Ireland is the Stakhanovite of the Troika. The accepted narrative is that the Irish, unlike those untrustworthy Greeks, realised the errors of their ways, accepted an EU/IMF Programme of Financial Support and implemented difficult reforms, and have since been rewarded by a surge of economic growth.

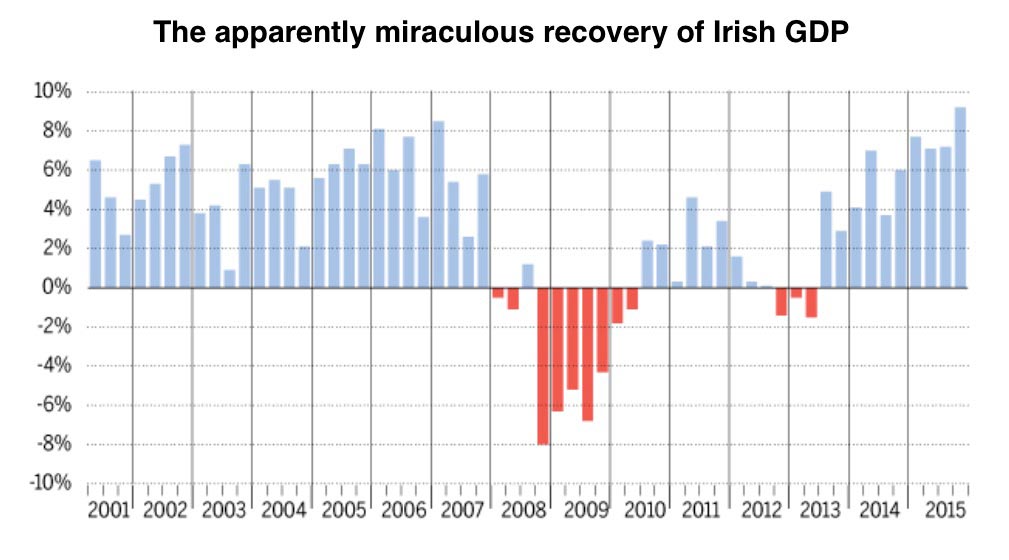

Ireland began to post impressive figures for GDP growth not long after the crash and became the star of the eurozone recovery. Then last year (2016) Ireland posted an astonishing GDP growth rate of more than 26 per cent which is nearly three times the highest level recorded during Ireland’s Celtic Tiger boom years in the early 2000s. At this point many economists became deeply sceptical, “Leprechaun economics,” tweeted Paul Krugman, the Nobel Prize-winning economist. Tom Healy, director of the Nevin Economic Research Institute think-tank, said: “I don’t know if even Soviet Russia in the 1930s exceeded these figures.”

In July 2017 came the announcement that most economists were expecting, that because GDP was no longer an accurate measure of Irish economic activity (for reasons explained below) the size of the Irish economy had been recalculated and it was now estimated it to be 30% smaller than previously claimed. Oops!

Background

Prior to 2008 Ireland’s economy was one of the hottest in Europe, earning it the label of Celtic Tiger. Apparently GDP growth from 1991 to 2001 averaged seven per cent, lifting Ireland from one of the poorer countries in the European Union to one of the richest by 2006. The runaway growth caused housing prices to double from 2000 to 2006. Prices continued to soar afterwards as tax incentives and poor lending regulations allowed a massive property bubble to form. This in turn inflated the entire Irish banking system so that by the time of the crash the Irish banking system was five times as large as the Irish economy.

The resulting collapse hammered the Irish economy. GDP shrank to a bottom of US$220 billion in 2010, a 22-per-cent contraction from US$274 billion in 2008 (even if, as we shall see, GDP is not an accurate estimate of the actual size of the Irish economy, relative changes in GDP over time is useful in estimating the impact of events like the crash).

In late 2010, the Irish banks were under severe stress. With international depositors pulling their money out, the banks became heavily dependent on the ECB for emergency liquidity support. A ‘normal’ central bank would have responded to a liquidity crisis in the banking system by offering liquidity support, and should have offered as much as was required to prevent a catastrophic widespread banking failure. Acting as a lender of last resort is a core function of ‘normal’ central banks. But the ECB is not a normal central bank. The ECB acts as the democratically unaccountable steward and manager of the eurozone economy and as such it expects national governments to implement its economic and fiscal policies irrespective of the expressed wishes of any national electorate. So the deployment of liquidity support during the financial crisis became a key political mechanism by which the ECB could intervene in members states domestic politics and enforce changes to economic and fiscal policies. See my previous article “One bank to rule them all: The ECB and European democracy”, the ECB did the same thing – threaten to crash the banking system for political reasons -in Spain, Italy and Greece.

