Spain is, supposedly, one of the success stories of the eurozone. Growth has resumed after the financial crisis and the current account is in surplus. According to the Rajoy government in Madrid Spain’s economy is back on track, and that will be the line that it pushes until the crucial Spanish general election in December. It’s also a narrative that the EU institutions are endorsing because if the People’s Party loses it’s majority in the coming election, which the polls indicate is a distinct possibility, then a new Spanish coalition government could reject the eurozone austerity program. And if the Spanish program unravels then the entire eurozone stability program could be at risk.

At the beginning of October the European Commission postponed a negative opinion on the Spanish budget for 2016, a budget that has been drawn up with one basic goal which is to buy off as many voters as it takes to tilt the electoral balance in the government’s favour. It’s a classic ruse as old as democracy itself: austerity gets suspended, spending is hiked, and tax cuts are brought forward. And then everyone goes to vote feeling just a little bit richer.

When Europe’s Economic and Taxation Affairs Commissioner Pierre Moscovici told the press that Madrid was at “risk of non-compliance” with the Stability and Growth Pact, not only for 2016 but for 2015 as well, he was quickly silenced by both the Commission and Germany’s Finance Minister Wolfgang Schauble in a move that was obviously entirely political and designed to avoid any criticism of Rajoy’s opportunistic pre-election give away budget.

The EU executive decided on the 6th October to postpone a negative opinion on the Spanish budget, drafted by the Commissioner Moscovic. The day before when speaking to the press after the Eurogroup meeting, Moscovici had said that, according to the Commission’s analysis, Madrid was at “risk of non-compliance” with the Stability and Growth Pact in 2015 and 2016. Moscovici told reporters that the EU executive would adopt an opinion the following day in which it would urge the Spanish government to “strictly execute” the budget for this year and “to take the necessary measures” to ensure Madrid meets its fiscal targets for 2016. In light of these new measures, on 23 November, the Eurogroup would assess the Spanish budget for next year, and could request an updated version to the new government elected on 20 December.

The proposed opinion prepared by Moscovic was based on European Commission forecasts which projected that Spain’s deficit would reach 4.5% of GDP in 2015 instead of the required 4.2%, and in 2016, the deficit would decrease to 3.5% of GDP, much higher than the target of 2.8%.

However by the next day, Valdis Dombrovskis, Commission Vice-President for the Euro, and Moscovici’s boss, corrected the French Socialist, and said that “more time is needed” to discuss this issue. The decision could be taken “in a matter of days”, he added. “It is important that we communicate the substance and give the full picture once the decision is adopted,” Dombrovskis emphasised in a veiled criticism of his French colleague.

The Commission’s stance on the budget is particularly sensitive ahead of the Spanish general elections taking place on 20 December. The ruling center-right party, the Partido Popular (PP) has invested a lot of political capital in the economic recovery for its reelection, raising suspicions that Moscovici’s decision to postpone the negative report was politically motivated.

In his concluding remarks after the Ecofin Council on Wednesday (6 October), Spain’s Minister of Econonmy, Luis de Guindos, said that the Commission services are “neutral, and sometimes they are right, and others, they are wrong”. Guindos ruled out adopting new austerity measures before the Spanish Parliament is dissolved on 26 October. In his view, the differences between the Commission’s forecast and the Spanish one are “small” and the financial gap could be covered by the better-than-expected growth for this year and next.

Then a few days ago, after a week of bumbling controversy, came news of yet another U-turn with the Commission effectively, if begrudgingly, admitting that Moscovici had been right all along: the Spanish government’s 2016 budget was just ‘a little on the optimistic side’.

Background: Spain’s economic problems are the result of reckless bank lending and not excessive public expenditure

