A very smart analysis of the political economy of the USA presidential election by Joel Kotkin entitled ‘We Now Join the U.S. Class War Already in Progress’

“Class is back. Arguably, for the first time since the New Deal, class is the dominant political issue. Virtually every candidate has tried appealing to class concerns, particularly those in the stressed middle- and lower-income groups. But the clear beneficiaries have been Trump on the right and Sanders on the left.

Class has risen to prominence as the prospects for middle- and working-class Americans have declined. Even amidst a recovery, most Americans remain pessimistic about their future prospects, and, even more seriously, doubt a bright future (PDF) for the next generation. Most show little confidence in the federal government, although many look for succor from that very source.

To understand class in America today, one has to look beyond such memes as “the one percent” or even the concept of “working families.” As Marx understood in the 19th century, classes are often fragmented, with even the rich and powerful divided by their economic interest and world view. In our complex 21st-century politics, there’s a big divergence among everyone from the oligarchic classes to those who inhabit, or fear they will soon inhabit, the economic basement.”

David Marsh, the European Markets Columnist at Marketwatch argues that ‘Europe should do the opposite of what it’s been doing’. Instead of more monetary stimulus (in the form of more QE), Europe ought to tighten monetary policy and ease fiscal policy

“Rather than persist with an approach that risks failure, European Central Bank President Draghi and German Finance Minister Schäuble — the continent’s two most senior economic policy makers — should engineer tighter eurozone monetary policy and simultaneously loosen fiscally. Reining back controversial plans for more ECB government bond asset purchases (quantitative easing) could be balanced by more pragmatic interpretation of euro bloc budgetary objectives, recognizing that many southern states are already struggling to meet fiscal goals.”

Meanwhile over the ‘Sparse Thoughts of a Gloomy European Economist’ blog Francesco Saraceno argues in a commentary on from Mario Draghi’s introductory remarks at the recent European Parliament hearing that ‘Draghi Wants the Cake, and Eat It’.

“Therefore, what we should be talking about is our social contract. Do we want to keep it or not? Are we ready to pay the price for it? Are we aware of what the alternative of low social protection would imply? Are our institutions ready for a world in which automatic stabilization would play a significantly lesser role? If after considering these (and other) questions, the EU citizen decided, democratically, to abandon the current EU social model, I would not object to it. I would disagree, but I would not object. The problem is that this change is being implemented, bit by bit, without a real debate. I am no fan of conspiracy theories. But when reading Draghi yesterday, I could not avoid thinking of an old piece by Jean-Paul Fitoussi, arguing that European policy makers were pursuing an hidden agenda. The crisis weakened resistance and is making it easier to gradually dismantle the EU social model. The result is growing disaffection, that really surprises nobody but those who do not want to see it. An Italian politician from an other era famously said that to think the worst of someone is a sin, but usually you are spot on…”

Tank Magazine has an article entitled ‘When the bubble bursts’ about the work of the economist Mariana Mazzucato, author of ‘The Entrepreneurial State: Debunking Public vs. Private Sector Myths’ and a member of both the Labour Party’s Economic Advisory Committee and the Scottish Government’s Council of Economic Advisors.

Bizarrely Tank Magazine decided to illustrate the piece with Mazzucato modelling fashion clothes.

“[Mazzucato] has investigated some of the most precarious and contentious economic activity of recent years, contrasting the over-investment in technology that creates fruitful technological bubbles (the economist Joseph Schumpeter’s concept of “creative destruction”) with the “destructive creation” of financial speculation. This distinction is vital in the current economic landscape. Mazzucato describes how John Maynard Keynes’ “animal spirits” are essential for driving investment in new technological capital, and are equally likely to lead to a financial crisis when confidence in future profits collapses. Even when investment bubbles burst, the technological innovations that survive can spur future growth. Yet the financial crisis of 2008 offers an example of pure speculation – destructive creation at its most brazen.”

One of my favourite economists, Steve Keen head of the School of Economics, History and Politics at Kingston University, has an article entitled ‘Tilting At Windmills: The Faustian Folly Of Quantitative Easing’. Keen is uses the work of Hymen Minsky to analyse the fragilities of the financial system and has developed software to model the real world using Minky’s concepts, in this article he forensically critiques Quantitative Easing – a bit technical but very good.

