The IMF has made €2.5 billion in profit from its loans to Greece by charging a high rate of interest

The IMF has been charging an effective rate of 3.6% interest on its loans to Greece. This far more than the rate of interest the Fund needs to meet all its costs which are currently around 0.9%. If Greece had been charged a lower rate of interest, say the rate needed to cover the Funds costs, since 2010 Greece would have spent €2.5 billion less on payments to the Fund.

Out of its lending to all countries in debt crisis between 2010 and 2014 the IMF has made a total profit of €8.4 billion, which means a quarter of its entire profits came from Greece. All this money has been added to the Fund’s reserves which now total €19 billion. These reserves would be made available, under the Funds governing rules, to meet the costs from a country defaulting on repayments. Greece’s total debt to the IMF is currently €24 billion.

The French banks dodged a banking bullet

Much of the financial crisis in the eurozone has consisted of a sort of pass the parcel. Nobody wanted to be left holding bad debt, and because of reckless lending on a massive scale by the eurozone banks there was a lot of bad debts in the eurozone. By the time the great debt shuffle had finished the banks mostly walked away debt free and the remaining debt was now being held by the taxpayers of various eurozone member states. But the bad debt was not distributed to the tax payers based upon the ratio of bad loans made by their respective national banking systems. And one country that really benefited from this redistruibution of debt was France.

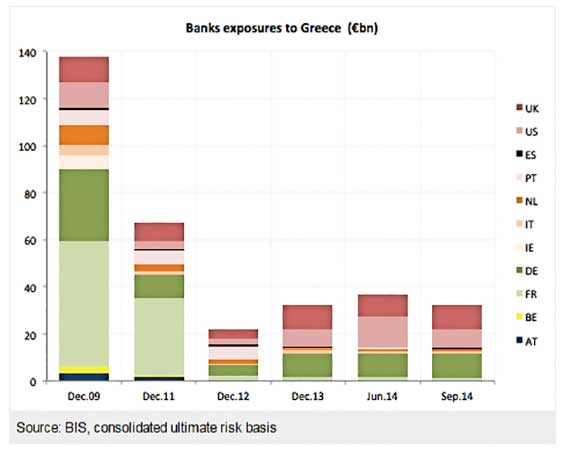

In March 2010, two months before the announcement of the first Greek bailout, European banks had €134 billion worth of claims on Greece. French banks, as shown in the light green blocks in the bar chart below, had by far the largest exposure of €52 billion which was 1.6 times that of Germany, eleven times that of Italy, and sixty-two times that of Spain.

The €110 billion of loans provided to Greece by the IMF and Eurozone in May 2010 enabled Greece to avoid default on its obligations to these banks. In the absence of such loans, France would have been forced into a massive bailout of its banking system. Instead, French banks were able virtually to eliminate their exposure to Greece by selling bonds, allowing bonds to mature, and taking partial write-offs in 2012.

The impact of this backdoor bailout of French banks is being felt now, with Greece on the precipice of an historic default. Whereas in March 2010 about 40% of total European lending to Greece was via French banks, today only 0.6% is. Governments have filled the breach, but not in proportion to their banks’ exposure in 2010. Rather, it is in proportion to their paid-up capital at the ECB – which in France’s case is only 20%.

As a consequence, France has actually managed to reduce its total Greek exposure – sovereign and bank. In contrast, Italy, which had virtually no exposure to Greece in 2010 now has a massive one: €39 billion. Total German exposure is up by a similar amount – €35 billion. Spain has also seen its exposure rocket from nearly nothing in 2009 to €25 billion today.

In short, France has managed to use the Greek bailout to offload billions of euro in junk debt onto its neighbours and burden them with tens of billions more in debt they could have avoided had Greece simply been allowed to default in 2010. The upshot is that Italy and Spain are much closer to financial crisis today than they should be.

This financial three card trick was very beneficial for the French national economy because if it had had to bail out its own banks, as opposed to getting countries like Germany, Italy and Spain to do it (via the Greek bail out), then its already very sick economy would be even weaker. France like the periphery countries has discovered that once the currency union prevented the use of devaluation as a shock absorber it was hit very hard by the decision of the eurozone’s biggest economy, Germany, to run a low wage, low income economy. All other eurozone countries have to adapt to the German model by dismantling social protection and suppressing living standards but this is often politically very hard.

At the end of June 2015 Wikileaks released a new batch of NSA intercepts among which included an intercepted communication which reveals that the then French Finance Minister Pierre Moscovici believed the French economic situation was far worse, as of mid-2012, than perceived. Specifically, Moscovici who served as French finance minister until 2014 and then became European commissioner for Economic and Financial Affairs, Taxation and Customs, used some very colourful language, i.e., the French economic situation was “worse than anyone [could] imagine and drastic measures [would] have to be taken in the next two years”. Moscovici’s conclusion was that “the situation is dire” although the finance minister ignored warnings that without a “pre-retirement unemployment supplement known as the AER… the ruling Socialist Party will have a rough time in the industrial basin of the country, with voters turning to the rightwing National Front.”

Thanks to the Drahgi’s ECB “whatever it takes” 2012 speech and the subsequent Quantitative Easing program (which Greece can not participate in), yields on French sovereign debt was pushed down to record low levels making the need for any drastic action on shrinking the French public sector less urgent (that is until the inherent weakness of the eurozone economy and its architecture once again causes a generalised crisis). But although the debt situation had eased the underlying impact of living in a currency union with the very large German low wage economy has pushed French unemployment to record levels.

Moscovici’s comments about the Socialist Party being vulnerable to the National Front proved prophetic because the current frontrunner for the next French president is none other than National Front’s Marine Le Pen, who will no doubt seize this memo as further proof of the terrible economic state of the country and leverage it even more to her benefit, and add even more fuel to the Frexit fire. As a reminder, Le Pen now prefers to be called Madame Frexit because as she warned last week, when she becomes president, unless the Eurozone yields to her demands, France will be the next country out of the monetary project effectively ending the Eurozone.

BRICS opening to Greece – a US nightmare

BRICS member-states ((Brazil, Russia, India, China and South Africa) established the New Development Bank by an agreement signed on July 15, 2014 in Brazil. The institution was set up to finance infrastructure projects and sustainable development of these and other developing countries. The new bank will start operating in April of 2016. The bank will start operating in dollars and then move to a basket of currencies. The bank’s headquarters are in Shanghai.

On Tuesday this week Russian Deputy Finance Minister Sergey Storchak said Greece can easily receive financing from the New Development Bank established by BRICS. According to him, it will be enough for Greece to buy a couple of shares of the bank to be eligible for funding. He added that this would require a political decision.

“If they buy, so to speak, a few shares and become members of the bank, they will be able to count on the resources. We do not have any co-relation between a contribution and an amount of funding. There is general agreement that the system of the countries’ assets will be balanced,” said Storchak. The Deputy Finance Minister also said that the admission of a new member to the current system is always a political decision.

“Greeks happened to be first who got interested in BRICS bank. As soon as the Institute starts operating, the board of directors will prepare and the board of governors will approve the procedure to consider membership applications from new candidates,” he stressed. Storchak said he “sees no problems” with the approval of Greece’s possible application. “I do not see any problem if all five governments order their governors to uphold [Greece’s request],” he said.

Support for Greece by the New Development Bank would no doubt be connected to the China’s ambitions to control Greek ports as a European entrepot and Russian ambitions to secure a Mediterranean anchorage for its fleet. No wonder Obama has been haranguing the Germans about the need to do deal that keeps the Greeks in the EU and the Euro.