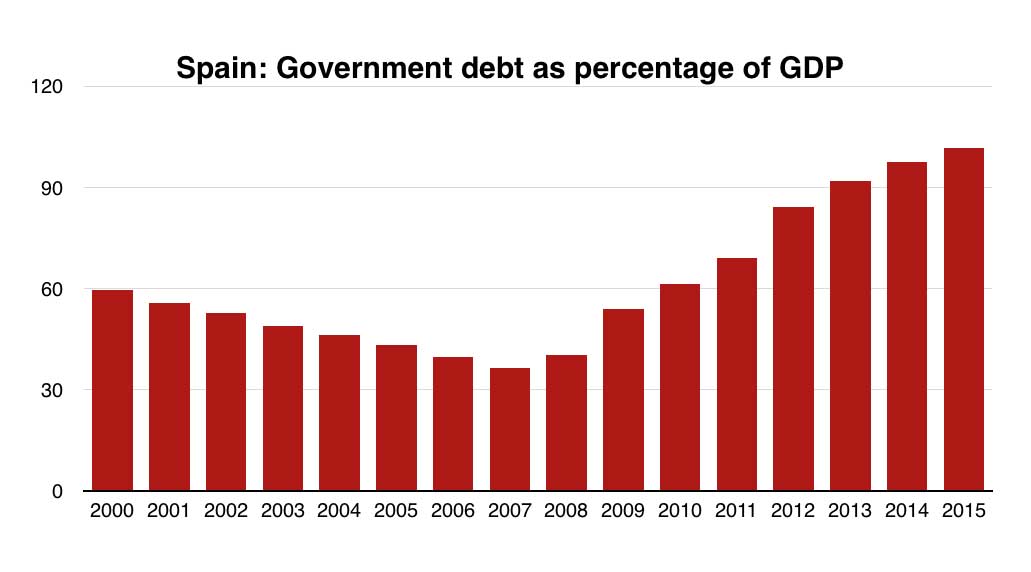

Prior to the financial crisis in 2008 Spain had a comparatively low public sector debt level among advanced economies. Its public debt relative to GDP in 2010 was only 60%, more than 20 percentage points less than Germany, France or the US, and more than 60 percentage points less than Italy, Ireland or Greece. Public debt in Spain had been kept low by the ballooning tax revenue from the pre-crash housing bubble, and it was revenues from from the bubble that helped accommodate a decade of increased government spending without debt accumulation.When the bubble burst, Spain spent large amounts of money on bank bailouts. By late May of 2011, it had become clear to all that Spain’s banks needed substantial recapitalisation, starting with Bankia, a recently-created conglomerate of a number of cajas or community based savings banks.

The Spanish government decided that its preferred method for recapitalising Bankia was to directly provide it with Spanish government bonds. This approach is perfectly legal and would have been approved by Spain’s banking regulators. However, the ECB didn’t like this approach and effectively vetoed it. The ECB threatened to refuse credit to Bankia thus triggering the type of crisis the recapitalisation plans were attempting to avoid (the same tactic the ECB used in Greece in 2015 in order to influence the outcome of the Greek referendum). Since Spain could not raise the sums being deployed by the ECB to shore up the liquidity of Spanish banks, this decision effectively forced Spain to apply to the EU for aid with recapitalising its banks.

In June 2012, with Spain’s debt becoming unmanageable as interest on Spain’s 10-year bonds reached the 7% level and it faced difficulty in accessing bond markets, the Eurogroup granted Spain a financial support package of up to €100 billion. The funds did not go directly to insolvent Spanish banks, but as elsewhere in the eurozone the bank bail out funds were channelled via the public sector turning private bad debt into public debt. In the case of Spain the bailout funds were transferred to a government-owned Spanish fund responsible for implementing the needed bank recapitalisations (FROB), As a result of the bank bailout a large amount of new additional sovereign debt was added to Spain’s national account. As well as saving the banks the bailout effectively placed the Troika in control of Spanish economic policy, which had been the aim of the ECB’s manoeuvres.

In May 2012, Bankia received a 19 billion euro bailout, on top of the previous 4.5 billion euros to prop up Bankia. Questionable accounting methods disguised bank losses. During September 2012, regulators indicated that Spanish banks required €59 billion (US$77 billion) in additional capital to offset losses from the burst property bubble.

The bank bailouts and the economic downturn increased the country’s deficit and debt levels and led to a substantial downgrading of its credit rating. To build up trust in the financial markets, the government began to introduce austerity measures and in 2011 it passed a law in congress to approve an amendment to the Spanish Constitution to require a balanced budget at both the national and regional level by 2020. The amendment states that public debt can not exceed 60% of GDP, though exceptions would be made in case of a natural catastrophe, economic recession or other emergencies. As one of the largest eurozone economies (larger than Greece, Portugal and Ireland combined) the condition of Spain’s economy is of particular concern to international observers and financial analysts. Under pressure from the United States, the IMF, other European countries and the European Commission the Spanish governments eventually succeeded in trimming the deficit from 11.2% of GDP in 2009 to an 7.1% in 2013.

