, muddling through.

But then the new Greeks government revealed their deficit was much bigger than had previously been revealed and the shit hit the fan.

In the early mid-2000s, Greece’s economy was one of the fastest growing in the eurozone and but this was actually the result of a very large structural government deficit. As the world economy was hit by the financial crisis of 2007–08, Greece was hit especially hard because its main industries—shipping and tourism—were especially sensitive to changes in the business cycle. The government spent heavily to keep the economy functioning and the country’s debt increased accordingly.

Despite the drastic upwards revision of the forecast for the 2009 budget deficit in October 2009, Greek borrowing rates initially rose rather slowly. But April 2010 it was apparent that the country was becoming unable to borrow from the markets and on the 23rd April 2010, the Greek government requested an initial loan of €45 billion from the EU and International Monetary Fund (IMF), to cover its financial needs for the remaining part of 2010. A few days later Standard & Poor’s slashed Greece’s sovereign debt rating to BB+ or “junk” status amid fears of default, in which case investors were liable to lose 30–50% of their money. Stock markets worldwide and the euro currency declined in response to the downgrade. The financial markets were deeply unnerved when it became clear that the eurozone system had no prepared mechanisms for dealing with such problems, that the EU had responded with its traditional policy of kicking the can down the road, and the realisation that the European Central Bank was not set up to be a lender of last resort.

