As I explained in my previous post yesterday the job of a central bank is to support banks who are solvent but who are suffering a liquidity crisis. A common cause of a liquidity crisis is that too many people are trying to take their money out of the banks all at the same time, and this is what has been happening in Greece. A core job of central banks is to act as lenders of last resort, to give banks suffering from a bank run enough cash to tide them over until the crisis ends and depositors return. Central banks can do this because they can create as much money as they want. When they create money and hand it over to a solvent bank that is running out of cash the central banks asks for the recipient banks to make some collateral available to cover the short term cash loan. A common type of collateral is any sort of government bonds but can also include mortgages, loans the bank had made, investments, etc.

None of this is exceptional, its just the standard way central banks act to stem market panics and stop banks from collapsing because of bank runs. The principles of how this should be done were laid out in the 19th century by the great British financial writer Walter Bagehot, and the principles laid out in his book “Lombard Street: A Description of the Money Market” are still used by central bankers all over the world to guide their actions.

Except for the European Central Bank.

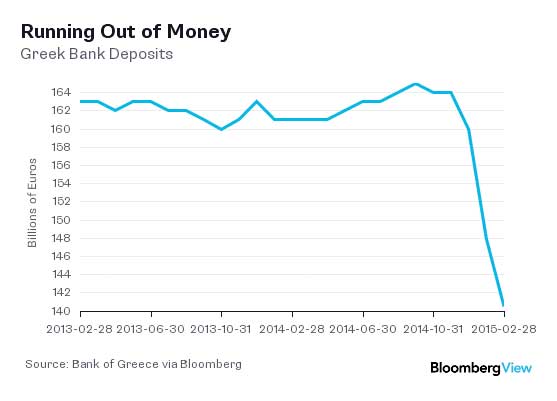

The ECB has behaved in relation to the Greek banking system in exactly the opposite way central banks should behave. Rather than calming the markets it has inflamed them with dire warning of a looming Greek financial armageddon. Rather than pumping in as much liquidity as is needed to keep the bank open it has reduced the support and forced the banks to close. And now it has turned the screw again.

It seems that the the votes of millions of Greeks count for very little and the the vote of a tiny group of people, the Governing Council of the European Central Bank, counts for far more.

As I explained yesterday when a national central bank in the eurozone receives a request for emergency liquidity support (ELA) from a bank it passes the request to the ECB HQ in Frankfurt and the ELA is only approved if the recipient bank is deemed to be solvent and can produce some form of suitable collateral. The ECB had for quite a while been imposing a ‘haircut’ on Greek bank collateral. This means the ECB was cutting the assumed value of Greek bank collateral by a fixed amount in order to calculate how much ELA funding it could cover. There are no official figures (because like so much of what the ECB does it is a secret) but there is some information that the haircut was around at least 40% and maybe as much as 50% (see below) until today. That meant that for every asset with say the nominal value of one billion euro that a Greek bank is holding it only actually got 600 million euros in ELA cash.

Now the ECB has announced, the day after the referendum and the ‘No’ vote, that it is increasing the haircut on Greek bank collateral. Greek banks now need to put up a lot more collateral to get any short term cash from the ECB. And the ECB has not turned on the flow of that cash to meet increased demand for cash in Greece (which is what central banks should always do) and thus Greek banks remain too short of cash to reopen.

If Greece is forced out of the euro, it will have been because of this ECB decision. The overarching question about the eurozone’s financial management, therefore, is not about the Greek referendum, but about how its central bank could refuse cash to all the major banks in one of its member states. As Charles Wyplosz recently explained in a comprehensive critique of the ECB actions this is “a political decision of historical importance … By not keeping the Greek banking system afloat, the ECB is failing on a core responsibility.”

The EU Treaty (in clause 127) lays out explicitly what the job of ECB is, which is to work with the national central banks (that the ECB now controls) to maintain price stability. The issue of price stability is not currently relevant to the problems of Greece or its banks because Greece’s economy is so small even flushing its banks with liquidity will have no effect on the eurozone price level. If anything, crushing the banking system and forcing Grexit will be more destabilising. The ECB has a number of other explicit explicit responsibilities, so long as they don’t come into conflict with stable prices. Two are particularly relevant – one specific, one general.

