The rather unsavoury and somewhat outrageous decision of the European Central Bank (ECB) that it will no longer accept Greek government debt as collateral starting next week came late last night after the markets had closed and shortly after the meeting between the Greek Finance Minister and the Mario Draghi the President of the European Central Bank.

The announcement was no doubt intended to put pressure on the Greeks before todays key meeting between between Varoufakis and German Finance Minister Wolfgang Schaeuble.

This in an overtly political act by a central bank that seems to have lost sight of what are, and are not, the responsibilities of a central bank. The ECB is acting far beyond its mandate in seeking to influence negotiations between Eurozone member states regarding the terms and conditions under which member states lend to their distressed partners. It has no business interfering in fiscal policy: if the Greek government decides to run 1.5% fiscal surpluses instead of 4.5%, hike minimum wages and create lots of government jobs, it is none of the ECB’s business. It should not use changes in fiscal policy by a democratically-elected sovereign government – even one that has inherited an economy in tatters with a massive debt burden – as justification for limiting liquidity to that country’s banking system.

The actual decision on the renewal of the ECB’s waiver under which it was prepared to accept Greek sovereign bonds as collateral for liquidity was not due until the 28th and by bringing forward the decision the ECB is clearly trying to send a message, apply pressure and probably support one side, in a political dispute in the Eurozone. There is another interpretation circulating today that the ECB’s move is also intended to up the pressure on the other side, particularly the Germans, by inching closer to the precipice, looking over, and saying “look how far the fall is”. Either way this is way too much politics for a central bank (see my generalised comments about the ECB at the end).This is not it’s job but the ECB has a track record of doing this sort of thing, it did the exact same move to put the squeeze on the Irish banks in 2010, and it actually pulled ELA from Cyprus’s Laiki Bank and the Bank of Cyprus, forcing immediate closure and restructuring. This second piece of brinkmanship resulted in the truly reckless decision to remove depositor guarantees, which was (fortunately) subsequently overturned by the Cypriot legislature. Give that the basic job of a central bank is to ensure stability and confidence in the banking system undermining deposit insurance is almost criminally insane.

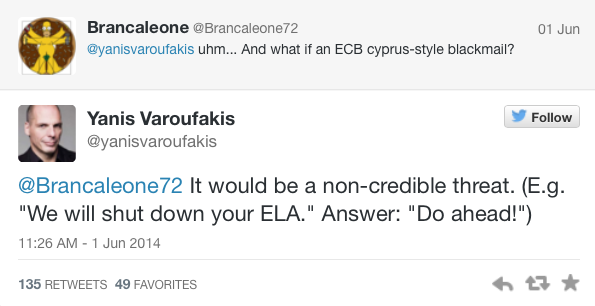

Will this pressure Varoufakis? I don’t think so not least because he saw it coming six months ago!

Note this Twitter exchange from June 2014

(There is a typo in the Varoufakis tweet, ‘Do ahead!’ should read ‘Go ahead!)

The action by the ECB yesterday did not actually pull funding from Greek banks, since they can still pledge other assets at the ECB. But all funding using any form of Greek sovereign debt must, from 11 February, be obtained from the Hellenic Central Bank under the Emergency Liquidity Assistance (ELA) scheme. And the ELA scheme itself is under the control of the ECB and reviewed bi-weekly. The ECB could pull it at any moment. So yesterday didn’t actually fire the gun it just cocked the trigger in a threatening manner.

Will the ECB actually pull the trigger? It might but if it did it would have potentially dire consequences for all concerned. If the ECB actually stops ELA support to Hellenic Central Bank then it will almost certainly bring down the Greek banking system. If the ECB forced a banking collapse by pulling ELA, Greece might try to limp on within the Eurozone as Cyprus did, using capital controls to prevent capital flight. But this would be the worst possible situation for Greece and it seems highly unlikely that the Greek government would even consider it. Greece’s economy is already in worse shape than Cyprus’s was at the time of its banking collapse, and Cyprus’s banking system was crippled but not destroyed by the restructuring. Greece’s banking system would be wrecked beyond repair. Greece would have no choice but to create a completely new currency and reflate its economy directly via the central bank. That means leaving the Euro, at least temporarily.

The collapse of the Greek banking system would probably cause extreme distress across the financial systems of the Eurozone. The forced Grexit, the collapse of Greeks banks and distress across the financial sectors of Europe would most certainly force up government bond yields for the weaker peripheral countries (Portugal, Spain, Italy, etc), driving up their debt costs reigniting a generalised and perhaps uncontrollable Eurozone crises.

It’s worth noting that this drama is been played out with a global audience and Obama has already openly sided with the Greeks warning that:

“You cannot keep on squeezing countries that are in the midst of a depression. At some point there has to be a growth strategy in order for them to pay off their debts and eliminate some of their deficits”.

So yes the ECB could shoot itself in the head by crashing the Greek banks but I suspect Varoufakis will call their bluff.

Postscript:

The ECB is most unaccountable central bank in world.

The Advocate General of the European Court of Justice recently issued a legal opinion that Quantitative Easing (QE) by the European Central Bank (ECB) was legal and could proceed. This actually had some very big and profound political implications which most observers missed.

In his Opinion, Advocate General Pedro Cruz Villalon observes that the framing and implementation of monetary policy are the exclusive competence of the ECB. In order to carry out its task, the ECB has at its disposal technical expertise and valuable information, which, together with its reputation and communications strategy, enable it to manage expectations in such a way that its monetary policy “impulses” actually reach the economy. Therefore, the ECB must have a broad discretion when framing and implementing the EU’s monetary policy, and the courts must exercise a considerable degree of caution when reviewing the ECB’s activity, since they lack the expertise and experience which the ECB has in this area.

This judgement has big implications way beyond QE. Remember that the ECB is an unusual (in fact unique) central bank because it has no government above it exercising any political control over it’s activities or policies. In that context if one looks at the the Advocate General’s opinion you can see that it makes the ECB the most powerful central bank in the world: it is now not only democratically but also legally unaccountable. It can do whatever it pleases.

what’s your twitter name?

I don’t post on Twitter. I hope to restart writing stuff on the blog soon, various family commitments took over my life recently and I had to stop the blogging for a while but things will ease soon I hope.

Comments on this entry are closed.