China has been running a high export, high investment economy for a couple of decades. The result has been that China has the smallest share of national product going to domestic consumption of any economy ever. The Chinese people have got much richer but their share of the national product has actually fallen and in recent years the share of private consumption has fallen further to the historically low level of 34%. This high export economy was based on a policy of keeping the Chinese currency, the Renminbi, pegged at a low value against the dollar thus making Chinese exports cheaper in the US and other foreign markets. I will be posting some articles soon about how savings, investments, consumption, trade balances and capital flows all connect and what larger implications this has, but for now all that needs to be said is that a necessary condition of this policy, low value of Renminbi plus high Chinese exports, has been massive capital flows from China into the global economy and in particular into the US. The Chinese capital flows into the US primarily took the form of Chinese purchases of government bonds and as a result the Peoples Bank of China now holds three trillion dollars worth of US Treasury Bills. It was the giant capital flows out of surplus countries like China and Germany which fuelled the global financial crisis and again I hope at some point to get round to writing about that complex event.

In the long run the only way the Chinese economy can become more balanced is if the share of national income that goes to private consumption increases, this will automatically reduce the scale of Chinese exports and connected capital flows. The Chinese leadership are aware of this need to boost domestic consumption but the political problem it faces is that the wealth of the ruling communist party elite families is closely tied to the giant semi-state owned export companies and so reducing exports and increasing domestic consumption means reducing the wealth of those families and this in turn means defeating them politically. Hence the purges, trials for corruption and sackings that characterise the current Chinese political scene.

After the crisis of 2007 the entire global economy took a hit and global trade dropped by several percentage points, plus key importers of Chinese goods such as the US fell into recession. In order to maintain growth in the economy the Chinese leadership responded by massively boosting domestic investment as this meant that export companies could reorientate relatively easily to production for domestic investment. The result was a massive investment spree and the share of domestic product going to consumption actually fell. The investment boom focussed on massive infrastructural projects and above all property development, the result has been China’s own property bubble (sound familiar) and mounting bad debts accumulating inside the Chinese financial and banking system. Chinas will probably be able to avoid an actual banking crash simply because state control of the banks and the economy is still be very extensive and the state has a lot of resources available. Nevertheless the Chinese face in the decade ahead a wrenching transition from a high investment, high export and high growth economy to a high domestic consumption slower growth economy. Generally in the years ahead watch the Chinese growth rates and if it slowly falls to somewhere between 3% to 4% per year that will actually be a good sign that it is moving in the right direction.

In the meantime I want to share some truly staggering statistics about the scale of the recent investment and property boom, perhaps frenzy is a better word, and to do so by looking at the Chinese consumption of cement.

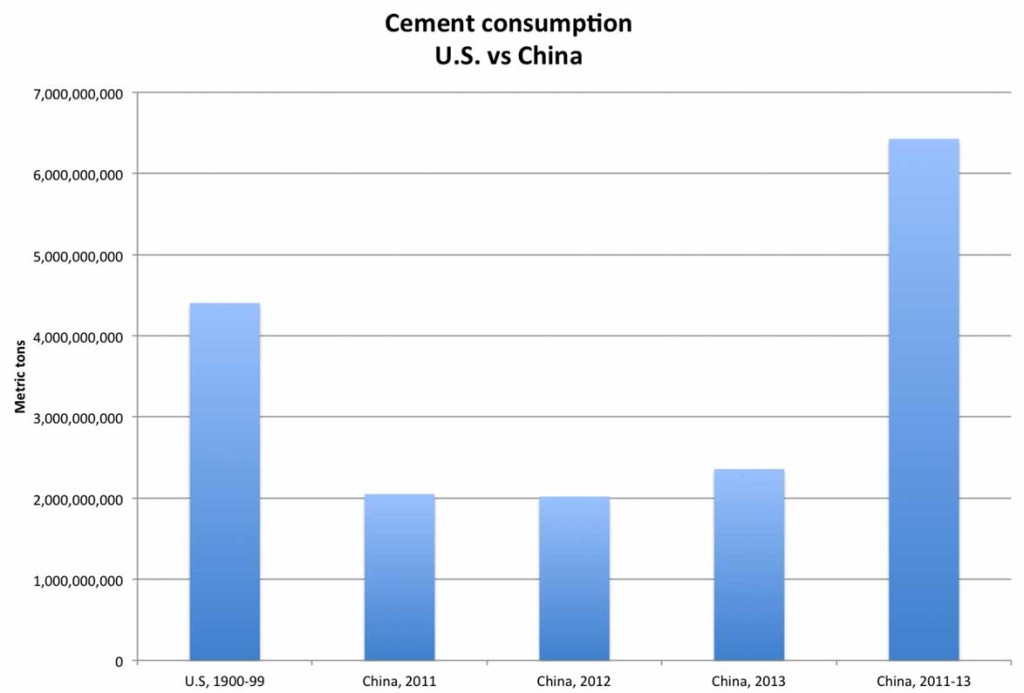

China used more cement between 2011 and 2013 than the U.S. used in the entire 20th Century!