A specific task of the ECB, as laid down in the treaty, is to “promote the smooth operation of payment systems”. Ask anyone queuing at the ATM’s in Athens, or the Greek businesses that cannot pay their suppliers whether the ECB has promoted the smooth operation of payment systems.

A general task as laid down in the legal remit of the ECB is to “support the general economic policies in the Union with a view to contributing to the achievement of the objectives of the Union” as laid down in the treaty. One such economic policy is the “imperative to break the vicious circle between banks and sovereigns” – that is to say, to make sure that the functioning of banks does not depend on the solvency of the state (and vice versa). And the stated objectives of the EU include “the sustainable development of Europe based on balanced economic growth and price stability … full employment … economic, social and territorial cohesion”. Are the ECB decisions that are causing the Greek financial system to cease to function promoting full employment, and economic, social and territorial cohesion?

Starving the Greek banks of funding, forcing the closure of the Greek banking system and disrupting the entire Greek monetary economy is actually in utter breach of the legal remit of the ECB. The ECB will advance some spurious lines of arguments to claim that they are merely acting within their famous (but secret) rule based system, and that all this has nothing to do with politics, but that is rubbish.

First, the ECB is arguing that if Greek banks get more funding they may use it to prop up the Greek state by lending it on to the government which the ECB claims would in effect constitute an illegal credit line to the government. In reality that is exactly what the ECB itself is doing across the eurozone. But if the Greek banks do offer a line of credit to the Greek government it wouldn’t matter because the ECB has already, in its supervisory capacity, limited the amount of Greek government debt the banks are allowed to hold. The amount is, in fact, very small, as publicly available Bank of Greece data shows. Greek banks own about €15 billion of Athens’ debt outright, and have another €25 billion in assets that depend on a government guarantee. That €40 billion of Greek government related debt held by the banks has to be set in the context of the total ‘pot’ of €400bn of assets held by the Greek banks as whole.

The second argument the ECB advances, as I have explained before, is that to protect against losses, central bank loans to Greek banks must be “overcollateralised”, that is to say the face value of the security pledged must be larger than the loan. In other words Greek collateral has to suffer a ‘haircut’. Like much of the ECB’s activities and decision making processes the current haircut imposed on Greek bank collateral is secret but it is possible to work out roughly the haircut being imposed. In the last published update to its accounts, the Bank of Greece held €156bn of bank assets (largely mortgages and other loans) as security for emergency liquidity worth €77bn, or less than half. That means the “haircut” – the loss the lender could take and still come out whole – of 51 per cent. Todays announcement from the ECB is that the haircut is to be increased but once again no actual figures were made public, we just know it is larger than the already substantial 50%+ haircut that was in place.

Are loans to Greek households and business really worth that little? Maybe they are. But if so, why is the ECB in its capacity as regulator saying that the Greek banks – which have equity of 18 per cent of assets – are solvent? Matthew Klein in a recent piece in the Financial Times has explained that this is a nonsense. The ECB can’t have it both ways. If 18 per cent is safe enough to guard against losses, then the ECB should lend on the same basis – that is, up to 82 per cent of the face value of the pledged assets. That would end the Greek bank run immediately. Alternatively, if 18 per cent (let alone 51!) is not enough, then the ECB should immediately declare the banks insolvent, and trigger the European-wide single resolution mechanism that would restructure the banks so they can access liquidity again.

The ECB actions in relation to the Greek banks, where is has acted in precisely the way most likely to destabilise the Greek financial system, is a clear breach of its legal remit and frankly a disgrace. Why isn’t there outrage in the European parliament at this politically motivated, dangerous and probably illegal action by the ECB? If the ECB can do this in Greece, especially as they got away with threatening to do it to Ireland and Spain in order to change their government’s policies, then the ECB could do this to any eurozone member state that was undergoing a financial crisis. Plenty of other countries share Greece’s bad demographics, slow growth and lots of public debt. Could they too be forced out of the single currency by the unelected and unaccountable ECB the next time a recession strikes and people elect a government that the ECB doesn’t like.

Is that how democratic government in Europe is supposed to work?