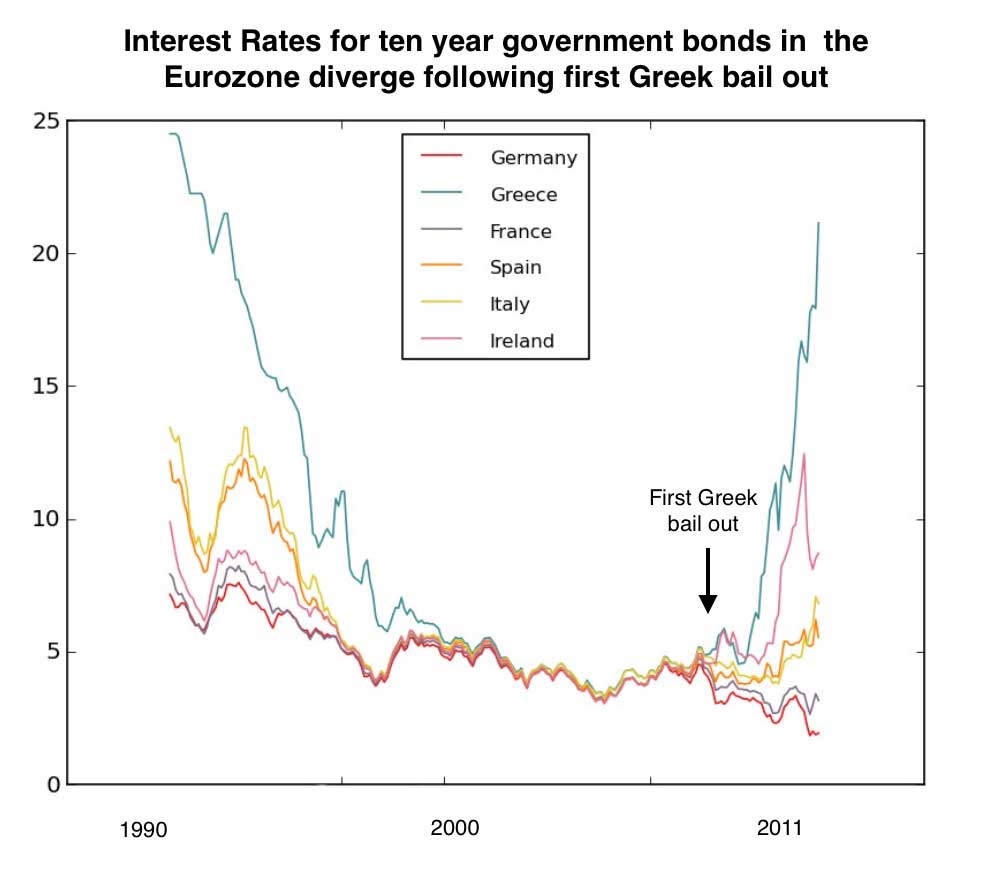

At that point the financial markets suddenly began to view government bonds across the eurozone periphery as being very risky indeed. Interest rates on government bonds in the eurozone, which had been slowly diverging after the 2008 crisis began to separate as interest rates for new bonds issued by the peripheral countries began to steadily climb ever higher (see the graph below) while the rates on German bonds continued to fall. This was very problematic for the repo market short term financing that was keeping the eurozone banking system afloat and solvent. While mortgage-backed securities, the collateral of choice for US borrowers in the US repo markets, were AAA-rated, for European borrowers in the repo markets in London the collateral of choice was AAA-rated European sovereign debt. Just as US borrowers needed a substitute for scarce T-bills and turned to AAA mortgage bonds, so European borrowers had too-few nice, safe German bonds to pledge as collateral since the core banks were busy dumping them for periphery debt. So they had increasingly been pledging the periphery debt they had purchased en masse, which was, after all, rated almost the same, a policy that was turbocharged by an earlier European Commission directive that had helpfully “established that the bonds of Eurozone sovereigns would be treated equally in repo transactions” in order to build more liquid European markets. By 2008, PIIGS debt was collateralising 25 percent of all European repo transactions. And now the value of government debt PIIGS was plummeting as the market ran away from periphery debt as fast at it could.

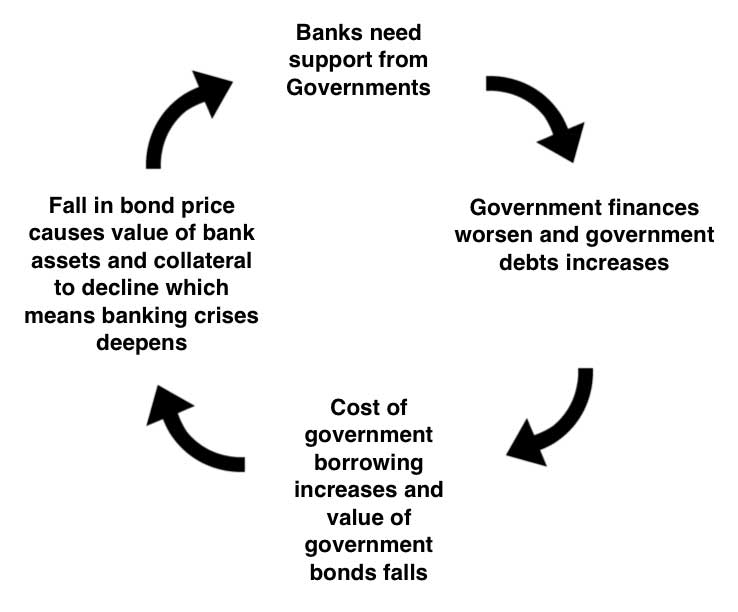

As investors fretted about European the value of eurozone government bonds, credit-ratings agencies started to downgrade various eurozone government’s credit ratings, and their bonds went from AAA to BBB and worse. When this happened eurozone banks needed to pledge more and more of these sovereign bonds to get the same amount of cash in a repo market deal. Unfortunately, with around 80 percent of all such repo agreements using European sovereign debt as collateral, when those bonds fell in value, the ability of European banks to fund themselves and keep their highly levered structures going began to evaporate. If the eurozone banks had been more prudent in the years before the crisis, if they had kept portfolios of better assets, if they had resisted the urge to super charge their leverage ratios, then the banks might have been able to withstand this sudden loss of funding, but as well as probably worthless US mortgages cluttering up their books, European banks were stuffed full of other rapidly devaluing periphery assets. The exposures of eurozone banks in the eurozone periphery, the regions that had felt the full force of cheap credit flows, abundant German capital and asset bubbles, were astonishingly high. By early 2010, Eurozone banks had a collective exposure to Spain of $727 billion, $402 billion to Ireland, and $206 billion to Greece. French and German bank exposures to the PIIGS were estimated in 2010 to be nearly $1 trillion. French banks alone had some $493 billion in exposures to the PIIGS, which was equivalent to 20 percent of French GDP. Standard & Poor’s estimated French exposures to be as high as 30 percent of GDP, all told. Again, the vast majority of these exposures were private-sector property lending in Spain, and the like. It is absolutely essential to be clear in understanding that only a small proportion of all these bad debts and over leveraged dodgy deals was the result of public spending or government debt. But what mattered back in 2010 was how levered these banks were and how important those sovereign bonds were for funding these banks. Once these bonds lost value, European banks increasingly found themselves shut out of US wholesale funding markets at the same time that US money markets began dumping their short-term debt. What happened in the United States in 2008, a general “liquidity crunch,” gathered pace in Europe in 2010 and 2011. A vicious circle was created.