In September 2012 in respnse to Spain adopting an austerity program and committing to cutting public expenditure the ECB removed some of the pressure from Spain on financial markets, when it announced its “unlimited bond-buying plan”, on the condition that Spain sign a new sovereign bailout package with EFSF and the ESM. Strictly speaking, Spain was not hit by a sovereign debt-crisis in 2012, as the financial support package that they received from the ESM was earmarked for a bank recapitalisation fund and did not include financial support for the government itself. On 23 January 2014, with foreign investor confidence in the country apparently restored, Spain formally exited the EU/IMF bailout mechanism.

The results of the Spanish austerity program

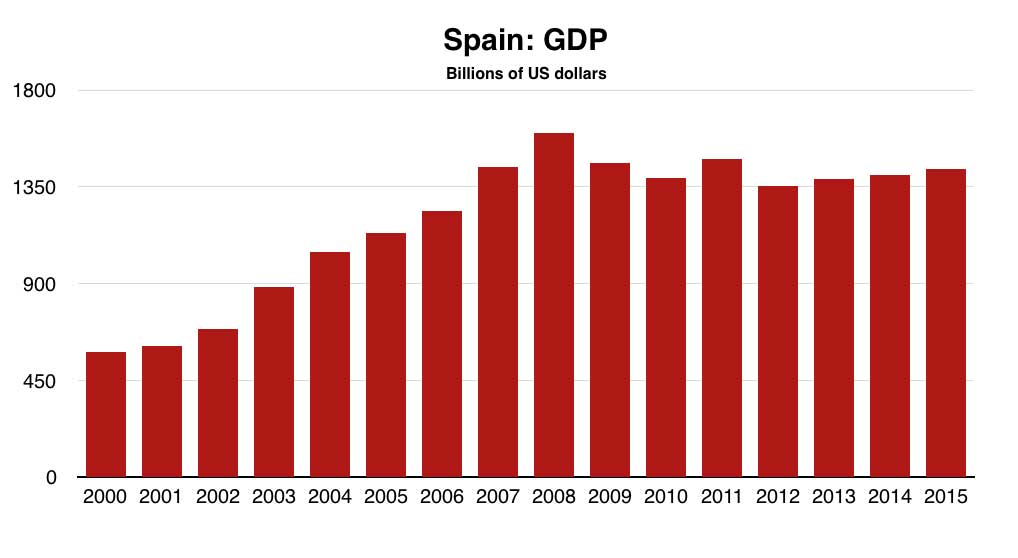

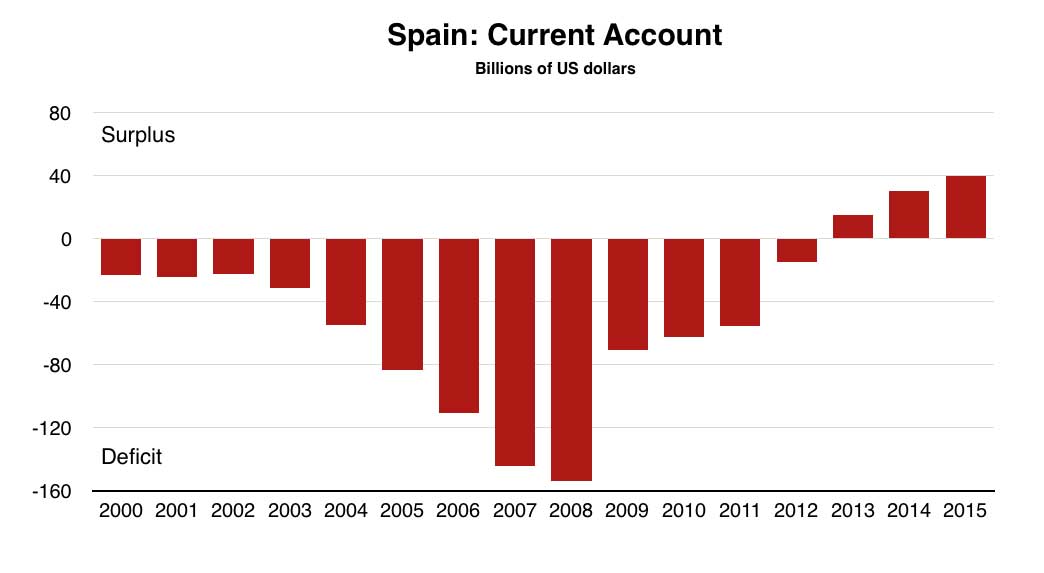

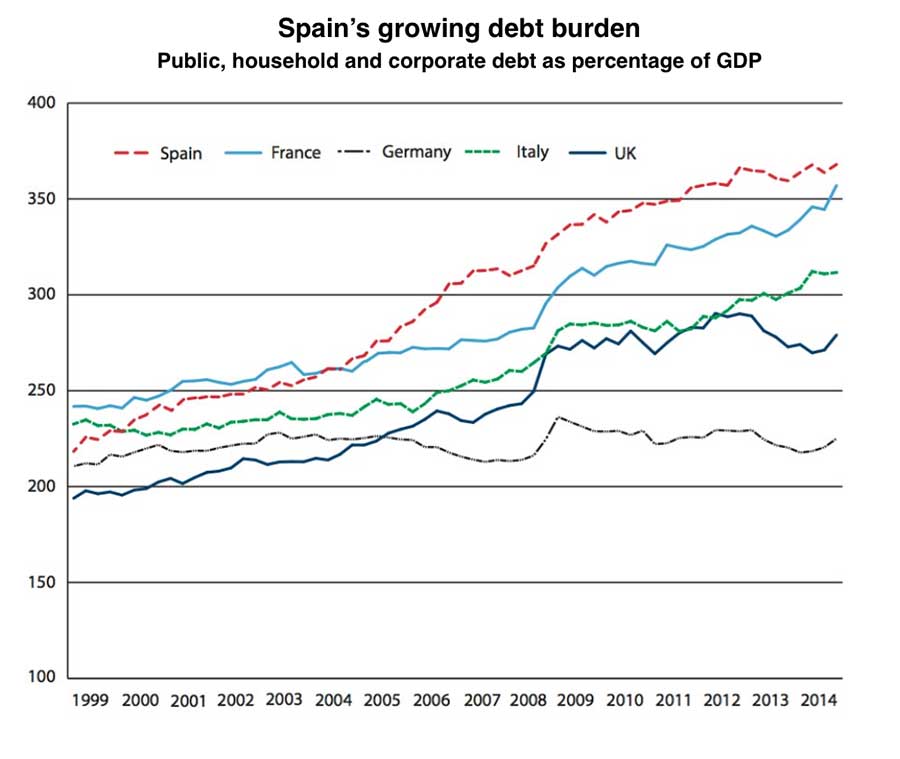

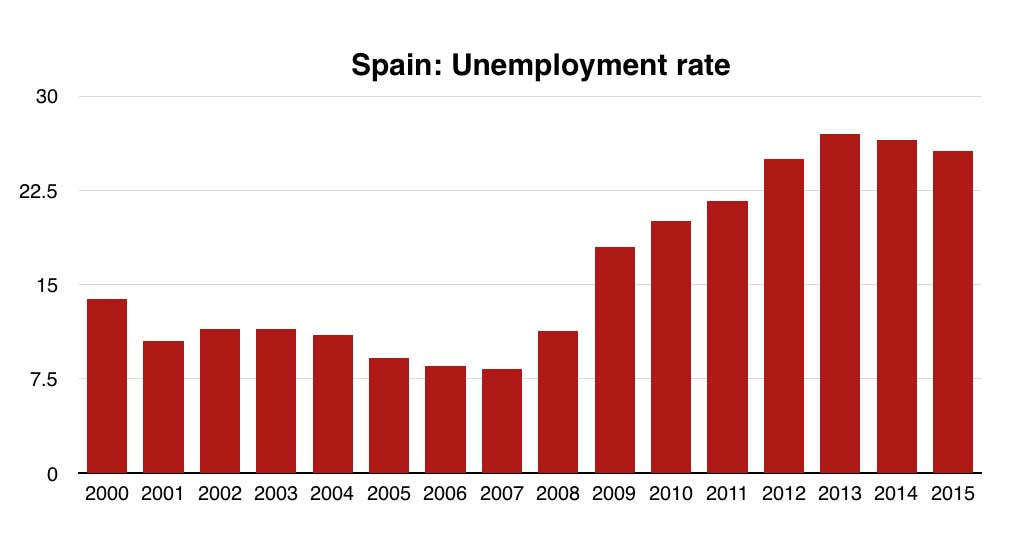

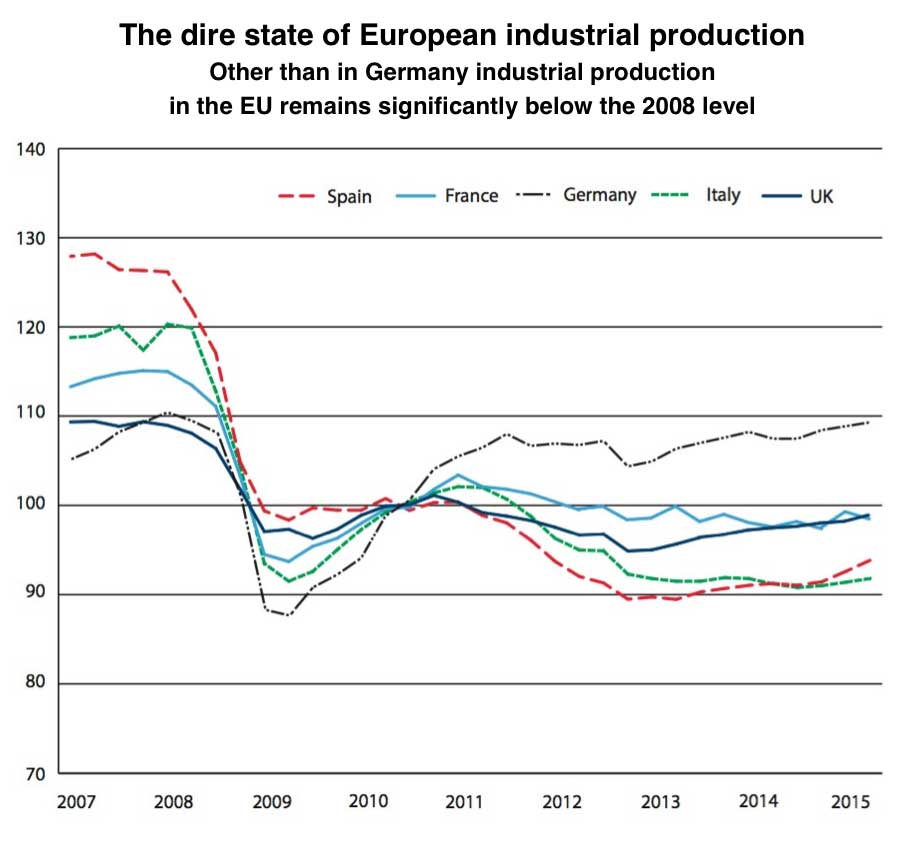