Describing the workings of QE in some detail Keen argues that:

“.. rather than rescuing Central Bankers from folly, this escape clause is an unwitting pact with the devil: they are now caught in a Faustian bargain. Any attempt to terminate QE is likely to end in deflating the asset markets that it inflated in the first place, which will cause the Central Banks to once more come “riding to the rescue” on their monetary Rocinante.

While Central Bankers can personally still join Faust and ascend to Heaven—thanks to their comfortable public salaries and pensions—the rest of us have been thrust into the Hell of expanding and bursting speculative bubbles, hoist on the ill-designed lance of QE. Bernanke is a rich man’s incompetent Frank N. Furter: confronting a wet and shivering couple, he promises to remove the cause—but not the symptom:

All the while, the Fed has not only ignored the real cause of both the Asset Price Bubbles and the crisis itself—the private debt bubble that financed the DotCom and SubPrime Bubbles—its Impossible Dream was that QE would cause this debt bubble to rise again too. Quoting Bernanke from 2009 again, “The idea behind quantitative easing is to provide banks with substantial excess liquidity in the hope that they will choose to use some part of that liquidity to make loans”.

Bernanke and his Central Bank colleagues around the world have made the symptoms of the crisis worse, in the hope that the cause would get worse, thus curing the patient.”

There are worries that bankruptcies in the oil producing sector resulting from the crash in oil prices could play a similar role in the next financial crash as the collapse in US house prices did in the last.

More than one-third of independent oil and gas producers are at risk of slipping into bankruptcy this year, according to a new study by consulting group Deloitte.

The crisis of low prices and a combined $150 billion in debt could claim the 175 highest-risk companies across the globe this year, Deloitte analysts said. Another 160 companies have less leverage, but will face an “almost equally alarming” 2016 as their cash flow is eviscerated by sub-$30 crude oil.

“We could see E&P bankruptcies surpass Great Recession levels as companies struggle to remain solvent,” said John England, who leads Deloitte’s oil and gas sector, in a written statement.

“Access to capital markets, bankers’ support and derivatives protection, which helped smooth an otherwise rocky road for the industry in 2015, are fast waning.”

“The landscape has never been more complicated,” said Andrew Slaughter, an executive director at Deloitte, in a written statement. “Staying solvent will require the same level of perseverance, innovative thinking and creativity as the technology breakthroughs that led to the boom in supply we have seen over recent years.”

Michael Hudson (an economist who has analysed the parasitical nature of modern financialisation) discusses the New Global Financial Cold War.

“Suppose a country owes money to another nation’s government or official agency. How can creditors collect, unless there’s an international court and an enforcement system? The IMF and the World Bank were part of that enforcement system and now they’re saying: ‘We’re not going to be part of that anymore. We’re only working for the U.S. State Department and Pentagon. If the Pentagon tells the IMF it’s okay that a country doesn’t have to pay Russia or China, then now they don’t have to pay, as far as the IMF is concerned.’ That breaks up the global order that was created after World War II. The world is being split into two halves: the U.S. dollar orbit, and countries that the U.S. cannot control and whose officials are not on the U.S. payroll, so to speak.

There are a number of policy shifts. The first shift was that – In the past the IMF has not made loans to countries that are in default to governments. That’s because in the past, the government in question was the U.S. Government. Since World War II almost all international financial bailout or stabilization loans by the IMF and World Bank have involved the U.S. Government, in conjunction with consortia of U.S. banks.

For the first time, now that China and the BRICs are growing, countries are borrowing not only from the United States subject to U.S. lobbying forces, but can now borrow from China and other countries as well.

The United States has responded by changing the IMF rules. It said, ‘Wait a minute. It’s okay for the IMF to make loans to countries that don’t pay China and Russia or the BRICs, because we’re in a new Cold War. The IMF really is working for us.’ As long as the U.S. has veto power in the IMF, its delegate can veto any loan to a country that owes money to the United States that the United States doesn’t wish to support. But it has no objection for the IMF making loans to U.S. satellites such as Ukraine, that official debts to Russia.

Ukraine last December owed $3 billion to Russia on a loan that is coming due from the Russian state investment fund. The United States is doing everything it can to hurt Russia economically, thinking that if it hurts it enough, Russia will capitulate to the U.S. strategy. The New Cold War strategy is basically an attempt to force other countries to privatize their economies to follow neoliberal policy. The aim is to open their economies to U.S. corporations and U.S. banks.”

