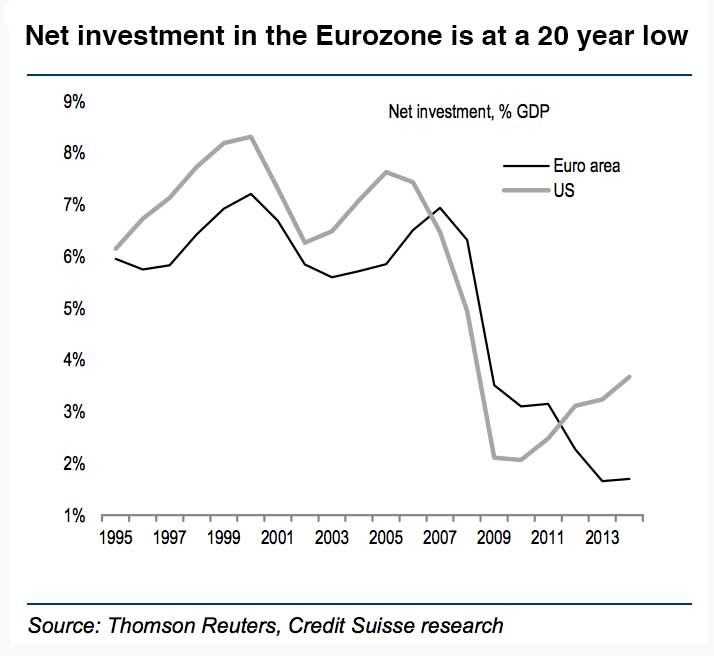

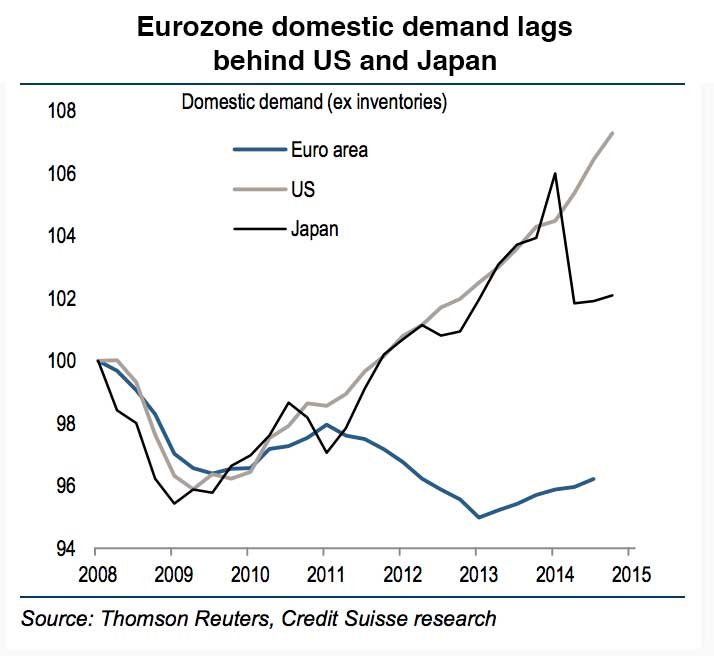

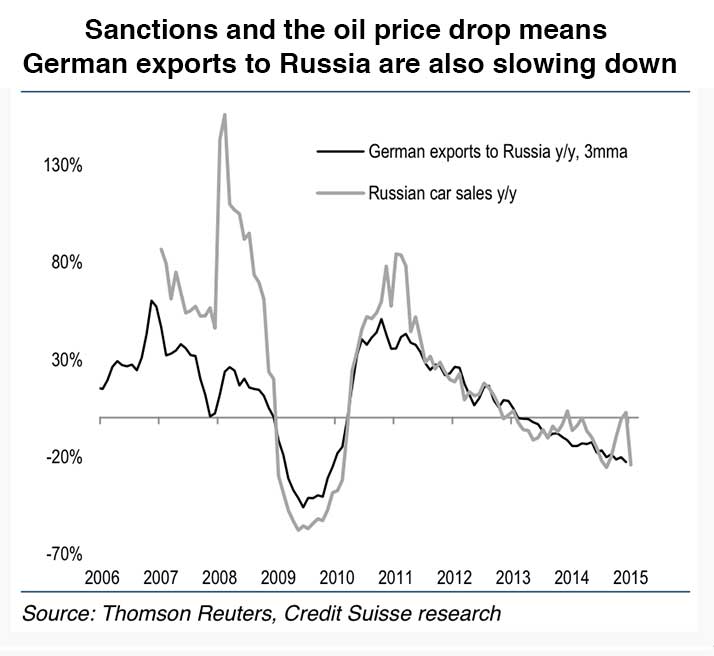

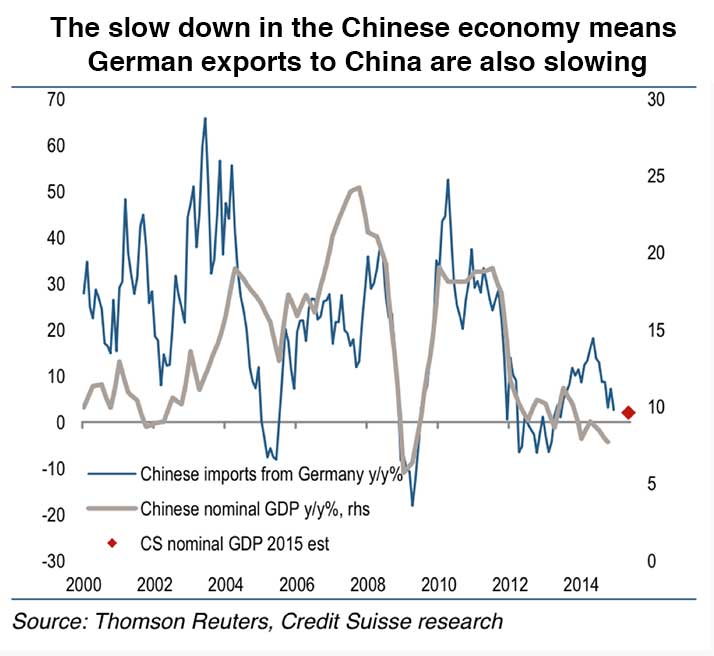

The charts are from Credit Suisse research and show some trends in the eurozone revealing continuing weakness.

The video is a seminar in Croatia in May 2013 where Yanis Varoufakis discussed his book the “The Global Minotaur: America, Europe and the Future of the Global Economy”. Varoufakis is not the best writer but his book is a very interesting piece of political economy which places the crisis of 2007 and the eurozone crisis in a much broader global and historical context. Although nearly an hour long the video is well worth a watch to see a really interesting global perspective on the 2007 crisis and its historical roots.

I disagree with the analysis of Varoufakis when he claims in the book, and the seminar, that the dollar gives the USA “exorbitant privilege”, to use the phrase first coined by Valery Giscard d’Estaing in the 1960s to describe the alleged benefit the United States has due to its own currency being the international reserve currency. I tend towards the view that the position of the dollar is on balance detrimental to the US in the long term.

A clip from this video is currently whipping up a media storm in Germany because when discussing what Greece should have done back in 2010 he says that instead of implementing the draconian Troika imposed austerity program Greece should have defaulted and ‘stuck the finger to Germany’. He then sticks his finger up (at 40 minutes 32 seconds). That clip has been shown many times on German TV in recent days. Varoufakis is finding how much harder it is being a politician than an economist. The interesting bit comes right after the ‘finger’ moment when Varoufakis explains why Greece should not leave the euro, and right at the end he explains why he wants Germany to become the truly hegemonic power in Europe

Here is the ‘fingergate’ video, its a briefest of moments in a very interesting presentation.

Finally, got round to watching the video! Fascinating and clear expositions of how he see the world economy has been ordered since world war two and explanations on why Greece should have defaulted in 2010 rather than see a banking debt Greece transferred to the Greek people. Also though he argues Greece should never not have entered the euro, why it would be folly to simply leave now. Can’t help thinking they must be considering and preparing for these 2 outcomes now though.

Varoufakis is so very clear in this video and obviously has a very comprehensive overview of the historical roots of the crisis and of political economy – know wonder he irritates the other finance ministers so much.

If I was part of the Syriza leadership my view would be that they should do as much as they can to build a viable future for Greece inside the Euro but prepare for life outside if getting a viable deal from intransigent EU elites proves impossible. That means engaging, in good faith, in a protracted and attritional process of negotiation with the EU elites which might lead to a viable future for Greece but as it drags on will cause more and more Greeks to see a Grexit as necessary and inevitable should that turn out where it leads.

Comments on this entry are closed.