Here are five charts that summarise the impact of the Spanish austerity program (source). It’s hardly a success story.

The Centre for European Reform recently published a report by Simon Tilford entitled ‘Gain or more pain in Spain?’ which exposed the continuing deep weaknesses in the Spanish economy and which concluded:

“Spain is likely to enter the next downturn having barely recovered from the previous recession, with high levels of public and private sector indebtedness, and unemployment well above pre-crisis levels. Crucially, it will have few policy tools available to combat a renewed weakening of domestic demand, which increases the likelihood that the next recession will be a deep one”

After all the pain of austerity, and the Troika supervised structural reform program, the Spanish economy is still, seven years after the the financial crisis (2008) and five years after the crisis of the Euro zone (2010), very weak and very vulnerable to the next global recessionary downturn. A downturn that has almost certainly already started. In other words this is as good as it gets in Spain, from now on things will probably get worse again.

What has the ‘success’ of the Troika program achieved in Spain?

Unemployment remains at Great Depression levels. Unemployment may have fallen in the last four years from 26.5% to 22% but that still means that one in five Spanish workers is unemployed and youth unemployment is running at an appalling 50%. The main reason the rate of unemployment has fallen is because the active working population is shrinking at a much faster rate than the growth in job creation as a result of the mass exodus of foreign workers and Spanish workers moving abroad to look for work. “The recession has led to the biggest migration in Spain’s history,” the Bank of Spain lamented in a recent report. The banking institution pointed out that since 2010, around 400,000 people, mostly those with good qualifications and skills, have left Spain annually.