The Irish government itself actually had sufficient cash on hand at the time of the banking crisis to finance the country for about nine more months and was not at the time seeking bail out funds from the EU or IMF so the ECB had no leverage to force its desired policies on the Irish government. The ECB decided that it wanted to reshape the politics of Ireland so the then ECB President Jean-Claude Trichet wrote to to Brian Lenihan, Ireland’s finance minister at the time, to say that the position of the central bank’s governing council was that it was “only if we receive in writing a commitment from the Irish government” to seek international assistance “that we can authorise further provisions of ELA to Irish financial institutions.” He was referring to Emergency Liquidity Assistance. Without ELA the Irish banking system would collapse and the only way the Irish government could stop this happening was by providing massive financial support.

The reason the ECB was insisting on a bail out of the banks via the Irish government, effectively bankrupting the Irish state, was so that the the Irish government would have to ask for a bailout package from the EU and the IMF and as a result would forced to submit to a program of supervision meaning that the ECB would gain leverage over the Irish government in order to seek specific changes to the way Ireland was being governed. In the letter, having used the threat of withholding financial support for the Irish banks (and thus effectively threatening to crash the Irish banking system) Trichet, the ECB president, then instructed the Irish government to make a commitment to undertake “decisive actions in the areas of fiscal consolidation, structural reforms and financial sector restructuring” in agreement with international partners. Faced with ECB threats to withdraw funding and thus trigger a full-scale banking meltdown and the insolvency of the government, Ireland quickly agreed to enter an EU-IMF supervision program.

The Irish ‘miracle’ recovery

The crash of the Irish property market, the insolvency of the financial system, the massive public bailout and the EU/IMF imposed austerity program all combined to drive the Irish economy into a severe contraction. Unemployment soared, incomes fell and it is estimated that around 300,000 Irish citizens (just over 6% of the population) emigrated seeking work .

But then things seemed to improve. Unemployment fell (helped significantly by mass emigration as mostly young people left the country) and economic growth appeared to surge as Ireland posted increasingly impressive GDP growth rates. In fact a large part of this claimed economic growth was derived from Ireland’s role as a hub for global corporate tax management. Companies based in Ireland were adding more assets to their operations there to take advantage of its low corporate tax rate, because of tentative moves in the US and internationally to reform the way companies are taxed. More and more companies were posting more of their economic activity through Irish shell companies in order to avoid tax and even though the real economic activity that was appearing on Irish books was actually happening in other countries the effect was to inflate Irish GDP statistics, and both the Irish government and the institutions of the EU were happy to claim credit for the apparent miraculous turnaround.

Last year’s claimed 26% increase in GDP was the final straw and pretty much everyone, outside of EU cheerleaders, began to express a deep scepticism in the statistics. Finally the Irish Central Statistics Office began to reexamine how GDP was calculated and in July 2017 it released its report which was a bit of a bombshell. The Irish economy according to the new measuremsnt by the Irish Statistics Office is about a third smaller than expected. The country’s current account surplus is actually a deficit. And its debt level is at least a quarter higher than taxpayers have been led to believe.

