Consider Portugal.

In the first half of 2011, Portugal received a €78 billion IMF-EU bailout package in a bid to stabilise its public finances. Portugal is often presented as showing how a relatively poor eurozone member state can cope with a big debt problem by obeying the rules and embracing harsh, but necessary, ‘reforms’ and as result is now, unlike Greece, on the road to recovery. Portugal’s government is a stable coalition of a centre party and centre-right party that together have held the majority of parliamentary seats since the 2011 election, and it has pretty much done all that which has been demanded by the Troika following its 2010 bailout. Exports are performing well, helped by the fall in the value of the euro. Tourism is booming and its property market seems pretty buoyant. The Portuguese citizens have endured a range of tough austerity measures with surprisingly little social disruption. Portuguese unemployment peaked at around 17% in 2013 and has dropped back to 14% recently but the youth unemployment rate is still running at 34.4%.

And yet for all the pain and the austerity Portugal’s debts are unsustainable. Lets do the the math.

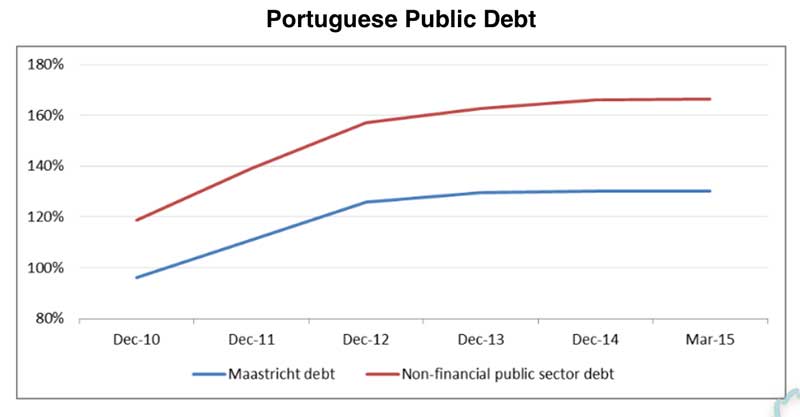

Using Bank of Portugal data its possible to calculate that as of March 2015, non-financial public sector debt stood at €288 billion, or 166% of GDP. Generally Portugal is described as only having public debt of 130% of its GDP, but that because most commentators usually do not include the debt of Portuguese public companies when calculating the Portuguese total debt burden. Including the debts of those public bodies raises the real public debt level by a whopping 36%.

Again using using Bank of Portugal data its possible to calculate that Portuguese GDP is about €174 billion. Let’s assume that the cost of debt on all that €288 billion of government debt is only 1%. In this case, the annual interest expense for the government should be 1%, or €2.88 billion. In fact this is actually a very low estimate because the actual interest paid in 2014 was almost €7 billion, so a 1% rate is much lower than the real one.

Next lets assume that going forward Portugal’s nominal GDP grows at 1%, which is not exactly an impressive rate of growth but certainly better than recent years, from December 2011 to December 2014, the average nominal growth rate was actually minus 0.6% (Bank of Portugal data). So that means that at a GDP growth rate of 1%, and a starting GDP of €174 billion, the actual annual GDP growth in monetary terms is €1.74 billion.

So Portugal has to find €2.88 billion (using our super low estimate – probably a lot more) from an an annual growth of €1.74 billion. Doesn’t really add up does it. Of course GDP growth is compound over time but so is debt interest.

The chart below shows the situation clearly, Portugal is not reducing its debts.

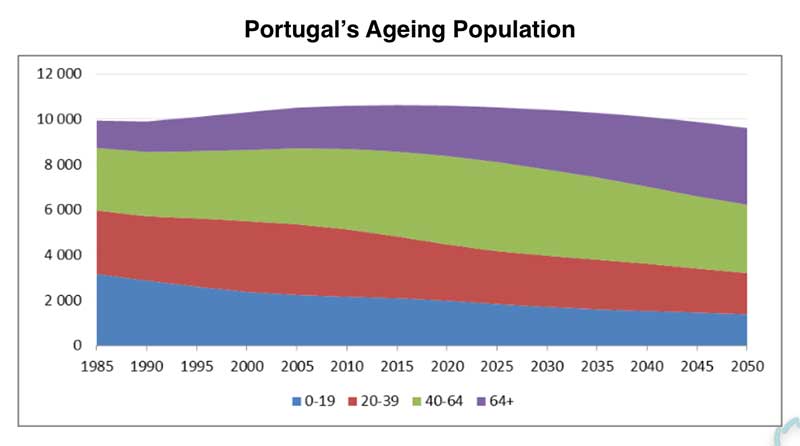

This means that Portugal’s creditors will expect even more austerity, and their response to the plight of Portugal will be the same as their response was towards Greece, the Portuguese government will be instructed to generate a bigger budget surplus by cutting its costs. Portugal needs to generate a bigger surplus just to stabilise the debt situation but it will need a gigantic one to actually start paying down the debt (for a critique of prolonged budget surpluses as a solution to eurozone debt see here). But with an ageing population, sluggish internal demand and the recessionary impact of having to further reduce government expenditures in this context, the hurdle just keeps getting higher.