One in four Spanish workers is poor, according to a study by the International Labor Organization. The number of people earning less than 60% of the average salary increased by four percentage points between 2000 and 2014, from 18% to 22.2%. This year the number of households with no official source of income reached a historic peak of 770,000 – close to 5% of all households. Spain has become a society that boasts of economic growth as entire families and communities are excluded from the economy. According to the OECD, the average monthly salary of young Spanish workers decreased from 1,210 euros in 2008 to 890 euros in 2013 – a 35% drop in real terms.

Job insecurity has soared. The percentage of part-time work in Spain grew from 12% in 2008 to 17.4% in the fourth quarter of 2014. Since the government’s labor reform act of 2013, Spain has become an economy increasingly built on ‘mini-jobs’. Statistics provided by the Ministry of Employment show that of the 1.24 million employment contracts signed in August, only 6.4% were for permanent jobs while more than one in four contracts were for jobs lasting less than seven days.

The Spanish government’s management of the economy, under the Troika’s ever watchful and generally approving gaze, has significantly reduced the Spanish economy’s long-term growth prospects. Gross capital formation, as a proportion of GDP, is now down 14 percentage points since 2007; funds for research, development and innovation shrank from €321.90 per inhabitant in 2009 to €279.30 in 2013.

Spain along with the rest of the eurozone is skating on thin ice

Spain demonstrates the severe limitations of the current official economic orthodoxy in the eurozone. Trying to control the size of the deficit and government debt by merely trying to control the balance of government income and expenditure (i.e through merely budgetary methods) is a flawed strategy. It is flawed because the actual balance of public expenditure, and the size of any deficit or surplus, is determined by the performance of the economy as a whole. It is the condition of the economy as whole that determines the actual level of tax revenues collected and, to a significant degree, the amount of expenditure on things such as social security programss. If reducing government spending at a time of deficient demand causes economic growth to stop and the economy to slow then it will also cause government finances to worsen. It is growing the economy that shrinks public debt.

Currently in the eurozone there is a coordinated program of pro-cyclical demand reduction as multiple governments all embark on simultaneous austerity programs aimed at reducing public debt by reducing government spending and increasing tax rates. This program is seeking to force eurozone governments to adhere to a rigid set of rules as to what level of deficit and spending is permissible. These rules are arbitrary. This program of coordinated austerity sucks demand out of the eurozone economy and causes a slow down in economic activity, and this makes reducing debt even harder as tax revenues fall and social security spending is forced up.

