The financial crisis of 2008 was the moment that the credit bubble that had been building for more than a decade burst. Overnight credit flows stopped and financial assets owned by banks collapsed in value. European banks were particularly exposed because under the eurozone system they didn’t really have a central bank standing behind them ready to print money to prevent a spiral of financial collapse. When the crisis hit it revealed just how weak the European banking system had become. The IMF estimated that the eurozone banking system was some €550 billion short of the required capital once likely losses, caused by collapsing asset values and escalating bad debts, were taken into account.

Because banks damaged by the credit crisis knew that their capital was going to be eaten up by losses they contracted credit – ‘deleveraging’ in the jargon – and this meant that bank lending in the eurozone collapsed. This had a particularly dire impact in Europe because European business are far more dependent than say US businesses on bank loans for funding investment and business expansion. The result was that the financial and credit crisis quickly became a crisis of the entire eurozone economy.

The flawed policies and systems of the eurozone meant that the post crash recession was made much, much worse, not least by the utterly absurd decision to tighten credit conditions in 2010, followed by a prolonged squeeze on public spending. The fairly predictable result has been a lost decade of stagnation, deflation and unemployment. The missing post-recession recovery phase has meant that the eurozone cannot grow its way out of debts and the collapse into deflation means that debts cannot be eroded by inflation. Eurozone banks remain weak, lending is weak, investment is stagnant, growth anaemic and unemployment painfully high. This leaves the eurozone vulnerable when the next global recession hits.

A particular area of weakness in the eurozone banking system is in Italy where a large number of big banks are in real trouble.

The longs stagnation of the Italian economy

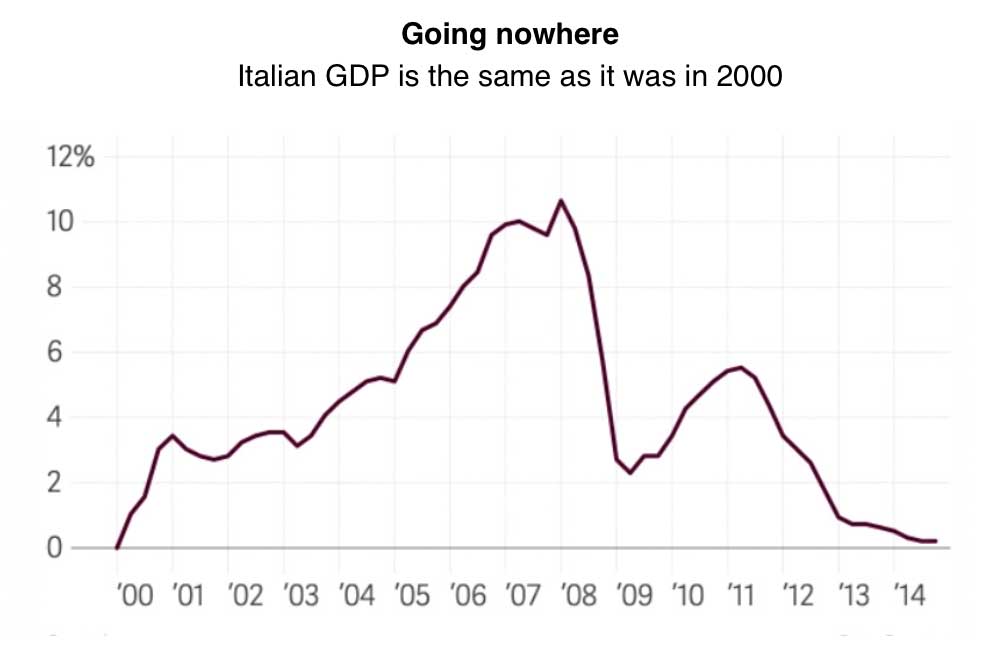

Italy stopped growing long before the recent financial crisis. In the early nineties, the Italian economy was one of the world’s largest per GDP. This successful performance was the outcome of a long period of sustained growth, which had started immediately after the end of WW2 and continued until the late eighties. In 1991, per-capita GDP was above EU average. Starting in that year however, the so- called “Italian ‘Economic Miracle’ seemed to vanish quickly, and a long period of stagnation began, and because the slowing of growth predated the 2008 crisis Italy was hit hard by the crisis. In 2014 Italian GDP was only just back to the levels as of 1997. As of now the Italian economy is essentially the same size as it was in 2000.