Even taking into account the fact that the Chinese economy has grown at a very fast rate, and it has more than four times as many people as the United States thats still a fuck of a lot of cement. It was during the 20th century that the U.S. built almost all of its roads and bridges, the Interstate system, the Hoover Dam, and many of the world’s tallest skyscrapers. And China and the U.S. are roughly the same size in terms of geographic area, ranking third and fourth in the world, respectively. And still China beat the US hundred years consumption in just three years!

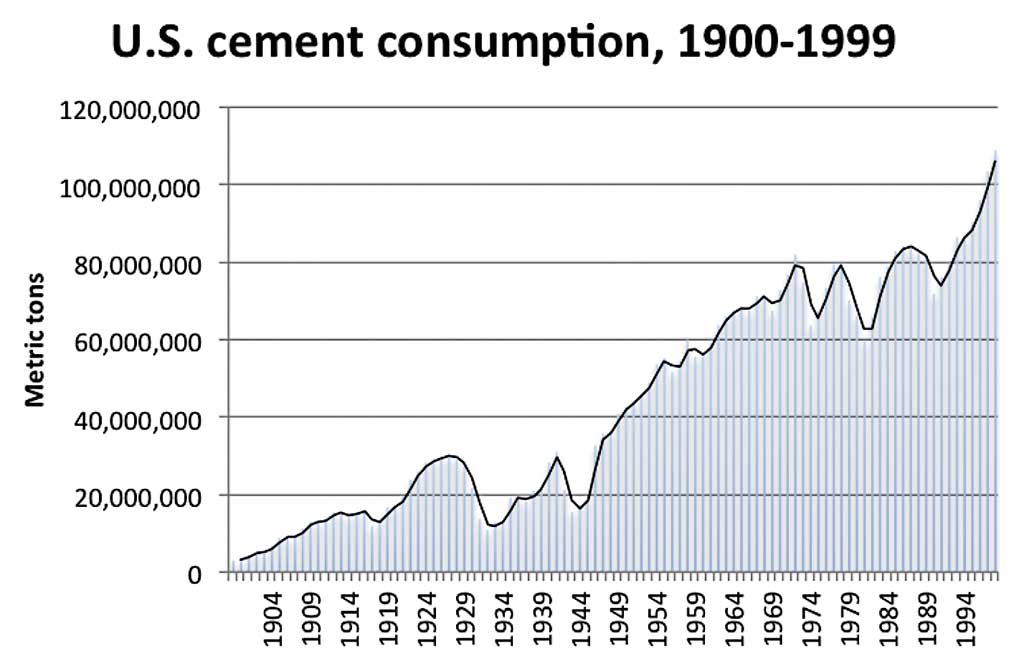

This chart of US cement consumption shows how it tracks economic activity, including dips in construction during the Great Depression, World War II and the recession of the early 1980s. All of America’s cement consumption during the century adds up to around 4.4 gigatons (1 gigaton is roughly 1 billion metric tons).

In comparison, China used around 6.4 gigatons of cement in the three years of 2011, 2012 and 2013, as data in the chart below show. According to Hendrik van Oss, a mineral commodity specialist at the U.S. Geological Survey, China’s cement consumption between 2010–12 was about 140 percent of U.S. consumption for 1900–99.

So how did China use so much cement? First, the country is urbanizing at an historic rate, much faster than the U.S. did in the 20th Century. More than 20 million Chinese relocate to cities each year, which is more people than live in downtown New York City, Los Angeles and Chicago combined. This massive change has taken place in less than 50 years. In 1978, less than a fifth of China’s population lived in cities. By 2020, that proportion will be 60 percent.

China’s cities have been transformed to make room for this influx of people. By some estimates, half of China’s infrastructure has been built since 2000, with new rail networks, interstates, dams, airports and high-rise apartment buildings springing up across the country. For example, the gif below shows how Shanghai’s Eastern Pudong District changed between 1987 and 2013. You can see why Spike Jonze chose Pudong as the setting for a city of the future in the recent movie “Her.”

What’s almost more impressive than China’s biggest cities is the incredible number of “small” cities that no one has ever heard of. In 2009, China had 221 cities with more than a million people in them, compared with only 35 in Europe. Even relatively minor cities like Zhengzhou and Jinan are more populous than Los Angeles or Chicago.

This amazing explosive increase in cement production and consumption is a prime example of the strengths and weaknesses of the current Chinese economy. China’s cement industry is much larger than it should be. Many of China’s cement manufacturers are state-owned, and they benefit from government support and access to cheap capital. As in other overcapacity state-owned industries such as aluminium, steel, and shipbuilding, China’s cement sector has undergone a period of explosive growth, fuelled by loans from state banks, without much regard for product quality or profits.

What’s more, low standards for construction quality mean some of China’s concrete buildings may have to be knocked down and replaced in as little as 20 or 30 years. According to Goldman Sachs, about a third of the cement that China uses is low-grade stuff that wouldn’t be used in other countries.

China will have to change course in the next decade and how well it manages to do that, and what the domestic political implications will be, are going to have a global impact as well as being very interesting.