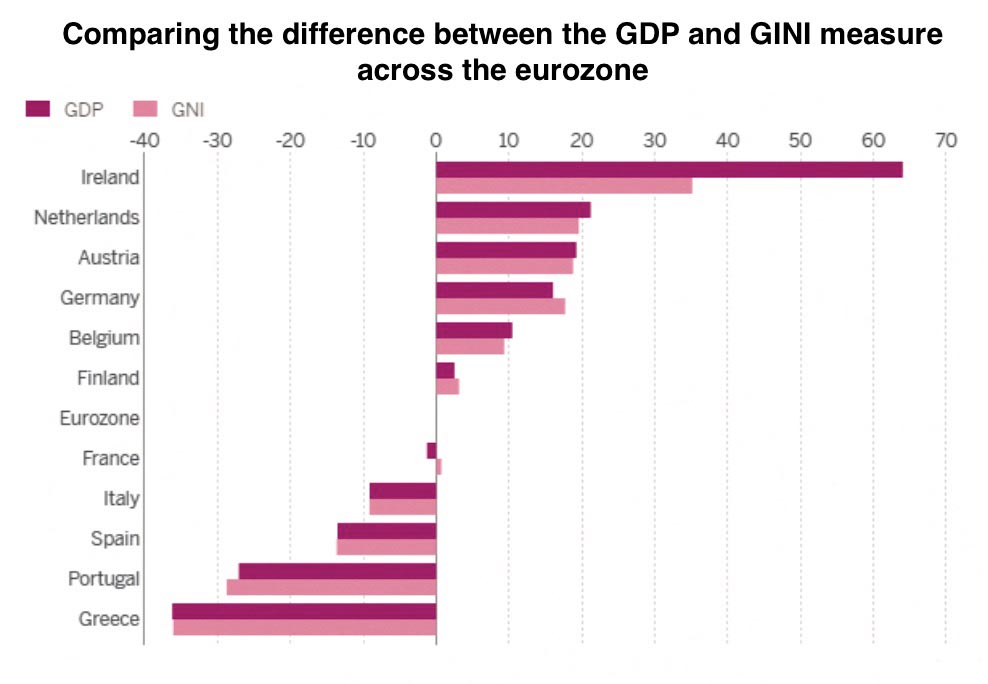

The new statistics were derived from using a new measure of economic activity to replace the old GDP figures, which is called GNI (Gross National Income). The key difference between GDP and GNI as an economic indicator is that GNI tries to calculate the income generated by the national economy in terms of its gross national income, which is what is actually available to its residents, while making adjustments for external financial flows. The difference between GDP and GNI is what statisticians call “net factor income from abroad” — mostly wages earned by cross-border workers, repatriated profits and dividends of foreign-owned companies operating in the country. All countries show a difference between GDP and GNI but the distinction usually only matters to statisticians rather than policymakers, since for most industrial countries the two measures are similar and the terms can be used almost interchangeably. But Ireland’s gap between its GDP and its GNI is large and rising.

Ireland apparently attracts substantial foreign investment as companies park their taxable economic activity in Irish based subsidairies and those accounting entries contributes to its economic growth as measured by the GDP indicator, however a big chunk of the profits arising from such foreign ‘investment’ does not remain in the nation and so really should not be counted when measuring Irish economic growth.

Using the GNI measure, which strips out factors related to Ireland’s status as a favoured tax shelter for foreign companies shows Ireland as less prosperous and a long way from the poster child of the eurozone reform program. It is 20 per cent richer than the US in terms of GDP per capita, but poorer in terms of GNI per capita. Irish GDP per capita is more than 60 per cent larger than the eurozone average but only about half that much larger in GNI per capita. Similarly, financial stability measures tend to look gloomier in GNI terms. According to the Irish statistics office, Irish government debt in 2015 was 79 per cent of GDP but 100 per cent of GNI. And while the fiscal deficit did not look too bad at 1.9 of GDP, as a proportion of GNI it was a much less flattering 3.4 per cent — outside the EU limit of 3 per cent.

If the profits of US companies with big operations in Ireland, such as Apple, Google, Microsoft and Pfizer, and the effects of the depreciation of the assets domiciled in Ireland by the aircraft leasing sector, for which Dublin is a global hub, are excluded by using the GNI measure, then the value of the Irish economy in 2016 was just €190 billion (compared to the €275 billion using GDP).

The GNI measure provides information that Irish taxpayers may have been missing in recent years about what is really happening to the domestic economy, which is dominated by small and medium enterprises, farming and agrifoods. “What you’re trying to measure is the real income and output of real people living in Ireland,” says Professor John Fitzgerald of Trinity College Dublin. Most people in Ireland are actually still worse off than before the financial crash and headline grabbing claims about massive GDP growth feels a lot like the claims in the old Soviet Union that quotas had been over over fulfilled while there was nothing to buy in the shops.

With national economies so much more open to cross border financial movements in the eurozone, and with national governments exercising their remaining powers to set national corporation tax rates and systems and thus attract financial flows apparently boosting their reported national economic performance, old methods for assessing national economic performance are becoming inadequate and a new methodology is required.

“If you torture the data long enough, it will confess”

Ronald Coase, British economist