The Troika argue that once the ‘reforms’ take root Portugal, via its enhanced competitiveness, will be able to grow its way out of its debt hole. The problem is that the only growth phase of the Portuguese economy following its accession to the eurozone was, like many other member states, based on utilising inflowing capital (mostly from German, French and Spanish banks) to inflate speculative asset bubbles and fund private and public debt. In other words Portugal has never shown that inside the eurozone it can actually grow its GDP by any significant amount without resorting to debt bubbles.

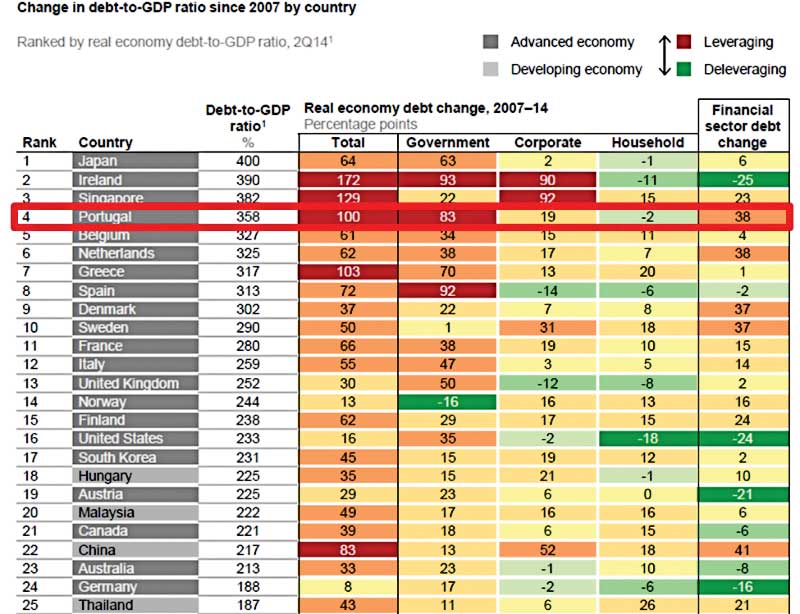

Another problem is that the financial crisis has left the eurozone banking system, including the Portuguese banks, saturated with bad debt and very unwilling to fund the business credit that a growing economy needs. In fact if private debt is included Portugal is one of the most indebted countries in the world, even more than Greece, as shown in the table below.

Meanwhile there will continue be upward pressure on Portuguese social spending because, like many other eurozone countries, it is undergoing significant demographic change with a rapidly rising proportion of pensioners which is pushing up pension and healthcare costs.

At the moment Portuguese debt appears manageable mostly because of the famous ‘Drahgi Put’ which means that the European Central Bank is backing Portuguese debt through programs like Quantitive Easing (due to end in 2016) and through its general commitment to “do whatever it takes”. The result is that 10-year Portuguese bonds are currently trading at only 186 basis points over German Bunds (compared to Greece at 1043 basis points) and the US at 155 basis points.

Here’s what José Socrates, Portuguese Prime Minister from 2005 to 2011, had to say about the country’s financial situation, soon after leaving office:

“For countries like Portugal and Spain, the idea that we now have to pay the debt is a childish idea. Sovereign debts, as it is taught in economics – that’s what I have studied for some time – are by definition eternal. Debts are to be managed. That’s what I studied. Of course we should not let debt grow too much because that’s a burden on expenses (…)”.

If recession returns to the eurozone, or if the market decides that Portuguese government bonds are a bit of a risk, and consequently yields rise and the cost of servicing Portuguese debt goes up, then Portugal could be forced very easily into a debt default. A Portuguese default could be much more problematic than Greece’s for a couple of reasons. First because despite the bail outs and ECB interventions sovereign debt, particularly in southern Europe, remains very, very high and the markets could quite easily spook and decide to push yields higher (as they did in 2010) and if that happens then almost overnight several eurozone countries, including big one like Italy and Spain, could find their debt situation becoming unmanageable. And a default by Portugal (or anyone else in the eurozone) would almost certainly trigger big rises in yields.