The New York Times reports on the work Peter Wohlleben entitled ‘German Forest Ranger Finds That Trees Have Social Networks, Too’

“After the publication in May of Peter Wohlleben’s book, a surprise hit titled “The Hidden Life of Trees: What They Feel, How They Communicate — Discoveries From a Secret World,” the German forest is back in the spotlight. Since it first topped best-seller lists last year, Mr. Wohlleben has been spending more time on the media trail and less on the forest variety, making the case for a popular reimagination of trees, which, he says, contemporary society tends to look at as “organic robots” designed to produce oxygen and wood.

Presenting scientific research and his own observations in highly anthropomorphic terms, the matter-of-fact Mr. Wohlleben has delighted readers and talk-show audiences alike with the news — long known to biologists — that trees in the forest are social beings. They can count, learn and remember; nurse sick neighbors; warn each other of danger by sending electrical signals across a fungal network known as the “Wood Wide Web”; and, for reasons unknown, keep the ancient stumps of long-felled companions alive for centuries by feeding them a sugar solution through their roots.”

In amongst the economic gloom, the malaise of the EU, the wars in the Middle East and the refugee crisis there is some very good news from the Brookings Institution. A new study by Brookings researchers examines the very real prospects for ending extreme poverty by 2030 and the factors that will determine progress toward this goal.

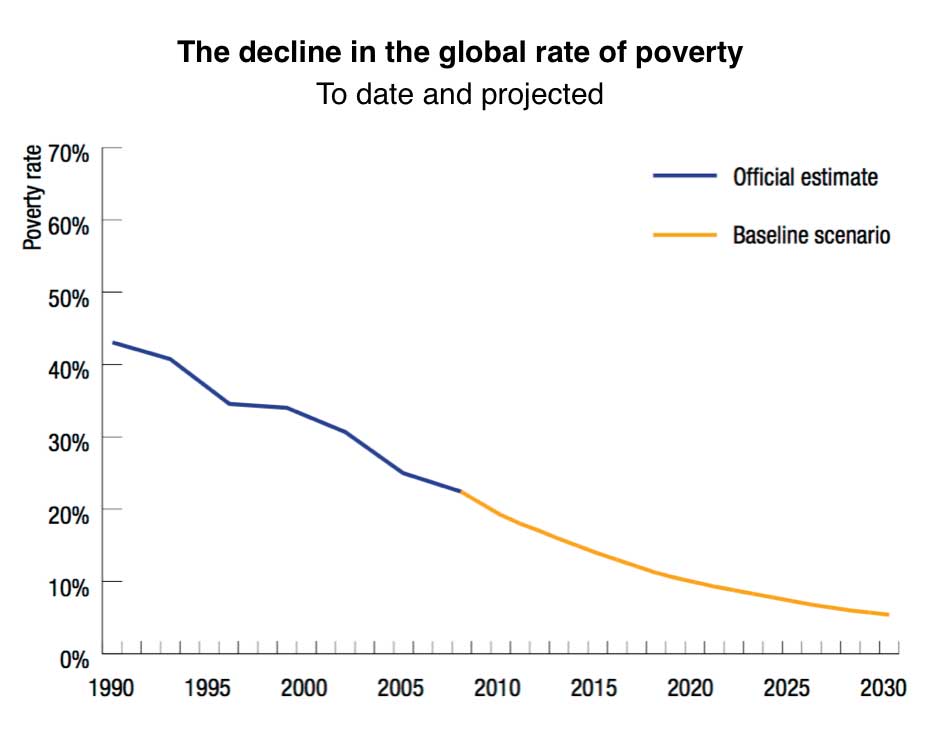

“Between 1990 and 2010, the share of the population of the developing world living in extreme poverty was cut in half. This fulfilled the first and foremost Millennium Development Goal (MDG1a) five years ahead of schedule. Moreover, it would appear to bring the end of extreme poverty within reach. If the same rate of global progress is sustained, extreme poverty will be eliminated in 2030. In other words, if it took 20 years to lift half the world’s poor above the poverty line, a further 20 years should take care of the other half. This has rightfully got people excited. In the words of Bono, “The zero zone…is just around the corner”.

What are reasonable expectations for how poverty will unfold over the coming years? How feasible is it for ex- treme poverty to be eliminated by 2030? And what factors will determine progress toward this goal?

This paper attempts to answer these questions.”

Last year I wrote a piece arguing against pessimism which made the case that the data shows without doubt that things are getting better and because no post feels complete to me unless it includes a chart here is a graph showing the wonderful progress that has been made on poverty reduction.