The Italian banks are in a terrible condition

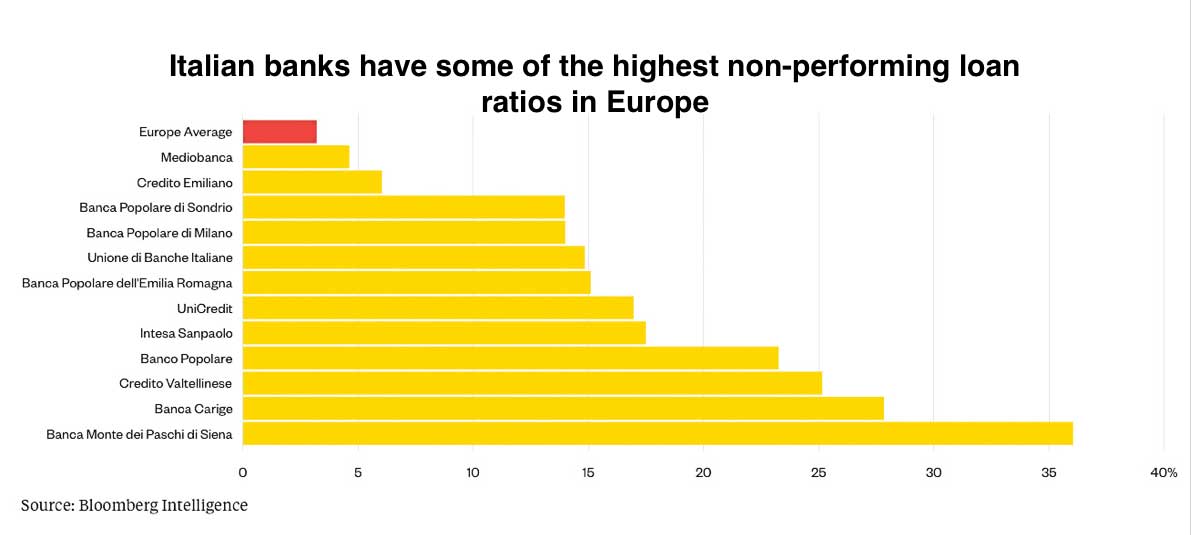

The root of the problem of the Italian banks are nearly 360 billion euros ($409 billion) of non-performing loans (bankers jargon for bad debt). As a proportion of total lending, the country’s banks have more non-performing loans than in any other major European economy. That bad debt prevents them from issuing new loans to promote economic growth and without credit the real economy cannot grow and without growth there is no way for the banks to rebuild their capital base and become profitable again.

Governments in other countries, like Ireland, that were saddled with bad loans in the wake of the financial crisis created state-backed bad banks that took the most troublesome debt off lenders’ books, allowing the banks to continue some lending. Big asset managers then bought the loans at a discount from the bad bank. In Italy, the crisis was not so deep and there was no state-backed cleansing of loan books. Since then, the Italian economy has struggled and more loans have soured, but the European Union authorities have blocked further state aid for the banking industry.

That leaves Italy’s banks trying to find buyers for their bad loans themselves, something that has proved difficult. The lenders have already marked down their loan books a lot — the industry has taken provisions covering about 45 percent of total non-performing loans, according to Barclays — but even at that level, buyers aren’t interested, and sales of Italian debt have been meagre. A plan concocted by Italy’s government in January offered insurance, at market rates, against losses on securitised parcels of bad loans. It failed to generate much interest from investors, partly because nobody understood what the market rate really was, and partly because potential buyers were unconvinced about how the plan would work in practice.

There are other solutions, but none are especially workable. A relatively strong Italian lender – Intesa, say – could buy a weaker domestic peer if the price were low enough. The argument goes that combining a good balance sheet with a bad one creates a mediocre one that can at least support more lending and help economic growth that benefits everyone. The problem, though, is that the acquirer’s shareholders would likely balk at the idea and there’s little incentive for management to take the risk. It’s not clear Italian regulators would allow an overseas buyer to step in, either.

Another option being discussed is the possibility of a fund backed by foundations, pension funds and others that could help recapitalise banks. But again, this looks difficult given European rules on state-sponsored bailouts. Plans to inject more capital into some of the banks are increasingly crucial. A proposed 1 billion-euro initial public offering of Veneto Banco has been dogged by concerns it won’t draw enough backers. And Banco Popolare must pull off a one billion euro share sale to win European Central Bank approval for its planned merger with Banca Popolare di Milano. If a combination of poor market responses and the ECB-EUs unhelpful interference prevents the merger then the consolidation route may also be a non-starter in terms of rebuilding the Italian banking system.

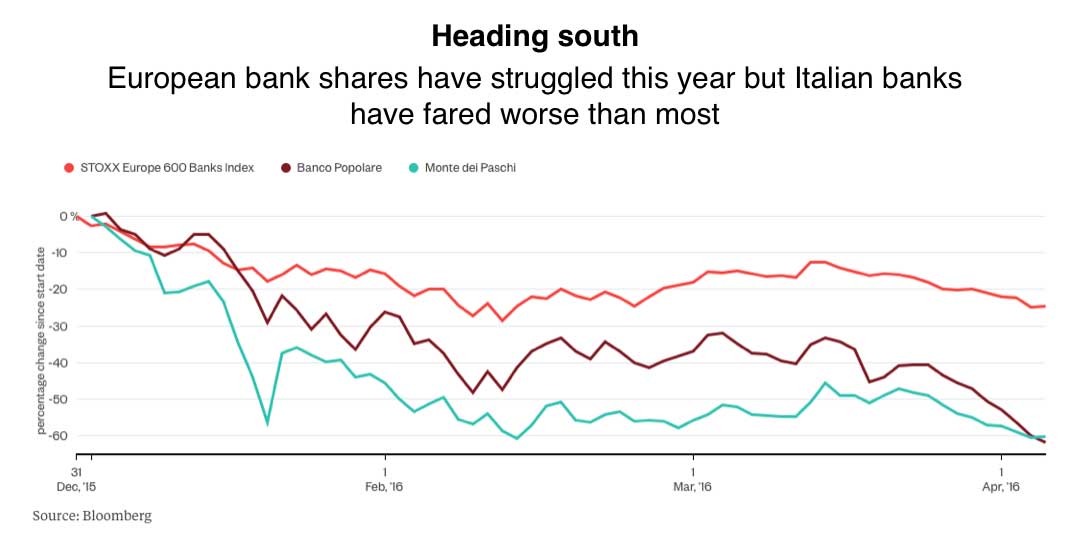

Shares in European banks have been wobbling downwards since the start of the year as fears of a generalised eurozone banking crisis have grown and Italian bank stocks have declined even more than the average.

When it comes to where a new eurozone crisis might begin all eyes are on Greece, Spain and Portugal, but the economic and financial situation in Italy, the EU’s fourth largest economy, remains very poor. If there were a financial crisis in Italy the markets would move against Italian sovereign debt causing yields to rise and the Italian public debt could become unsustainable quite quickly.