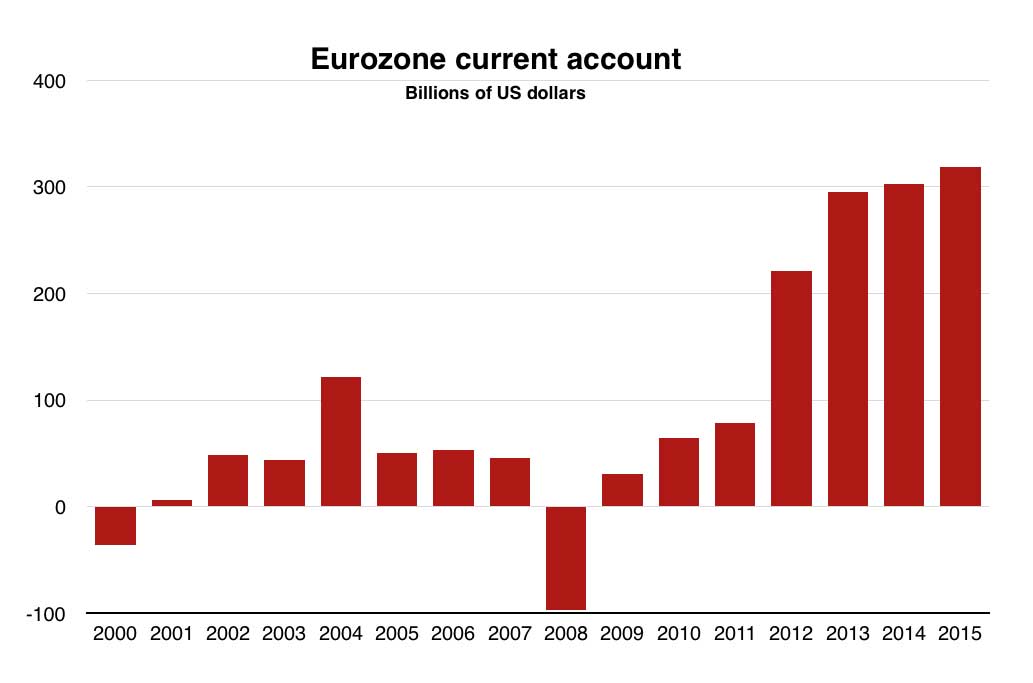

With austerity programs in place across the eurozone, which means that domestic demand is held down, the only alternative is to import demand from outside the eurozone by exporting products. The Germany model (low wages, low domestic demand, increasing dependency on exports and foreign demand) is now the model being imposed in the eurozone. And because the imported demand resulting from exporting products does not fully compensate for the low domestic demand the result is slow or non-existent growth, and endemic unemployment. While the sluggish eurozone economy under performs the eurozone has significantly increased its trade surplus with the rest of the world (as the chart below shows). So in a global economy which is rife with insufficient demand (which is the same things as a global surplus of savings), and as a result of a deliberate policy of suppressing demand through austerity, the eurozone is making matters worse by sucking demand out of the global economy.

The roll out of the German model across the eurozone (except for France which continues to run a significant current account deficit) means that the eurozone is now heavily dependent on external demand for its products to plug the gap left by the suppressed domestic demand. The external demand for eurozone products already fails to make up for the suppressed domestic demand within the eurozone (hence the slow growth and high unemployment) and is of course extremely dependent on the willingness and ability of the rest of the world to continue to absorb eurozone exports. With the global economy slowing, emerging economies moving into recession, and the Chinese embarking on a profound and probably wrenching adjustment of their growth model, it is possible that external demand for eurozone exports could significantly decline. If that were to happen then the economy of the entire eurozone could be in trouble and fall back into recession. This would of course increase government deficits and debt, drive up unemployment and reignite a destabilising generalised crisis of the single currency system.

Spain and the structural failures of the eurozone

As well as Spain demonstrating the severe limitations of the current official economic orthodoxy in the eurozone, its economy also illustrates the deep structural weakness of the entire single currency system, weaknesses that are so deep and profound that they will almost certainly cause further generalised crises in the eurozone and eventually lead to forced restructuring. Broadly there are four possible scenarios for the development of the eurozone over the next decade (these scenarios are largely derived from the work of Michael Pettis).

First, Germany could reflate domestic demand (via significant increases in wages and government spending) by enough to exceed the consequent increase in its domestic production of goods and services by at least 4-5% of GDP, and probably more. This would mean that Germany would have to run a current account deficit and thus export demand to help reflate the rest of the eurozone. I don’t believe that politically that is possible in the forceable future, it would require overturning the entire economic and political consensus in German.

Second, peripheral Europe could tolerate excruciatingly high unemployment for at least a decade, and probably more. That is the current model being implemented but very high levels of unemployment will eventually lead to political ruptures of some sort, either from the left or the right. Enduring very high levels of unemployment is not a politically viable long term solution.

Third, the weaker economies of the eurozone could leave the euro and restructure their debt with substantial debt forgiveness (or, which is nearly the same, force Germany to leave the euro, which would require much less debt forgiveness) causing losses in the German banking system at the same time that it caused Germany’s manufacturing sector to drop precipitously. Such a drastic break up of the eurozone is unlikely to be embarked on as an agreed strategy and is most likely to occur as a forced outcome arising from a crisis (i.e it is likely to be disorderly).

Fourth, the eurozone could run huge surpluses with the rest of the world, perhaps two times or more than its current surplus. This seems the preferred solution in Berlin where the belief is that the entire eurozone, given a strong enough commitment to binding and very restrictive budgetary rules, and a ruthless restructuring of the labour and social security systems, could become one big Germany with an economy based on a permanent massive trade surplus with the rest of the world. It is very unlikely that a surplus of the size required to reignite growth in the eurozone is achievable and sustainable over the long term. Note that even though the eurozone is currently running an irresponsibly high surpluses (see chart above), the surplus is not large enough to allow Europe to grow.

So far Europe has chosen the second option and a bit of the fourth option. This is not politically or economically sustainable and so option three is probably where it will end up. And it will be very, very messy.