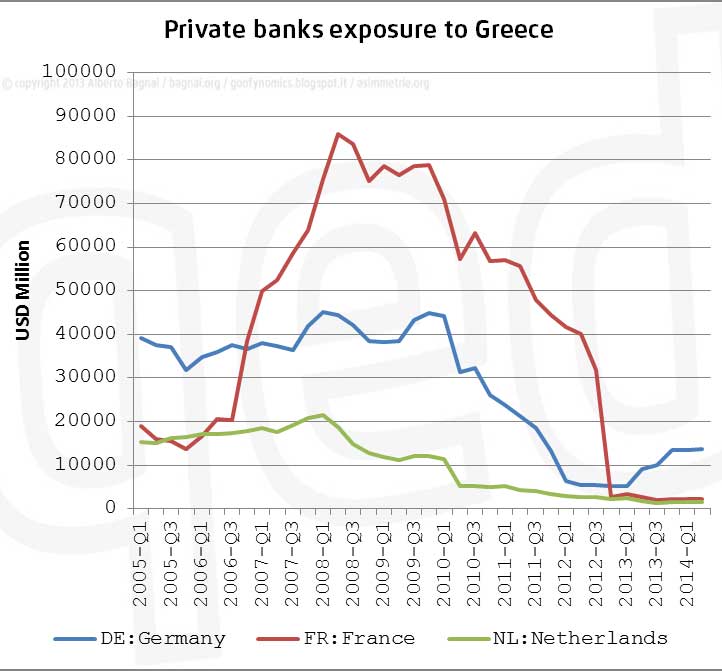

Secondly the European taxpayers are primarily on the hook in case of a Greek debt haircut, but there are still plenty of private creditors left in Portugal, including from Spain, France and Germany, and with the eurozone banking system still in a very fragile state a major default could bring a lot of banks down. So things could escalate fairly quickly.

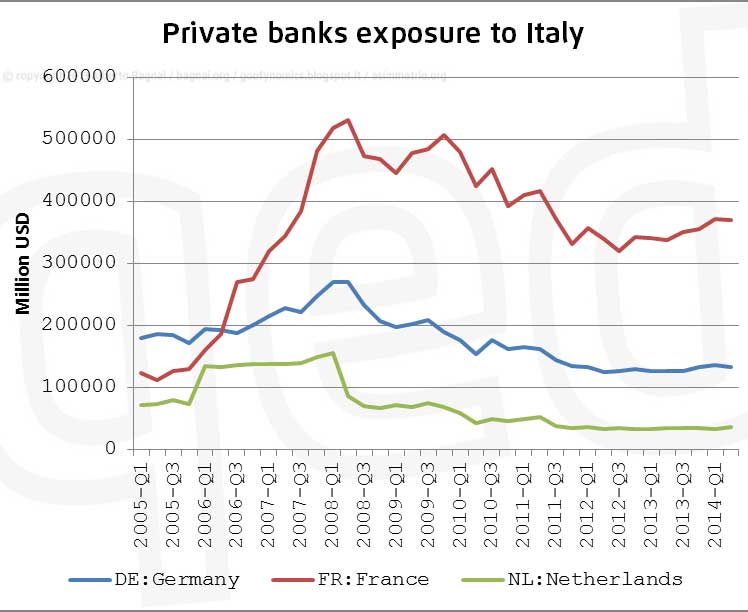

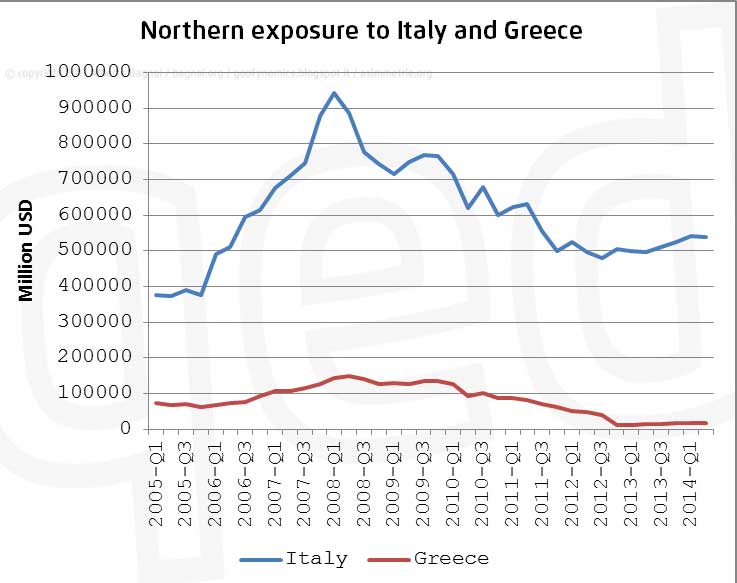

These three charts show how the bail out of Greece was really a bail out of the northern eurozone banking system, public funds flowed through the Greek government and back into the banking systems of the major national lenders. The result is that even if Greece defaults the banking system of the eurozone (except for inside Greece) is mostly safe from contagion. But that’s not true for the other big debtors in the Eurozone. For example northern banks are very exposed (i.e hold a lot of) Italian government debt and if Italy were to default it would without doubt crash a significant proportion of the northern banking system.

The Eurozone crisis is far from over.