Then things began to happen very quickly as the repo market short term money greasing the wheels suddenly stopped flowing because nobody wanted accept either peripheral eurozone government bonds or property based securities as collateral, and the interest on government bonds in the periphery went through the roof. In Ireland the banks cashed in the massive IOU the Irish government had offered, to unconditionally bail out all and any Irish banks, causing Irish government debt to head for the stratosphere, in Spain the government had to bail out almost the entire banking system because the property market had collapsed. Both Ireland and Spain needed bailing out at an EU level because their banks were too big to be bailed out by their host nations so funding the failed banks had bankrupted the nation. Then Portugal and Italy also needed bailing as the sky rocketing bond interest rates made their debt burden unmanageable. Then Cyprus, an island whose economy was based on exceptionally dodgy banking, went bust.

Through out all this the eurozone institutions floundered from one crisis to another undermining confidence and never doing enough to actually resolve the crisis. The problem was that the eurozone had given up all the usual shock absorbers that can prevent a crisis from becoming too deep, such as central banks that can print money to bail out banks, and an independent exchange rate that can be adjusted. Because monetary union had gone ahead without an accompanying political union there was no established mechanism or acceptable policy framework for making transfers between richer and poor nations. There was also no way to set economic policy at an eurozone level by, for example, reining in the absurdly destabilising German low wage high export economic machine and forcing Germany to reflate. Instead the eurozone elites and institutions pasted together endless last minute deals and arrangements to get the money, in the form of debt and not transfers, to various national governments who could pay it to the banks to stop them going bust and thus stop them bringing down the entire European, and a good part of the global, economy.

Meanwhile, the European Central Bank, the institution that was supposed to stabilise the system, turned out to be a not very good facsimile of a central bank, lacking many crucial features that real central banks have. It exercises no real lender-of-last-resort function instead it is constituted to fight inflation and so had no powers, policy frameworks or systems in place to combat deflation. While the US Fed and the Bank of England, real central banks, can accept whatever assets they want in exchange for however much cash they want to give out to ailing banks, the ECB is both constitutionally and intellectually limited in what it can accept. It cannot monetise or mutualise debt, it cannot bail out countries, it cannot lend directly to banks in sufficient quantity. It’s really good at fighting an inflation that does not actually exist, but confronted by a very real and very big banking crisis, it was almost completely useless. Since the crisis of 2010 the ECB has been developing new powers bit-by- bit throughout the crisis to help the European banking system, and the real economies of the eurozone, to survive, but its capacities are still quite limited.

So that’s how a bunch of insanely reckless bankers conned themselves into thinking they had invented a money making a machine, and then transformed the giant mess they made into a government debt problem, unleashed a crisis of EU governance and legitimacy, as well as impoverishing a large portion of the population in the eurozone periphery. The eurozone remains full of zombie banks, banks so stuffed with bad debt that although they are still walking they are actually essentially dead. Meanwhile the idiotic and rigid deployment of a set of single currency rules designed to combat inflation during a time of deflation is relentlessly suppresing growth in the real economy. Sorting out this mess will take years